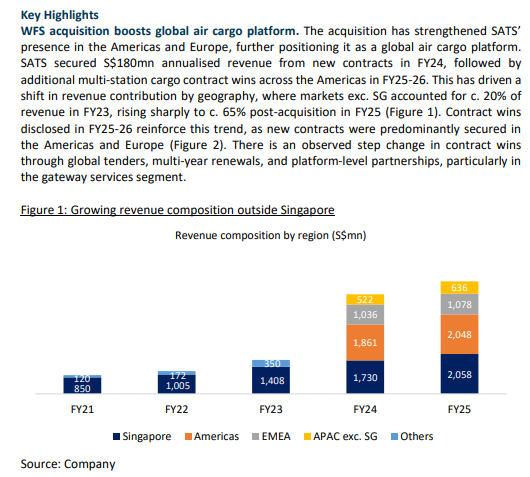

SATS – Creating a global platform cushions volatility

- SATS operations continues to be resilient due to capacity redeployment to routes with higher demand amid trade volatility, and new contract wins due to business development efforts.

- After the successful integration of WFS, SATS has transitioned from station-specific or project-based incremental wins toward network-wide cargo handling mandates. FY26 wins, such as its overseas hub-carrier contract with Riyadh Air, US multi-station cargo contract with Turkish Airlines, and its contract renewal for cargo handling in the US and Europe with Saudia Cargo, underscore its significance as a global air cargo operator.

- We downgrade to NEUTRAL recommendation with higher TP of S$3.84 (prev: S$3.66). Our higher target price reflects our expectation that the removal of the De Minimis exemption will be less disruptive to SATS’ cargo operations in the Americas, supported by rising demand from US domestic freight routes. FY26e PATMI forecast has been raised by 5.5% to S$249mn. Earnings resilience will be underpinned by the c. 20+ contract wins and renewals in FY25 & FY26, with phased revenue recognition across long contract tenures providing stability.

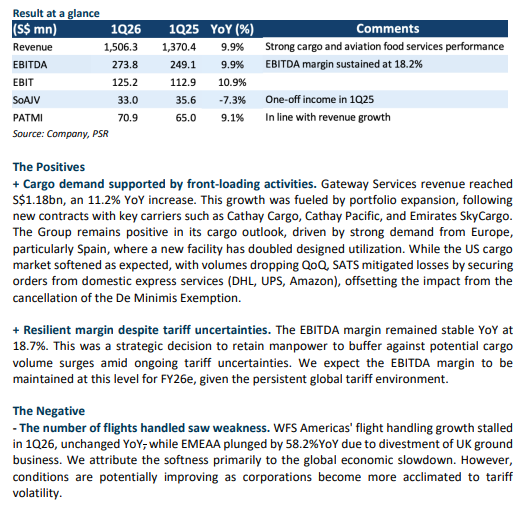

SATS – Resilient cargo demand supported by front-loading

-

1Q26 PATMI soared 9.1% YoY to S$70.9mn, outperformed our expectation at 30% of our FY26e forecast underpinned by strong cargo demand from front-loading activities. Cargo tonnage reached 2.4mn (+10.4% YoY), flight movements totalled 158.8k (+2.6%YoY), and aviation meal production grew to 16.4mn (+5.6%YoY).

- EBITDA and PATMI margin stayed flat YoY at 18.2% and 4.7% respectively. SATS is also committed to the de-leveraging strategy and increased the debt repayment by 2.7%YoY to S$70.7mn, EBITDA / Interest ratio improved by 0.2x as a result.

- We adjust our FY26e PATMI higher by 3% to S$245mn to reflect the resilient cargo outlook as e-commerce in Europe and American domestic express services remain resilient, and the loss in volume from e-commerce due to the cancellation of the De Minimis Exemption has been made up by other products such as tech products. Leveraging their global network, we anticipate cargo volume will exceed the IATA forecast of 0.7% YoY. We downgrade our rating from BUY to ACCUMULATE due to the recent share price performance with a higher DCF-TP of S$3.66 (prev:S$3.58). We expect share price upside to come from a potential increase in dividend payout ratio (FY25: 30%) supported by resilient PATMI and operating cash flow of S$54mn. We increase the payout forecast to 35%, implying an FY26e DPS of 5.8 cents.

