Sea Ltd.- All rounded growth continues

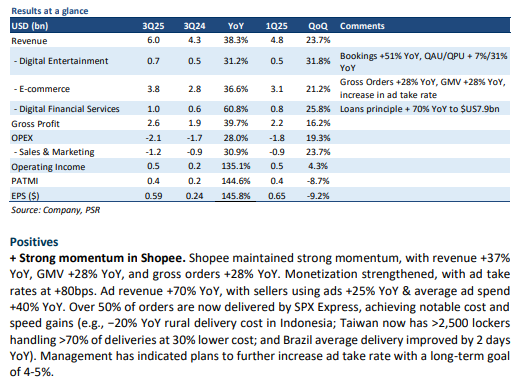

- 3Q25 revenue was in line with expectations, while PATMI underperformed mainly because Shopee’s higher logistics, fulfilment, and user-engagement investments. 9M25 revenue/PATMI was at 75%/60% of our FY25 estimates.

- Revenue rose 38% YoY, driven by Shopee’s strong momentum with higher commission and ad take rates, Monee’s rapid loan-book expansion (+70% YoY), and Garena’s best performance since 2021 on the back of successful IP collaborations.

- We raised our FY25/26 revenue by 3%/4% to reflect improved growth in all three segments. We increase FY25/26 selling & marketing expense by 5% to account for the elevated investment. Our DCF target price remains unchanged at US$170, with a terminal growth rate of 4.5% and a WACC of 7.6%. We upgrade our recommendation from NEUTRAL to BUY due to recent share price movement.

Sea Ltd.- Profitability surge and Garena slowdown

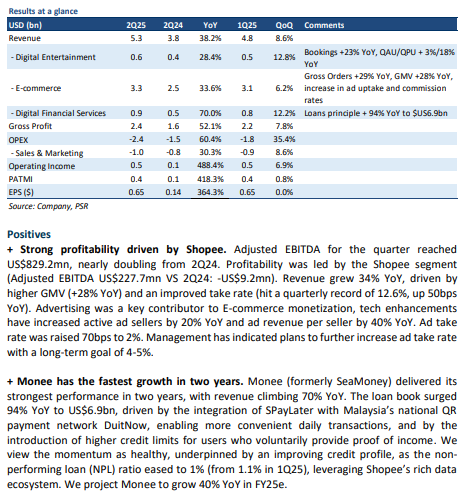

- 2Q25 revenue/PATMI were in line with expectations, with its 39% YoY growth primarily driven by strength in Shopee (+34% YoY in revenue) and Monee (+70% YoY in revenue). 1H25 revenue/PATMI was at 48%/46% of our FY25 estimates.

- PATMI grew 418% YoY to US$414mn. Shopee and Monee maintained strong momentum, fueled by higher take rates in commissions & ads, as well as robust loan book growth. Garena shows signs of a slowdown in growth.

- We maintain our NEUTRAL recommendation. We raised our FY25 revenue/PATMI by 1%/9% to reflect growth in Monee, Shopee, as well as the improvements in take rates. We raised our DCF target price to US$170 (previously US$160) given the strong momentum in e-commerce and financial services as well as improved monetization, with an unchanged terminal growth rate of 4.5%, and a WACC of 7.6%. We see limited upside due to stretched valuations.

Sea Ltd. – Outperformance likely to continue, but valuations stretched

Recommendation: NEUTRAL (Downgraded) , Last done: US$162.72, TP: US$160, Analyst: Helena Wang

- 1Q25 revenue/PATMI were in line with expectations, with its 30% YoY growth primarily driven by strength in Shopee (29% YoY) and Monee (58% YoY). 1Q25 revenue/PATMI was at 23%/25% of our FY25 estimates.

- All three segments —Shopee, Monee, and Garena —maintained their strong momentum, fueled by higher take rates in commissions and ads, robust loan book growth, and strong bookings.

