Q & M Dental Group Ltd – More growth after the reorg

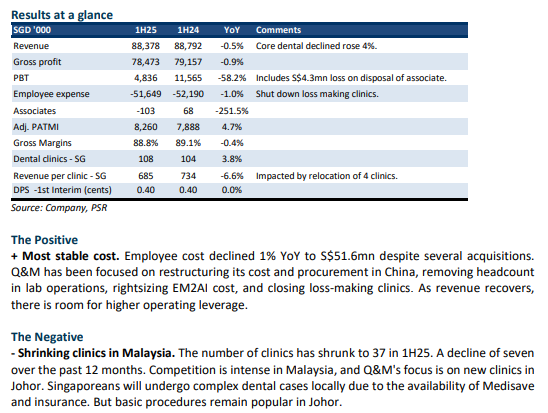

- 1H25 results were within expectations. Revenue and adj. PATMI were 47% and 40%, respectively, of our FY25e forecast. Adj. PATMI expanded 4.7% YoY to S$8.3mn. Q&M has been reorganising its clinics with closures of loss-making locations in Singapore and raising its stake in Aoxin China. 2H is seasonally stronger in China and Singapore.

- Q&M opened eight and closed four clinics in Singapore over the past 12 months. Q&M reported a S$4.3mn loss from consolidating Aoxin and EM2AI from an associate. Core dental revenue rose 4% YoY to S$87.4mn but offset by S$3mn from cessation of the lab business in Sep24.

- We maintain our FY25e earnings. Our target price is raised to S$0.545 (prev. S$0.40) as we peg our valuation to 25x PE from 18x, a 10% discount to the healthcare sector. We expect growth to improve in 2H25 onwards. The company is reorganising its cost structure in China, restructuring the clinic footprint in Singapore, and the S$130mn note raised could fuel earnings accretive acquisitions. 2H25 earnings will be supported by the jump in Singapore government subsidies in dental procedures and EM2AI rollout in 1,100 clinics.

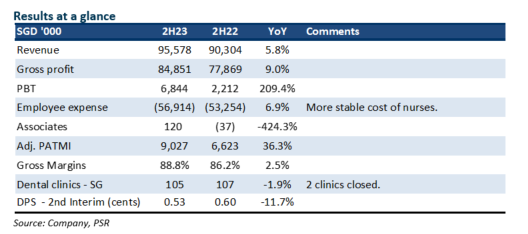

Q & M Dental Group Ltd – Reorganising for future growth

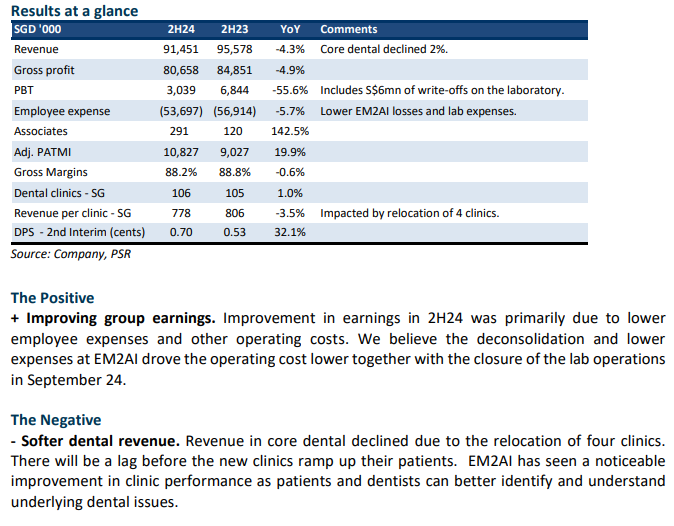

- FY24 profits exceeded our expectations: revenue and adj. PATMI were 97% and 113%, respectively, of our FY24e forecast. There was a turnaround in profitability of EM2AI and Aoxin and lower operating expenses. Adj. PATMI rose 20% YoY to S$10.8mn. The second interim dividend was raised 32% to 0.70 cents, and a 50mn share buyback was announced.

- 2H24 revenue declined 4% YoY to S$91.4mn due to the closure of the Acumen lab and slower core dental revenue. Core dental revenue fell due to the relocation of several older and less profitable clinics, with total clinics in Singapore rising by only one in FY24. Malaysia closed six clinics as the company focused on efficiency. Losses from EM2AI narrowed, and partial disposal on March 24 lowered employee costs. Associate Aoxin Q&M Dental has been turning around following more regulatory support for the large dental hospitals.

