Spotify Technology S.A. – Strong pricing power in play

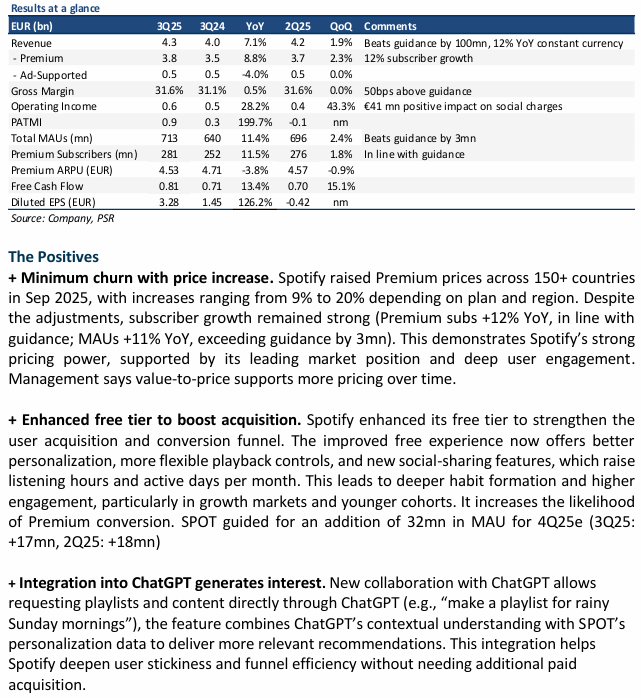

- 3Q25 revenue/PATMI grew 7% and 200% YoY respectively and were within expectations. PATMI’s big jump is mainly due to royalty accounting adjustment and reduced social charges. 9M25 revenue/PATMI were at 75%/70% of our FY25e forecasts.

- User metrics ramped up to 713mn MAUs (+11% YoY), beating guidance by 3mn. Premium subscribers grew in healthy double digits to 281mn (+12% YoY) despite a 9%-20% price increase in multiple markets.

- We increased FY25e/FY26e revenue and PATMI by 1%/1% and 3%/4% respectively to account for the recent increase in pricing. We have also lower SPOT’s beta to 0.75 to reflect improving revenue stability and demonstrated pricing power. We upgrade our recommendation from REDUCE to ACCUMULATE and our DCF target price is raised to US$650 (prev. US$600).

Spotify Technology S.A.- Strong user growth, but soft guidance

-

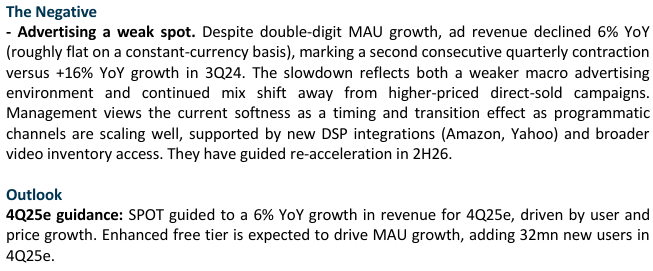

Both 2Q25 revenue and adj. PATMI fell short due to execution delays in scaling ad capabilities. 1H25 revenue/adj. PATMI were at 45%/30% of our FY25e forecasts.

-

User metrics ramp up to 696mn MAUs (+11% YoY), in line with guidance. Premium subscribers grew in healthy double digits to 276mn (+12% YoY). Margins are improving across both premium and ad-supported. Guidance for 3Q25e, however, remains soft (revenue +5% YoY) due to near-term investments.

-

We keep our FY25e revenue assumption unchanged. We decrease FY25e PATMI by 12% to account for the extra social charges after share price strength. Our DCF target price remains unchanged at US$600. We upgraded our recommendation from REDUCE to NEUTRAL due to the recent share price performance. While user and subscriber growth remain robust, lower 3Q25e guidance due to near-term investments —combined with high operating costs and currency drag—has tempered near-term expectations.