- We downgrade our recommendation from Accumulate to Neutral due to the recent share price rally. We raised our FY25 revenue/PATMI by 2%/13% to reflect growth in Monee, Garena, and continued improvements in cost efficiency. We also raise our terminal growth rate assumption to 4.5% (previously 4%), reflecting the long-term growth potential of Monee as it penetrates the large unbanked population in Southeast Asia. We have raised our DCF target price to US$160 (previously US$140), with an unchanged WACC of 7.6%. After the significant price rally, we see minimal upside.

Sea Ltd. – Further growth ahead

- Shopee and SeaMoney maintained their growth momentum, driven by higher take rates

in commissions and ads, as well as robust loan book growth. We believe ad and off-

Shopee loans are good growth opportunities for SE.

- Garena has experienced strong 20% YoY in user metrics throughout FY24, with revenue

typically lagging. 4Q24 marks its first YoY revenue increase since 2Q22; we believe the

decline has bottomed out and expect revenue growth of 9% in FY25.

- We upgrade our recommendation from Neutral to Accumulate due to recent share price

movement. We maintain our DCF target price at US$140, with an unchanged terminal

growth rate of 4% and WACC of 7.6%. SE has demonstrated strong growth momentum

and monetization capabilities in Shopee and SeaMoney, and we expect growth in Garena

in FY25.

Sea Ltd. – Growth momentum continues

- 4Q24 revenue was in line with expectations, with its 37% YoY growth primarily driven by strength in Shopee (41% YoY) and SeaMoney (55% YoY). PATMI missed due to a higher-than-expected investment loss of $0.25bn. Excluding the investment loss, FY24 revenue/PATMI was at 103%/98% of our FY24 estimates.

- Shopee and SeaMoney maintained their strong momentum, fueled by higher take rates in commissions and ads, along with robust loan book growth. Garena's metrics remain positive, but the impact on top and bottom-line growth has been less significant than expected.

- We upgrade our recommendation from Reduce to Neutral after rolling over the results for another year. We raise our DCF target price to US$140 (prev. US$100), with an unchanged terminal growth rate of 4% and WACC of 7.6%. SE has demonstrated strong growth momentum and monetization capabilities in Shopee and SeaMoney, yet we see limited upside to valuations due to recent share price strength.

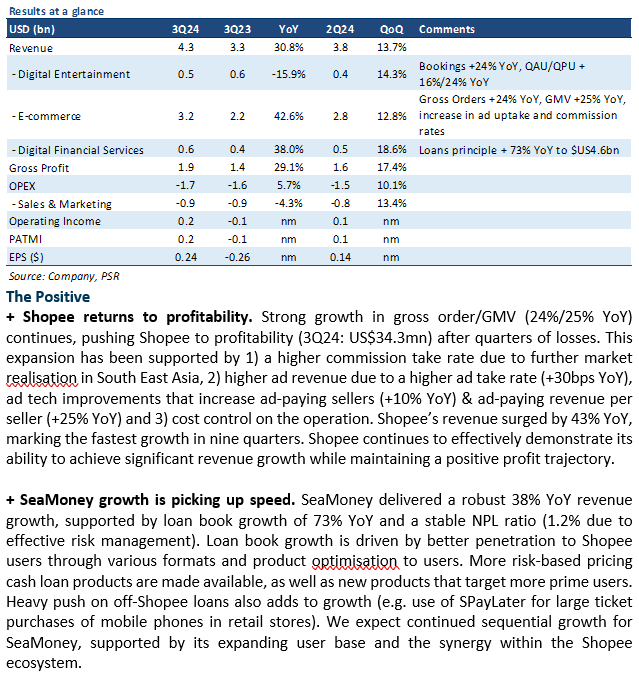

Sea Ltd. – High growth across all businesses

- 3Q24 revenue exceeded expectations, with its 30% YoY growth primarily driven by strength in Shopee (43% YoY) and SeaMoney (38% YoY). PATMI was missed due to continuously high sales and marketing spending that ate into profitability. 9M24 revenue/PATMI was at 76%/33% of our FY24 estimates. We expect PATMI to be backloaded into 4Q24e as the ramp-up of Shopee and SeaMoney continues and the late recognition of gaming revenue.

