Suntec REIT – Singapore’s strong performance fuels growth

- 2H25/FY25 DPU of 3.88/7.035 Singapore cents rose 23%/13.6% YoY, beating our expectations and forming 57%/104% of our FY25e forecast. The outperformance was driven by a 12.8% YoY decline in FY25 finance costs and stronger operational performance across the Singapore portfolio, more than offsetting weaker contributions from the Australian properties and The Minster Building in the UK.

- In FY25, SUN delivered strong positive rental reversion of +9.6% and +15.3% across its Singapore office and retail segments, respectively, while the Australian portfolio recorded a modest +1% effective rent reversion. Interest costs fell 35bps YoY to 3.71%, and we expect a slight further decline in FY26e.

- We maintain ACCUMULATE with a higher DDM-based TP of S$1.63 (prev: S$1.40) as we roll forward our forecast. We raise our FY26e DPU estimate by 9% on lower interest costs and stronger operating performance in Singapore. SUN’s portfolio resilience is anchored by its Singapore assets, with rental reversions expected to remain robust at c.10% for retail and c.5% for office. The new owner of the REIT manager (pending MAS approval) is also the largest unitholder, enhancing alignment of interests and potentially supporting an acquisition pipeline. SUN currently trades at an FY26e dividend yield of 5.2% and P/NAV of 0.72x.

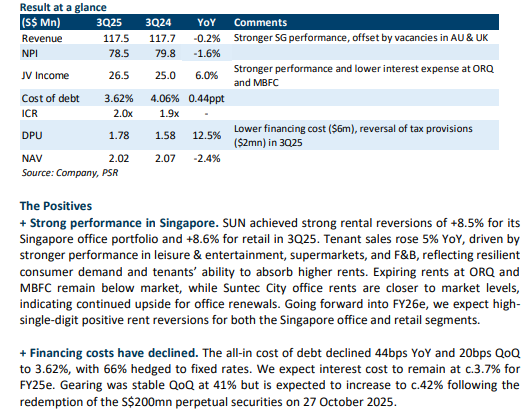

Suntec REIT – Low interest hedge ratio supports DPU growth

- 3Q25 DPU of 1.778 Singapore cents rose 12.5% YoY, beating our expectations and forming 28% of our FY25e forecast (9M25: 78%). This outperformance was driven by lower finance costs (-44bps YoY), stronger operating performance from the Singapore portfolio, and a S$2mn reversal of withholding tax provisions for the Australia portfolio. Excluding the tax reversal, 3Q25 DPU was still 8% higher YoY.

- In 3Q25, SUN achieved strong rental reversion rates of +8.5% and +8.6% for its Singapore office and retail segments, respectively. The Australia portfolio underperformed due to a weaker AUD against the SGD and lower occupancy, leading to an 11.3% YoY decline in NPI. Interest costs fell 44bps YoY to 3.62% and are expected to stay around this level in 4Q25.

- We downgrade SUN from BUY to ACCUMULATE with a higher DDM-TP of S$1.40 (prev: S$1.36) due to the recent share price performance. We raise our FY25e DPU estimate by 6% on lower interest costs and the reversal of tax provisions (another S$2mn expected in 4Q25). SUN’s portfolio resilience is anchored by its Singapore assets, which contribute c.70% of income. We expect low-teens rental reversions for the Singapore retail segment and high-single-digit reversions for the office segment in FY25e. SUN is currently trading at an FY25e dividend yield of 5.7% and P/NAV of 0.58x.

