Singapore Telecommunications Ltd – Preparing growth post ST28

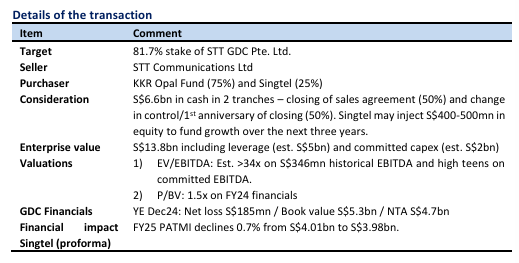

- Singtel and KKR will acquire the remaining 81.7% stake in ST Telemedia Global Data Centres (GDC) for S$6.6bn in cash. Singtel and KKR will own 25% and 75% of GDC, respectively. The transaction is expected to be completed 2H26, and no shareholder approval is required. Singtel will fund by debt and internal cash.

- GDC operates 50 data centres in 12 countries with a power capacity of 673MW. Year ended Dec 2024, GDC has a book value of S$5.3bn and reported a net loss of S$185mn. The estimated EBITDA is S$346mn. The proforma financial impact on Singtel's net earnings is less than 1%.

- We view the transaction positively as a growth funnel for Singtel post ST28. There is a pipeline of projects that could triple existing GDC capacity. And GDC operates largely in the underpenetrated data centre market in Asia-Pacific. We expect earnings and cash flow growth from additional data centres. There is also an opportunity to enhance value by listing selected Asian assets. The financial impact is minimal. There is no earnings contribution in the near term, as GDC reported a net loss. We maintain our ACCUMULATE recommendation with an unchanged target price of S$5.35.

Positives

• Scaling up of Singtel’s data centre footprint across multiple countries. It offers

customers greater geopolitical resilience and reduces redundancy.

• Large opportunity for growth with a pipeline of 1.7GW. It is double the combined

capacity of Singtel’s Nxera and GDC, which is 819MW.

Negatives

• No immediate earnings contribution as GDC was loss-making for the financial year

December 2024.

• Valuations are steep in the near term compared to listed US data centre operators

trading around 22x EV/EBITDA.

Singapore Telecommunications Ltd – More divisions start to shine

- 1H26 results were within expectations. Revenue/EBITDA/underlying PATMI were 48%/50%/52% of our FY26e forecast. Underlying net profit rose 14% YoY to S$1.35bn, supported by 12% growth in regional associates and 23% jump in subsidiaries. Interim dividend rose 17% YoY to 8.2 cents.

- Bharti India led the earnings growth with an 81% YoY jump in earnings to S$359mn in 1H26. Other divisions enjoying a pick-up in earnings growth were Thailand (+42% YoY) and NCS (+41% YoY). The weakest segments were Singapore (+0.3%), Indonesia (-17%), and the Philippines (-13%).

- Our ACCUMULATE recommendation and FY26e forecasts are maintained. Our target price is raised to S$5.35 (prev. S$4.86) from higher mark-to-market valuations of associates. The growth profile of the Singtel group has expanded from Bharti to include Thailand, and NCS. Thailand is undergoing mobile price repair (+5%), and NCS orders are picking up momentum (+20%). We expect more monetisation to be underway from the disposal of stakes in Gulf Development (~S$2bn) and Bharti Airtel (~S$4bn). The S$2bn value realisation share buyback has recently started. We expect the next growth driver will be new data centres especially GPU-as-a-Service.

