Thai Beverage PLC – Coping with a challenging environment

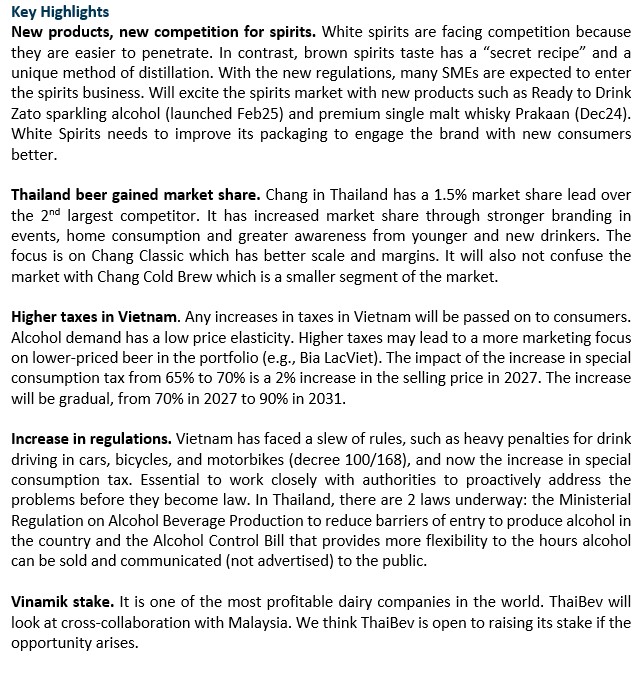

- Spirits' decline in sales volume is due to weaker economic conditions. White spirits is facing more competition from local producers. However, brown spirits are harder for competitors due to their unique taste and distillation methodology.

- Chang has become the number one beer in Thailand. The brand has performed well in events, home consumption and the younger generations. A higher alcohol tax in Vietnam from the current 65% to 70% in 2027 will raise prices by around 2%, which will be passed on to consumers.

- Plans for a Beerco listing have not changed. However, we think the current market environment makes securing the valuations the company wants difficult. Our FY25e forecast and target price of S$0.56 (based on 12x PE FY25e or 4-year average forward PE) are unchanged. We raise our recommendation from ACCUMULATE to BUY. The share price has underperformed due to tariff concerns, regulatory changes, and political uncertainty in Thailand. We find valuations at 9.5x PE and a yield of 5.8% attractive for a dominant food and beverage operator in the faster-growing SE Asia market. We expect consumer sentiment in Thailand will not be severely impacted by recent political turmoil. There is also upside in gross margins with falling molasses, malt, and aluminium costs.

Thai Beverage PLC – Will tighten the belt to grow

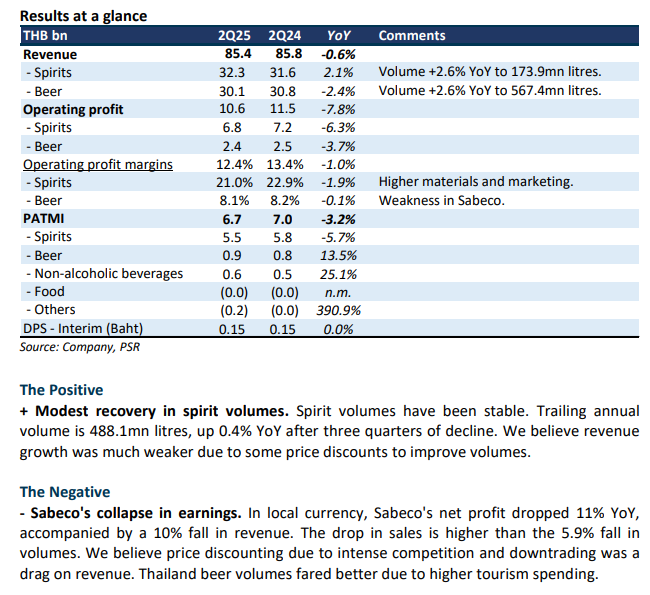

- Results were within expectations. 1H25 revenue/PATMI were 49%/50% of our forecasts. 2Q25 spirits revenue grew 2.1% YoY, but net profit (81% of group) declined 5.7% due to higher raw materials and marketing spend.