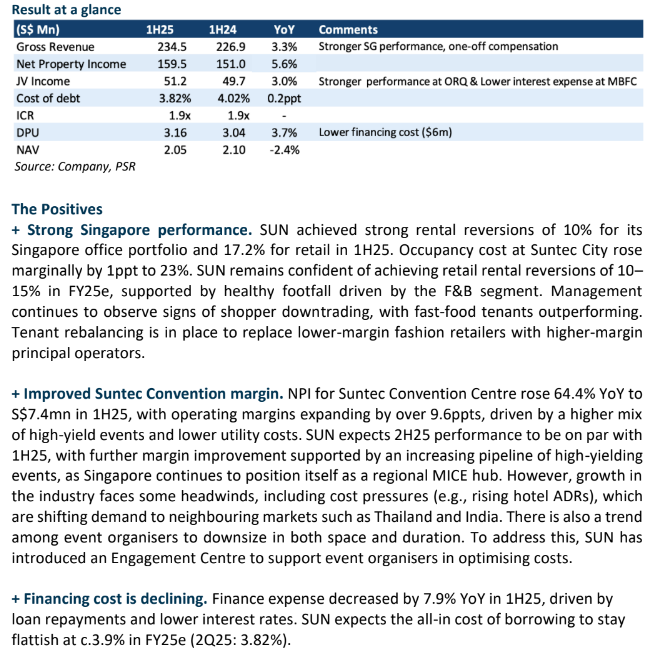

Suntec REIT – Robust SG rental reversion sustained

- 1H25 DPU rose 3.7% YoY to 3.155 cents, underpinned by S$6mn in finance cost savings. The result was in line with our expectations, accounting for 51% of our FY25e forecast. SUN achieved rental reversion rates of 10% for its Singapore office and 17.2% for the retail segment.

- Overseas markets remain a drag, with occupancy rates declining in both the UK (-0.5ppts YoY) and Australia (-3.3ppts YoY), though they contribute only 30% of group income. NPI from Australia rose 14.6% YoY in SGD terms, driven by a one-off AU$10mn compensation at 177 Pacific Highway. However, the impact on the bottom line is minimal as most of the proceeds will be allocated to fund CAPEX.

- Transaction activity for Suntec office remains muted as most potential buyers are owner-occupiers, and Suntec maintains a high occupancy rate of 99%. We reiterate our BUY recommendation with a higher DDM-TP of S$1.36 (prev: S$1.33), and have revised up our FY25e/FY26e DPU forecasts by 3% to 6.29/ 6.65 cents. Upward revisions are underpinned by improved margins at Suntec Convention, lower financing costs, and reduced tax exposure from UK assets. While overseas markets continue to be a drag, we expect FY25e DPU to be supported by low-teens rental reversions in the Singapore retail segment and high-single-digit reversions for the office segment. SUN is currently trading at an FY25e dividend yield of 5.3% and P/NAV of 0.57x.

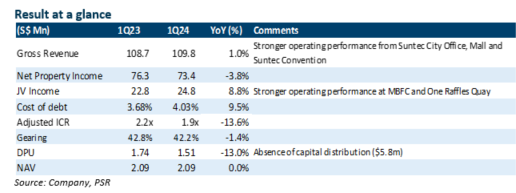

Suntec REIT – MIT status to hold

· 1Q25 DPU reversed its downward trend, rising 3.4% YoY to 1.56 Singapore cents, in line with our forecast and forming 25% of FY25e estimates. The YoY growth was driven by S$2.5mn in finance cost savings, a 176.9% surge in Suntec Convention NPI, and resilient rental reversions in Singapore (Office: 8.0%, Retail: 10.3%).

· SUN remains committed to its S$100mn divestment target for FY25e, with pricing expected to be 20–25% above book value. We anticipate valuations for overseas assets, particularly in the UK, to remain stable in FY25e, except for the Melbourne office market, which may face downward pressure due to negative net absorption.

· SUN is likely to retain its Managed Investment Trust (MIT) status, following the reduction of Gordon Tang (9.9%) and Celine Tang’s (9.1%) ownership to below 10% each. This enables Australia's effective tax rate to revert from 45% to 10–15%, pending regulatory confirmation. Following the recent share price performance, we maintain our FY25e forecasts and upgrade our recommendation to BUY. Our DDM-TP remains unchanged at S$1.33, with FY25e/26e DPU estimates of 6.09/6.45 cents. Given the cautious sentiment among retailers, we expect high single-digit rental reversions for the retail segment and mid-single-digit reversions for the office segment in FY25e. SUN is trading at an FY25e dividend yield of 5.3% and P/NAV of 0.55x.

Suntec REIT – Resilient Singapore performance sustained

· Gross revenue for FY24 inched up by 0.2% YoY to S$463.6mn, underperforming our forecast at 93% of full-year estimates. The improvement was supported by strong rental reversions of 22.9% for retail and 10.6% for office spaces.

· NPI slipped by 0.8% YoY to S$310.8mn due to the absence of a property tax refund, in line with our forecast and forming 100% of the FY24 estimate. DPU plummeted by 13.2% YoY to 6.19 cents, driven by higher financing costs and the exhaustion of the S$23mn capital top-up. FY24 DPU stands at 6.19 cents, which is within our expectations, at 100% of the full-year forecast.

