StarHub Limited – Still munching popcorn

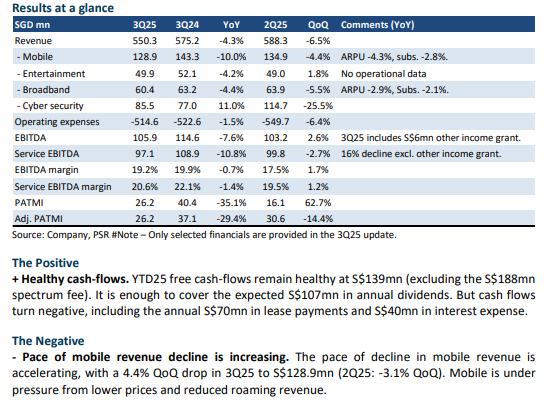

- Results were below expectations. 9M25 revenue and EBITDA were 72% and 71%, respectively, of our FY25e forecast. Earnings were propped up by S$6mn other income grant. 3Q25 PATMI was down 30% YoY to S$26.2mn following the 9% fall in EBITDA and higher depreciation.

- Mobile competition remains intense, especially at the low-end price plans and increased bundling of roaming packages. We think competition has intensified as unlimited mobile data and voice plans have been launched, targeting the premium user. Competition is also spreading to broadband, with 3Q25 revenue declining 4% YoY.

- We lower FY25e EBITDA forecast by 4% to S$418mn. Our NEUTRAL recommendation is maintained with a lower target price of $1.05 (prev. S$1.08). We assume mobile price competition in Singapore will not abate until the end of 2026. We believe StarHub will attempt to narrow its revenue market share with Simba Telecom as it turns 2nd largest operator and focused on integrating networks and synergies. A potential special dividend opportunity for StarHub will be a 20% (currently 56%) sale of Ensign under a call option.

StarHub Limited – Munch popcorn, just watch the fight

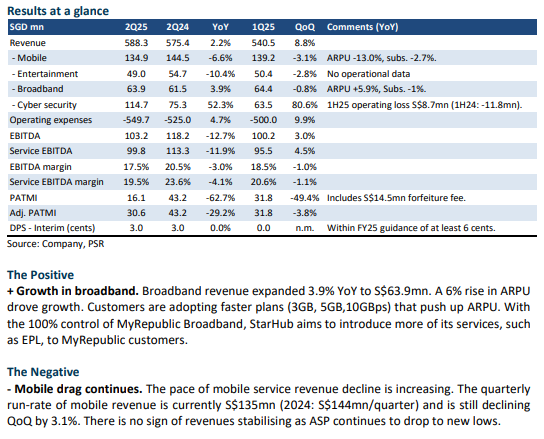

- Results were within expectations. 1H25 revenue and EBITDA were 48% and 46%, respectively, of our FY25e forecast. Headline PATMI was down 63% YoY to S$16.1mn in 2Q25, due to a S$14.1mn spectrum right forfeiture fee. Excluding the fee, PATMI decline would be 29% YoY.

- Mobile revenue and ARPU continue to weaken, falling 7% and 13% YoY, respectively. Competition in the mobile market is intensifying, with mobile plans now bundling significantly more local and roaming data. Price aggression is also appearing from the market leader.

- We maintain our FY25e forecast and NEUTRAL recommendation. Our target price of $1.08 is unchanged. StarHub will ramp up its aggressive pricing despite the planned acquisition of M1 by Simba. It is unclear what Simba’s pricing strategy is post-acquisition. StarHub has revised its FY25e EBITDA guidance downward from stable to a 12% to 16% decline (PSR: -5%).