- Sabeco was the key drag in the operations. Revenue declined 10% YoY as volumes fell 6% to 301.8mn litres. Beer sales in Thailand were the bright spot, with volumes jumping 14.3% YoY to 265.6mn, bolstered by tourist spending.

- We maintain our ACCUMULATE recommendation and target price of S$0.56, based on 12x PE FY25e or 4-year average forward PE. We expect the weak consumer sentiment in Thailand and Vietnam to persist into 2H25. Uncertainty over tariffs, lack of government spending, and weakness in export markets will further dampen the fragile consumer sentiment. Margins are expected to recover as commodity prices slide lower and the company takes more aggressive steps to lower marketing spend.

Thai Beverage PLC – A slow start

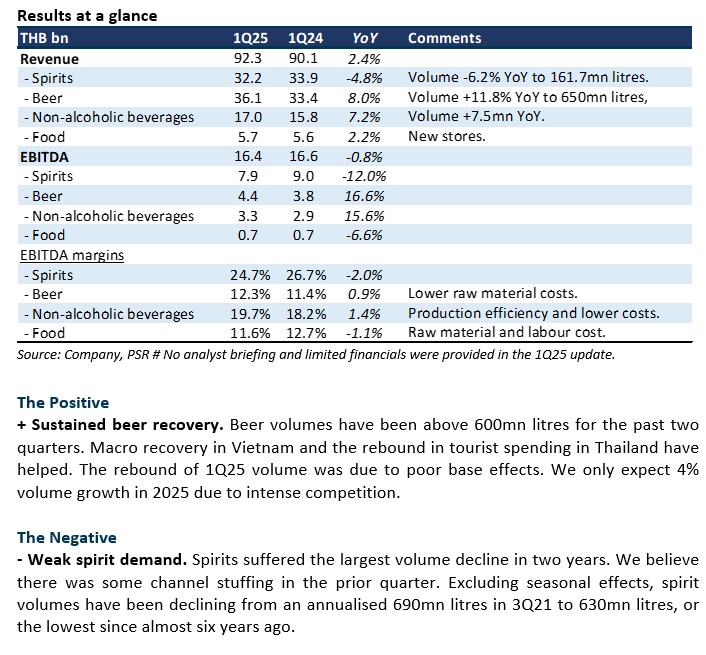

- Results were within expectations. 1Q25 revenue/EBITDA were 25/30% of our forecasts. Due to poor performance in spirits, we expect PATMI to be below estimates.

- Spirits is 48% of EBITDA and a much larger 75% of PATMI due to the high minority stake and interest expense of the beer business. Spirits volume declined 6.2% YoY in 1Q25, the weakest in 8 quarters. We believe this is in part due to overstocking in the prior quarter.

- We downgrade our recommendation from BUY to ACCUMULATE. Our earnings forecast is maintained, but the target price has been lowered to S$0.56 (prev. S$0.64). We are reducing our target PE from 14x to 12x PE FY25e, or back to 4-year average forward PE. We believe the sluggishness of earnings and modest improvement in consumer spending will keep valuation multiples depressed. Spirit volumes have been on a declining trend for the past three years.