Spotify Technology S.A.- Growth story remains intact, yet full valuations

- 1Q25 revenue was within expectations while PATMI fell short due to €76mn in social charges - €58mn above forecast - driven by a surge in the share price. 1Q25 revenue/PATMI were at 24%/10% of our FY25e forecasts.

- User metrics ramp up to 678mn MAUs (+10% YoY), in line with guidance. Premium subscribers grew in healthy double digits to 268mn (+12% YoY). Management has indicated no change in demand due to macro-economic conditions and guided continued strong growth in revenue, MAUs, and premium subs for 2Q25.

- We keep our FY25e revenue assumption unchanged. We decrease FY25e PATMI by 4% to account for the extra social charges after share price strength. Our DCF target price remains unchanged at US$600. We downgraded our recommendation from NEUTRAL to REDUCE due to the recent share price strength. SPOT continues to be the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power. Yet we do not see much upside due to full valuations.

Spotify Technology S.A. – First year of profitability

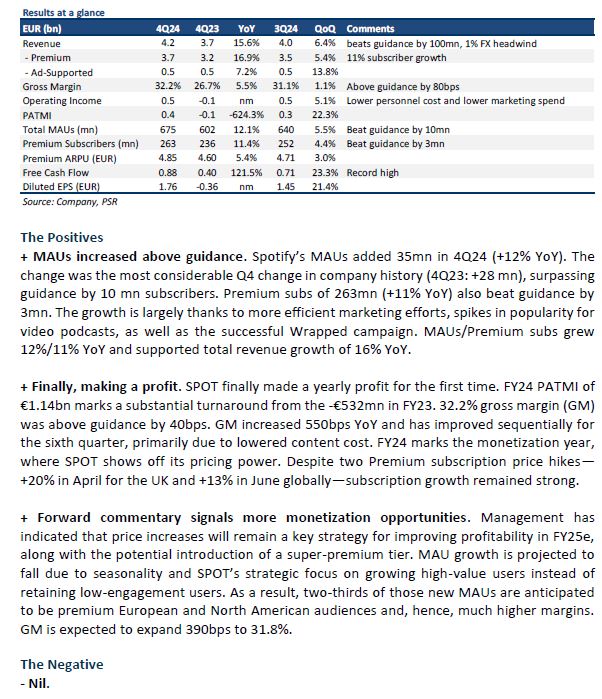

- 4Q24 results were within expectations. FY24 revenue/PATMI were at 100%/102% of our FY24e forecasts. Revenue grew 16% YoY, while net margin expanded 5.5% YoY.

- User metrics ramp up, with 675mn MAUs above guidance by 10mn. Premium subscribers are still growing healthy double digits to 263mn (+11% YoY). Further margin expansion is expected into FY25e due to gaining greater scale, lowering costs and prioritization on premium subscribers.

- We roll over another year of valuations and keep our FY25e assumptions unchanged. Our DCF target price has been raised to US$600 (prev. US$485), but we downgraded to NEUTRAL from ACCUMULATE due to recent share price gains. SPOT continues to be the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power. Yet we do not see much upside due to full valuations.

