Sheng Siong Group Ltd – More optionality in store openings

- FY25 results were within expectations. Revenue/adj. PATMI was 99/98% of our FY25e forecast. 4Q25 PATMI rose 17% YoY to S$33.4mn. Earnings growth came from 11% rise in revenue, together with record gross margins.

- Sheng Siong (SSG) grew its store footprint by a record 98.4k sft or 12 new stores to 87 in FY25. The new base of stores is generating 10% points of revenue growth in 2H25. It should accelerate to 12% in FY26e. SSG is potentially expanding more aggressively outside the HDB store into retail malls. There have been better terms offered.

- We push up our FY26e earnings by 2%. Our target price is raised to S$2.82 (prev. S$2.55). Our valuation is raised to the higher quartile 25x PE of the 10-year average. Our ACCUMULATE recommendation is maintained. The record number of store openings in FY25 will carry over to revenue and earnings growth in FY26. Another support for earnings is the continuing rise in gross margins, aided by higher sales and greater bargaining power. Opening stores in retail malls is an additional pathway to expand their footprint more quickly.

Sheng Siong Group Ltd – More stores, more growth ahead

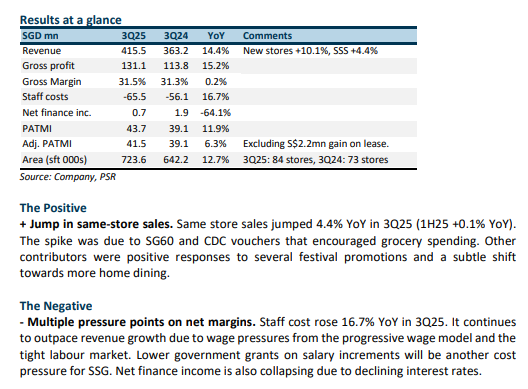

- 3Q25 results were within expectations. 9M25 revenue and adjusted PATMI were 75%/76%, respectively, of our FY25e forecast. Adjusted PATMI (excluding gain on lease) rose 6.3% YoY to S$41.5mn. Pressuring net margins were higher wages, lower finance income, and a decline in wage grants.

- Sheng Siong (SSG) has grown its store footprint by 13% YoY (or 11 new stores) to 84. Two new stores will open in 4Q25. 2025 will record 10 new stores or an 11% rise in footprint to 736k sft. It will be the largest number of store openings since 2018 and support revenue growth for FY26e.

- We maintain our FY25e forecast. Our target price is raised from S$2.30 to S$2.55 as we roll over valuations to FY26e earnings. We peg SSG to 23x PE, valuations the company enjoyed during its growth years. Our ACCUMULATE recommendation is maintained. The pipeline for new stores remains robust, with opportunities in HDB and private-market locations. However, net margins will be under pressure in the near term from the new S$520mn Sungei Kadut distribution centre and extension of the progressive wage model.

Sheng Siong Group Ltd – Operating leverage will return

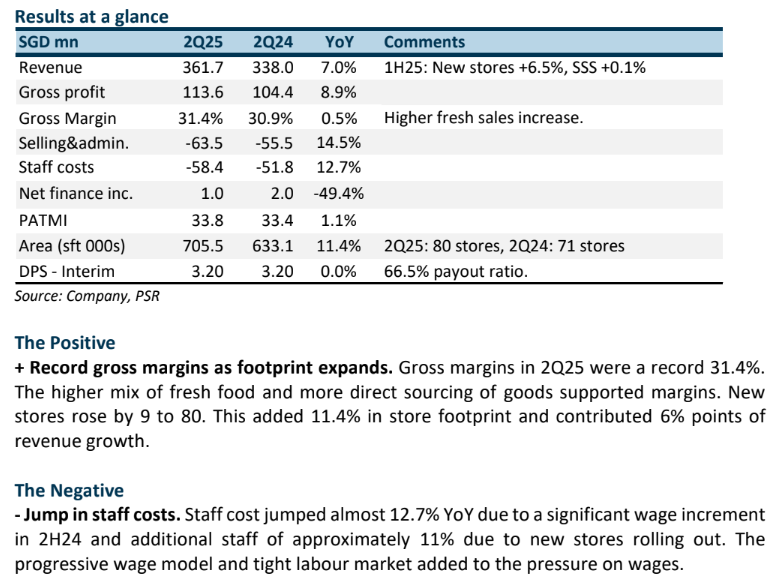

- 2Q25 results were within expectations. 1H25 revenue and PATMI were 49%/48%, respectively, of our FY25e forecast. 2Q25 PATMI only expanded 1.1% YoY despite a record gross margin due to a jump in staff costs. Higher wages and new stores are weighing down operating margins in the near term.