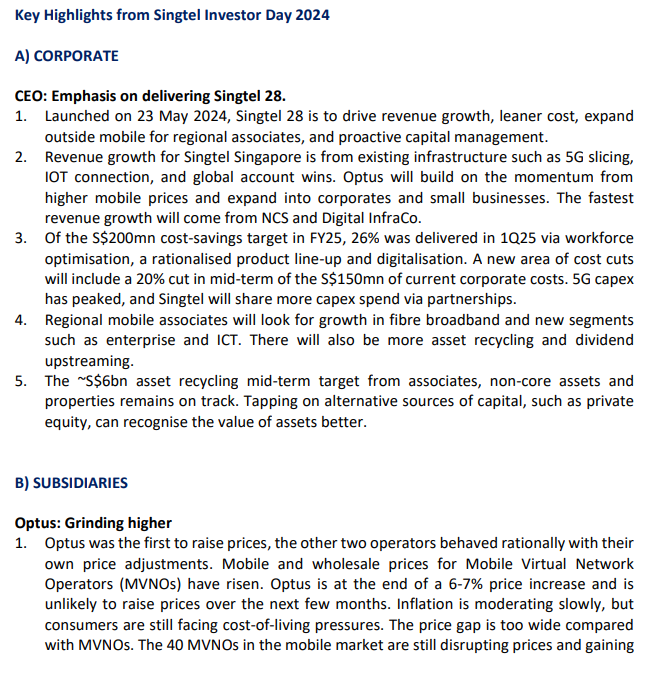

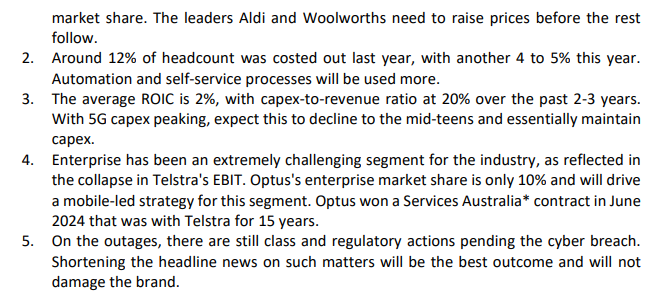

Singapore Telecommunications Ltd – Mobile price repair is largely underway

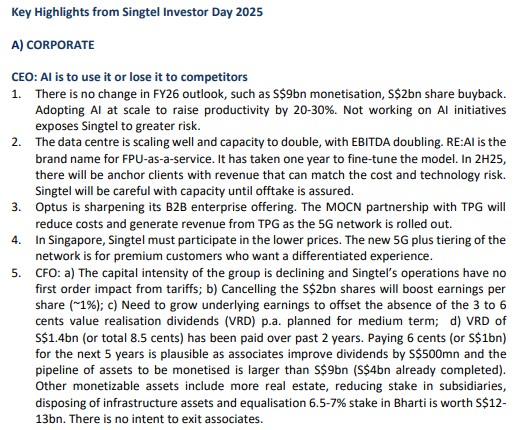

- 2025 Investor Day: Singtel mentioned that the asset monetisation target is much larger than S$9bn, the scaling up of its data centre as Singapore capacity doubles, finalised its GPU-as-a-service business model, and the need to adopt AI at scale to secure the competitive edge in cost and service levels.

- Countries experiencing mobile price repair are India, Thailand, and Australia. Mobile prices in the Philippines are bottoming, but Indonesia's price repair is still fragile. Singapore remains in a downward trend, with fingers crossed expectations following the planned consolidation of Simba and M1.

- We maintain our ACCUMULATE recommendation with a higher target price of S$4.86 (prev. S$4.40). We increased our EV/EBITDA multiple from 7x to 8x, aligning with industry peers as operations improve in Australia and earnings from data centres surge. Our discount on associate valuations has narrowed from 15% to 10%. Visibility to monetise key associates has increased. Except for Singapore and Indonesia, most countries have a clear line of sight for mobile price repair. Value realisation (or medium-term special) dividends are likely to be at the higher range of 6 cents with the larger pipeline of assets to monetise.

Singapore Telecommunications Ltd – Growth and monetisation combo

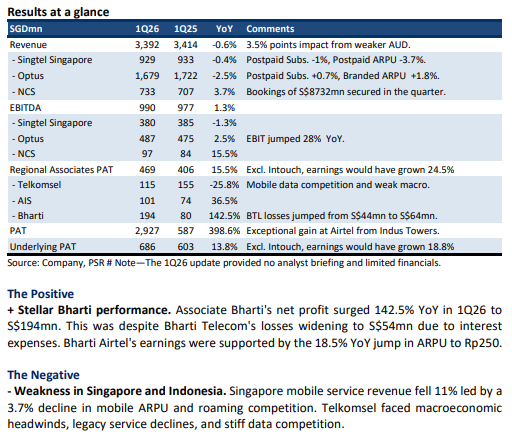

- 1Q26 results were within expectation – revenue/EBITDA were 23%/25% of our FY25e forecast. Underlying PAT grew 14% YoY to S$686mn from stellar growth in Bharti and improvement in Optus margins. Exceptional gain of S$2.9bn from disposal of 1.2% stake in Airtel and merger of Intouch and Gulf Energy. Currency shaved off 2.8% points of earnings growth.