- All three key business segments show strong growth, driven by increased take rates in Shopee, strong loan book growth in SeaMoney, and a highly engaged user base for Garena’s Free Fire (growth reflected in user metrics due to late recognition of revenue).

- We downgrade our recommendation from Neutral to Reduce after considering recent share price movement. We raised our FY24e revenue/PATMI by 4%/1% to account for higher Shopee and SeaMoney growth. We raise our terminal growth rate assumption to 4% (prev. 3.5%) to reflect higher long-term revenue from Shopee and SeaMoney and raise our DCF target price to US$100 (prev. US$80), with an unchanged WACC of 7.6%. The company's triple-sided growth in SeaMoney, Shopee, and Garena shows potential to deliver returns for long-term growth.

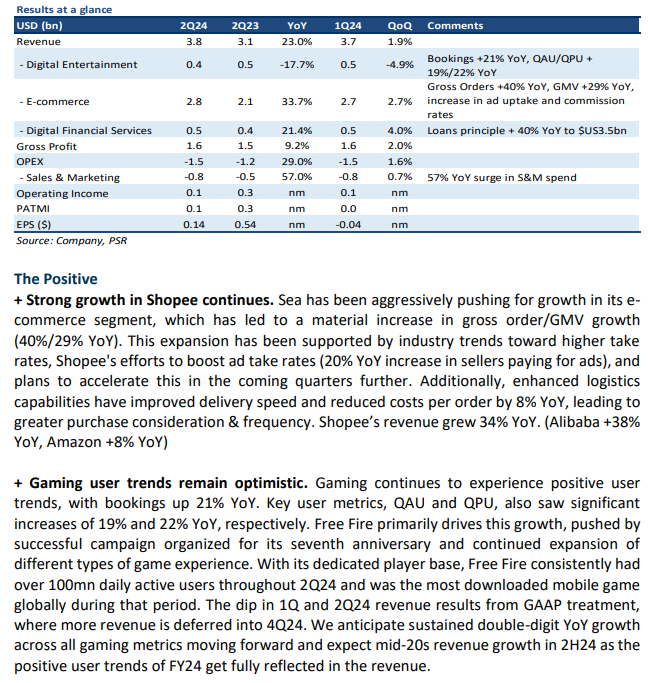

Sea Ltd. – Raised Shopee Guidance

- 2Q24 revenue was slightly above expectations, with its 23% YoY growth primarily driven by strength in Shopee (34% YoY). PATMI missed on 57% YoY jump in S&M spending. 1H24 revenue/PATMI was at 49%/9% of our FY24 estimates. We expect PATMI to be backloaded into 2H24e as the ramp-up of Shopee continues as well as the late recognition of gaming revenue.

- For 3Q24e, Sea expects positive EBITDA for Shopee and has raised its FY24 GMV growth rate guidance from the high teens to the mid-20s. The company is benefiting from less competition. Shopee's emphasis on operational priorities, coupled with the industry trend of rising take rates, is anticipated to drive both top- and bottom-line growth.

- We maintain a NEUTRAL rating. We raised our FY24e revenue/PATMI by 1%/1% to account for higher e-commerce growth. Our DCF target price is raised to US$80 (prev. US$75), with an unchanged WACC/growth rate of 7.6%/3%. The company's triple-sided growth in SeaMoney, Shopee and Garena shows potential to deliver return for long-term growth. However, short-term growth remains challenged by competition as SE currently needs to maintain its high sales and marketing expenses in order to keep market share.

