United Overseas Bank Limited – Provisions stockpiling hits earnings

-

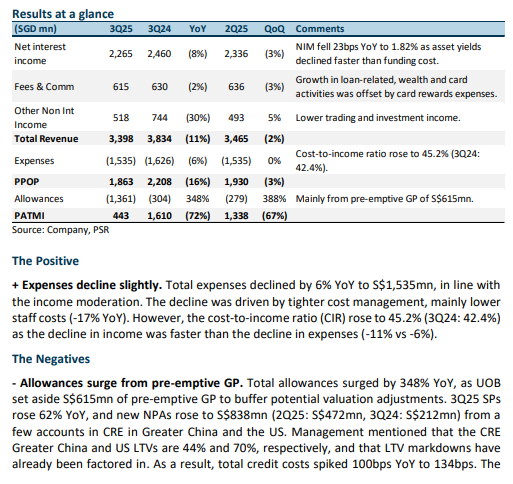

3Q25 earnings of S$443mn were below our estimates from higher-than-expected specific provisions and a S$615mn pre-emptive GP. 9M25 PATMI was 56% of our FY25e forecast.

-

NII fell 8% YoY from NIM compression of 23bps, while fee income dipped 2% YoY. Allowances surged 348% from higher SPs and pre-emptive GP of S$615mn, which will be a one-off to increase NPA coverage. Credit costs are expected to normalise in 4Q25 and FY26e. UOB has provided FY26e guidance of NIM at 1.75-1.80%, low-single-digit loan growth, high single to double-digit fee income, and credit costs at around 25-30bps. We expect FY25e earnings to decline by ~22%, mainly due to the surge in allowances.

-

Maintain NEUTRAL with a lower target price of S$30.40 (prev. S$34.60) as we lower FY25e earnings by ~18% from higher provisions estimate. We assume a 1.08x FY25e P/BV as we lower our ROE estimate to 11.1% (prev. 12.3%) in our GGM valuation. We expect UOB’s FY25e earnings to decline by ~22% YoY from the pre-emptive S$615mn GP set aside. NIM compression to ease in 2H25 as funding costs improve from deposit rate cuts. Fee income will be the most significant driver from the successful integration of Citi portfolios, which will accelerate UOB’s expansion into ASEAN. UOB reaffirmed its capital return plan and will maintain its S$2bn share buyback over three years. The dividend payout will exclude the S$615mn pre-emptive GP, and we estimate a FY25e payout ratio of ~74% (including the 50 cents special dividend), while maintaining their 50% dividend payout ratio guidance in FY26e even if absolute DPS declines YoY.

United Overseas Bank Limited – NII and allowances pull down earnings

-

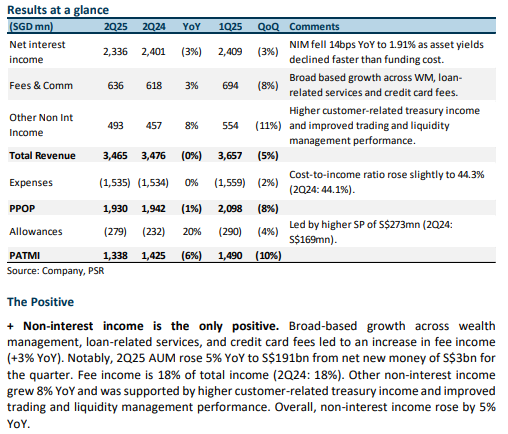

2Q25 earnings of S$1.3bn were below our estimates from lower-than-expected NII and higher provisions. 1H25 PATMI was 47% of our FY25e forecast. Interim dividend fell 3% YoY to 85 cents, with dividend payout ratio stable at 50%.

-

NII dipped 3% from NIM compression of 14bps, while fee income rose by 3% YoY. Allowances up 20% from higher SPs, mitigated by pre-emptive provisions. UOB has provided FY25e guidance for NIM of 1.85-1.90%, low-single digit loan growth, high-single digit fee income, and credit costs at around 25-30bps from a top-up in GP buffer. We expect FY25e earnings to decline by ~4% as margin compression continues.