Thai Beverage PLC – Rebound in volumes, beer less relevant

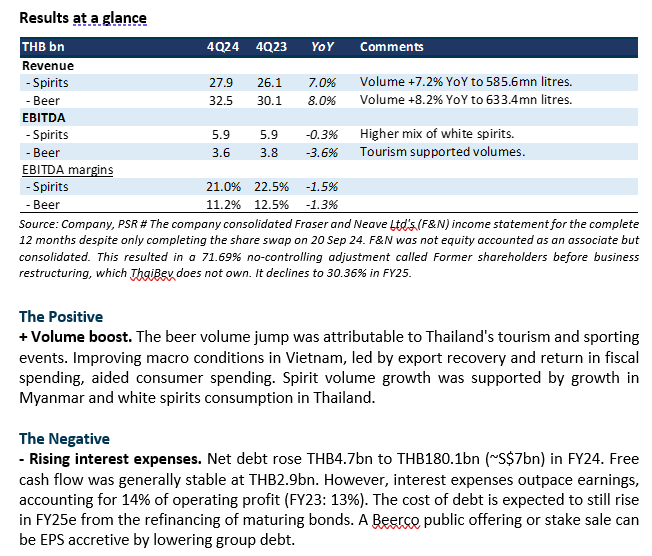

- Results were within expectations. FY24 revenue and PATMI (excl. NAB) were 98% /98% of our forecasts. Dividends in FY24 were raised 3.3% to THB0.62 (S$0.023).

- Post-share swap, ThaiBev will avoid swings in earnings from Frasers Property fair value changes and lumpy development projects. In exchange, it will receive more stable beverage profits, including Vinamilk. Non-alcoholic beverages will account for 15% of PATMI, larger than beer’s 10%.

- Our BUY recommendation is maintained. The target price is raised marginally to S$0.64 (prev. S$0.63). We peg ThaiBev's valuation at 14x PE FY25e and exclude associate market capitalisation. ThaiBev's valuation has been on a de-rating from 16x to 14x PE's 3-year historical average. We see better visibility of a volume recovery in FY25e from improving macro drivers such as tourism and reviving fiscal spending and exports.

Thai Beverage PLC – Beer drive profit growth

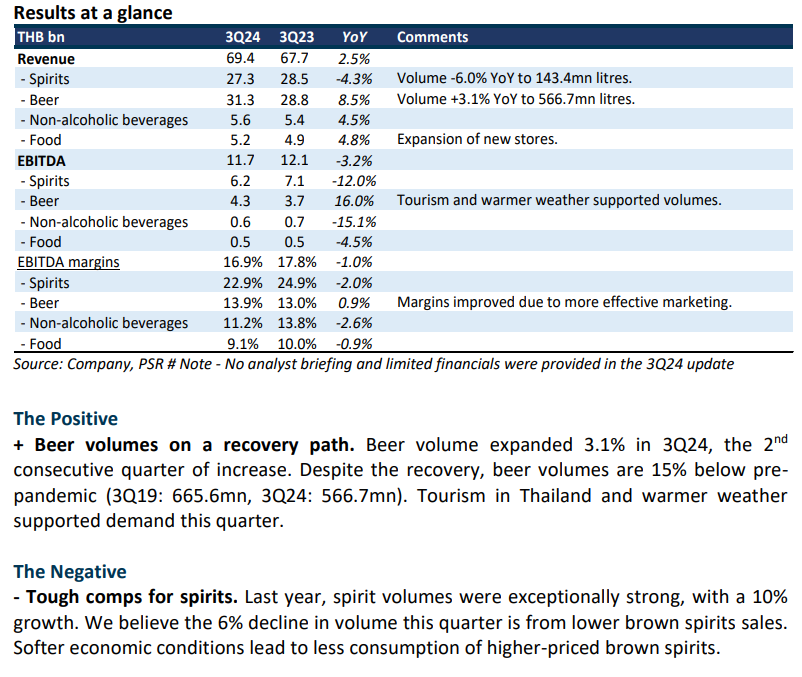

- Results were within expectations. 9M24 revenue and EBITDA were at 73%/83% of our FY24e forecasts. 3Q24 EBITDA declined 3.2% YoY to Bt11.7bn due to a drop in spirits revenue and profits. We believe weaker property earnings from associates and higher interest expense to be a drag to net profit.

- EBITDA in 3Q24 dipped 3.2% YoY due to a 12% decline in the spirits operations. Beer was the only segment that enjoyed growth. EBITDA rose 16% YoY to Bt4.3bn led by Thailand. Higher tourism and warmer weather supported consumption. Despite the recovery, beer volumes are 15% below pre-pandemic levels.