- We raised our earnings by 6% on the back of the turnaround in EM2AI, and Aoxin, and improving the profitability of existing clinics. Our BUY recommendation is maintained and target price raised to S$0.40 (prev. S$0.36) as we roll over our valuations. We value the company at 18x PE FY25e earnings, in line with industry peers. There is upside to our earnings if the company pursues a more aggressive acquisition strategy for growth and EM2AI finalises the agreement to sell its software to a network of approximately 1,000 clinics.

Q & M Dental Group Ltd – Growth drivers appearing

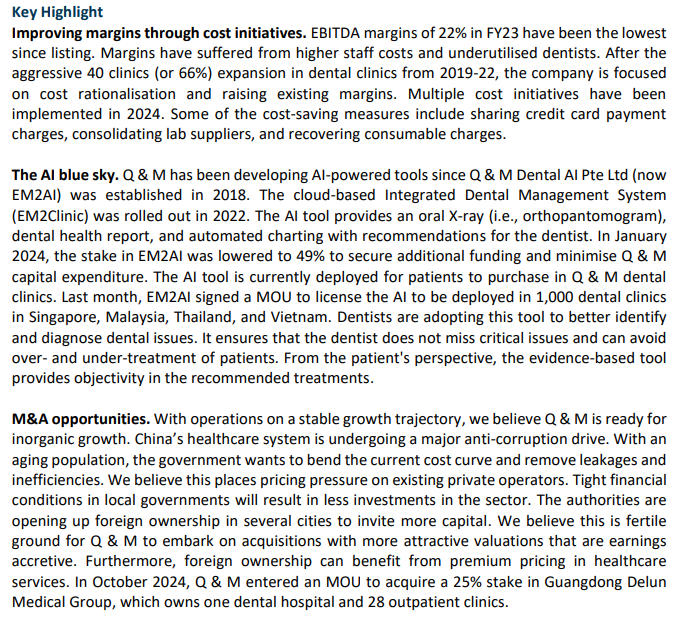

- Q & M is undergoing multiple cost initiatives to improve margins. Some of the cost-down efforts include sharing payment charges, consolidating suppliers, and recovering consumable charges.

- EM2AI has signed a memorandum of understanding (MOU) to integrate its dental AI solution into approximately 1,000 dental clinics in Thailand, the Philippines, Vietnam, and Indonesia. EM2AI has been in development for seven years, and this is a transformative milestone for Q & M. It represents a new source of recurrent earnings growth. There is an opportunity to become the essential clinical tool used in dental procedures as awareness and trust grow with the technology.

- We maintain our BUY recommendation and target price of S$0.36. There have been no changes in our forecast. We believe new growth opportunities are appearing for Q & M. Organically, the company aggressively looking to cost down its operations. Associate EM2AI AI is turning around with the commercialisation of its AI software. Inorganic opportunities could arise, especially in China, as the healthcare sector is facing major scrutiny and investigations.

Q & M Dental Group Ltd – Data-driven treatments can commence

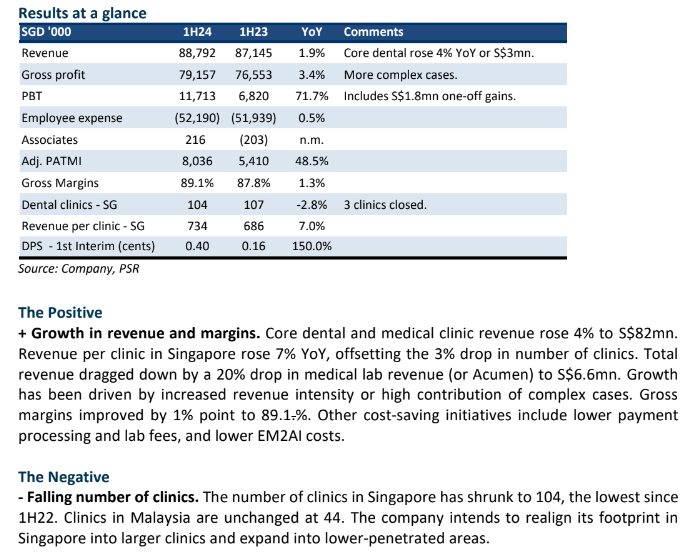

- 1H24 results were within expectations. Revenue and adj. PATMI were 48% and 47% respectively of our FY24e results. Adj. PATMI jumped 48% YoY to S$8mn. Interim dividend jumped 150% YoY to 0.4 cents.