StarHub Limited – Still in hyper-competition mode

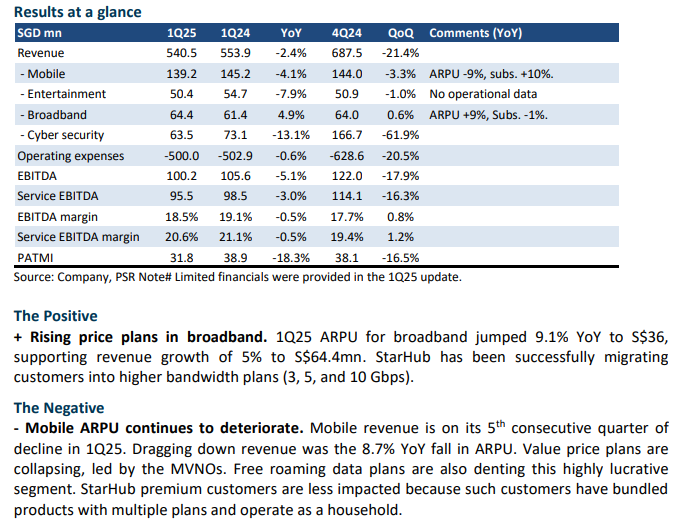

- Results were below expectations. 1Q25 revenue and EBITDA were 23% and 22%, respectively, of our FY25e forecast. Mobile ARPU continues to suffer from intense competition. On a QoQ basis, ARPU slipped 4.5%.

- Mobile price competition is across categories, including roaming and MVNO. The economics of the business will only worsen with the additional capacity and S$282mn payment for the 700MHz spectrum due 1 July.

- Our FY25e EBITDA is lowered by 5% to S$438mn as we reduce our mobile ARPU assumptions. We lowered our recommendation to NEUTRAL from ACCUMULATE. The target price is cut to S$1.08 (prev. S$1.29), from lower earnings and valuations (6.5x to 6.0 EV/EBITDA). There has been no let-up in the competitive pressure. The intense price competition and bulking up are driving the sector into consolidation and forcing incumbents to realign their cost structure.

StarHub Limited Mobile competition clouds outlook

- Revenue was within expectations at 102% of our FY24 forecast. But EBITDA was below at 96%. Mobile continues to face intense competition, with 4Q24 ARPU declining 12.1% YoY. The final dividend per share was down 24% YoY to 3.2 cents.

- Mobile postpaid subscribers are still ramping up by 94k in 4Q24 (4Q23 -5k). However, it is at the expense of revenue declining 6% YoY to S$144mn in 4Q24. Market share has crept up 1.4% points YoY to 23.9% in FY24. StarHub is guiding stable EBITDA for FY25.

- We lower our FY25e EBITDA by 13% to S$461mn due to the intense competition in mobile. Our target price of S$1.29 (6.5x FY25e EV/EBITDA) and ACCUMULATE recommendation are unchanged. Earnings recovery is expected in FY26e as DARE+ cost savings materialise. Intense mobile price competition has no winners in the industry except for quickening the urgency for consolidation. We believe the consolidator will face the distraction and cost of an acquisition. StarHub has the financial capacity to consolidate but is not the only aspirant.

StarHub Limited – Spike in mobile subscribers

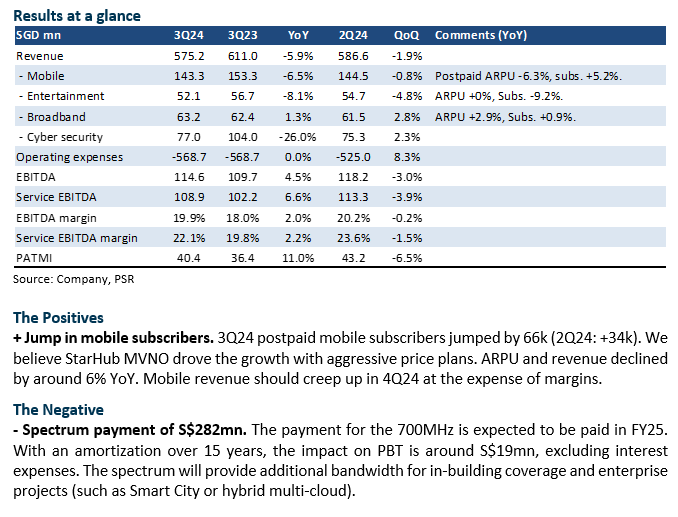

- 3Q24 results were marginally below expectations due to project timing in the enterprise business. 9M24 revenue and EBITDA were 72%/71% of our FY24 estimates. StarHub has not changed FY24e guidance in revenue and EBITDA.

- Mobile postpaid subscribers spiked by 66k in 3Q24 to 1.66mn. This is more than a decade high in quarterly subscriptions and taking market share from peers (Singtel’s -16k, M1 -23k). The 700MHz spectrum payment of S$282mn is payable in FY25. We find minimal value creation opportunities from this additional bandwidth to justify the price tag. It is a S$19mn p.a. amortisation or 10% drag on earnings, wiping most Dare+ benefits.