-

Downgrade to NEUTRAL from ACCUMULATE with a lower target price of S$34.60 (prev. S$36.30) as we lower FY25e earnings by ~4% from lower NII and fee income estimates. We assume a 1.23x FY25e P/BV as we lower our ROE estimate to 12.3% (prev. 12.8%) in our GGM valuation. We expect UOB’s FY25e earnings to decline by ~4% YoY from the decline in NII. NIM compression to ease in 2H25 as funding costs improve from deposit rate cuts. Fee income will be the most significant driver from the successful integration of Citi portfolios, which will accelerate UOB’s expansion into ASEAN. UOB reaffirmed its plan to return S$3bn of surplus capital over FY25-FY27, including a 50 cents/share payout in FY25 and a S$2bn share buyback over three years, but will maintain its 50% dividend payout ratio guidance even if absolute DPS declines YoY.

United Overseas Bank Limited – Stashing provisions under the mattress

-

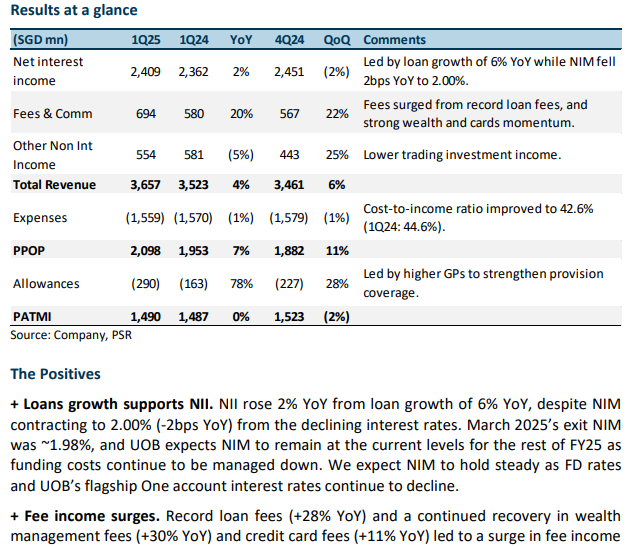

1Q25 earnings of S$1.5bn were below our estimates from lower-than-expected NII and higher provisions. 1Q25 PATMI was 22% of our FY25e forecast.

-

NII inched up 2% from loan growth of 6%, while fee income surged by 20% YoY. Allowances jumped 78% from higher GP to strengthen their provision coverage. UOB has suspended its FY25e guidance amid macroeconomic uncertainties but mentioned that US tariffs had minimal direct impact, with only about 2% exposure from US exporters, and, given that its major customers in ASEAN and China largely do not sell to the US, credit quality is expected to remain stable even as growth slows.

-

Maintain ACCUMULATE with a lower target price of S$35.50 (prev. S$39.80) as we lower FY25e earnings by ~10% from lower NII and other non-interest income estimates. We assume a 1.26x FY25e P/BV as we lower our ROE estimate to 12.8% (prev. 14.3%), risk-free rate to 2.5% (prev. 3.1%) and terminal growth rate to 1% (prev. 2%) in our GGM valuation. We expect UOB’s FY25e earnings will be flat YoY as excess profits will be placed into GP to strengthen their provision cover. NIM will be maintained by cutting deposit costs and continuing to increase loan growth. At the same time, fee income will be the biggest driver from the successful integration of Citi portfolios, which will accelerate UOB’s expansion into ASEAN. There is further upside to our estimated 6.6% dividend yield (including the 50-cent special dividend) should UOB raise the dividend payout ratio above 50%. We believe the special dividend can continue for at least two more years (until FY27) to reach UOB’s CET-1 optimal range of 14%.