· SUN successfully divested S$58.3mn of strata units at a price 24% above book value, reflecting the underlying value of the assets. However, it fell short of its FY24 divestment target of S$100mn. We have lowered our FY25e-26e DPU forecasts by 8%/3%, respectively, after factoring in a decelerated decline in interest rate. We maintain our ACCUMULATE rating with a lower DDM-TP of S$1.33 (prev: S$1.36) and FY25e/26e DPU of 6.10/6.48 cents. While topline growth is hobbled by overseas performance, FY25e earnings are likely supported by Singapore's sturdier office rental reversion at high-single-digit levels and retail at the low teens.

Suntec REIT – Overseas performance subdued

· Gross revenue for 3Q24 is in line with expectations, sliding by 4.6%YoY to S$117.7mn. 9M24 revenue forms 74% of our FY24e estimates, and the decline was due to lower contributions from the Suntec Convention and overseas properties.

· NPI slipped by 5.7% YoY to S$79.8mn which 9M24 constituting 73% of our FY24e estimates and was within expectation. DPU plummeted by 11.9% YoY as the S$5.8mn capital distribution has been exhausted. 3Q24 DPU stands at 1.58 cents, which is within our expectation, and 9M24 DPU forms 75% of our full-year forecast.

· Rental reversion in Singapore was healthy, with office achieved at 10.8% and retail at 20.9%. Overseas assets were the main drag to the portfolio, with a 20.5%YoY drop in NPI for the UK and a 10.9% YoY decrease for Australia in 3Q24 due to increasing vacancy. While SUN is committed to its S$100mn strata units divestment with 50% completion YTD, we do expect year-end valuation from the overseas assets to place pressure on gearing. There is no change in FY24e forecast, but we lowered our FY25e DPU estimates by 7% after factoring in the lacklustre overseas performance. We downgrade SUN to accumulate with a lower DDM-TP of S$1.36 (prev: S$1.41) and FY24e/25e DPU of 6.2/6.96 cents in the face of the deteriorating NPI margin, lacklustre overseas performance and slowing down in large-scale events in Singapore.

Suntec REIT – Resilient Singapore assets and improving overseas outlook

-

Gross revenue for 1H24 is in line with expectations, inching up by 1.2% to S$226.9mn due to the strong performance of Singapore assets (Retail rental reversion: +20.8%, Office: +9.7%) while overseas assets faced pressure (Australia revenue: -6.4%, UK: -16.1%).

-

NPI increased by 1.5% to S$151mn, forming 48% of our FY24e estimates. DPU plummeted by 12.5% in the absence of the 0.398 cents capital top-up, with 1H24 DPU standing at 3.042 cents, which is 49% of our full-year forecast.

-

SUN continues to demonstrate the capability of monetizing its assets as it divested S$31.5mn of strata units at 27% above book value and has put another 12.3k sqft for sale at c.S$41.8mn. With the strengthened cash position and the possible uplift on MAS’s regulation (ICR lowered from 2.5x to 1.5x), SUN would soon improve its balance sheet, which has been one of the main drags on its share performance. We reiterate our BUY recommendation with an unchanged DDM-TP of S$1.41 and FY24e-25e DPU of 6.2 to 7.5 cents.

Suntec REIT – Higher-for-longer interest rate continue eroding DPU

- Gross revenue for 1Q24 inched up 1% YoY to S$109.8mn and NPI contracted by 3.8% YoY to 73.4mn underpained by the stronger-performing Suntec Center, forming 23%/22% of our FY24 estimate respectively. DPU decreased by 13% in 1Q24 to S$1.51 cents, in the absence of capital distribution (FY23: S$5.8mn), and was within our expectations. If the capital top-up is excluded, DPU will decline slightly by 1.8% YoY.

- High rental reversion continued in FY24 with Singapore office generated 11.4% for 1Q24 and Suntec City Mall contributing 21.7%. We expect rental reversion of mid-teens for retail and high-single-digit for office in FY24.

- We reiterate our BUY recommendation with a lower DDM-TP of S$1.41 (prev: S$1.47) and FY24e-25e DPU forecasts of S$6.2 to S$7.49 cents after factoring in the higher-for-longer interest rate and longer-than-expected leasing downtime of oversea properties. We expect FY24e DPU to be eroded by the high interest rate since only hedged 57% of its borrowing to fixed-rate. Nevertheless, earings will be supported by high rental reversions of the Singapore side and divestment of strata office assets in Suntec reduce to lower interest expense.