- The mobile operating environment remains intense. Most of the mobile subscriber gains were from Mobile Virtual Network Operators (MVNOs) on the StarHub network (i.e. wholesale pricing). We believe margins will be impacted. We maintain our FY24e forecast and target price of S$1.29 (6.5x FY24e EV/EBITDA). We upgrade our recommendation from NEUTRAL to ACCUMULATE due to the recent weakness in share price. Consolidation in the mobile industry is rational, as the current competitive intensity and upcoming spectrum payments only depress the return profile of the entire industry. However, any price repair from consolidation still depends on the behaviour of competitors.

StarHub Limited – Service revenue stalling

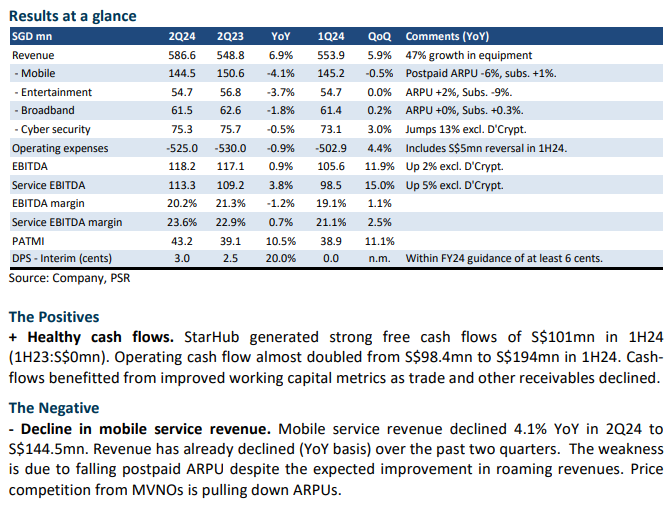

- 2Q24 results were within expectations and management full-year guidance. 1H24 revenue and EBITDA were 47%/46% of our FY24 estimates, excluding D’Crypt (disposed in Feb24). Interim dividend rose 20% to 3 cents and within guidance of at least 6 cents full year.

- 2Q24 service EBITDA expanded 5% YoY to S$113mn excluding D’Crypt. Margins benefited from a S$5mn reversal of overseas lease circuits. Excluding this reversal, 2Q24 service EBITDA will be flat or up 0.4% YoY.

- Competition from lower priced mobile MVNOs price plans is dragging down ARPU. Broadband is faced with new competition from SIMBA. Our forecasts are largely unchanged. The target price of S$1.29 is maintained (6.5x FY24e EV/EBITDA) in line with other mobile peers. We downgrade from ACCUMULATE to NEUTRAL due to the share price performance. We believe the competitive environment in mobile and broadband will place pressure on revenue in the near term. With DARE+ investments, cost savings will be more evident in FY25.