- Associate Bharti registered a 142% YoY jump in 1Q26 net profit to S$194mn. The jump was driven by an 18.5% rise in Bharti Airtel ARPU in India. Optus EBIT rose 28% to S$111mn from higher ARPU and cost savings.

- Our ACCUMULATE recommendation is maintained. We also maintain our FY26e forecast (before exceptionals) and target price of S$4.40. Both Bharti and Optus are key earnings drivers for Singtel in FY26e. The growth is offset by weakness in Indonesia and Singapore due to mobile competition. We see the remaining S$5bn asset monetisation efforts by Singtel to come from the 7.7% stake in Gulf Energy (~S$2bn) and 3% in Bharti Airtel (~S$5bn).

Singapore Telecommunications Ltd – The Giving Pledge

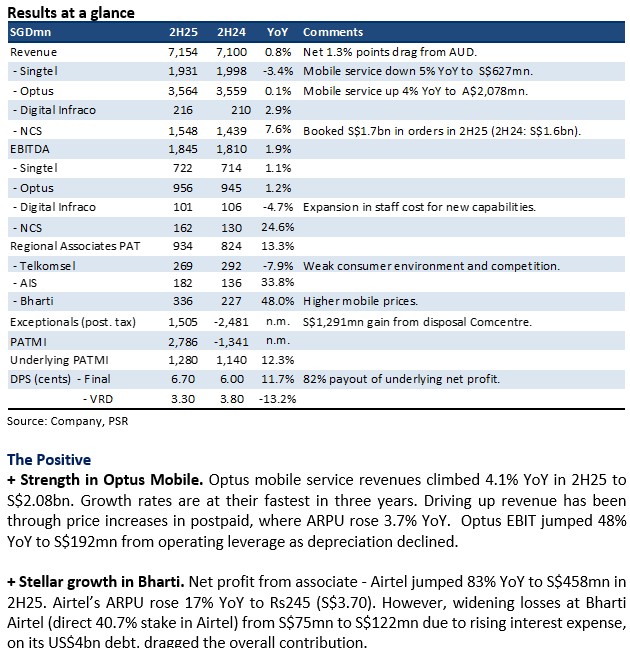

- 2H25 results were within expectations. Revenue and underlying PATMI were 97%/99% of our FY25e forecast. The 12% YoY rise in underlying net profit to S$2.78bn was supported by a 48% rise in Optus EBIT and 48% growth in associate Bharti earnings.

- The mid-term asset recycling target has been raised from S$6bn to S$9bn. Proceeds from assets recycled continue to be distributed as a value realisation dividend of 3 to 6 cents annually. Singtel will add a S$2bn share buyback over three years. Core dividend remains a payout ratio of 70-90% of the underlying net profit.

- Our ACCUMULATE recommendation is maintained. We raised our target price to S$4.40 (prev. S$3.77). We narrowed our discount to associates from 20% to 15% as Singtel intensifies its monetisation efforts. We raised the EV/EBITDA of the subsidiaries from 6x to 7x due to the stronger operating performance. Lowering the discount on associates invariably leads to more volatility and momentum in our target price. Operationally, mobile price repair and operating leverage are underway in Optus. Conversely, Singapore mobile remains under intense competition but is undertaking a significant realignment of costs. We believe asset monetisation efforts will be from disposing of the 7.7% stake in Gulf Development (~S$2bn) and another 3% in Bharti Airtel (~S$5bn).