- Core dental revenue rose 4% YoY from an increase in case complexity and revenue intensity aided by EM2AI AI model, despite the closure of 3 clinics over the past 12 months. Other cost saving initiatives were from professional and lab fees. Associate Aoxin Q&M Dental also registered a major turnaround in operations from government policies, reduced competition and cost control measures.

- We maintain our BUY recommendation and target price of S$0.36. No material change to our estimates. We value the company at 20x PE FY24e earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.053, Not Rated) is valued at market price with a 20% discount. After the aggressive expansion of 40 clinics from 2020-23, Q&M is focused on consolidating its clinics, turning around its associates and raising revenue intensity. Revenue growth is aided by EM2AI AI software that provides patients with unbiased and evidence-based treatment advice.

Q & M Dental Group Ltd – Data-driven treatments can commence

- 2023 adjusted PATMI exceeded our expectations at 121% of forecasts. Operating margins recovered from higher revenue per patient and more stable employee expenses. Associates also turned around from losses the prior year.

- Q&M is rationalising their network of clinics and closing poor performing clinics. Revenue intensity per patient is raised by utilising its EM2AI software. Data is drawn from dental scans, medical notes and records to ascertain the necessary level and timeliness of the treatments for patients. We view EM2AI as a critical tool for efficiency and differentiation.

- We upgraded from ACCUMULATE to BUY and raised our target price to S$0.36 (prev. S$0.34). We value the company at 20x PE FY24e earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.051, Not Rated) is valued at market price with a 20% discount. We expect Q&M to return to growth in FY24e. The key drivers are higher revenue per patient, more stable employee cost (as staffing levels for nurses normalise), deconsolidation of EM2AI R&D expenses and turnaround in associates.

The Positive

+ Recover in revenue and margins. 2H23 revenue growth is the fastest over the past two years. Despite fewer clinics, revenue expanded from higher revenue per patient. Using data driven treatment, Q&M can ascertain and provide a more intensive treatment for patients. Margins recovered from operating leverage and a stable number of staff or nurses.

The Negative

- Declining number of clinics. 2023 saw the first decline in the number of clinics in six years. Q&M closed two clinics in Singapore. The restructuring was to close loss-making clinics. Q&M is still looking to expand its clinics but for larger sites.

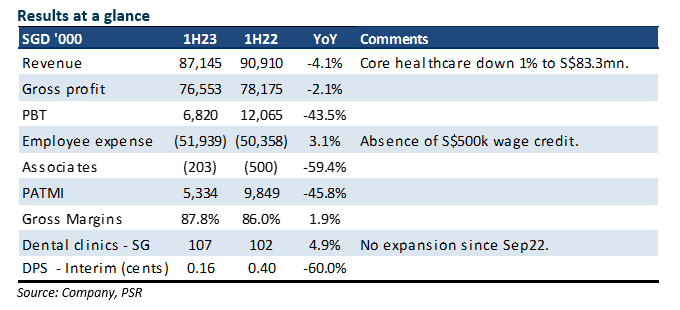

Q & M Dental Group Ltd – Still filling up the new clinics

- 1H23 revenue was within expectations, but earnings were below. Revenue and adjusted PATMI were 47%/29% of our FY23e forecast. Post-expansion of clinics, the company is facing operating cost pressure such as staff cost, utilities, rent, finance and development expenditure of AI-guided clinical support software.

- Q&M has not opened any new clinics this year. The aim is to raise the utilisation of existing clinics with dentists and improve skill sets, especially for the loss-making clinics.

- We cut our FY23e PATMI by 34% to S$11.9mn. We lowered revenue by 4% and raised our operating expense assumptions. Our recommendation is downgraded from BUY to ACCUMULATE. The target price is lowered to S$0.34 (prev. S$0.47). We value the company at 25x PE FY23e earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.125, Not Rated), is valued at market price with a 20% discount. After building out a record 34 clinics or 30% more, Q&M needs to raise profitability by recruiting new dentists to fill its existing chain of clinics, installing new equipment and upgrading the poorer performing dentists.

