Venture Corporation Ltd – More time needed to recover

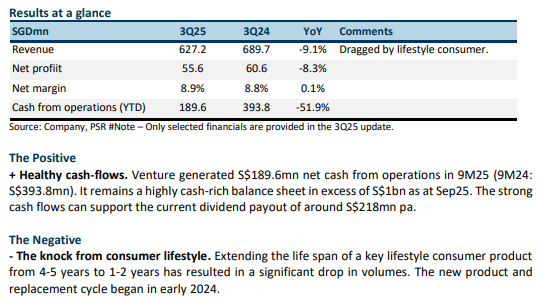

- 3Q25 results were within expectations. Both 9M25 revenue and PAT were 76% of our FY25e forecast. Net profit in 3Q25 fell 8.3% YoY to S$55mn. The shorter replacement cycle of the key lifestyle consumer product was a significant drag on revenue.

- Venture’s guidance points to new product wins in network connectivity products for hyperscaler data centres and new product launches in lifestyle consumer. Both categories will only contribute meaningfully likely in 2H26. Tariffs have also made Singapore a more attractive manufacturing destination for the US market.

- We nudge our FY25e PATMI down by 1% on account of lower interest rates and foreign exchange. Our NEUTRAL recommendation is maintained. The target price is raised to S$13.00 (prev. S$11.80) as we roll over our valuations to FY26e as the recovery year. The PE ratio is also increased to 15x, in line with its 5-year average. The dividend yield of 5.5% and the strong net cash balance sheet of S$1.2bn have been the attraction. Operationally, we expect challenging conditions until 2H26 when new products materially ramp up. The stock is trading at a steep valuation of 18x PE FY25e.

Venture Corporation Ltd – Coping under challenging conditions

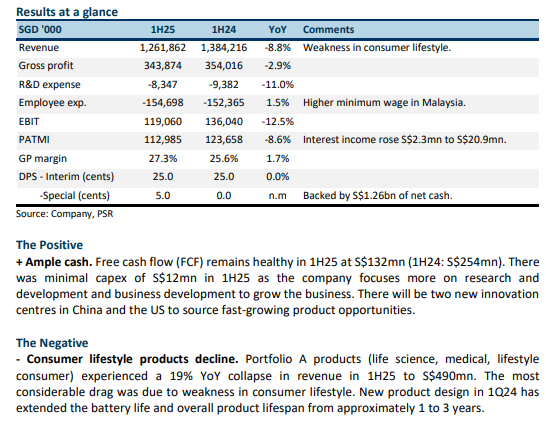

- 1H25 results were within expectations. Revenue and PATMI were 51%/49% of FY25e expectations. 1H25 PATMI net profit declined 8.6% YoY to S$112.9mn, in-line with revenue contracting 8.8%. A special dividend of 5 cents was announced in addition to an unchanged interim dividend of 25 cents.

- Venture’s outlook commentary shared little on near-term operating conditions. The company emphasised its long-term relationship, investments, and strong balance sheet. Nevertheless, we believe 2H25 earnings will remain weak – (i) the replacement cycle of its key consumer lifestyle product has been extended due to product design changes; (ii) uncertainty over drug pricing has scaled back big pharma capex; and (iii) cuts in US research funding grants further pulling down demand for life science equipment.

- We maintain our FY25e revenue and PATMI but believe there is downside risk to our forecasts. Our NEUTRAL recommendation is maintained, but we raise our TP to S$11.30 (prev. S$10.40) or 14x PE FY25e, a slight premium to the 2-year average of 13x. The attractive yield of 6% backed by huge S$1.26bn net cash warrants our improvement in valuations.