Spotify Technology S.A. – More monetisation the key driver

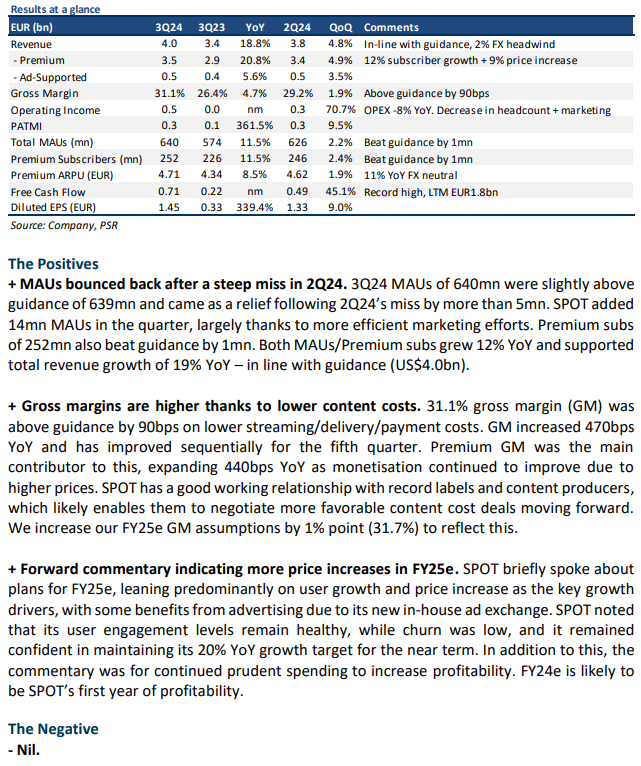

- 3Q24 results were within expectations. 9M24 revenue/PATMI was at 74%/62% of our FY24e forecasts. Revenue grew 19% YoY, while net margin expanded 6% points YoY.

- User metrics still improving, with 640mn MAUs above guidance by 1mn. Premium subscribers are still growing healthy double digits to 252mn (12% YoY). Further margin expansion is expected into FY25e due to gaining greater scale and lowering costs.

- We keep our FY24e assumptions unchanged, but raise FY25e PATMI by 9% on higher profitability. Our DCF target price has been raised to US$485 (prev. US$420), but we downgrade to ACCUMULATE from BUY due to recent share price gains. SPOT continues to be the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power.

Spotify Technology S.A. – Prime example of pricing power

Spotify Technology S.A. – Raised prices and subscribers still grew

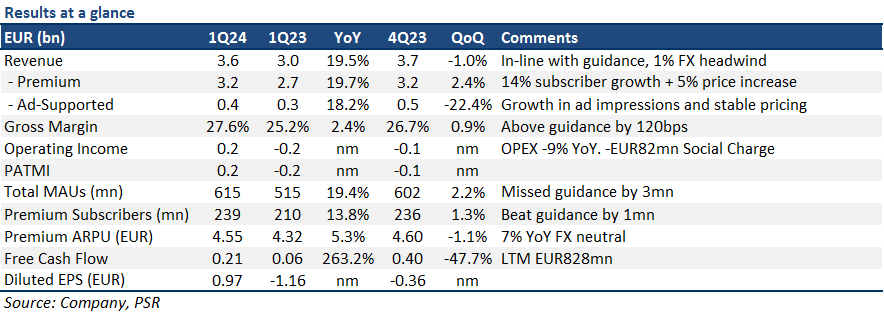

- 1Q24 revenue was within expectations, while PATMI was above due to lower-than-expected costs. 1Q24 revenue/PATMI was at 23%/33% of our FY24e forecasts.

- Growth driven by a combination of subscriber gains and price increases (ARPU 5% YoY). Leveraging scale for meaningful cost benefits through better royalty agreements, improving gross margin 240bps YoY to 27.6%.

- We raise our FY24e PATMI by 26% on lower costs and higher operating leverage while keeping our revenue forecast unchanged. SPOT continues solidifying its position as the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power. We upgrade to BUY from ACCUMULATE with a raised DCF target price of US$340 (prev. US$270) to reflect our assumptions. Our WACC/growth rate of 7.5%/4% remains unchanged.

The Positives

+ Premium revenue growth is accelerating, a sign of improving monetisation. Price hikes (ARPU 5% YoY) towards the back end of FY23 and broad-based growth in subscribers (14% YoY) across all regions drove Premium subscriber revenue growth of 20% YoY (21% FX neutral) in 1Q24 – 3% point increase in growth vs 4Q23. SPOT also expects another quarter of sequential ARPU growth in 2Q24e as it remains focused on improving monetisation of its users after several years of driving user growth. We remain positive about SPOT’s ability to keep churn low while raising prices as it delivers incremental value to its users through new products (Audiobooks, AI DJ, music videos) and platform improvements.