StarHub Limited – Mobile competition intensifying

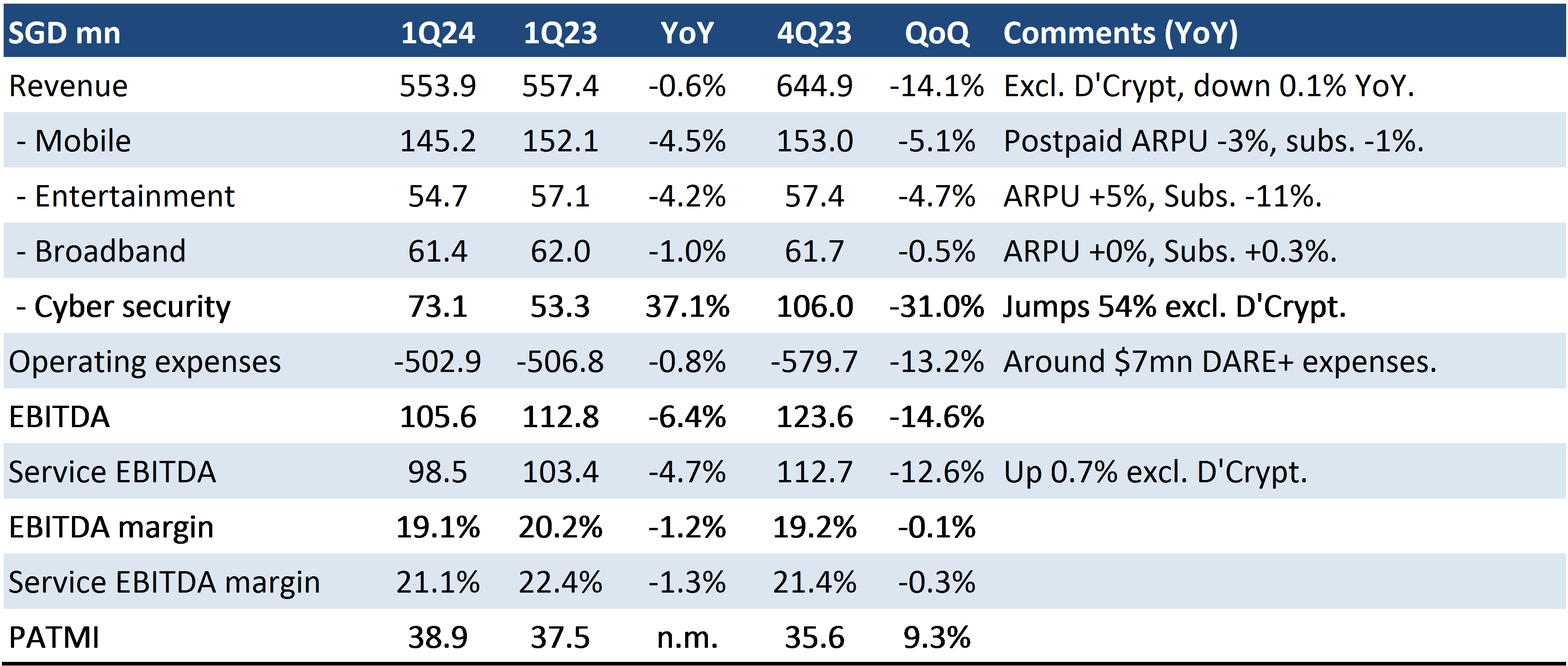

- 1Q24 results were within expectations and management full-year guidance. FY24 revenue and EBITDA were 23%/22% of our FY24 estimates.

- Service EBITDA was up 0.7% YoY to S$108.4mn excluding D’Crypt which was disposed of in February 2024. Earnings were pulled down by a contraction in mobile and entertainment revenue.

- Mobile competition is more intense than expected. 1Q24 mobile decline is the highest in 11 quarters, or since the pandemic began. We believe competition from MVNOs and MNOs has affected the lucrative roaming segment. Our forecasts are largely unchanged. The target price of S$1.29 is maintained, 6.5x FY24e EV/EBITDA, in line with other mobile peers. And ACCUMULATE recommendation maintained. This year, around 90% of the DARE+ S$270mn investments will be completed. Earnings this year are expected to be sluggish, with DARE+ opportunities in cost and revenue materialising only next year.

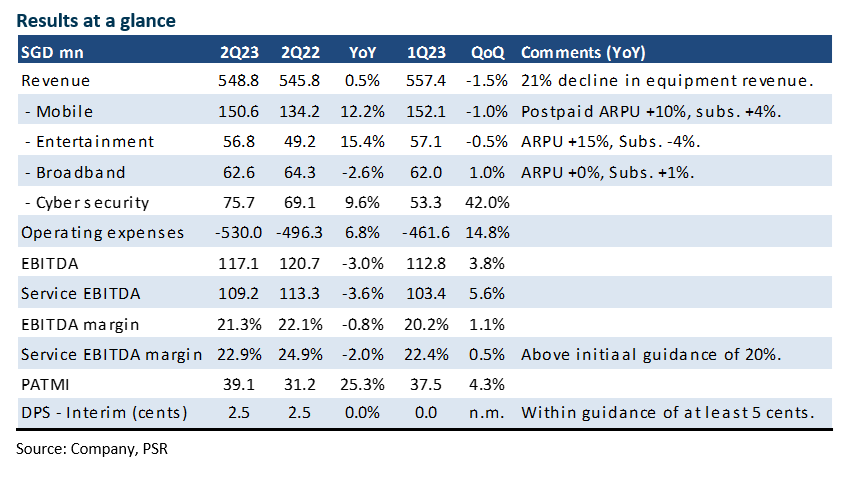

Results at a glance

The Positives

+ Strong cybersecurity revenue. Cybersecurity expanded 37% YoY to S$73mn. Excluding D’Crypt, Ensign's revenue would have jumped 54% to S$64.7mn. The surge in revenue was due to project delivery, and 1Q is typically weak on a seasonal basis. Ensign continues to add headcount and fixed costs, which affect its profitability.