SATS – Fading e-commerce tailwinds from China to the US

· FY25 PATMI surged 332% YoY to S$243.8mn, in line with our expectations at 96% of our FY25e forecast. The strong growth was driven by broad-based performance, supported by a 15.1% YoY increase in air cargo volume and a 21.2% YoY rise in aviation meals.

· SATS declared a final DPS of 5 cents, representing a 30% payout ratio. Free cash flow turned positive at S$228.3mn, reversing from a deficit, as PATMI margin improved nearly fourfold YoY to 4.2%

· Although China and the US have agreed to reduce bilateral tariffs, uncertainty remains for the air cargo segment. Particularly, e-commerce from China to the US, which accounted for 5% of the Group’s revenue in FY25, following the cancellation of the De Minimis Exemption. We revise down our FY26e PATMI forecast by 10% to S$236mn, as near-term growth catalysts have been exhausted. However, upside potential may emerge from evolving supply chains, with SATS well-positioned to capture rising e-commerce demand from China to Europe and the Middle East, supported by its global network. We reiterate our BUY rating with a lower DCF-TP of S$3.58 (prev: S$4.34). We expect the dividend payout ratio to remain at 30%, implying an FY26e DPS of 4.7 cents.

SATS – Minimal FY25e financial impact from De Minimis removal

· 3Q25/9M25 revenue surged by 12.5%/14%YoY to S$1.5/ 4.3bn which was in line with our estimates at 26%/77% of our FY25e forecast. The strong growth was underpinned by air cargo volume improving by 16.6%YoY, meals served rising 24% YoY in 9M25.

· PATMI proliferated by more than 7.6/1.2 times to S$205.1/38.9mn in 9M25/3Q25, which met our forecast and reached 75%/14% of FY25e forecast. SATS set an additional bonus provision in 3Q25 on the back of the exceptional result, which resulted in higher operating expenses. Otherwise, the normalised EBIT margin would have been 9.2% (3Q25: 6.2%).

· We maintain our FY25e financial estimates as we believe the impact of U.S. tariffs on SATS' bottom line will be minimal, given that only two financial month will be affected by the new tariff, and customers may take longer to adjust their inventory plans. However, we lower our FY26e PATMI forecast by 9%, as the U.S. cargo handling segment accounts for c.25% of SATS' total revenue. Even though the prohibition on De Minimis entry for Chinese goods was suspended, it remains a downside risk for SATS as customers are shifting supply chain out of China. We expect potential disruptions in cargo volume and have factored in a worst-case scenario of a 20% decline due to the 10% price increase following the removal of the De Minimis tax rule. We reiterate our BUY recommendation with a lower DCF-TP of S$4.34 (prev: S$4.62).

SATS – Volume and prices drive earnings

· 1H25 revenue climbed 14.8% YoY to S$2.8bn which was in line with our estimates at 51% of our FY25e forecast. Revenue growth was driven by, air cargo volume increasing by 17.5%YoY, meals served rising 26.1% YoY in 1H25 and a series of contract repricings, including with key margin customer SIA.

· PATMI reversed from loss of S$7.8mn in 1H24 to S$134.7mn profit in 1H25 which exceeded our estimates and reached 54% of our full-year forecast. Core PATMI excluding S$22.9mn foreign exchange losses would be S$157.6mn which is 65% of our FY25e estimates. The strong operational performance was driven by higher business volumes and, contribution from JVs (+ 47.1%YoY to S$65.3mn).

· We have raised our FY25e PATMI forecast by 9% on the back of the lower effective tax rate and higher contribution from JVs. We reiterate our BUY recommendation with a higher DCF-TP of S$4.62 (prev: S$4.37). Recovery in volumes will drive up earnings from operating and financial leverage. SATS declared interim dividend of 1.5 cents per share which implies payout ratio of 16.7%. SATS currently trading at 21x/18x FY25e/FY26e PE and our TP indicates 22x FY26e PE.