+ Meaningful cost benefits from reaching scale. SPOT has a variety of cost models for its different audio products, with most of its cost base comprised of revenue sharing (royalties) agreements with labels, and fixed content costs for podcasts. We believe that SPOT is beginning to see meaningful cost benefits from reaching scale as it: 1) leverages its distribution for more favourable agreements with its music partners and 2) continues to be more efficient with removing underperforming podcasts. Its 27.6% gross margin for 1Q24 (90/240bps QoQ/YoY) beat its own guidance by 120bps, with Premium gross margin of 30.2% and ad-supported gross margin of 6.4%.

The Negative

- 615mn MAU fell short of SPOT’s 618mn guidance. SPOT under-delivered on its MAUs for 1Q24, with 615mn MAUs and 3mn under its own guidance. The company attributed this to 3 main factors: 1) sequential slowdown in momentum after a very strong FY23, 2) slight disruption in BAU operations from its workforce reduction (-17% reduction) in Dec 23, 3) excessive pullback in marketing spend throughout FY23 (which has since been corrected).

Spotify Technology S.A. – Growth exceeds, monetisation to begin

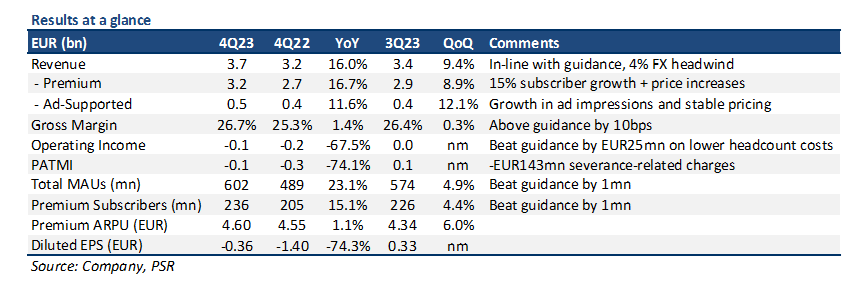

- 4Q23 results were within expectations. FY23 revenue was at 97% of our FY23e forecasts, with a net loss of ~EUR30mn more than our FY23e forecasts. SPOT added 113mn/31mn MAU/Premium Subs in FY23.

- MAU/Premium Subs outperformance keeping SPOT’s growth story intact; revenue growth of 16% YoY (20% FX neutral) accelerating into FY24e.

- Margins and profitability at an inflection point due to SPOT reaching scale; we expect a ~250bps increase in FY24e gross margin due to better monetisation.

- Due to increasing scale and operating leverage, we raise our FY24e PATMI by ~4x to EUR593mn. Our revenue forecast remains unchanged. We roll over an additional year of valuations and maintain our ACCUMULATE recommendation with a raised DCF target price of US$270 (prev. US$190) to reflect our assumptions. Our WACC/growth rate of 7.5%/4% remains unchanged.

The Positives

+ Revenue growth accelerating into FY24e with 28mn new MAUs, 10mn new premium subscribers. SPOT again exceeded its user growth expectations with 23%/15% YoY growth in MAU/Premium Subs. It ended FY23 adding 113mn monthly users, and 31mn new premium subscribers (Figure 1). MAU growth is extremely important for SPOT as it is the main channel used to convert free-to-listen users into premium subscribers. The outperformance in users, together with price increases mid-4Q23, drove an acceleration in revenue growth (4Q23: 16% YoY vs 3Q23: 11% YoY) – with SPOT also expecting growth to accelerate in FY24e.

+ Positive commentary on margins, focusing on monetisation for FY24e. Management was positive on its expanding margins, with 4Q23 gross margin of 26.7% 10bps above guidance. SPOT spent much of FY23 working on being more efficient in terms of investments and costs, from laying off employees to cutting non-performing content. Moving into FY24e, we expect gross margins to expand by ~250bps with sequential increases QoQ, driven by: 1) price increases; 2) improving efficiencies of scale; 3) better monetisation of Podcasts and advertising; and 4) improved deals with record labels/agencies.