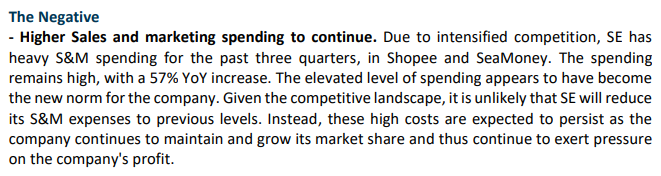

Sea Ltd. – Growth Supported by Spending

- 1Q24 revenue exceeded expectations at 25% of our FY24e forecasts. The 23% YoY growth was primarily driven by 33%/21% YoY growth in Shopee and SeaMoney. While a net loss of ~US$24mn fell short of our FY24e forecasts due to continued high S&M spending and US$111mn unrealised equity investment losses.

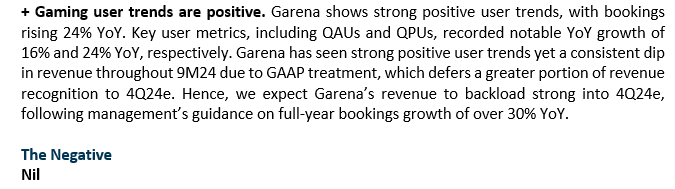

- Garena is seeing positive user trends, with bookings surged by 11% YoY. Quarterly active users/quarterly paying users were also up 21%/30% YoY as gamers finally returning to gameplay. We anticipate sustained improvements in most gaming-related metrics moving forward and expect double digit YoY growth in user base and bookings for FY24e.

- We downgrade to a NEUTRAL rating from ACCUMULATE due to recent share price gains. We raised our FY24 revenue by 4% to account for higher e-commerce and gaming growth. We raised DCF target price to US$75 (prev. US$70), with an unchanged WACC/growth rate of 7.6%/3%.

The Positive

+ Stronger-than-expected growth in Shopee. Shopee’s revenue growth has been accelerating since 3Q23. Its 1Q24 revenue grew 33% YoY, with gross order/GMV growth accelerating to 57%/36% YoY (4Q23: 46%/29% YoY, 3Q23: 13%/5% YoY). This growth was fueled by the seasonality effect of Ramadan occurring within Q1 and operational priorities that enhance price competitiveness (optimized logistics & introducing more sellers with competitive pricing) and improved customer services (direct management of returns and refunds by Shopee & introduction of features like guaranteed delivery times). Shopee has also put in efforts to strength its ecosystem, becoming the largest live streaming e-commerce in Indonesia.

+ Gaming user trends picking back up. Gaming is seeing positive user trends. Bookings were up by 11% YoY, highest in the last three years. Additionally, user metrics QAU and QPU have surged by 21%/30% YoY, ending the two years trend of decline/slow growth and indicating improvements in user retention and monetization. The acceleration is due to gamers finally returning to gameplay after the two year fatigue from excessive gaming during Covid. We anticipate sustained improvements in most gaming-related metrics moving forward and expect double digit growth YoY in both user base and bookings for FY24e.

The Negative

- E-commerce spending still remains high. Since 3Q23, SE has been doubling up its S&M spending for Shopee YoY due to intensified competition from new entrants, such as TikTok Shop, resulting in a net loss for the company. The spending remains notably high with a 92% YoY increase. The sustainability of such aggressive S&M spending to support Shopee's robust growth is questionable.