United Overseas Bank Limited – Higher allowances hurt earnings

-

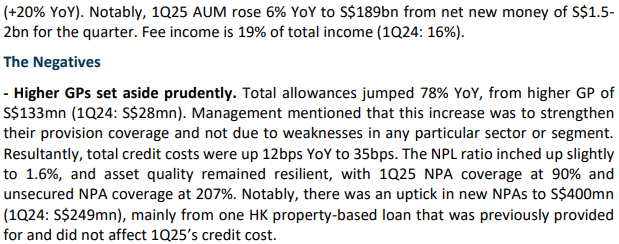

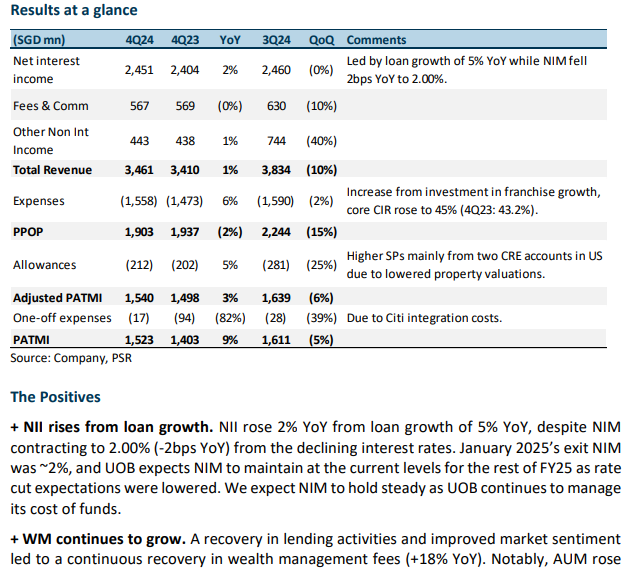

4Q24 adjusted earnings of S$1.54bn were slightly below our estimates from lower-than-expected fee income and higher provisions. FY24 adjusted PATMI was 97% of our FY24e forecast. 4Q24 DPS was up 8% YoY to 85 cents; the full-year FY24 dividend rose 6% YoY to 180 cents. A S$3bn capital distribution package (50 cents special dividend in FY25 and S$2bn share buyback) was announced.

-

NII increased from loan growth of 5%, while fee and other non-interest income remained flat. Allowances rose 5% from higher SPs. UOB has provided FY25e guidance for “higher total income” from high single-digit loan growth and double-digit fee growth. We expect FY25e earnings to grow ~12% YoY from more substantial fees, trading income, and loan growth recovery while NII and NIM remain stable.

-

Maintain ACCUMULATE with a higher target price of S$41.80 (prev. S$37.00) as we roll over our valuations. We lower FY25e earnings by ~3% from lower non-interest income estimates, and higher provisions estimates. We assume a 1.49x FY25e P/BV and ROE estimate of 14.3% in our GGM valuation. UOB will be able to maintain NII and NIM by cutting deposit costs and continuing to increase loan growth. The successful integration of Citi portfolios will boost fee income as UOB expands in ASEAN. There is further upside to our estimated 6.5% dividend yield (including the 50-cent special dividend) should UOB raise the dividend payout ratio above 50%. We believe the special dividend can continue for at least two more years (until FY27) to reach UOB’s CET-1 optimal operating range of 14%.

United Overseas Bank Limited – Other non-interest income boost earnings

-

3Q24 adjusted earnings of S$1,639mn were slightly above our estimates from a jump in trading and investment income, and higher fee income. 9M24 adjusted PATMI was 76% of our FY24e forecast.

-

Positives include a surge in trading income (+131% YoY), continued recovery in WM fees (+25% YoY) and NII inching up from loans growth of 5%, while negatives were higher allowances from Thailand operational merger issues. UOB has maintained their FY24e guidance for double-digit fee income growth and low-single digit loans growth with NIM to hold above 2%, while providing FY25e guidance for “higher total income” from high single-digit loan growth and double-digit fee growth. We expect double-digit trading income growth in 4Q24 from higher volatility surrounding the US elections.

-

Maintain ACCUMULATE with a higher target price of S$37.00 (prev. S$34.90) as we raise our FY24e estimates. We increased FY24e earnings by ~4% from higher fee and trading income estimates and lower OPEX estimates. We assume 1.49x FY24e P/BV and ROE estimate of 14.4% in our GGM valuation. UOB will be able to maintain NII and NIM from cutting deposit costs and continuing to increase loan margins. We expect 4Q23 earnings to grow ~15% YoY from continued loan growth recovery from rate cuts and double-digit WM and trading income growth, which will boost earnings. UOB has also mentioned possible share buybacks, which would further improve ROE and EPS.