Venture Corporation Ltd – 2025 looks tough

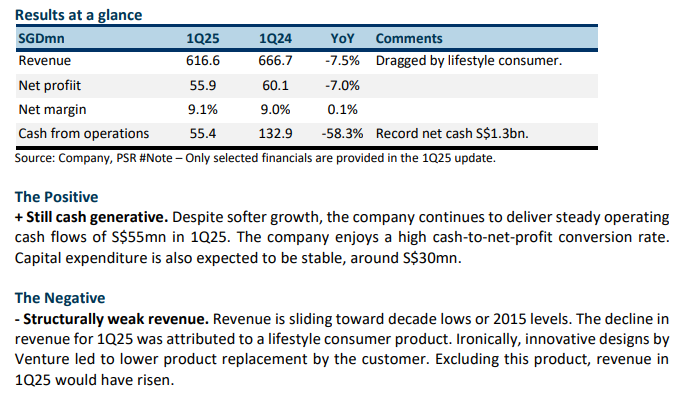

- 1Q25 results were below expectations, with revenue and PATMI at 23% of our FY25e forecast. Net profit in 1Q25 declined 7.0% YoY to S$55mn. Quarterly revenue is the lowest in a decade or since 1Q15. Lower contribution from a key lifestyle consumer product impacted revenue.

- Venture’s guidance remains cautious for the rest of the year. The company mentioned that there is significant uncertainty in the global economic environment due to tariffs, and there is no clear visibility in the tariff landscape over the next 12 months.

- We lower both our FY25e revenue and PATMI by 5%. Our NEUTRAL recommendation is maintained, but we have lowered our TP to S$10.40 (prev. S$11.80) and 13x PE FY25e, in line with the 2-year average. We expect another year of sluggish growth in FY25e. Nevertheless, Venture pays an attractive yield of 6.7% backed by net cash of S$1.3bn with aggressive share buyback plans.

Venture Corporation Ltd – Policy headwinds

- FY24 results were below expectations. Revenue and PATMI were 96% of expectations. 4Q24 net profit declined 9.2% YoY to S$61.2mn as revenue contracted 10.1% YoY. Earnings are at 8-year lows. DPS of 75 cents was maintained at a record payout ratio of 89% (FY23: 81%).

- Venture’s guidance is “short-term business environment is deemed uncertain”. We believe the new US administration policies have resulted in (i) Customers turning more cautious in their orders due to tariff uncertainty and (ii) Proposed cuts in the US National Institute of Health budget will curtail spending on life science equipment from research institutes and labs.

- We lower our FY25e revenue and PATMI by 12% and 10%, respectively. Our NEUTRAL recommendation is maintained, but we have lowered our TP to S$11.80 (prev. S$13.00) to 14x PE FY25e, a slight premium to the 2-year average of 13x. The company is targeting growth in FY25. However, similar to last year’s guidance, it may be revised downwards due to the current uncertain environment. The dividend yield of 5.8%, net cash of S$1.3bn, and 8.3mn share buyback plan is supportive of the share price.

Venture Corporation Ltd – Paid for gazing at the horizon

- 9M24 results were below expectations. Both revenue and PATMI were 69%/68%, respectively, of our FY24e forecasts. 3Q24 net profit declined 3.8% YoY to S$60.6mn as revenue declined 2% YoY. Earnings are expected to contract to 7-year lows in FY24e.

- Venture has lowered its 2H24 revenue guidance from stronger to relatively stable compared to 1H24. The company said that good opportunities from life science and AI data centres are on the horizon. However, we are not clear how far this horizon is.

- We lower our FY24e revenue and PATMI by 5% and 6%, respectively. Our NEUTRAL recommendation is unchanged. We have maintained our S$13.00 as we roll over to an FY25e PE ratio of 14x, a slight premium to the 2-year average of 13x. We believe earnings have stabilised, but growth is dependent on a pick-up in customer orders from consumer lifestyle, life science, and AI data centres. We find the dividend yield of 5.9% attractive, supported by a net cash hoard of S$1.19bn.