SATS – Across the board tailwind

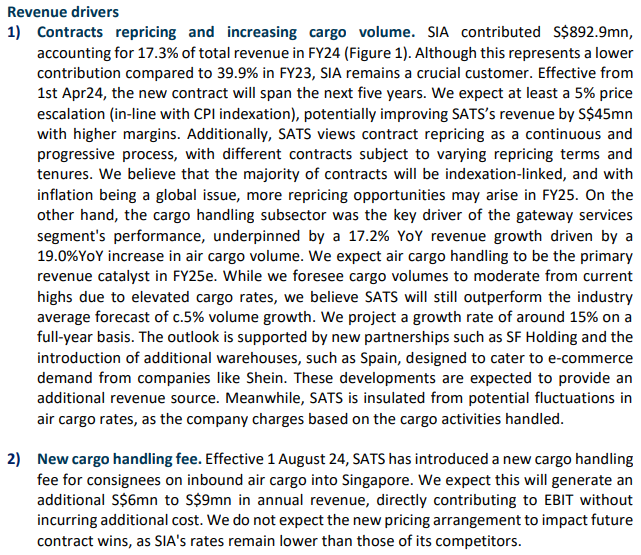

- SATS has successfully repriced the contract of one of its major customers, SIA, which accounted for 17.3% of FY24 revenue. The new contract took effect in 2Q25, and we expect at least a 5% rise, generating around S$45mn revenue. An additional S$6mn to S$9mn in revenue expected from the new cargo handling fee for inbound air cargo into Singapore, effective August 2024. Expect repricing to have direct benefit to earnings.

- SATS is fully capitalizing on the recovery tailwind of the airline industry and the spillover effects from the Red Sea conflicts. Cargo volume increased by 19% YoY in 1Q25, and while we expect some moderation from 2Q25 onwards, this should be partially offset by the new revenue source from partnerships in Europe, such as with SF Holding and additional warehouse in Spain. We expect that SATS will continue to outperform the industry average growth rate in FY25, with volume expected to increase by c.15% YoY.

- Upgrade to BUY with a higher DCF-TP of S$4.37 (prev: S$3.45). We have lowered our WACC assumption by 10% to 8.4%, driven by the improving operating leverage and reduced customer risk from the integration of WFS. There is no change to our earnings forecast.

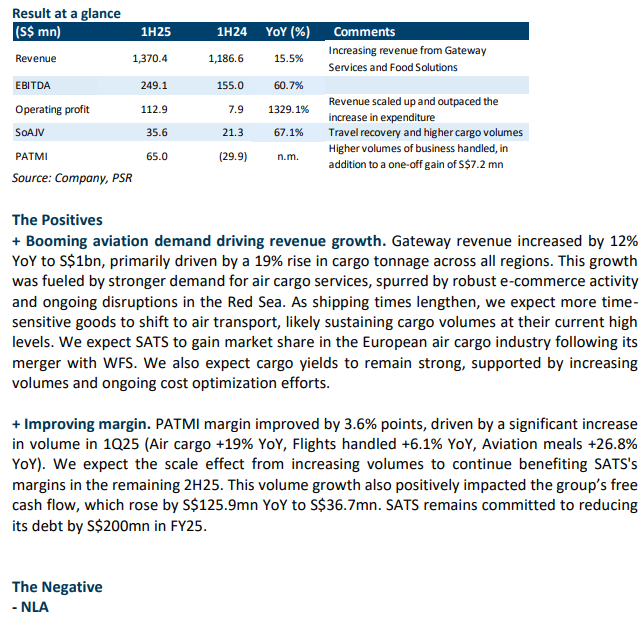

SATS – Aviation recovery continues

- 1Q25 revenue was slightly above our estimates at 27% of our FY25e forecast and rose 15.5% YoY to S$1.37bn. Revenue growth came from cargo tonnage and aviation meals volume, which scaled by 19.0% and 26.8% YoY respectively.

- PATMI of S$65mn, exceeded our estimates and reached 40% of our full-year forecast driven by stronger performance from share of earnings of associates and joint ventures (SoAJV), higher business volumes and a one-off gain of S$7.2mn from the settlement of an existing loan arrangement. We believe repricing with SIA boosted margins.

- Upgrade to NEUTRAL with a higher DCF-TP of S$3.45 (prev: S$2.66). We have raised our FY25e revenue forecast by 10%, driven by increased cargo and food rates due to the continued recovery in the airline industry and the pronounced synergies from the acquisition of WFS. FY25e PATMI raised by 54% to reflect the increasing contribution from SoAJV and one-offs. We expect the revenue catalyst to continue coming from the air cargo segment, driven by sustainable e-commerce demand and spill over effects from various geopolitical tensions. SATS is currently trading at 22x FY25e PE, we believe much of the catalyst has already been priced into the current share price.