- Sheng Siong (SSG) has grown its store footprint by 11% YoY (or 9 new stores to 80). Another three stores will be opened in 3Q25. SSG will end FY25 with at least a 9% rise in footprint. It is the biggest rollout in stores since 2018.

- We maintain our FY25e revenue and earnings forecast. The entire sector is enjoying a re-rating and expansion in the P/E ratio. During the high growth years of 2014-15, SSG’s P/E ratio averaged 23x. As SSG’s growth accelerates, we re-peg SSG's valuation from historical 18x to 23x PE. Our ACCUMULATE recommendation is maintained with a higher target price of S$2.30 (prev. S$1.89). New stores will provide the backdrop for revenue to accelerate. We expect operating leverage to creep in as new store sales pick up and wage growth decelerates.

Sheng Siong Group Ltd – Surge in new stores

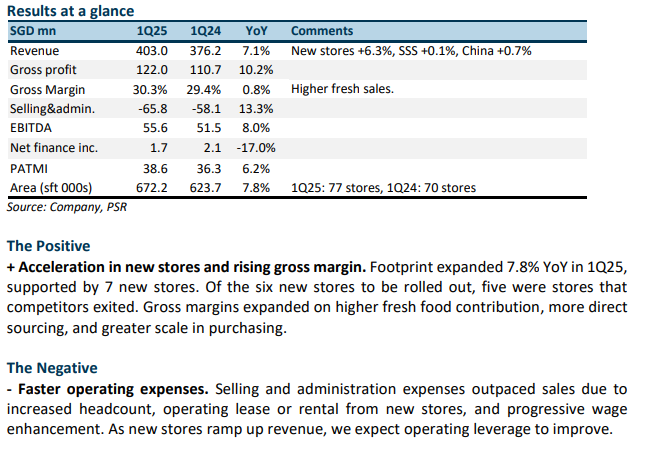

- 1Q25 results were within expectations. Revenue and PATMI were 26%/26%, respectively, of our FY25e forecast. PATMI rose 6% YoY from the 7.8% YoY increase in-store footprint and expansion in gross margins.

- Sheng Siong (SSG) is on track to open at least 8 new stores in FY25 (~10% in footprint). This is the 2nd largest expansion of stores since the 10 in 2018. The major difference is the current expansion is largely due to competitors exiting stores.

- We lift our FY25e revenue and earnings forecast by 2% from the higher number of expected stores. Our target price is increased to S$1.89 (prev. S$1.76) from a higher earnings estimate and PE ratio. Historical PE is 18x, but we nudge the target ratio to 19x as growth accelerates. Our ACCUMULATE recommendation is maintained. Growth rate is rising from the jump in new stores and steeper market share gains. Higher wages from the progressive wage model will weigh down operating margins.

Sheng Siong Group Ltd – Rising market share

- FY24 results were below expectations. Revenue/adj.PATMI were 98%/97%, respectively, of our FY24e forecast. Staff costs jumped 14% YoY to S$56.6mn in 4Q24. The progressive wage model is causing wage levels across roles in the store to continue climbing.

- Sheng Siong (SSG) added two stores in 4Q24, bringing the total to 75. Two more new stores have been opened this year, and eight more being tendered. Several HDB stores have been secured from competitors who have relinquished them in matured estates.

- We lowered our FY25e forecast by 4% to S$147.3mn. The rise in staff costs has been more severe than expected. FY25 will be the final year of the progressive wage model increases for the retail sector. We raised our target price to S$1.76 (prev. S$1.74) as we rolled over valuations to FY25e earnings. Our ACCUMULATE recommendation is maintained. The store openings for SSG are accelerating, further boosted by competitors reducing their footprint of supermarkets in HDB estates. Over the past 2 years, SSG’s revenue growth has been 4%-5% points p.a. faster than the industry.