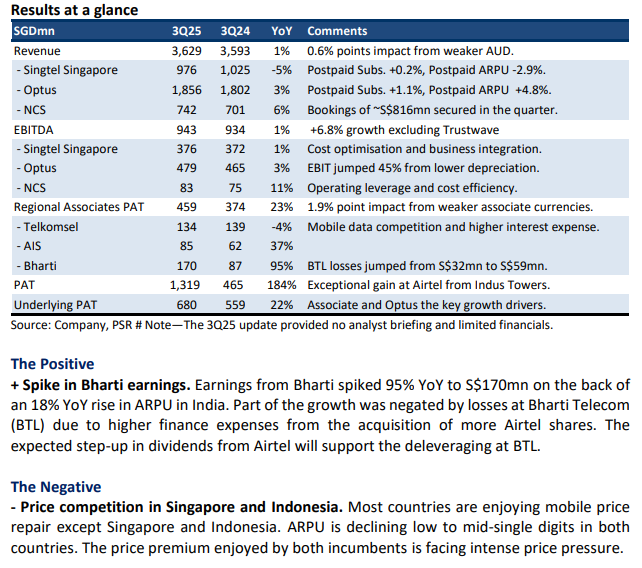

Singapore Telecommunications Ltd – Earnings spike in India and Australia

- 3Q25 results were within expectation. 9MFY25 Revenue and EBITDA were 73%/75% of our FY25e forecast. PATMI exceeded estimates at 79% of FY25e due to stronger than-expected performance from associate Bharti. Dividend guidance for FY25e was around 16.6 cents, higher than our initial estimate of 15.9 cents.

- Singapore continues to face revenue pressure from mobile competition, dragging down Average Revenue Per User (ARPU) and structural weakness in legacy voice. Recovery in Optus gains momentum, with EBIT jumping 43% YoY in 3Q25 to S$91mn. Aggressive cost-cut measures and revenue growth were the key drivers.

- Our ACCUMULATE recommendation is maintained. We raise our target price to S$3.77 (prev. S$3.44) due to mark-to-market gains in associates. Revenue and EBITDA forecast remained unchanged, but PATMI raised 6% to incorporate higher associate earnings and lower depreciation. Multiple growth drivers are underway, including Optus, NCS, and Bharti. We expect S$6bn monetisation to be gradually realized from stakes in Intouch and Bharti Airtel.

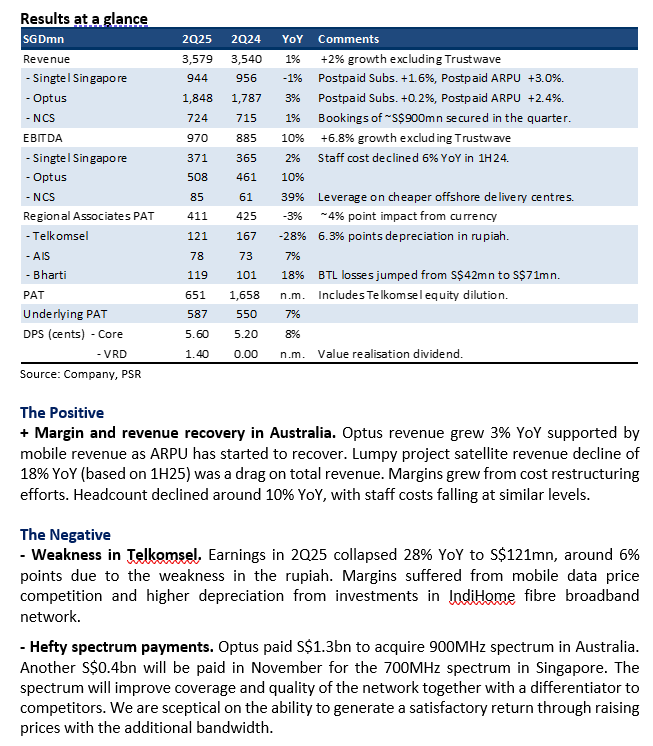

Singapore Telecommunications Ltd – Positives in Australia and asset monetisation

- 1H25 results were within expectation. Revenue and EBITDA were 48%/51% of our FY25e forecast. Optus continued its commendable performance with EBITDA growth of 10% YoY in 2Q25 from cost savings and rising prices.

- Associate earnings fell 3% YoY to S$411mn in 2Q25. Mobile competition in Telkomsel has hurt earnings together with expanded losses at Bharti Telecom due to higher interest rates. Singtel has raised their EBIT growth guidance for FY25e from “high single digit to low double digits” to “low double digits”.