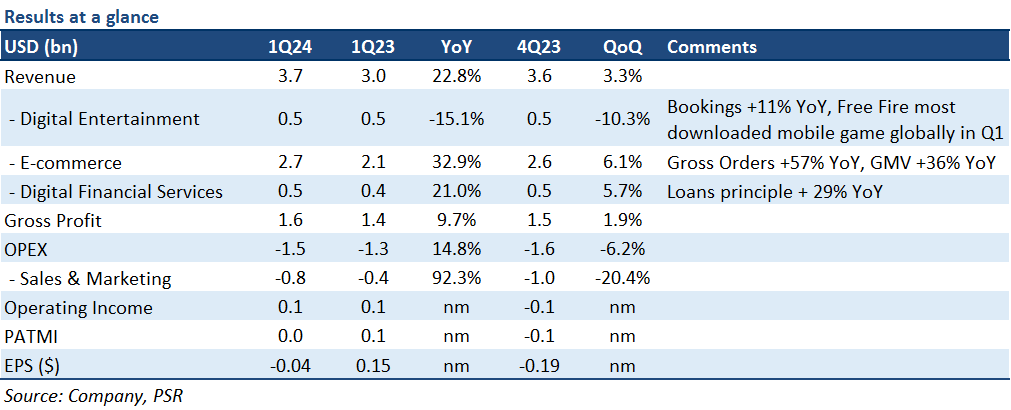

Sea Ltd. – More E-Commerce Growth Ahead

- Both 4Q23 revenue and PATMI were in line with expectations. FY23 revenue was at 98% of our FY23e forecasts, while PATMI was ~US$0.7bn below. Sea has hit its first profitable year since its IPO in 2017.

- Shopee is gaining market share against its competitors, with both GMV and gross orders growing strong (29%/46% YoY), driven by increased investments in the business since 3Q23. Garena is guided to increase by double digits after two years of decline.

- We raised our FY24 revenue growth rate/PATMI by 2%/0.28bn driven by higher e-commerce and gaming growth. We expect FY24 to be profitable given profitability contribution from Garena and Shopee. We roll over an additional year of valuations and downgraded our recommendation from Buy to Accumulate due to a recent share price change. Our DCF target price is raised to US$70 (prev. US$61), with an unchanged WACC/growth rate of 7.6%/3%.

The Positive

+ Investments in Shopee are paying off; gaining market share. Shopee’s strategic pivot to reinvigorate its topline growth through ramped up investment to competed aggressively for market share since July last year has paid off, helping Shopee gain more market share: there was a renewed surge in its GMV and gross orders (29%/46% YoY). Revenue grew 23% YoY in 4Q23. Shopee focuses on the expansion of last-mile delivery facilities and optimising routing, which cuts costs and improves delivery speed. Both market gain and improved logistics signal long-term growth for Shopee.

+ Shopee expected to see high-teens GMV growth in FY24e. Shopee has guided high-teens GMV growth YoY in FY24e as its investment in gaining market share starts to bear fruit. Its new initiative live-streaming e-commerce business continues to gain traction due to its leadership position and economics of scale. It now accounts for 15% of order volume by the end of FY23. SE claims to be making adjustments in take-rates, especially in ads, which has a sizable room to grow compared to global peers. SE has disclosed their confidence of returning Shopee to positive EBITDA in 2H24 even as competition picks up.

+ Gaming guidance is a pleasant surprise. Despite gaming continuing to show a 52% YoY revenue decline, SE has surprisingly guided a positive outlook for Free Fire. Both user base and bookings of SE’s largest and most profitable game are expected to increase by double digits in FY2024, indicating a rebound in gaming earnings after two years of decline.

The Negatives

- Nil.