- We maintain our FY24e PATMI and BUY recommendation is unchanged. The target price of S$0.63 is maintained based on 16x FY24e core earnings, the 3-year historical average. Listed associates are valued at market valuations with a 20% discount. A recovery in beer volumes in Thailand and Vietnam will support earnings. Aggressive government stimulus in Thailand will provide an added spurt in consumption.

Thai Beverage PLC – Swap property for more milk and soft drinks

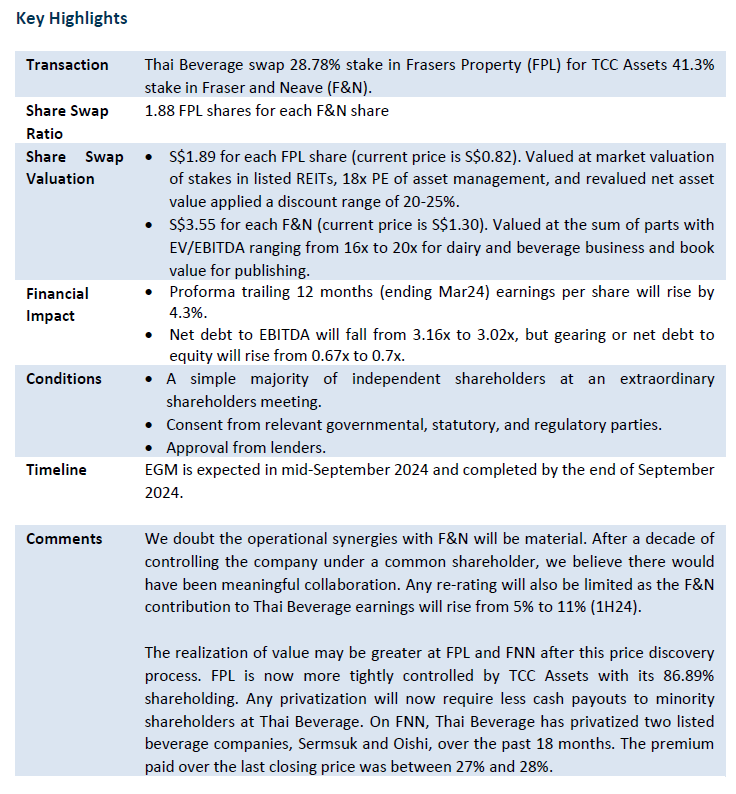

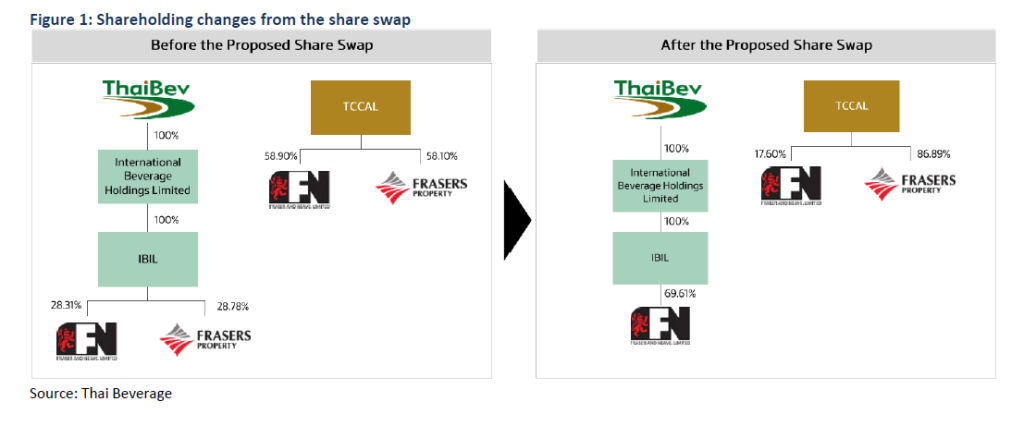

- Thai Beverage has proposed a share swap with TCC Assets. It will transfer its 28.78% stake in Frasers Property in exchange for a 41.3% stake in Fraser and Neave (F&N). There will be no cash exchange.