Sheng Siong Group Ltd – More stores and margin expansion

- 9M24 revenue met our expectations, but PATMI exceeded at 75%/79% respectively of our FY24e forecast. Progressive wage reimbursement and gross margins were higher than expected. Gross margin was a record 31.3% in 3Q24 from higher fresh product contribution and margins.

- In 3Q24, Sheng Siong opened two new stores in Singapore, bringing the total to 73 (or +1.4% expansion in space). Another new store opened in October, and Toa Payoh store acquisition is pending completion by the end of this year. Furthermore, five new stores are waiting for their tender results from HDB.

- We raised our FY24e forecast by 5% to S$145.8mn. Our ACCUMULATE recommendation is maintained, and the target price has increased from S$1.66 to S$1.74, based on a historical PE of 18x. Sheng Siong will at least open five new stores in FY24. This will almost triple the average of two new stores per year over the past three years. New stores will provide at least 6% points of revenue growth next year. The unknown has been sluggish in same-store sales of around 2%, which includes the recent GST hike.

Sheng Siong Group Ltd – New stores start to accelerate

- 1H24 revenue and PATMI were within expectations at 49%/50% of our FY24e forecast. Revenue only grew 1.2% YoY in 2Q24. We estimate same-store sales sales contracted in 2Q24 by around 2% points. Gross margins at a new record of 30.9%.

- In 1H24, there were two new HDB stores opened. Another three new stores will be opening in 2H24 with three more pending results of the tender. In addition, seven more tenders are expected to be opened in 2H24. Some of the tenders included several competitor supermarkets closing down stores.

- We maintain our FY24e forecast and target price of S$1.66. Our valuations are based on historical PE of 18x. We forecasted a total of eight new stores in FY24e and FY25e. There is upside to our forecast as more tenders open up. Sheng Siong will face slower growth this year due to a lack of new stores of only three over the past twelve months. Gross margins continue rising to new record levels.

Sheng Siong Group Ltd – Seasonal and base effect bump

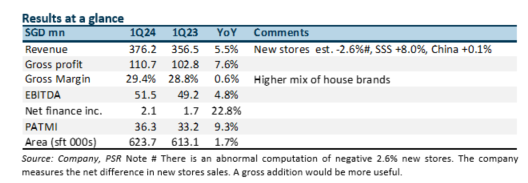

- 1Q24 revenue and PATMI were within expectations at 26%/26% of our FY24e forecast. Same-store sales growth accelerated to 3.6% benefitting from the later lunar new year.

- Only one new HDB store was secured in 1Q24. The pipeline is healthy with three stores tenders submitted and another six to be tendered out. The lack of new stores will keep growth muted this year.

- We maintain our FY24e forecast and target price of S$1.66. Our valuations are based on historical PE of 18x. Only two stores were opened last year. The lack of new stores will be a drag on revenue this year. With industry-leading margins, it will be challenging for Sheng Siong to expand further. Supply chain bottlenecks include distribution centres. Another avenue for growth is acquisitions, as the company has built up a record net cash hoard of S$352 million.

The Positive

+ Acceleration in revenue and margins. Same-store sales jumped 8% (effective growth from 63 matured stores is 3.6%). This year, the longer days between Christmas and Lunar New Year provided an additional runway for festive shopping. It was much closer last year, where shopper fatigue can occur. Margins were supported by higher house brand sales, especially the successful rollout of frozen products.

The Negative

- Only one new store was secured this year. Only one new store opened this quarter in Clementi. A positive has been the narrowing number of bidders for the stores. There are now typically three bidders for stores compared to four or five in the past.