- Our ACCUMULATE recommendation and target price of S$3.44 is maintained. We reduced our FY25e associate earnings but offset by a reduction in effective tax. PATMI is unchanged. Cost-out efforts in Singapore and Australia are supporting a recovery in margin. There is no change in the strategy to monetize S$6bn of assets including Intouch, Comcentre and Bharti Airtel.

Singapore Telecommunications Ltd – Eyeballing cost and AI opportunity

- 2024 Investor Day: The effects of higher mobile prices in Australia, India, and Thailand will flow into upcoming quarters via higher margins. The S$200mn cost out p.a. in Optus and Singapore are on track together with an additional 20% cut in S$150mn corporate cost. Capital expenditure has peaked and will gradually decline.

- The most exciting division is Digital Infrastructure, which has three major growth drivers. Firstly, data centre (attributable) capacity will almost triple from 62MW currently to 166MW by 2026. Besides capacity, a new GPU-as-a-service revenue streaming service utilising Nvidia AI chips will be rolled out. Finally, revenue from its patented Paragon platform is beginning to surge as deployment is underway in multiple countries.

- We maintain our ACCUMULATE recommendation with an unchanged target price of S$3.44. We expect earnings growth to be largely driven by cost savings, higher mobile prices, and data centre capacity. Paragon and GPU-as-a-Service are two new growth drivers and share price catalysts. AI is also an opportunity for NCS as a catalyst for new application and integration projects. The pace of earning growth for the group will depend on currency and the health of consumer spending, especially in Thailand and Australia.

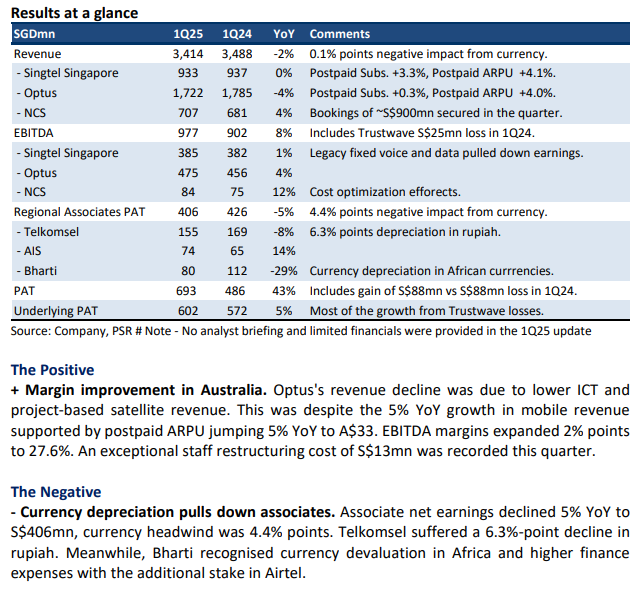

Singapore Telecommunications Ltd – Prices are up, costs down, but currency headwind

- 1Q25 results were within expectation. Revenue and EBITDA were 23%/25% of our FY25e forecast. Optus reported stronger margins offset by weaker associate income due to currency depreciation. 1Q25 net profit growth was largely driven by an absence of losses in Trustwave.

- Associate earnings were down 5% YoY to S$406mn. A weaker Indonesia rupiah pulled down Telkomsel's net profit by 6.3% points. Bharti suffered from Nigerian Naira translation losses and higher interest expenses from the additional stake in Airtel.

- Our ACCUMULATE recommendation and target price of S$3.44 is unchanged. We nudge our PATMI by 2% to account for lower depreciation. Optus operations are benefiting from the planned S$200mn cost-out plans p.a. Associates will benefit from higher mobile price plans, especially India’s repricing in July. Currency depreciation will be the headwind. Further monetization of assets will be a share price catalyst.