The Positive

+ Growing the number of dentists. 1H23, the company has grown the number of dentists by 40 to 320 currently. This expansion in headcount will support revenue in 2H23. The company has stopped expanding into new clinics since September 2022. The aim is to grow the number of dentists or chairs in the existing chain.

The Negative

- Negative operating leverage. 1H23 operating expenses rose 3.7%, or S$2.1mn. Around 70% of the increase was higher employee expenses. Wages rose due to higher nurse wages and absence of a S$500k wage credit. Other increases were expansion-related fixed costs such as rental and depreciation. Q&M will suffer from negative operating leverage as fixed costs have elevated.

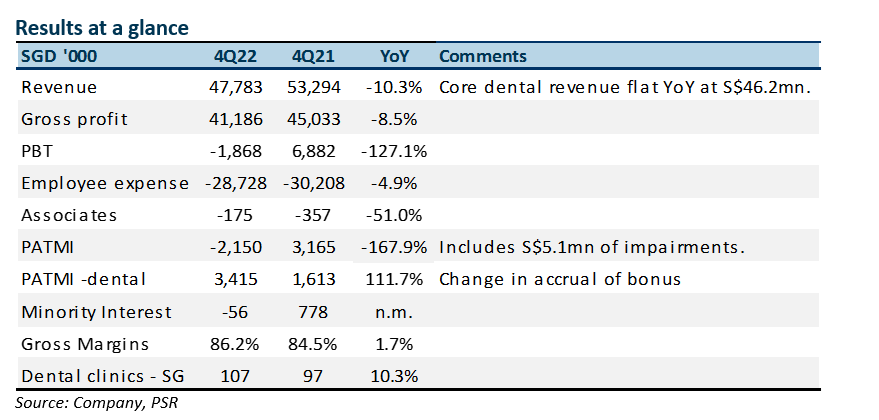

Q & M Dental Group Ltd – Pursuing operating leverage post-record expansion

- Revenue met expectations but earnings were below. FY22 revenue and adjusted PATMI were 99%/90% of our forecast. The significant drop in COVID-19 related earnings and higher expenses in the development of AI-guided clinical support systems were the drag.

- Our adjusted PATMI excludes S$5.1mn of impairment of inventories (S$4.9mn) and plant and equipment (S$0.2mn) incurred in 4Q22.

- We are lowering our FY23e PATMI by 17% to S$17.9mn. After increasing the number of clinics by a record 34 (or 30%) over the past two years, the focus is to raise utilisation. Q&M continues to recruit dentists to fill its existing chain of clinics and upgrade the skills of dentists. Our BUY recommendation is maintained but target price lowered to S$0.47 (prev. S$0.52). We value the company at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.115, Not Rated), is valued at market price with a 20% discount.

The Positive

+ Number of clinics expanded. In FY22, Q&M expanded the number of clinics by 16 (or 12%). Most of the new clinics were in Singapore, with 10 new clinics. Profitability from core dental operations tripled to S$3.4mn. This was due to a change in the accrual of staff bonuses from a lumpy 4Q to proportionate provisioning per quarter.

The Negative

- Revenue per clinic declined. 4Q22 revenue per clinic declined by 12% YoY to S$382k. New clinics have not reached maturity, as nurse shortages and the re-opening of borders have dampened visits. Nevertheless, total revenue from core dental was flat YoY at S$46.2mn.

Outlook

The priority in FY23 is to raise the utilisation of the existing clinics. After the aggressive expansion over the past two years (34 clinics), the company will look to raise visits and revenue intensity per patient. Recruitment into the existing network of clinics will boost the availability of dentists. Improving the skill sets of the current dentists is another initiative to increase revenue intensity. Q & M is also pursuing an AI-guided dental software that creates an ethical standard cum procedures that supports dentists.