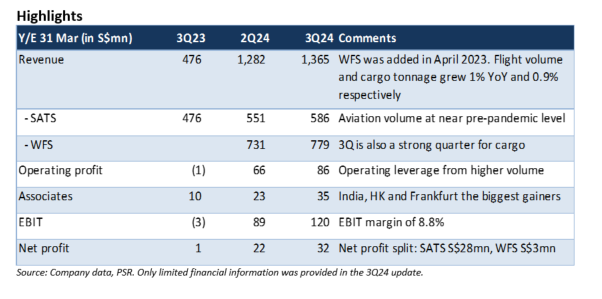

SATS LTD – Focus on refinancing debt and managing costs

- SATS reported 3Q24 net profit of S$31.5mn, which included S$3.1mn profit from WFS. The 9M24 net profit of S$23.7mn is in line with our FY24e estimates of S$66mn, before an estimated S$30mn amortization of intangible assets. The amount will be finalized in March 2024.

- SATS group operations (excluding WFS) have nearly returned to pre-pandemic volume – flights handled was 86%, meals served, cargo handled and ground handling were 94% to 99% as of Dec 2023. Looking ahead, growth will be led by overseas operations in China, India and Indonesia, and lower interest costs through refinancing of debt. Net debt was flat QoQ at S$2.2bn, and net gearing was 0.9x.

- Maintain our FY24e earnings forecast and REDUCE call. We raised our DCF-derived TP to S$2.31 (prev. S$2.23), as we roll over to the next financial year.

The Positives

- SATS continued to improve on net profit by 45%, QoQ, due to continued recovery in air travel demand and 3Q being a seasonally strong quarter for aviation and cargo. Associates’ contributions improved, led mainly by India, Hong Kong, and Frankfurt.

The Negatives

- 3Q24 EBIT margin of 8.8% is still below the mid-teens level during pre-pandemic. The aviation industry has pressures from manpower crunch. With the inclusion of WFS, staff costs have risen by 241% YoY in 9M24 and now account for 60% of total expenditure (9M23: 49%).

- Net debt is flat QoQ at S$2.2bn as at Dec 23. Of these, about €580mn (S$847mn) matures in May 2024 and needs to be refinanced.

- 3Q24 annualised ROE at 5.4%. This is dragged down mainly by WFS, contributed only S$3.1mn to 3Q24 net profit.

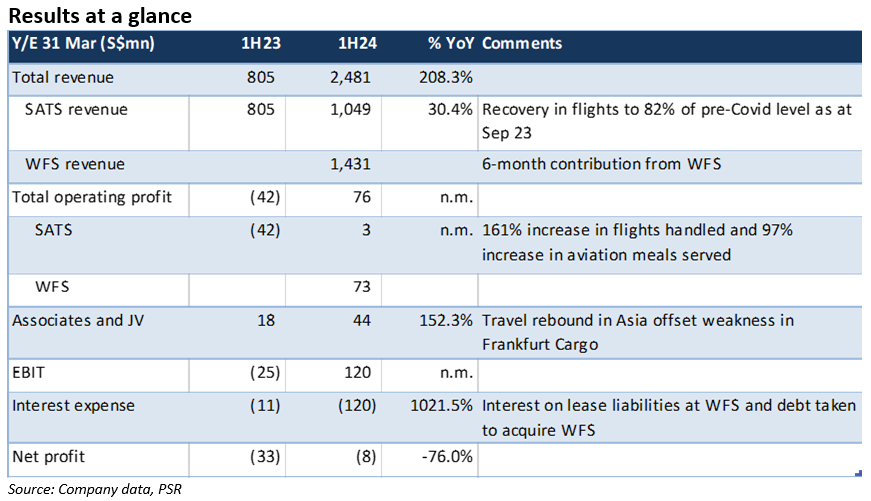

SATS – A weary recovery

- The results were in line with our expectations, though the mix was disappointing. Food solutions remained in the red with operating loss of S$0.9mn despite recovery in revenue to pre-Covid levels. WFS contributed operating profit of S$73mn for the first time, or operating margin of 5.1%. 2Q24’s net profit turned around to S$22.2mn (1Q24: net loss S$29.9mn). This was also due to lower depreciation charge of about S$20mn.