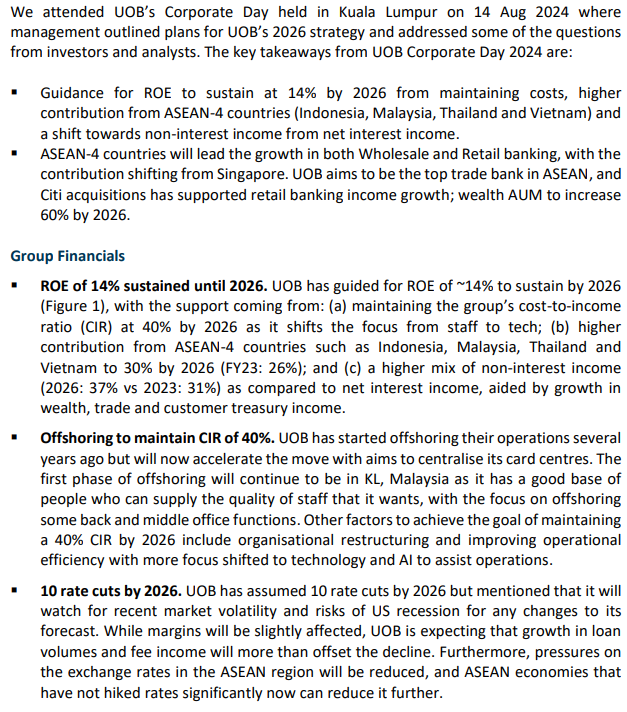

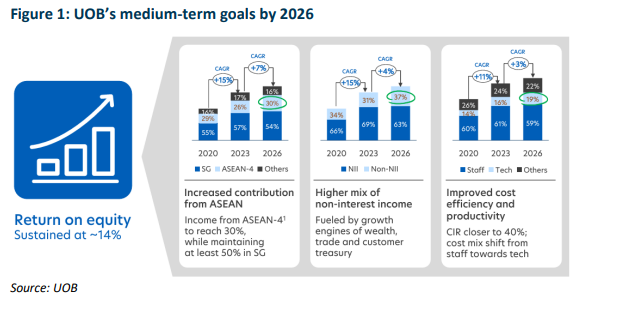

United Overseas Bank Limited – ROE to sustain at 14%

- Guidance for ROE to sustain at 14% by 2026 from maintaining costs, higher contribution from ASEAN-4 countries (Indonesia, Malaysia, Thailand and Vietnam) and a shift towards non-interest income from net interest income.

- ASEAN-4 countries will lead the growth in both Wholesale and Retail banking, with the contribution shifting from Singapore. UOB aims to be the top trade bank in ASEAN, and Citi acquisitions has supported retail banking income growth; wealth AUM to increase 60% by 2026.

- Upgrade to BUY with an unchanged target price of S$34.90 as we account for recent share price performance. Our FY24e estimates remain unchanged. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. UOB will be able to maintain NII and NIM by cutting deposit costs and continuing to increase loan margins. Other tailwinds include loan growth recovery from rate cuts in 2H24 and double-digit fee income growth, which will boost earnings

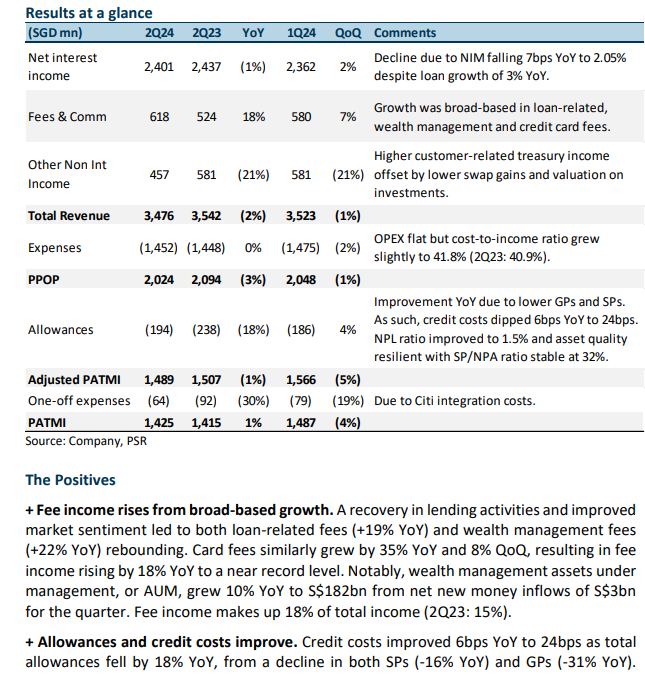

United Overseas Bank Limited – Trading and investment offset fees growth

- 2Q24 adjusted earnings of S$1,489mn met our estimates as higher fee income and lower allowances were offset by lower-than-expected NII and other non-interest income. 1H24 adjusted PATMI was 49% of our FY24e forecast. 1H24 interim dividend up 4% YoY to 88 cents.

- Positives include fee income growth of 18% YoY and allowances dipping 18% YoY, while negatives were NII declining by 1% YoY as NIMs fell 7bps and trading and investment income decreased by 21% YoY. UOB has maintained their FY24e guidance of low-single-digit loans growth, NIM to come in above 2%, double-digit fee income growth, stable cost-to-income ratio of around 41-42% and credit cost at the lower end of 25-30bps.