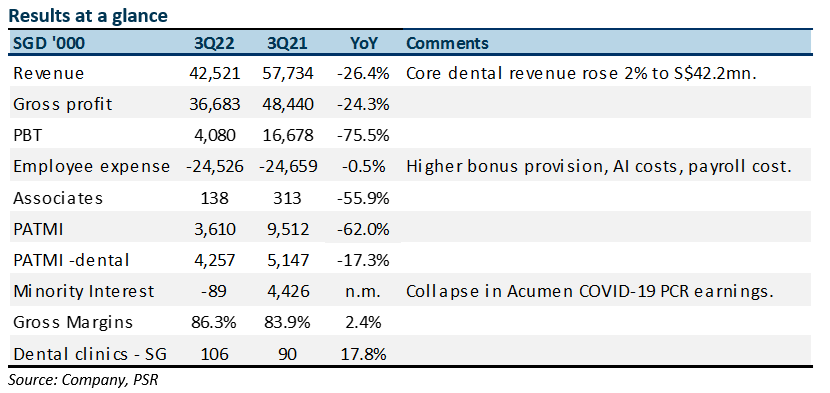

Q & M Dental Group Ltd – Expansion cost starts to bite

- 3Q22 earnings were below expectations. YTD22 revenue and PATMI were 77%/61% of our FY22e forecast. Employee expenses were higher than expected due to Acumen losses, software development expenses and higher opex from new clinics.

- Sharp 62% drop in earnings due to the absence of COVID-19 test revenue from Acumen. Acumen swung from PAT of S$4.4mn to an estimated S$0.1mn loss.

- We cut our FY22e PATMI by 30% to S$22mn. Expenses are running higher than expected. We expect employee expense to revenue to trend downwards as new clinics start to ramp up visitations. Our target price is lowered to S$0.52 (prev. S$0.60). We value core dental operations at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.169, Not Rated), is valued at market price with a 20% discount.

The Positive

+ Franchise is still expanding. There were three new clinics opened in 3Q22 (2Q22: 8). Another two clinics are planned in November. There has been a change in strategy in clinic openings. The priority is to fill existing capacity in current clinics before new locations are open. Other efforts are to build larger dental centres where profitability is higher from economies of scale.

The Negative

- Sluggish dental earnings and other expenses. Net profit from core dental operations declined 17% YoY to S$4.2mn. Performance of new clinics has been softer since border re-opening as visits have declined. Other expenses causing a drag in earnings have been the development cost of the AI guided dental software, recruitment cost for new dentists and start-up costs from new clinics. The record expansion of 24 clinics in Singapore and Malaysia over the past 12 months has been a burden on profitability in the near term.

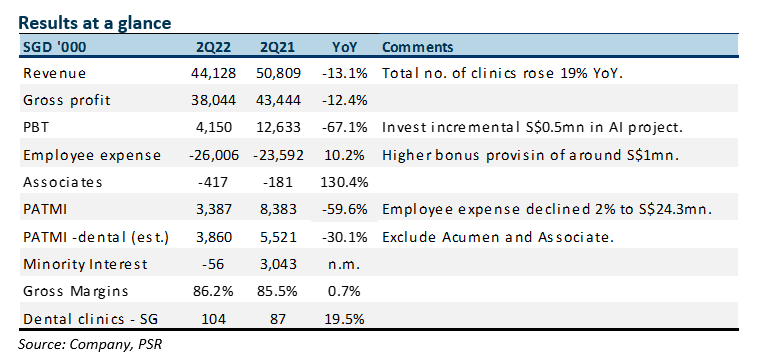

Q & M Dental Group Ltd – Hurt by upfront and uneven expenses

- Earnings were below expectations. 1H22 revenue and PATMI were 52%/37% of our FY22e forecast. Additional cost from investments in AI project and change in recognition of bonus provision. Earnings from COVID-19 PCR tests swung from $3mn net profit a year ago to S$50k net loss.

- During the quarter, the number of clinics increased by 8 during to 149, a 19% YoY jump. Together with Malaysia, Q &M has 350 dentists.

- We lower our FY22e PATMI by 16% to S$22mn. We are incorporating additional cost for the AI project and even weaker earnings from Acumen. The target price is lowered to S$0.60 (prev. S$0.71). We value core dental operations at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.17, Not Rated), is valued at market price with a 20% discount. The company is expanding its dental clinics at the fastest pace since inception. We estimate CAGR of 18% over the next two years.

The Positive

+ Surge in number of clinics. There were 8 new clinics opened in 2Q22. It is a 19% YoY jump to 149. 1H22 has seen the opening of 13 new clinics, tracking our modelled 25 new clinics this year. Headcount especially nurses is a major bottleneck in the expansion of clinics. Despite the rise in the clinics, revenue rose by only 5%. Revenue per average clinic has declined to 10% YoY to S$293k. We believe it will take time for new clinics to ramp up. Group utilisation rate is still at 60-70%.