- EBIT barely covered the higher interest expenses on debt incurred for the acquisition. Net debt as at end Sep 2023 was S$2.3bn or net gearing of 0.9x.

- Maintain our earnings forecast, but downgrade to REDUCE (from NEUTRAL) and a lower TP of S$2.23 (prev. S$2.51), to factor in higher working capital at WFS.

The Negatives

- SATS-only operating margin was just 0.3%. Excluding the contribution from Worldwide Flight Services (WFS), operating profit was S$3mn. Despite revenue returning to the pre-Covid level of 1H20, food solutions incurred a marginal operating loss of S$0.9mn We believe the key reasons were 1) rise in operating costs, chiefly staff costs due to a manpower shortage in Singapore and Hong Kong; 2) fall in revenue from non-aviation (-13.8% YoY) due to lower catering and distribution demand. Flights at Singapore Changi Airport have been restored to about 89% of pre-Covid levels. Further growth is limited given the manpower and capacity bottlenecks faced by airlines. Thus, we are concerned that further improvement in food solutions earnings could be muted.

- 1H24 EBIT barely covered interest expenses. Net debt rose to S$2.3bn and net gearing of 0.9x after the acquisition of WFS.

The Positive

- Cargo volume reversed into growth in August and September. If the momentum sustains, operating leverage from higher volume could lift overall operating margin from 3.1% currently.

Outlook

Rising costs and interest expenses could impede earnings recovery. Working capital needs could rise with the inclusion of WFS. We downgrade to a REDUCE recommendation (from Neutral) and DCF-derived TP of S$2.23 (prev. S$2.51).

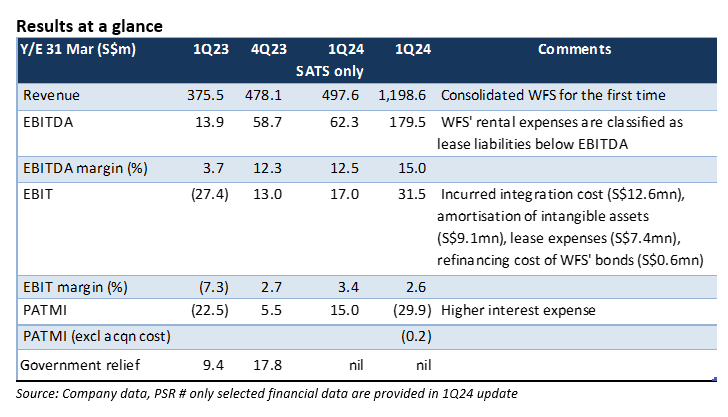

SATS LTD – Acquisition costs weighed on 1Q24 earnings

- SATS slipped into net loss in 1Q24, after booking S$29.7mn integration costs and amortization expenses relating to the acquisition of WFS. Excluding these, net loss was S$0.2mn, which was in line with our expectations. Operating gains were cancelled out by higher interest expense.

- SATS’ core operations turned in a profit, even with the expiry of government relief, though EBIT margin of 3.4% is still a far cry from pre-COVID level of 16%-17%. WFS’ volume declined in line with softer cargo demand, but yields are holding up.

- Maintain NEUTRAL recommendation and TP of $2.51. We lowered FY24e earnings forecast by 49% to take into account the integration costs.

The Negatives

- Acquisition-related costs weighed on earnings. WFS was consolidated for the first time. It incurred a one-off integration cost (S$12.6mn), amortization of intangible assets (S$9.1mn), lease expenses (S$7.4mn) and cost for refinancing of WFS’ bonds (S$0.6mn). The final amount of intangible assets will be determined in 2H24e. The annual amortization could change.

- Net debt rose to S$2.2bn (Mar 23: S$0.77bn). Higher interest expense cancelled out all the operating gains. Free cash flow was negative S$10.7mn in 1Q24.

- Volume handled by WFS has declined in tandem with the decline in global air cargo demand. However, the industry decline is moderating (Jun 23: -3.4% YoY, YTD: -8.1%).

The Positive

+ SATS-only operations were profitable, though it no longer enjoy government relief.

Outlook

The outlook is mixed. Aviation-related profits could improve with 1) inflight meals restoring to pre-COVID levels; 2) reduction in double-catering; and 3) increase in number of flights. On the other hand, air cargo volume might remain sluggish from lower manufacturing output and trade activities. The higher interest expense is a drag on earnings.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report