- Thav Beverage will cease to hold any stake in Frasers Property. Its stake in F&N will rise from 28.31% to 69.61%. There is no requirement for a general offer for F&N. Approval from independent Thai Beverage shareholders by a simple majority at an extraordinary shareholder meeting is required.

- We view the transaction as mildly positive. It can reduce the earnings volatility from Frasers Property development profits and investment property fair value changes. With the consolidation of F&N, net debt to EBITDA will moderate. Proforma earnings per share will rise 4.3%, but this is against the recent collapse in Frasers Property earnings. We do not expect any valuation re-rating from the disposal of this property division. F&N contribution to Thai Beverage earnings will only rise from 5% to 11%. Our BUY recommendation and target price of S$0.63 is maintained. Our earnings are unchanged pending the completion of the transaction.

Thai Beverage PLC – Beer turning fresh

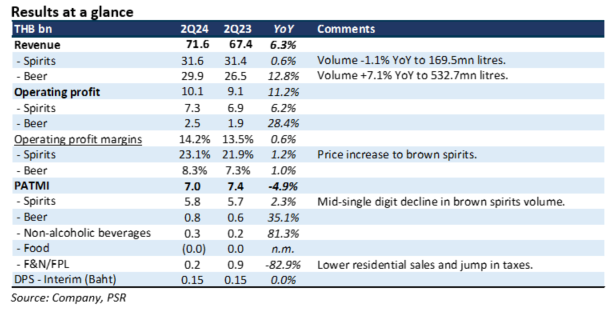

- Results were within expectations. 1H24 revenue and PATMI were at 50%/53% of our FY24e forecasts. Margins are ahead of expectations, but associate profit fell 83% YoY on weaker property sales and higher taxes.

- After four quarters of decline, beer volumes have started to rebound. 2Q24 volumes jumped 12.8% YoY to 532.7mn litres. Growth was in both Vietnam (+6.4%) and Thailand (+8.2% YoY). Beer volumes are still 20% below pre-pandemic.

- We lower our FY24e PATMI by 4% to THB27.8bn to account for lower associate earnings. Our BUY recommendation is maintained, but the target price has been cut to S$0.63 (prev. S$0.67). We revised our foreign exchange assumptions lower and accounted for the lower associate market capitalisation, which was unchanged. We peg our target price to 16x FY24e core earnings, the 3-year historical average. Listed associates are valued at market valuations with a 20% discount. We expect beer volumes to recover further as macro conditions and consumer spending rebound in Thailand and Vietnam. Aggressive government stimulus in Thailand will provide an added spurt in consumption.

The Positive

+ Beer volume recovery. There was a significant turnaround in beer volumes. After four quarters of decline, beer volumes rebounded on market share gains, warmer weather, more marketing events, a higher number of tourists, and overall improvement in macro conditions.

The Negative

- Associate earnings collapse. Associate earnings are volatile due to the lumpiness in residential property project earnings and fair value changes. Fraser's property earnings were hurt by a reduction in residential revenue in Singapore and Thailand and higher taxes.