The Negative

- Rise in expenses. 2Q22 staff cost and depreciation jumped by 12% YoY to S$30mn despite the decline in revenue. We attribute the rise in expenses due to additional $0.5mn spent on the AI project, $1mn in bonus provision and S$0.7mn in equipment. AI expense was higher than expected. Bonus provision is allocated evenly across each quarter compared to a lumpy 4Q recognition.

Outlook

Investment into Artificial Intelligence (AI) project will continue into 2H22. Revenue per clinic should improve as clinics mature. Further, the company aims to raise the utilisation of current chain of clinics by adding new dentists in existing clinics rather than adding new clinics. AI software has received approval as a Class B medical device. It is being rolled out across Q & M’s dental clinics to independently generate dental plans for patients. Next phase is to deploy to other clinics in Singapore. Acumen’s focus is on sepsis, colon cancer and pharmacogenetics screening.

Maintain BUY with lower TP of S$0.60 (prev. S$0.71)

2022 is a transition year as the company invests in the AI project, accelerates the roll-out of more clinics and Acumen pivots away from the COVID-19 PCR test to other test kits.

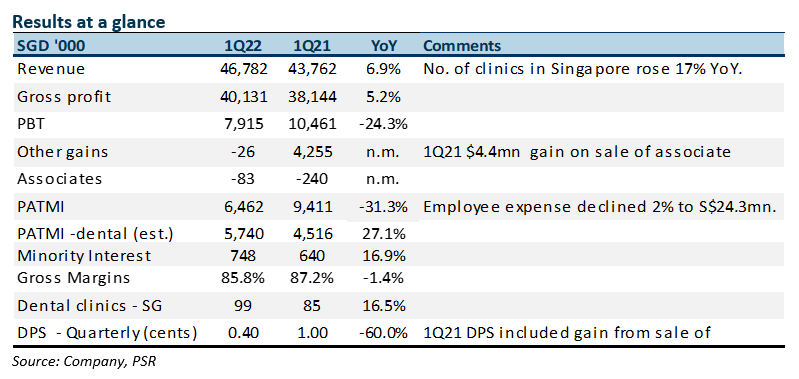

Q & M Dental Group Ltd – New clinics support earnings growth

- Earnings were within expectations. 1Q22 revenue and PATMI were 27%/25% of our FY22e forecast. New dental clinics drove dental earnings growth.

- Excluding disposal gains and COVID-19 PCR earnings, we estimate dental earnings growth of 27% to S$5.7mn in 1Q22.

- We maintain our FY22e PATMI and BUY recommendation. The target price is unchanged, and core dental operations are valued at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.175, Not Rated), is valued at market price with a 20% discount. Q & M Dental is expanding its franchise of dental clinics across Singapore and Malaysia. We estimate the number of clinics to grow at 18% CAGR over the next two years (or 27 p.a. vs management target of at least 30 p.a.).

The Positive

+ Fewer clinics this quarter but up 17% YoY. Only 2 clinics were opened in Singapore, unchanged from a year ago, but fewer than the 7 clinics opened last quarter. Total number of clinics in Singapore rose 17% YoY to 99. Together with Malaysia, the total number of new clinics opened was 5. The company maintained the guidance of at least 30 and has identified 10 new locations.

The Negative

- COVID-19 PCR tests contribution becoming negligible. COVID-19 related earnings from Acumen, as measured by minority interest, has declined 76% QoQ from S$2.9mn to S$0.7mn. The need for PCR tests is now largely for outbound travellers. Acumen's focus is on sepsis and cancer marker PCR tests.

Outlook

We believe the reopening of borders will become a near-term headwind as the availability of dentists decline and patients will likely fall due to travel reasons. New dental clinics will be the key earnings driver for the company. Other benefits of a larger dental chain are the de-risking revenue contribution from a larger pool of dentists and a more valuable referral ecosystem to the specialist dentist. In 1Q22, industry outpatient dental admissions was down 14%, QNM likely took some market share judging by the more stable revenue.

Maintain BUY with an unchanged TP of S$0.71

QNM is on its most aggressive expansion plan from an average of 5 clinics p.a. before 2019 to currently 25 to 30 p.a. Earnings in FY22e will be impacted by the collapse in COVID-19 PCR test revenue.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report