The Positives

+ Income supported by high rental reversion and increasing contribution from Suntec Convention. Singapore offices' rental reversion was 11.2% in 1Q24 and 21.7% for Suntec City Mall. Pure Yoga and Pure Fitness have returned ac.41k sqft back to SUN, and only 25% of it has been backfilled. Rental of backfilled is c.21% higher. As Singapore positions itself as the MICE spot and lines up events until the end of 2028, Suntec Convention Center is well-positioned to capture the momentum, given its central location, amenities, and the delay of the MBS renovation. Revenue for the convention center is up by 26.1% to S$11.6 mn, and we expect it to contribute to approximately 20% of total revenue in FY24e.

+ Firm on the S$100mn divestment goal. SUN is committed to the S$100mn divestment goal no plans on lowering the price. The proceeds generated will be used for debt repayment, with the aim of lowering gearing to 40%. The S$100mn strata units contribute to c.2.5% of the total revenue, thus compressing DPU by 1.5% after factoring in interest savings from debt repayment.

The Negative

- The creeping up in vacancy rate is overshadowed by high rental reversion. The retail and office occupancy rates at potfolio level saw a 2.1% points YoY and 3.5% YoY decline, respectively. We expect further downtime is required for 55 Currie Street and The Minster Building. Australia saw more leasing demand dropback due to supply influx in the CBD area; effective rental reversion was at negatives for 1Q24. SUN also observed increasing incentives for the Australian market, thus compressing earnings; incentives are up to 35-45% of the total income of the contract period. Valuation for the Australian side may decline further in the face of a possible cap rate expansion of 25bps.

- Borrowing cost inching up. Given the high-for-longer interest rates generally priced in by the market, we expect elevated interest costs to continue eroding DPU. FY24e, the cost of debt is expected to increase by 4.2%. However, the weakening start of FY24 may just mean that some extra patience is required to get there. We are still confident in SUN’s ability to generate cyclical rebound due to its lower % hedging ratio of 57% as of the end of 1Q24.

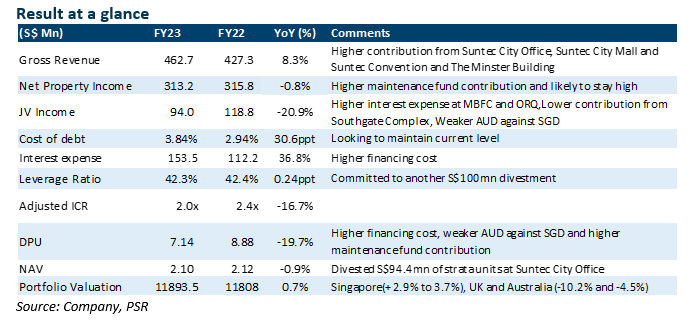

Suntec REIT – Deeply discounted assets

- Gross revenue for FY23 surged by 8.3% to S$462.7mn, surpassing our expectations by 7.8%. NPI slided 0.8% YoY to S$2mn and was in line with expectation at 104.2% of our forecast.Revenue were supported by a rental reversion of 12.3% for Singapore office spaces and a 21.8% rental reversion for Suntec City Mall. Suntec Convention has fully resumed its operations, with revenue surpassing pre-COVID levels by 3.9%.

- DPU decreased by 19.7% YoY but exceeded our estimates(S$307.9mn) by 6.7%, primarily due to higher maintenance fund contribution and weaker Australia performance, ending the full year at 7.135 cents. Another S$100mn divestment plan has been set, following the S$94.4mn of strata offices sold in FY23.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$1.47 and FY24e-25e DPU forecasts of S$7.30 to S$7.89 cents. We have factored in the effects of leasing downtime and a better-than-expected recovery of the Suntec Convention Center in FY24e. Rental reversions for retail spaces will continue to trend strong in the mid-teens, while office spaces are expected to be in the mid-single digits. The stock is trading at 42% discount to book value of S$2.1.

The Positives

+ Resilient balance sheet upon completion of divestment goal. SUN divested S$94.4mn at Suntec City Office Towers in FY23 at,31% above the book value. Post-divestment, gearing stood at 42.3% (-0.24ppt YoY). SUN is committed to another S$100mn disposal plan, with a priority on strata units in Suntec Office due to better visibility of end-user demand. The proceeds generated will be used for debt repayment, aiming to lower gearing to 40%. The S$200mn strata units contribute to c.5% of the total revenue, thus compressing DPU by 3% after factoring in interest savings from debt repayment.

+ Singapore valuation rose. Tenant sales surpassed the pre-COVID level by 14%, while shopper traffic lagged behind by c.10%. Singapore retail achieved a rental reversion of 21.8% in FY23 despite cautious domestic consumption. Meanwhile, rental reversion for offices remains resilient at 12.3%, with high tenant retention of 71% in Suntec. Occupancy costs continue to trend down to 21%, compared to the pre-COVID level of 23%, leaving room for further rental reversion. Singapore assets valuation rose by 3.1% in FY23. The overseas portfolio fell due to cap rate expansion, ranging from 25 bps to 63 bps, resulting in a total portfolio valuation uplift of 0.7%.