The Negative

- Weakness in mobile APRU. Mobile revenue declined 4.5% to S$145mn. The large drag in revenue stems from lower postpaid ARPU and competition. Apart from competition, excess data and voice usage charges have been falling as packages enjoy higher bandwidth.

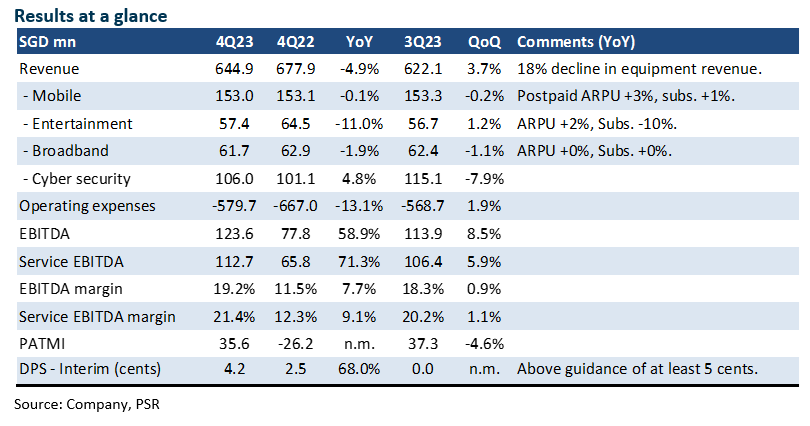

StarHub Limited – Pop in dividends

- 4Q23 results were within expectations. FY23 revenue and EBITDA were 99%/101% of our FY23 estimates. The full-year dividend was 6.7 cents, a 34% YoY rise and ahead of our 5 cents estimate.

- Revenue guidance for FY24e was for weaker growth of 1-3% (FY23: +5.5%). We believe mobile revenue faces stiffer competition from lower-end price plans, thus impeding ARPU growth despite contributions from higher-margin roaming revenue.

- The increase in FY24e dividend guidance from 5 cents to at least 6 cents has placed a minimum yield of at least 5% at the current price. Our target price is raised from S$1.21 to S$1.29 as we roll over our earnings to FY24e. We peg valuation to 6.5x FY24e EV/EBITDA, in line with other mobile peers. It will be another year of investment and slow growth for StarHub with its DARE+ initiative. The expected spend is S$80mn in FY24e, of which S$32mn is opex and S$48mn capex. Any premium valuations (or re-rating) for StarHub will depend on the efficiency and revenue gains from DARE+. This is elusive so far. Another catalyst will be monetisation or operating leverage at Ensign, the cybersecurity operations.

The Positives

+ Jump in dividends supported by FCF. The final dividend was 4.2 cents, up 68% YoY. Full-year dividend payout was 80%. It aligns with management guidance to distribute at least 80% of earnings or 5 cents, whichever is higher. The company mentioned it generated a free cash flow (FCF) of S$186mn, sufficient to cover the S$115mn in dividends. However, we believe lease payments of S$37mn should be deducted from FCF as it is operating in nature.

The Negative

- Slower services revenue. Service revenue declined 1.4% YoY in 4Q23 to S$527mn, the first decline in two years. Most segments were weak. Despite roaming revenue, mobile ARPU only rose 3% YoY to S$33. Entertainment revenue declined due to the absence of World Cup 4Q22. ARPU for broadband was flat YoY at S$34 as competition is accelerating ahead of the entry of Simba, the fourth mobile operator.