- Downgrade to ACCUMULATE with an unchanged target price of S$34.90 as we account for recent share price performance. Our FY24e estimates remain unchanged. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. UOB will be able to maintain NII and NIM from cutting deposit costs and continuing to increase loan margins. Other tailwinds include loan growth recovery from rate cuts in 2H24 and double-digit fee income growth, which will boost earnings.

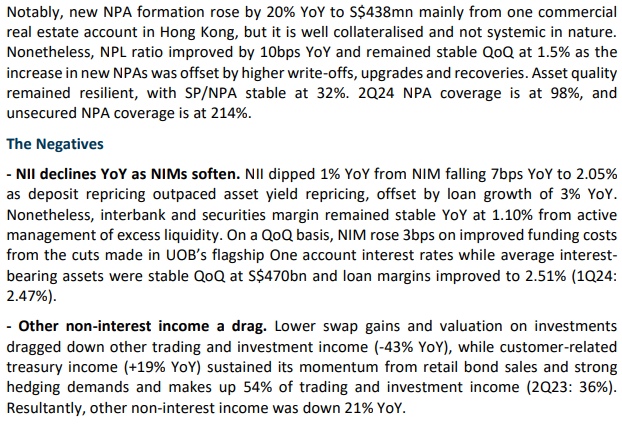

United Overseas Bank Limited – Non-interest income growth offset NII decline

- 1Q24 adjusted earnings of S$1,566mn met our estimates as higher fee income and other non-interest income were offset by lower-than-expected NII and higher expenses. 1Q24 adjusted PATMI was 25% of our FY24e forecast.

- Positives include fee income growth of 5% YoY, trading and investment income rising by 10% YoY, and allowances dipping 3% YoY, while negatives were NII declining by 2% YoY as NIMs fell 12bps. UOB has maintained their FY24e guidance of low-single-digit loans growth, NIM to come in above 2%, double-digit fee income growth, stable cost-to-income ratio of around 41-42% and credit cost at the lower end of 25-30bps.

- Maintain BUY with an unchanged target price of S$34.90. Our FY24e estimates remain unchanged. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. FY24 will be another year of growth from stable NIMs, loan recovery, and double-digit fee income growth, which will boost earnings.

The Positives

+ Fee income continues to grow. Fees grew 5% YoY, largely due to higher loan-related fees of S$244mn (+3% YoY) and a pickup in wealth management fees to S$164mn (+6% YoY) due to a return in investor confidence. Notably, wealth management assets under management (AUM) grew 11% YoY to S$179bn. Credit card fees continued to grow, reaching S$90bn in 1Q24 (+11% YoY) but normalized from last quarter’s seasonal high (-28% QoQ). Fee income makes up 16% of total income (1Q23: 16%).

+ Trading and investment income rose 10% YoY. The growth was led by customer-related treasury income hitting a record level of S$219mn (+8% YoY) from increased retail bond sales and strong hedging demands, while trading and liquidity management activities continued to perform well (+11% YoY). Customer-related treasury income makes up 42% of trading and investment income (1Q23: 43%). Other non-interest income was up 3% YoY and 33% QoQ.

+ Credit costs and new NPAs dip YoY. Credit costs dipped 2bps YoY to 23bps as total allowances fell slightly by 3% YoY, mainly from a decline in SPs (-4% YoY) on lower NPL formation, while GPs remained stable. New NPA formation fell by 17% YoY to S$249mn as asset quality stabilised during the quarter. NPL ratio improved by 10bps YoY and remained stable QoQ at 1.5%. Asset quality remained resilient, with SP/NPA stable at 32%. 1Q24 NPA coverage is at 99%, and unsecured NPA coverage is at 204%.

The Negative

- NII declines YoY as NIMs soften. NII dipped 2% YoY from NIM falling 12bps YoY to 2.02% mainly due to loan margin compression due to competition for high-quality credits and high cost of funding as the impact from the recent deposit repricing has yet to be felt. Nonetheless, interbank and securities margin remained stable at 1.11% from active management of excess liquidity. Loans grew slightly by 2% YoY, driven by selective good credits and short-term trade loans.