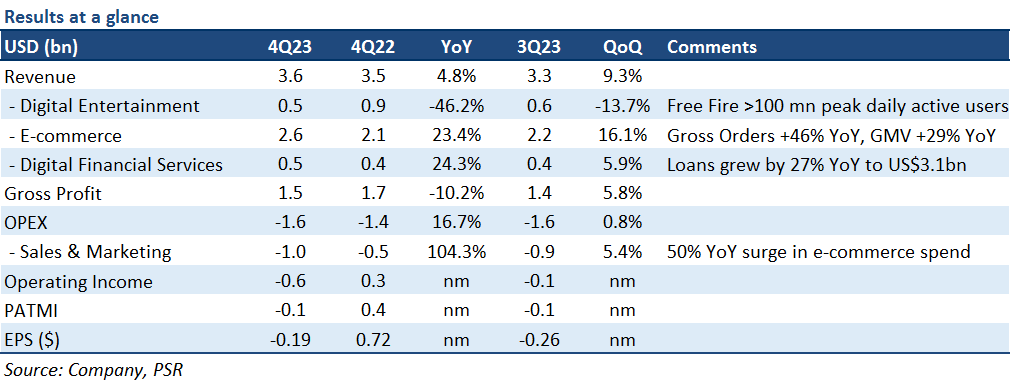

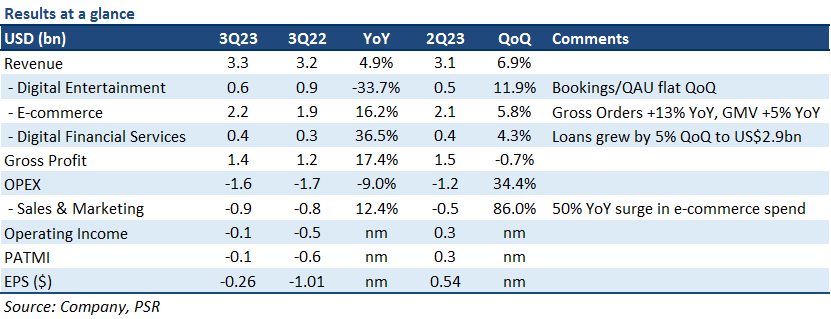

Sea Ltd. – Buying market share

- 3Q23 revenue was in line with expectations, while the -US$144mn net loss was a disappointment due to a 50% YoY surge in e-commerce sales and marketing (S&M) spend. 9M23 revenue/PATMI were at 71%/68% of our FY23e forecasts.

- Shopee is gaining market share against its competitors as GMV and gross orders return to strength, driven in part by Shopee Live. Market share gains have come at the cost of profitability. Garena user trends negatively impacted by back-to-school seasonality.

- We cut our FY23e/FY24e EBITDA by 19%/16% to reflect a ramp-up of investments in Shopee. FY23e PATMI is cut by 46% as a result. Even as its near-term outlook is clouded by increasing spend and competition, we still believe SE is well-positioned to capture e-commerce growth in many under-penetrated emerging markets due to its scale and logistics infrastructure. We expect FY24 to be profitable given comments from SE regarding its commitment to not overspend on Shopee, plus profitability contribution from Garena and SeaMoney. We maintain BUY with a reduced DCF target price of US$61 (prev. US$87), and an unchanged WACC/growth rate of 7.6%/3%.

The Positive

+ Investments in Shopee paying off; gains market share. Shopee saw sequential increases in its GMV/gross orders, with both growing 11%/24% QoQ as a result of a reacceleration in investments into the business. In addition, active buyers also increased 11% QoQ as SE made a strong push into e-commerce livestreaming (Shopee Live). Core marketplace revenue (transaction-based fees and advertising) was up 32% YoY to US$1.3bn.

The Negatives

- Disappointing gaming trends impacted by seasonality. Bookings and QAUs for Garena were flat QoQ, impacted by a return to school for many of its users. This was slightly disappointing given expectations of user growth following the release of its new game Undawn in Jun 23. On a YoY basis, QAU decline (-4%) seems to be moderating, although bookings are still down 33% YoY, implying still present near-term headwinds for gaming as its largest and most profitable game, Free Fire, continues to decline in popularity.

- 3Q23 net loss driven by increasing Shopee spend. On a group level, 3Q23 net loss was US$144mn, reversing 3 quarters of profitability. The net loss was mainly due to a 50% YoY (US$286mn) surge in Shopee S&M spend, as SE reaccelerated its investments in Shopee for market share gains. SE said that spending into 4Q23e will continue – as it is seasonally the best time to acquire new users and gain market share, while we further expect spending to persist into FY24e as SE attempts to penetrate deeper into its LATAM markets.

GMV: Gross Merchandise Value, QAU: Quarterly Active User, QPU: Quarterly Paying User

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report