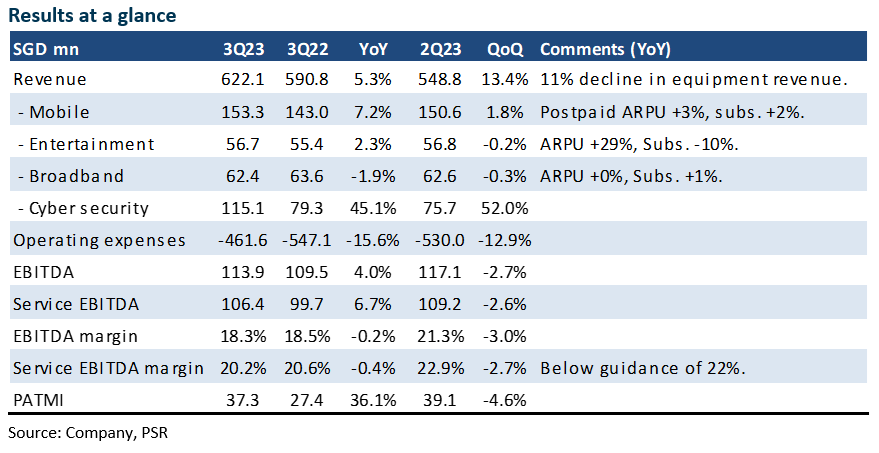

StarHub Limited – Dare+ investments ending soon

- 3Q23 results were within expectations. 9M23 revenue and EBITDA were 74%/73% of our FY23e estimates. No change in StarHub FY23 guidance.

- Revenue growth of 5% YoY in 3Q23 was led by cybersecurity and mobile. Cybersecurity revenue rose 45% YoY to S$115mn on strong order books and pipeline. Mobile revenue expanded 7% YoY to S$153mn from higher roaming revenues.

- We maintain our FY23e forecast and ACCUMULATE recommendation. Our target price of S$1.21, pegged at 6.5x FY23e EV/EBITDA, is unchanged. With the S$310mn Dare+ investments in operating expense and capital expenditure, we expect an improvement in earnings in FY24e. The revenue opportunities post Dare+ investments remain unclear. The cybersecurity operation continues to build up its franchise and is yet to be fully priced into StarHub valuations as it remains unprofitable.

The Positive

+ Jump in cybersecurity. Cybersecurity registered a record revenue of S$115mn in 3Q23. Project details were not disclosed but the orderbooks and project pipelines remain healthy. There have been new solutions in AI and automation.

The Negative

- Competition pressing down ARPUs. Competition is pressing down ARPU in mobile and broadband. ARPU was flat QoQ in 3Q23. Mobile is facing price competition from MVNOs, whilst broadband operators are pricing down ahead of the Simba.

Outlook

With Dare+ investments near completion this year, we expect an improvement in earnings for FY24e. The trajectory of earnings post Dare+ investment hinges on the new revenue opportunities resulting from the revamp of the IT systems. A wider suite of services with better customisation features are some of the benefits. Capex spending will be replaced with opex, such as the greater use of cloud solutions. Opex should also reduce in FY24 as overlapping legacy systems and costs are decommissioned.

StarHub Limited – Profit guidance raised 3 to 7%

- 2Q23 revenue was below expectation but EBITDA exceeded. 1H23 revenue and EBITDA were 44%/58% of our FY23e estimates. Equipment sales was down 21% YoY in 2Q23, but margins were strong due to lower and delayed investments in the DARE+ transformation strategy.

- FY23e EBITDA guidance was raised by between 6 and 10%. We expect the planned S$310mn in Dare+ expenditure over the next 3 years to be cut by around S$25mn. Negotiations and rationalisation have helped lower expected spend.

- We lower FY23e revenue by 7% on account of weaker mobile equipment sales and project delays in cybersecurity. Conversely, EBITDA is raised by 6% from rationalisation and delay in Dare+ spending. We raise our recommendation from NEUTRAL to ACCUMULATE. Our target price is increased from S$1.08 to S$1.21, pegged at 6.5x FY23e EV/EBITDA, in line with other mobile peers.

The Positives

+ Strong growth in mobile revenue. 2Q23 mobile revenue rose 12% YoY to S$150mn from an increase in both ARPU and subscribers. The strength in ARPU is from higher roaming revenue, recontracting to higher priced plans and an increase in value added services (such as cyber protect plus).

+ Strength in entertainment revenue. Entertainment (or payTV) grew revenues on the back of higher ARPU from English Premier League (EPL). EPL has also helped in driving up advertising and commercial revenue.

The Negative

- Weakness and restructuring in enterprise revenue. Enterprise revenue (network, cybersecurity, regional ICT) was flat YoY in 2Q23. The bulk of the decline was from regional ICT business, lower hardware sales and discontinuation of legacy business in JOS Singapore.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report