Sheng Siong Group Ltd – Lack of new stores

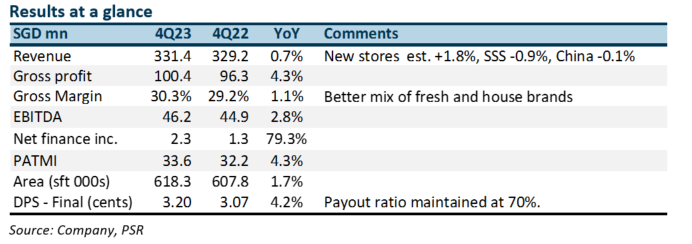

- FY23 revenue and PATMI were within expectations at 99%/99% of our forecast. Revenue growth was 2.1% YoY. Same-store sales contracted and new-store expansion was muted.

- For 2023, Sheng Siong only expanded with two new stores or a footprint growth of 1.7% (2022: +5.4%). The lack of new stores will weigh on revenue growth this year. The company aims to expand a minimum of three stores or equivalent 2.4% expansion per year.

- Same-store sales growth is expected to improve as outbound travel normalises. Inflationary pressure will also support more dining at home. The company has secured two stores so far this year in Singapore, with another ten likely to be tendered. We marginally lower our FY24e earnings by 2%. With a more sluggish growth outlook, we lower our target valuations from historical 20x PE to 18x. The target price is reduced to S$1.66 (prev. S$1.80). Until new stores accelerate, growth will be muted.

The Positives

+ Rise and rise of margins. Gross margins have been on an upward trajectory since listing. A decade ago, gross margins were 23% in FY13 and now stand at 30%. Scale, distribution centre, direct sourcing, and fresh food mix have been the major driver of margin expansion. The new driver is house brands. Competitors have also been raising prices to pass on their cost of production.

The Negatives

- No new stores. There were no new stores this quarter, and only two were opened this year. Expansion in new stores is a cumulative 8% over three years. Before this lull, new stores grew 7-8% p.a. The lack of new stores was due to fewer tenders made available. Of the five stores tendering in 2023, Sheng Siong has been successful in securing three.

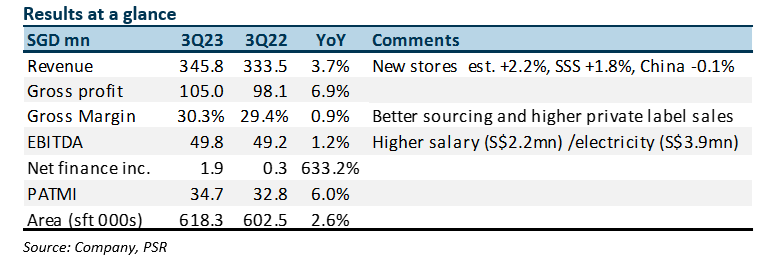

Sheng Siong Group Ltd – Same-store sales inching up

- 3Q23 results were within expectations. 9M23 revenue and PATMI were 75%/74% of our FY23e forecast. Despite, the spike in salaries and electricity cost, PATMI grew 6% YoY on improving gross margins and interest income.

- Same-store sales in 3Q23 grew 1.8% YoY, inching up from 2Q23 by 1.5%. We believe the improvement is from market share gains. Visible promotions in the community and a reputation as a cost leader helped push revenue growth.

- We expect higher earnings growth in FY24e from new stores, lower utility costs, increase in same-store sales and interest income. Our FY23e earnings and BUY recommendation is maintained. However, we are lowering our target price to S$1.80 (prev. S$1.98). Historical valuations have been creeping downward from 22x PE to 20x PE. Post- pandemic there has been a de-rating of growth expectations.

The Positives

+ Same-store sales building momentum. We have seen same-store sales turning since 2Q23. Momentum has crept up to 1.8% YoY in 3Q23, from an estimated 1.5% YoY in 2Q23. Same-store sales is rising from market share gains and a jump in population in Singapore.

+New stores recovering. SSG added one new store in Yishun. There are three more stores pending award by HDB. Thereafter, there are another 5 stores in the pipeline by HDB over the next six months.

The Negative

- Operating expenses jumped S$6.1mn YoY. The introduction of a progressive wage model and higher utility costs drove up operating expenses by S$6.1mn (or 10% YoY). Despite higher wages, the number of staff at 3200 is similar to pre-pandemic levels. Utility cost is expected to decline in FY24e.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report