Singapore Telecommunications Ltd – Adding liquidity to associates

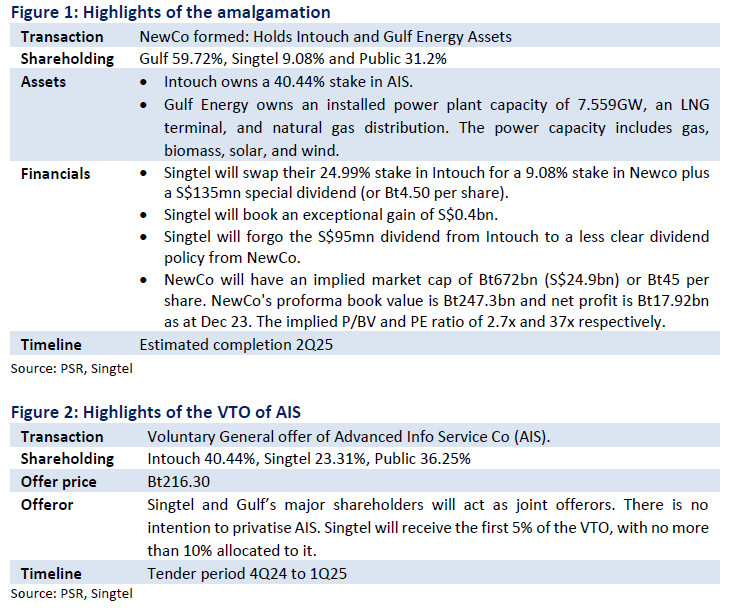

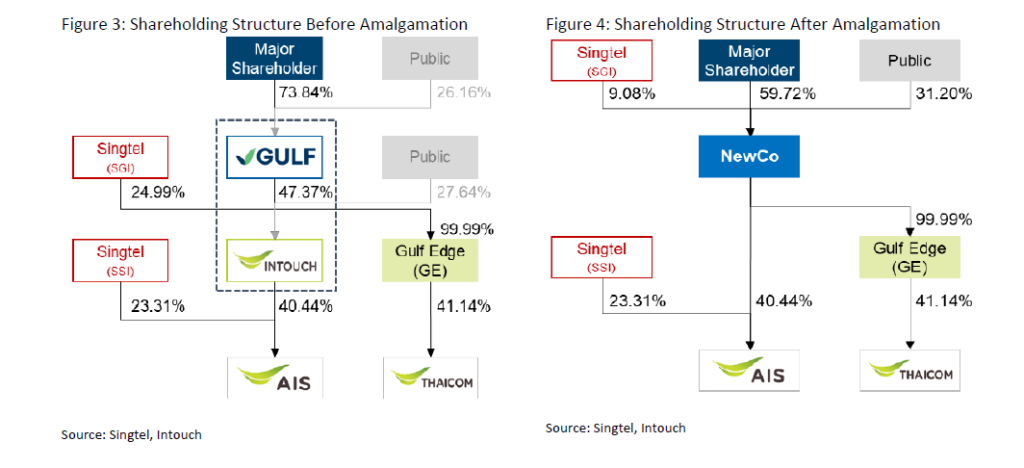

- A new company (NewCo) will be created to own Singtel’s 24.99% stake in Intouch and Gulf Energy Development’s assets such as gas-fired and renewable power plants. In exchange, Singtel will own 9.08% of NewCo and receive S$135mn in special dividends.

- Singtel and Gulf Energy will launch a voluntary tender offer for the 36.25% stake in Advanced Info Service (AIS) they do not own. The offer price of Bt216.30 per share is below the closing price of Bt220. Therefore, we assume Singtel’s stake in AIS will remain unchanged at 23.31%.

- We are positive on the transaction. It partially monetises Singtel’s stake in Intouch and AIS with the S$135mn special dividend. Furthermore, the Intouch stake will become part of a much larger (and likely more liquid) Newco with a market cap of S$25bn. We believe the trade-off is lower dividends from Intouch into a faster-growing NewCo, propelled by the planned build-up of energy assets. The eventual listing of NewCo shares above the implied Bt45 per share will be a value accretive catalyst. We downgrade our recommendation from BUY to ACCUMULATE due to the recent price rally. Our target is raised from S$3.00 to S$3.44 as we lower the discount on associates from 30% to 25%. The discount is narrowing as Singtel moves closer to achieving its S$6bn divestment target. No change in our forecast.

Key Highlights

There are essentially two transactions. The first is to amalgamate Intouch and Gulf Energy Development (Gulf Energy) assets in a new company (NewCo). The second transaction involves a voluntary tender offer (VTO) of Advanced Info Service (AIS).

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report