Venture Corporation Ltd – Some stability creeping up

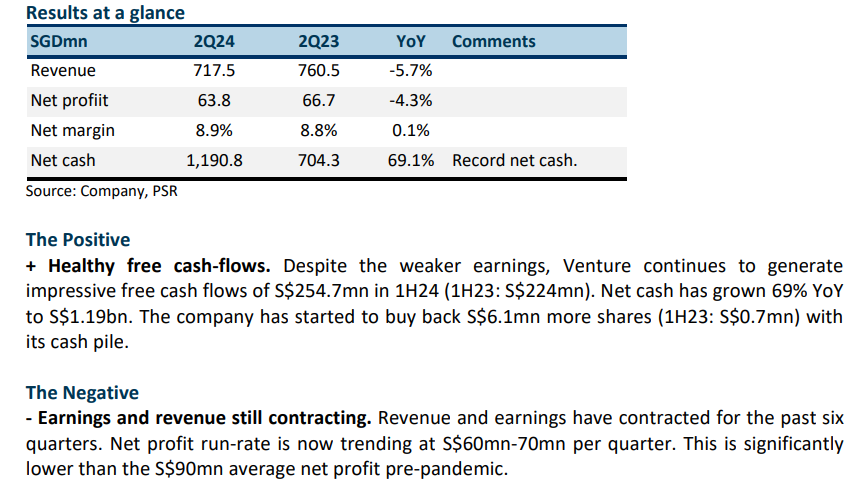

- 1H24 results were below expectations. Both revenue and PATMI were 44%/43% respectively of our FY24e forecasts. 2Q24 net profit declined 4.3% YoY to S$63.8mn, with revenue contracting 6% to S$717mn. The pace of revenue contraction is the slowest after six quarters.

- Venture is guiding revenue to be stronger in 2H24 compared to 1H24. We believe some of the growth domains the company is pursuing include optical transceivers for data centres and consumer lifestyle products.

- We lower our FY24e revenue and PATMI by 4% and 5% respectively. We maintain our NEUTRAL recommendation. We are nudging up our target price from S$12.75 to S$13.00 as we push up valuation to 14x from the 2-year historical PE ratio of 13x. There are some positive takeaways. The pace of revenue decline is slowing, fixed cost (staff and depreciation) is stabilising and several growth products were highlighted. If these new programmes were to ramp-up, we expect significant operational leverage. The dividend yield of 5.8% is attractive and well backed by record net cash of S$1.19bn.

Venture Corporation Limited – Worst performance since 2016

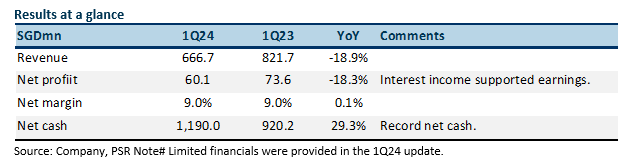

- 1Q24 results were within expectations. Both revenue and PATMI were 21% of our FY24e forecast. Net profit declined 18% YoY to S$60.1mn. We believe earnings were supported by strong interest income.

- Revenue in 1Q24 declined around 19% YoY to S$666.7mn, the weakest in eight years or 2016. The weakness was attributed to destocking in the life science, network, and communications segments.

- We maintain our FY24e earnings. We expect seasonality in demand to raise earnings sequentially in the coming quarters. Our NEUTRAL recommendation and target price of S$12.75, based on a 2-year historical PE ratio of 13x, is unchanged. The dividend yield of 5.6% is well supported by record net cash of S$1.19bn. Share buybacks is another avenue the company will pursue to return capital to shareholders.

The Positive

+ Cash piling up. Venture piles up net cash to record S$1.19bn (1Q23: S$920mn). Management said the cash improvement is due to working capital optimisation. We think it is also due to the lower sales performance. We believe the high cash levels is now the biggest growth driver with increased interest income.

The Negative

- Revenue plunging to 8-year lows. Revenue has dialled back down to 2016 levels. 1Q24 revenue of S$666.7mn is modestly above 1Q16 S$630.7mn. The near-term weakness was attributed to de-stocking in life science, network and communications segments.