+ Remaining focused on prudent spending moving forward. SPOT provided some near-term clarity for spending, saying that it would raise investment hurdle rates, and remain prudent on future spending – as it looks to balance growth and profitability. We forecast FY24e OPEX to decline -5% YoY due to the lumpiness of spend in FY22 and FY23, but to remain in line with its long-term linear trend. Long-term growth remains a key focus for SPOT, but we expect FY24e to be a year of monetising its ever-growing user base given its latest commentary.

The Negative

- Nil.

MAU (Monthly Active User): average number of active users during a month.

Spotify Technology S.A. – Profitability around the corner

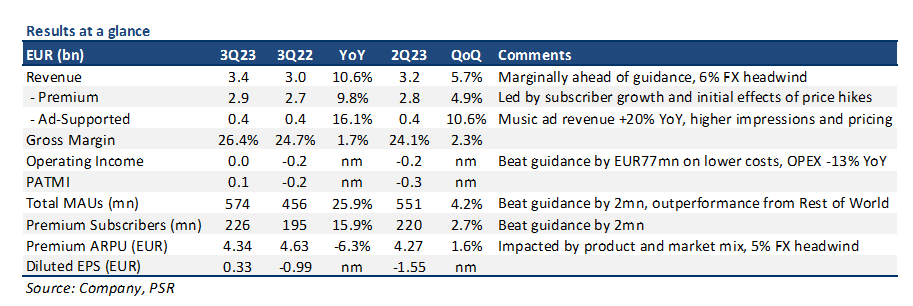

- 3Q23 results were within expectations. 9M23 revenue was at 70% of our FY23e forecasts, with net loss ~EUR50mn less than our FY23e forecasts. We expect earnings to breakeven for 4Q23e.

- 23mn/6mn new MAUs/Premium Subscribers both outperformed its own guidance by 2mn. 2nd largest Q3 MAU addition ever. Premium Subscriber-to-MAU ratio remains ~0.4x.

- Gross margins improved across both Premium and Ad-supported, driven by efficiencies due to scale and lowered cost structure of its podcasts. SPOT is expecting positive operating income moving forward.

- As a result of improving profitability and lower OPEX spend, we raise our FY24e EBITDA by 42% (or EUR161mn). We maintain ACCUMULATE with a raised DCF target price of US$190.00 (prev. US$162.00) to reflect a faster rate of margin expansion. Our WACC/growth rate assumptions of 7.5%/4% remain unchanged.

The Positives

+ User metrics continue to outperform even after price hikes. SPOT’s outperformance in subscribers was the main driver for its slight revenue beat. The company added 6mn new premium subscribers (16% YoY) even after it raised prices during the quarter, and 23mn MAUs (26% YoY), both ahead of guidance by 2mn – indicating low levels of churn. The 23mn new MAUs was also SPOT’s 2nd largest Q3 addition ever. SPOT guided to 601mn MAUs (23% YoY) and 235mn Premium Subscribers (15% YoY) by the end of FY23e. We view user and subscriber growth as key, given that the company is still in its scaling up phase and has not yet begun to efficiently monetise its users.

+ Margins improving across both premium and ad-supported. Overall gross margins saw a 166bps YoY improvement to 26.4%, with margin expansion across both Premium and Ad-Supported businesses. Premium gross margin was 29.1%, the highest for any Q3, driven by efficiencies from scale, while ad-supported gross margin was 8.3%, a 646bps increase YoY as podcast margins improved. Overall margin expansion reflected improvements in both music profitability and podcast trends. Gross margin beat guidance by 40bps, with expectations for sequential expansion in 4Q23e.

+ Profitabilty seems to have reached an inflection point. With the increase in gross margins, operating profits returned, with SPOT posting EUR32mn in operating income – beating its own guidance by EUR77mn, on lower marketing and personnel costs. Operating leverage seems to have returned, signaling a potential inflection point for profits moving forward as revenue growth (11% YoY) outpaces OPEX (-13% YoY). As a result, we forecast a EUR162mn improvement in PATMI for FY24e.

MAU (Monthly Active User): average number of active users during a month.

ARPU (Average Revenue per User): premium revenue for period divided by average number of premium subscribers for same period.