+ Better-than-expected recovery for Suntec Converntion Center. While MBS expansion faced some delays, Suntec Convention rebounded strongly in 2023 with the return of larger international events, driving revenue to grow 58%YoY to S$63.9 (+3.9% FY19). The growth is set to continue in FY24, driven by MICE and consumer events. We expect them to contribute to c.20% of total revenue.

The Negative

- Fading recovery tailwind. The retail occupancy rate saw a 2.3% YoY decline to 95.2%, mainly due to the departure of anchor tenants in both Singapore and overseas assets. The occupancy rate for 55 Currie Street was at 56.2% and is expected to improve by 1Q24. Minster Building occupancy stood at 87.3%. Portfolio occupancy for Offices segment also dropped by 3.4% YoY to 94.9%.

Suntec REIT – Resilient performance hampered by rising interest rates

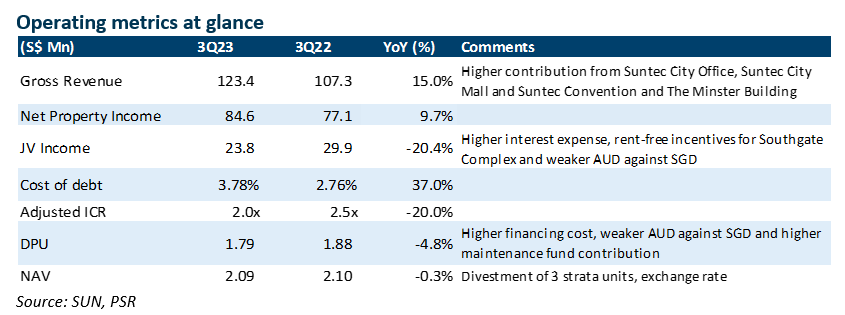

- 3Q23 results were within expectations. Gross revenue grew 15% YoY to S$123.4m and NPI increased by 9.7% YoY to S$6m. Over the past three quarters, results have been 79.7%/77.9% of our FY23e forecast, respectively.

- 3Q23 DPU declined by 14% YoY to 1.793 Singapore cents, and when considering 1H DPU, it was 76.3% of the FY23e forecast. Strong operating performance was offset by higher financing cost, FX fluctuation, and higher maintenance fund contribution.

- We maintain BUY with an unchanged DDM-TP of S$ 1.47. No change to our forecasts. We expect Singapore market to be the key revenue driver with double-digit rental reversion for the retail side to continue and high single-digit for office sector in FY24e. The current share price implies FY23e/24e DPU yields of 6.08%/7.16%.

The Positive

+ Positive Rental reversion. Office occupancy rates remain resilient at 97.4% (-1.2% QoQ), and the retail portfolio stands at 97.9% (+0.4% QoQ). Suntec City Mall achieved a rental reversion of 20.2% in 3Q23, with a 2% YoY increase in foot traffic and a 0.4% YoY rise in sales. Suntec convention revenue surged by 87.3% YoY to S$123.4m, driven by a strong recovery from MICE (Meetings, Incentives, Conferences, and Exhibitions) and advertising. We expect rental reversion to continue trending upwards for the retail sector in FY24e (c.10-15%), and Suntec convention is expected to make a full contribution of c.S$10 million in 1Q24e.

+ Divestment on track. SUN is committed to its current divestment plan, aiming to sell strata units at Suntec Office Tower 1-3 worth S$100 million by the end of FY23. Selling prices are supported by strong demand from end-users and limited supply due to URA's restrictions on new developments. By 3Q23, approximately 40% of the divestment plan was completed, with prices 20% above book value. This is likely to reduce gearing by 100bps, providing a buffer against potential year-end valuation declines. The management expresses confidence in the Singapore market and foresees no change in cap rates. While gearing improvement from divestment may be offset by overseas asset devaluation, it is expected to remain below the 45% threshold.

The Negative

- The cost of debt has increased to 3.78% (+0.14% QoQ, +37% YoY). Adjusted ICR deteriorated to 2.0x (2Q23: 2.1x), capping the regulatory gearing limit at 45%. We expect the all-in interest cost in FY24e to creep up to 4.25%. There is no commitment to top-up the distributional income using excess cash yet in FY24.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report