Venture Corporation Ltd – Recovery back-loaded

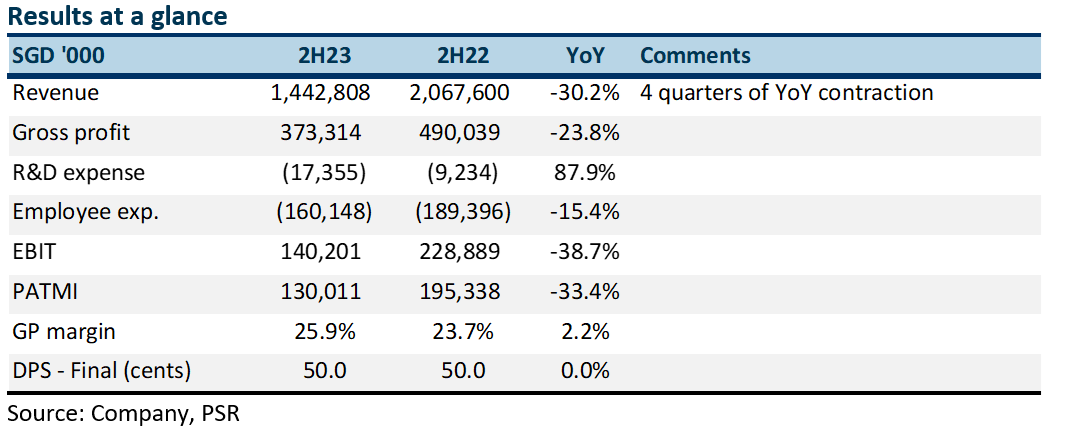

- 2023 results were within expectations. Both revenue and PATMI were 99% of our FY23 forecast. Earnings weakness persisted into the 4Q23, with PAT declining 25% YoY to S$67.4mn. The final dividend was unchanged at 50 cents and full-year at 75 cents.

- The outlook provided by the company, we believe, is for revenue softness to persist into 1H24 before recovery in the later part of the year. We believe driving growth will be new products by customers in semiconductor equipment, data centres connections, and medical and luxury consumer products.

- We nudge our FY24e earnings to be 2% higher and maintain our NEUTRAL recommendation. Our target price is raised modestly to S$12.75 (prev. S$12.50), based on a 2 year historical PE ratio of 13x. The dividend yield of 5.5% is reasonable, and the balance sheet is healthy, with record cash holdings of S$1bn. Visibility to earnings growth is poor and depends on customer confidence to launch new products.

The Positive

+ Record net cash. Free cash flow generated was a record S$478mn (FY23: S$236mn). The large jump in operating cash was from the decline in inventories of S$220mn. Net cash on the balance sheet surged to record S$1.05bn. Inventory is beginning to normalise to S$822mn but remains higher than pre-pandemic levels of S$706mn, despite the lower revenue. Interest income has almost tripled to S$28mn, accounting for 8% of earnings.

The Negative

- Sluggish revenue and earnings. The net profit for Venture is at a seven-year low. An inability to capture higher growth products plus delays in new product introductions and laclustre ramp-up in volumes have been major reasons for the multi-year decline in earnings.

Outlook

The company's outlook is for 2H24 to be stronger than 1H24. This is not new and has been the typical seasonality for Venture. We believe it implies softer revenues in the near term and a possible ramp-up later in the year. Visibility is poor as it depends on customer confidence and the ability to launch new products. Growth segments for Venture will include semiconductor equipment, data centres connections, and medical and luxury consumer products.

Maintain NEUTRAL with a higher TP of S$12.75 (prev. S$12.50)

Our FY24e earnings are raised a marginal by 2% to S$287mn.

Venture Corporation Limited – As weak as during the pandemic

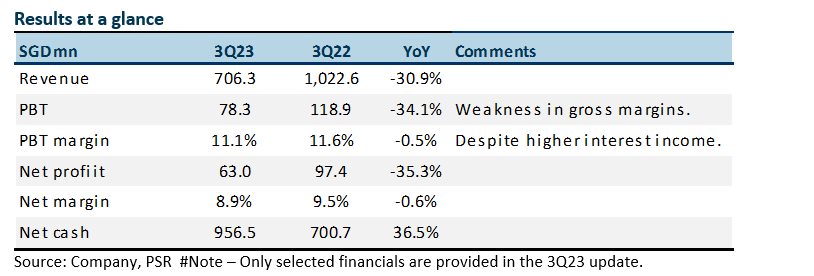

- 3Q23 PAT was down 35% YoY to S$63mn. The results were below expectations. 9M23 revenue and PAT were 70%/69% of our FY23e forecast. Soft demand and inventory adjustment continue to weigh down on revenue and earnings.