The Negative

- Nil.

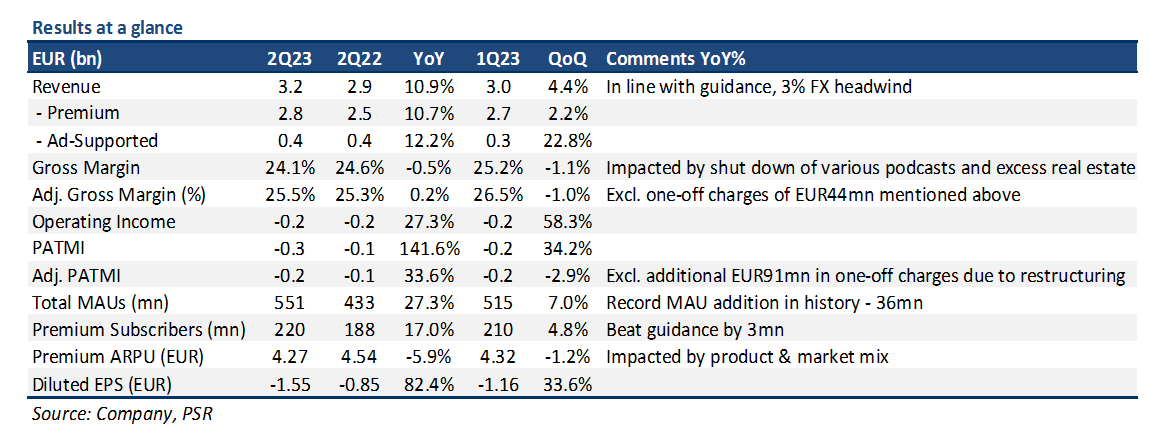

Spotify Technology S.A. – Record new users added

- 2Q23 results were within expectations. 1H23 revenue was at 45% of our FY23e forecasts, with adj. net loss (excl. one-offs) EUR25mn lower than our FY23e forecasts. Net loss was impacted by -EUR135mn in restructuring related charges.

- Record MAU growth with 36mn new users, attracting new Gen Z listeners through better podcast content. 3Q23 guidance is for slower net add of 21mn MAUs and revenue growth of 9% YoY.

- Renewed focus on efficiency with headcount falling 2% QoQ, cut underperforming podcasts and price increases in >50 markets.

- We widen FY23e net loss by -EUR423mn to account for higher restructuring, finance, and tax charges, while keeping FY23e revenue unchanged. We maintain ACCUMULATE with a reduced DCF target price of US$162.00 (prev. US$165.00), with a WACC of 7.5%, and a terminal growth rate of 4%.

The Positives

+ User growth continues to outperform, highest MAU growth. SPOT continues to attract more users onto its platform, with a record 36mn new MAUs in 2Q23, and 551mn MAUs to end the quarter (27% YoY). Similarly, Premium Subscribers also did well, with YoY growth accelerating over the last 4 quarters (2Q23: 17% YoY) as conversion rates remained healthy. Premium subscriber growth usually lags MAU growth as users gradually convert into paying subscribers.

+ Efficiency still front and centre. SPOT reiterated its focus on improving operational efficiency, evident from its reduction in headcount by 2% QoQ and downsizing of its real estate footprint in 2Q23. SPOT has also raised its hurdle rate for new investments, and also cut underperforming podcast content from its content library. The company also guided that OPEX as % of revenue should continue to fall over the long term as efficiency improves.

The Negative

- Losses widen due to EUR135mn in restructuring-related charges. 2Q23 operating loss stood at -EUR247mn, EUR53mn wider than a year ago. More than half the losses (-EUR135mn) were a result of charges relating to: 1) shutting down underperforming podcasts; 2) reducing real estate footprint; and 3) headcount reductions. Removing these charges, adj. operating loss of -EUR112mn would have been slightly ahead of guidance.

MAU (Monthly Average User): average number of users during a month.

ARPU (Average Revenue per User): premium revenue for period divided by average number of premium subscribers for same period.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report