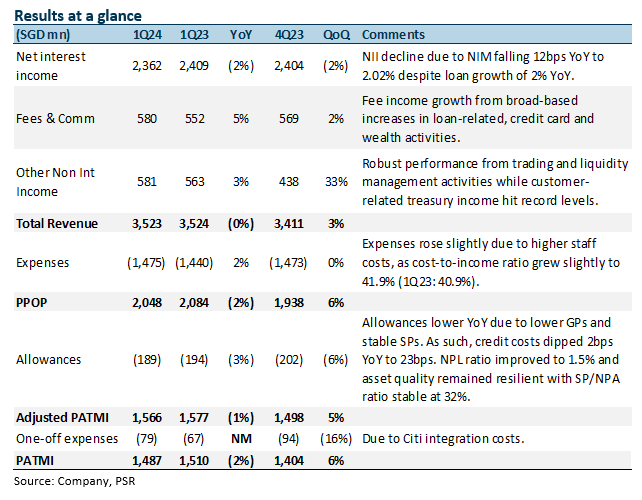

United Overseas Bank Limited – NII hurt by NIM decline and flat loan growth

- 4Q23 adjusted earnings of S$1,498mn were slightly above our estimates due to higher fee income and other non-interest income, but offset by lower-than-expected NII and higher allowances. FY23 adjusted PATMI was 102% of our FY23e forecast. 4Q22 DPS was up 13% YoY to 85 cents; the full-year FY23 dividend rose 26% YoY to 170 cents, with the dividend payout ratio stable at 50%.

- Positives include fee income growth of 17% YoY and other non-interest income rising by 54% YoY, while negatives were NII declining by 6% YoY as NIMs fell 20bps and allowances increasing 17% YoY. Management has provided FY24e guidance of low-single-digit loan growth, NIM to sustain at the current level of ~2% as funding costs have stabilised and expectations for rates to maintain till 2H24, double-digit fee income growth from the Citi acquisition, stable cost-to-income ratio of around 41-42% and credit cost to come in at the lower end of 25-30bps.

- Maintain BUY with a lower target price of S$34.90 (prev. S$35.90). We lower FY24e earnings by 9%. Our NII is reduced as we assume softer NIMs and increased allowances, offset by higher fees and other non-interest income. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. FY24 will be another year of growth from stable NIMs, loan recovery, and double-digit fee income growth will boost earnings.

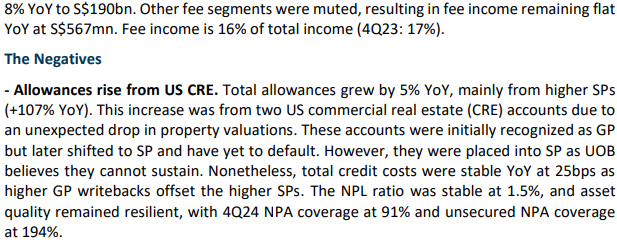

The Positives

+ Fee income continues the strong recovery. Fees grew 17% YoY, largely due to higher credit card fees, which hit a new record of S$125mn (+69% YoY), boosted by higher card spending on an enlarged regional franchise due to the Citi integration. Wealth management fees recovered modestly by 21% YoY, while loan-related fees grew 5% YoY amid cautious investor sentiment. Fee income now makes up 17% of total income (4Q22: 15%). On a full-year basis, fee income rose 4%, driven by record-high credit card fees, underscored by higher customer spending, expanded regional franchise, and higher wealth fees. This was partly offset by softer loan-related fees amid cautious corporate sentiment.

+ Other non-interest income surges YoY. Other NII surged 54% YoY as customer-related treasury income sustained momentum while trading and liquidity management activities continued to deliver good performance. On a full-year basis, other NII spiked 85% to S$2bn from all-time high customer-related treasury income and strong performance from trading and liquidity management activities.

+ New NPAs dipped 2% YoY. New NPA formation fell by 2% YoY to S$389mn as asset quality stabilised during the quarter. The NPL ratio improved by 10bps YoY and QoQ to 1.5%. Asset quality remained resilient, with SP/NPA improving slightly to 32%. 4Q23 NPA coverage is at 101%, and unsecured NPA coverage is at 209%.

The Negatives

- NII declines YoY as NIMs soften. NII dipped 6% YoY from NIM, falling 20bps YoY and 7bps QoQ to 2.02% mainly from loan margin compression due to competition for high-quality credits and loans remaining flat YoY. The decline in loan growth from Singapore was offset by growth in North Asia and the rest of the world. UOB is guiding for a low-single-digit loan growth for FY24e.

- Credit costs increase due to lower GP write-back. Total allowances rose by 17% YoY to S$202mn mainly due to a lower general allowance write-back of S$9mn (4Q22: write-back of S$80mn) despite specific allowance falling by 16% YoY to S$212mn. Credit costs rose by 4bps YoY to 25bps, with full-year FY23 credit costs coming in at UOB’s guidance of 25bps (+5bps YoY). Nonetheless, the total general allowance for loans, including RLARs, was prudently maintained at 0.9% of performing loans. UOB has guided for credit costs to come in at the lower end of 25-30bps for FY24e.