- The pace of decline should narrow in 4Q23e as contributions from new product introductions and supply chains transition from China to SE Asia.

- We cut our FY23e revenue and PATMI by 7% and 8%, respectively. We maintain our NEUTRAL recommendation. Our target price is lowered to S$12.50 (prev. S$15.20) due to our cut in earnings and a reduction in our PE ratio to 13x (prev. 15x). Venture’s valuation continued to de-rate as growth has stuttered over the past five years. The dividend yield of 6% is attractive and sustainable with its cash hoard of S$956mn.

The Positive

+ Recovery in net cash. Net cash recovered by S$255mn YoY in 3Q23 to S$956mn. Inventory declined by S$304mn YoY to a still elevated S$949mn. Inventory is high compared to pre-pandemic levels of around S$700mn.

The Negatives

- Weakness in margins. There was no disclosure of gross margins this quarter. But assuming interest income was similar to prior quarters, operating margins declined by at least 1% point. This was despite staff costs declining around 9% YoY.

- Revenue slump. Revenue growth remains problematic for Venture. 3Q23 revenue of S$706mn is trending around supply chain pandemic levels.

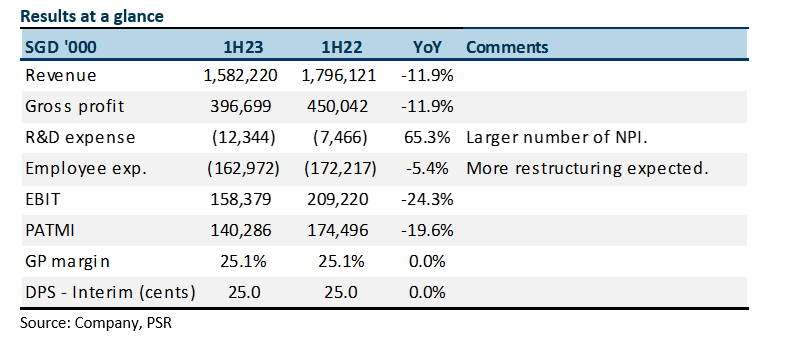

Venture Corporation Limited – No recovery visible, only dividends

- 2Q23 PAT was down 26% YoY to S$66.7mn. Results were below expectations. Revenue and PAT were 44%/45% of our FY23e forecast. Medical devices demand is down post-pandemic and other electronic products face overstocking. Interim dividend is maintained at 25 cents.

- We expect the weakness in revenue to persist until year-end. Recovery will come from new products such as EV chargers, semiconductor equipment and data centres.

- We lower our FY23e PATMI by 5% to S$296mn. Our revenue estimates are cut by 8% to S$3.3bn. We maintain our NEUTRAL recommendation. Valuations and dividend yield of 5.2% have turned more attractive, but there is little visibility of a recovery in the near-term. The target price is lowered to S$15.20 (prev. S$17.10), 15x PE FY23e. Our target valuations have been lowered as current earnings have a higher composition of interest income (7% vs 2% historically).

The Positive

+ Stable gross margins and healthy net cash. Despite the weaker revenue, gross margins were stable at 25.1%. We believe the weaker ringgit, lower freight cost and reduced labour force were some of the drivers to stable margins. Net cash improved by S$191mn YoY to S$896mn. The cash hoard has turned interest income into an earnings growth driver. 1H23 interest income jumped 4-fold from S$3.1mn to S$12.5mn.

The Negative

- Inventory is still too high. Inventory in 1H23 declined by S$248mn to S$1,002mn. With the lower revenue run-rate, inventory remains a concern with the possibility of write-offs, in our opinion. Annualised inventory days are currently around 137 days vs the pre-pandemic average of 100 days. This implies an excess of almost S$250mn of inventory compared to the historical average.

Outlook

We expect weakness to persist into the third quarter. The foundation of future growth for Venture stem from new programmes and customers looking to de-risk their supply chain out of North Asia into SE Asia. Malaysia is an attractive location for the deepening scale of the supply chain, skill sets, available space, and low-cost production. Singapore complements engineering expertise and oversight.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report