Thai Beverage PLC – No celebrations, yet

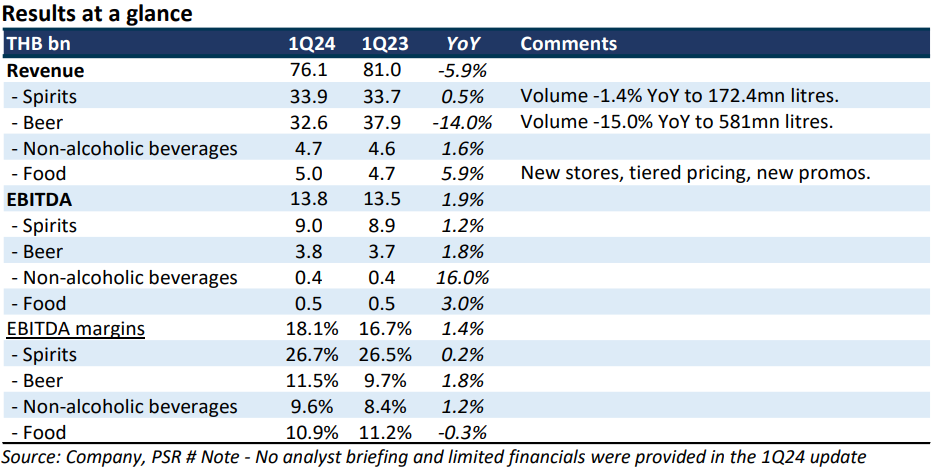

- Results were within expectations. 1Q24 revenue and EBITDA were at 26%/27% of our FY24e forecasts. 1Q24 EBITDA rose 1.9% YoY to Bt13.8bn.

- 1Q24 beer revenue suffered a 14% YoY decline in revenue, consistent with the 15% drop in volumes. Spirits operations were stable with revenue largely flat YoY. Margins for both businesses rebounded on lower production costs and marketing spend.

- We maintain our FY24e forecasts. Our BUY recommendation and target price of S$0.75 is unchanged. We peg our target price to 16x FY24e core earnings, the 3-year historical average. Listed associates are valued at market valuations. We remain positive on the recovery of volumes this year as economic conditions improve via government stimulus and a rebound in exports.

The Positive

+ Margin improvement. There was margin improvement, especially in the beer segment. We believe the improvement came largely at Sabeco through a combination of lower production costs and more disciplined spending on advertising and printing. Spirits margins were stable as the product mix of higher-margin brown spirits rose.

The Negative

- Volumes still falling for beer. Beer volumes were down in the teens for the past four quarters with the sharpest decline in 1Q24. For calendar 2023, volumes were down 12% YoY, only 4% points lower than the 16% drop in pandemic hit 2020. The slowdown in macro conditions in Vietnam has hurt consumption spending and distributor confidence to stock up.

Outlook

Recovery in 2024 highly depends on the strength of Thailand's and Vietnam's economies. We believe there is room for optimism in Thailand with planned fiscal stimulus, a cut in excise tax for spirits (from 10% to 0%), and the possible removal of prohibited periods (2 pm-5 pm) to sell alcohol. We do expect a slower recovery in Sabeco. Tet sales in Vietnam appear to be sluggish, with dealers and supermarkets being more cautious in building up inventory. Competition in prices and giveaways remains intense.

Maintain BUY with unchanged TP of S$0.67

Our target price is maintained at S$0.67. Valuations are based on a 3-year historical average of 16x PE and listed associates are valued at a 20% discount to current market prices.

Thai Beverage PLC – Waiting for macro to turnaround

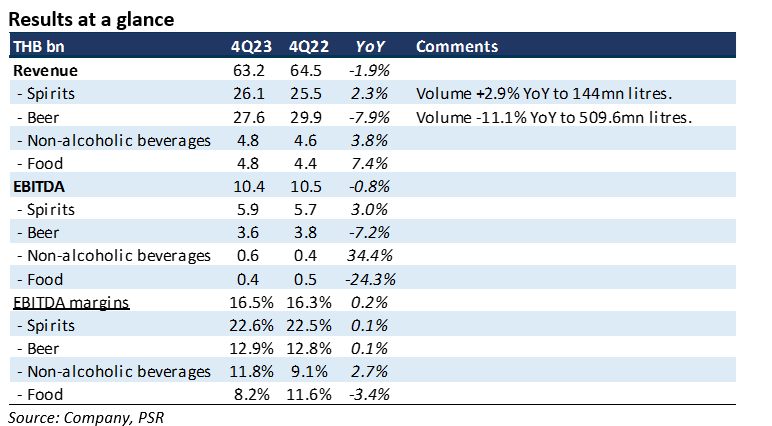

- Results were marginally below expectations. 2023 revenue and PATMI were at 97%/95% of our FY23e forecasts. Beer revenue and associate earnings were below our estimates.