- Expenses up 4% YoY. Excluding one-offs, expenses rose 4% YoY to S$1,473mn. The increase was across the board, including staff costs, revenue-related and IT-related expenses. Nonetheless, the cost-to-income ratio (CIR) was relatively stable and rose 0.6% points YoY to 43.2% on the back of strong income growth, with full-year CIR improving by 1.8% points to 41.5%. UOB has guided CIR to remain stable at around 41% to 42% for FY24e and for the one-time costs from the Citigroup acquisition to roll off substantially.

Outlook

PATMI: We expect UOB’s profits to grow 8% in 2024e on the back of stable margins, loan growth recovery, stronger fees and stable provisions. We expect credit costs to come in around the guidance of 25bps. UOB has guided for loan growth of low single digits and NIM of around 2% for FY24e.

Fee income: UOB expects fee income to continue its recovery and for the growth to be led by credit card fees and wealth and fund management fees as the market sentiment recovers. Wealth management AUM has grown 14% YoY to S$176bn. UOB has successfully integrated their Citi portfolios in Malaysia and Indonesia, with Thailand and Vietnam to be completed by FY24, which could further expand their regional franchise. As such, they have guided for double-digit fee income growth in FY24e, which could add ~S$220mn to revenue.

Loan growth: UOB expects to see demand for loans pick back up with rate cuts expected in 2H24 and is guiding for loans to grow 1-3% in Singapore and 4-5% in the region. However, we expect a slowdown in the first few quarters of FY24 as rates remain high with the recovery to come in 2H24. Management have guided low-single-digit loan growth for FY24e.

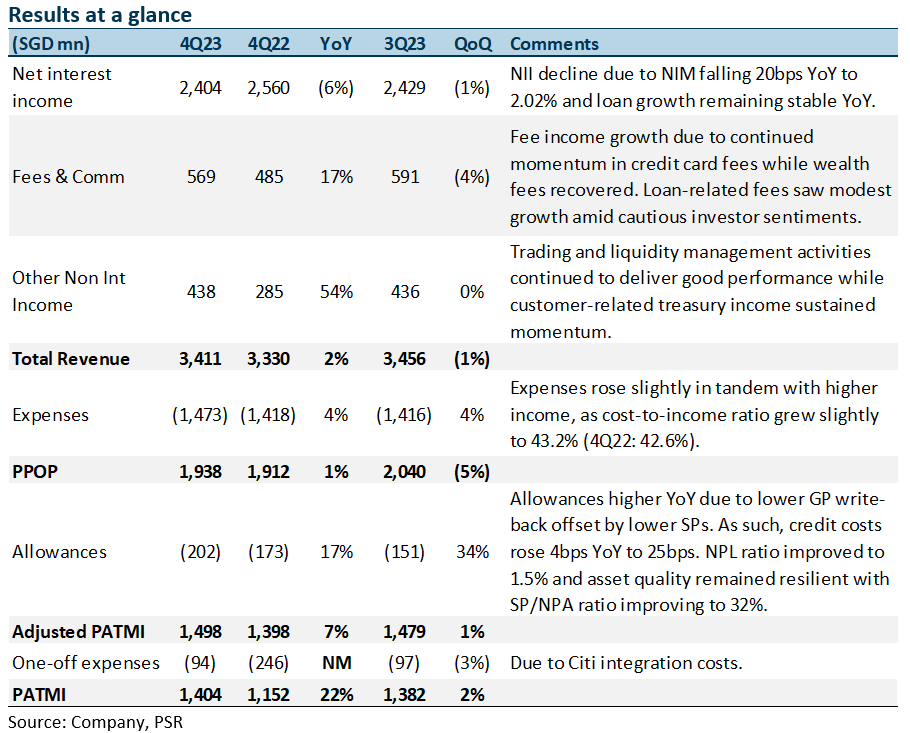

United Overseas Bank Limited – NIM growth stagnates while fee income recovers

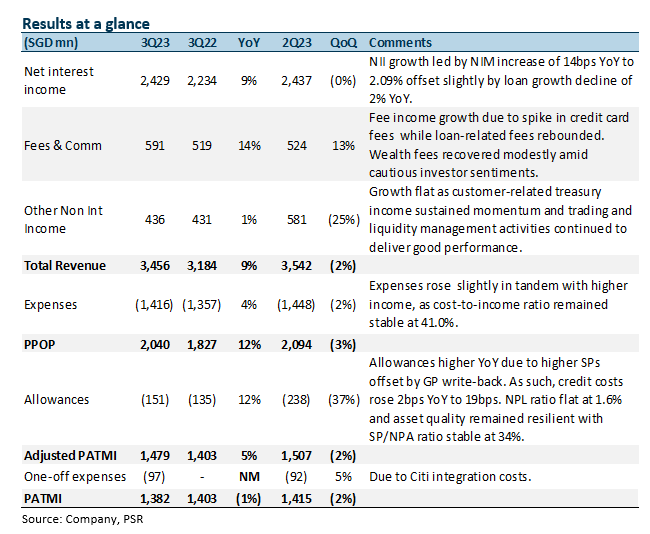

- 3Q23 adjusted earnings of S$1,479mn were slightly above our estimates due to higher fee income and higher NII offset by lower-than-expected other non-interest income growth and higher allowances. 9M23 adjusted PATMI was 77% of our FY23e forecast.

- Positives include NII growth of 9% YoY and fee income rising by 14% YoY, while negatives were the flat other non-interest income growth and allowances increasing 12% YoY. Management has maintained its FY23e guidance, while providing FY24e guidance of mid-single digit loan growth from a growing customer franchise and focus on high-quality customers, NIM to remain at current levels as funding costs have stabilised and expectations for rates to maintain till 2H24, double-digit fee income growth from the Citi acquisition, stable cost-to-income ratio and credit cost at around 25-30bps.

- Maintain BUY with an unchanged target price of S$35.90. Our FY23e estimates remain unchanged. We assume 1.48x FY23e P/BV and ROE estimate of 12.9% in our GGM valuation. Continued NIM and NII improvement and fee income recovery will boost earnings.

The Positives

+ NII and NIM continue to grow YoY. NII grew 9% YoY, despite a decline in loan growth of 2% YoY, while NIM rose 14bps YoY to 2.09% but declined 3bps QoQ due to lower margin on excess liquidity. Loan growth decline was from Singapore and Indonesia offset by growth in the rest of ASEAN. UOB has maintained its loan growth guidance for FY23e at low to mid-single digit and is guiding for a mid-single digit loan growth for FY24e.

+ Fee income recovers to near an all-time high. Fees grew 14% YoY largely due to higher credit card fees which hit a new record of S$104mn (+89% YoY) while loan-related fees rebounded and grew 5% YoY. Wealth management fees recovered modestly amid cautious investor sentiment. On a QoQ basis, fee income rose 13% from broad-based growth across all segments. Fee income now makes up 17% of total income (3Q22: 16%).

+ New NPAs fall 27% QoQ. New NPA formation fell by 27% QoQ to S$267mn as asset quality stabilised during the quarter. The NPL ratio remained stable QoQ but rose by 10bps YoY to 1.6%. Asset quality remained resilient with SP/NPA increasing slightly to 34%. 3Q23 NPA coverage is at 102% and unsecured NPA coverage at 205%.

The Negatives

- Other non-interest income growth flat YoY and declined QoQ. Other NII growth was flat YoY as customer-related treasury income sustained momentum while trading and liquidity management activities continued to deliver good performance. However, other NII fell 25% QoQ as growth in customer-related treasury income was more than offset by lower valuation on investments due to market volatility.

- Credit costs increase due to higher SPs despite GP write-back. Total allowances rose by 12% YoY to S$151mn mainly due to specific allowance increasing by 80% YoY to S$229mn despite a general allowance write-back of S$78mn for the quarter. The increase in specific allowance was a pre-emptive move to rebalance collateral value in US and Hong Kong/China. Management said that the accounts were not distressed or non-performing. This resulted in credit costs increasing by 2bps YoY to 19bps. Nonetheless, total general allowance for loans, including RLARs, was prudently maintained at 0.9% of performing loans. UOB has maintained its guidance for credit cost of around 25bps for FY23e and has guided for 25-30bps for FY24e.

- Expenses up 4% YoY. Excluding one-offs, expenses rose 4% YoY to S$1,416mn. The increase was across the board, including staff costs, revenue-related and IT-related expenses. Nonetheless, the cost-to-income ratio (CIR) improved 1.6% points YoY to 41.0% on the back of strong income growth. UOB has guided for cost-to-income ratio to remain stable in FY24e and for the one-time costs from the Citigroup acquisition to substantially roll off.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report