- Spirits EBITDA grew 3% YoY in 4Q23 to THB5.9bn due to growth in volumes. Beer EBITDA fell 7% to THB3.6bn, as beer volumes declined by 11%, the third consecutive quarter of contraction.

- We lower our FY24e PATMI by 9%. Beer is facing soft consumer demand in Vietnam due to the weak economic conditions, and made worse by five cumulative rounds of price increases since 2021. In Thailand, the emergence of Carabao as a new beer competitor further raised the pricing and marketing intensity. We expect growth in spirits revenue from normalisation of white spirits volume, price increases and higher mix of brown spirits. More aggressive fiscal spending in Thailand next year will support consumption spending. Our BUY recommendation is maintained but target price is lowered from S$0.75 to S$0.67. We roll-over valuation to FY24e earning but PE ratio is lowered to the 3-year average of 16x (prev. 18x). The listed associates are valued at 20% discount to current market price.

The Positive

+ Resilient spirits volume. Spirit volume expanded 2.9% YoY to 114mn litres from higher demand of the more expensive brown spirits. The brown spirits share of volume is still below pre-pandemic levels. White spirits volume were softer due to front loading a year ago.

The Negative

- Beer still suffering. Both beer revenue and EBITDA declined around 7%. Volumes contracted a larger 11% as a cumulative round of price increases has hurt consumption that is already weak from the soft macro environment, particularly in Vietnam.

Thai Beverage PLC – The beer is still flat

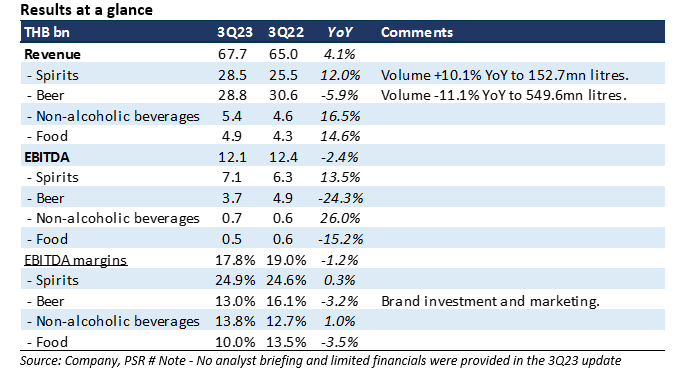

- Results were below expectations. 9M23 revenue and PATMI at 71%/65% of our FY23e forecasts. Weakness in beer sales was steeper than expected.

- Spirits revenue climbed 12% YoY to THB28.5bn in 3Q23, largely on 10% volume jump and improvement in selling price from better mix of brown spirits and price adjustment. 3Q23 spirits volume was a record 152.7mn litres.

- We lower our FY23e revenue by 10% and PATMI 7%. Beer contribution to group PATMI around 8% due to the large minority interest. The weakness in beer volumes was steeper than expected. Sabeco is facing major volume contraction due to weak macro conditions in Vietnam affecting discretionary spending such as alcohol. Our BUY recommendation is maintained but target price is lowered from S$0.80 to S$0.75. We peg 18x FY23e earnings for the core operations, its historical average. And listed associates are valued at market valuations.

The Positive

+ Rebound in spirits volume, revenue and margins. Spirits volume continue to pick up momentum, rising 10% YoY in 3Q23 to an estimated 152.7mn litres. Revenue rose a faster 12% YoY from higher selling price and better product mix of brown spirits.

The Negative

- Beer earnings collapsed. EBITDA for beer operations was down 24%, largely from the drag in Sabeco operations. Margins contracted from weaker volumes, high raw material inventory and higher marketing spend in events to promote the brands.

Outlook

We expect beer volumes for Sabeco to remain weak for the rest of the year. Any recovery is only expected early next year from economic uplift and lower raw material cost. Spirit volume may soften as festivities post-election wind down and farm incomes have been trending down.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report