PRIME US REIT – Laying the groundwork for future growth

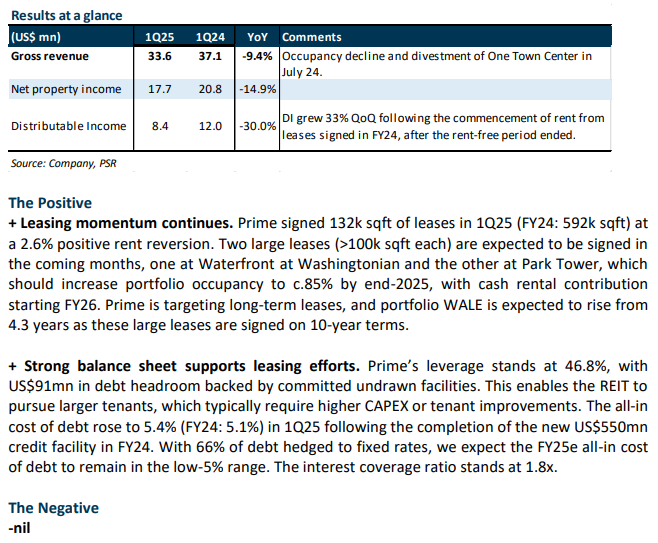

- 1Q25 NPI/DI were within expectations at 23%/25% of our FY25e forecast. DI declined 30% YoY due to lower portfolio occupancy (1Q25: 78.9% vs 1Q24: 80.9%), the divestment of One Town Center in July 24, and higher finance expenses.

- Leases signed in 1Q25 achieved a positive rental reversion of 2.6% (FY24: +1.8%). Two large leases (>100k sqft each) are expected to be signed in FY25, with cash rental collection commencing in FY26. These leases are expected to lift portfolio occupancy towards c.85% by end-2025. Prime has no refinancing requirements in FY25.

- Maintain BUY with an unchanged DDM-derived TP of US$0.20. Our estimates remain unchanged. We assume the 10% payout ratio continues through FY25e and a return to 100% distributions in FY26e, as new leases signed in FY24/1Q25 (6.4% of occupancy) begin contributing cash rentals after the rent-free periods. The current share price implies an FY25e/26e DPU yield of 1.8%/20.4%. Prime is currently trading at a steep discount at 0.25x P/NAV.

PRIME US REIT – Unexpected rise in portfolio valuations

- 2H24/FY24 DPU of 0.11/0.29UScts (-52%/-88% YoY) were below expectations at 33%/88% of our FY24e forecast. The YoY decline was due to: 1) the manager retaining c.90% of DI for capital expenditure, 2) the divestment of One Town Center in July 24, 3) Waterfront at Washingtonian’s asset enhancement initiative (AEI), and 4) higher finance expenses. 2H24/FY24 DI was 36%/93% of our FY24e forecast.

- Portfolio valuations rose 2.2% YoY to US$1.352bn, driven by stronger operating performance and positive leasing momentum, despite a slight increase in cap and discount rates. FY24 leasing volume grew 1.9% YoY, with leases signed at a 1.8% positive rental reversion.

- We maintain BUY with an unchanged TP of US$0.20. We lower our FY25e/26e DPU estimates by 21%/20% to reflect a lower NPI margin, aligning with FY24 levels as we roll forward our forecasts. Assuming the 10% payout ratio continues through FY25e and Prime resumes full distributions in FY26e, the current share price implies an FY25e/26e DPU yield of 1.7%/19.5%. We expect a return to 100% distribution in FY26e, supported by higher portfolio occupancy, lower capex and tenant incentive requirements, and cash contributions from leases signed in FY24/FY25 as rent-free periods and incentives phase out. With more employers mandating return-to-office five days a week, Prime is well-positioned to benefit from this trend and the improving leasing momentum. Prime is currently trading at a steep discount at 0.26x P/NAV.

PRIME US REIT – Improving leasing volumes

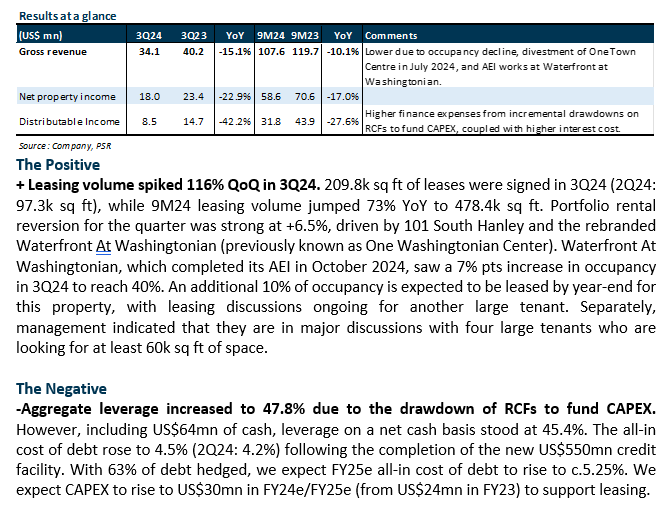

- 3Q24/9M24 distributable income, down 42.2%/27.6% YoY, was in line with our expectations and formed 21%/77% of our FY24e estimates. 3Q24 distributable income fell 42.2% YoY due to: 1) portfolio occupancy decline, 2) divestment of One Town Centre, 3) AEI works at Waterfront at Washingtonian, and 4) higher finance expenses from RCF drawdowns to fund CAPEX, along with higher interest costs.

- Leasing volume spiked 116% QoQ in 3Q24, with a gross rental reversion of +6.5% for the quarter. Excluding Waterfront at Washingtonian, which completed its AEI in October 2024 and is currently 40.2% leased, portfolio occupancy fell by 0.9ppts QoQ to 83%.

- We maintain BUY with a lower TP of US$0.20 from US$0.22. Our estimates remain unchanged, but we now assume the 10% payout ratio will persist through to FY25e (prev. 100% in FY25e). Based on our assumption of a 10% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 2.1%, which is still considered favourable compared to its peers, which are not paying any dividends. With further interest rate cuts expected and improving leasing momentum, we think there is potential for share price appreciation as Prime is currently trading at a steep discount at 0.27x P/NAV.

PRIME US REIT – Refinancing finally complete

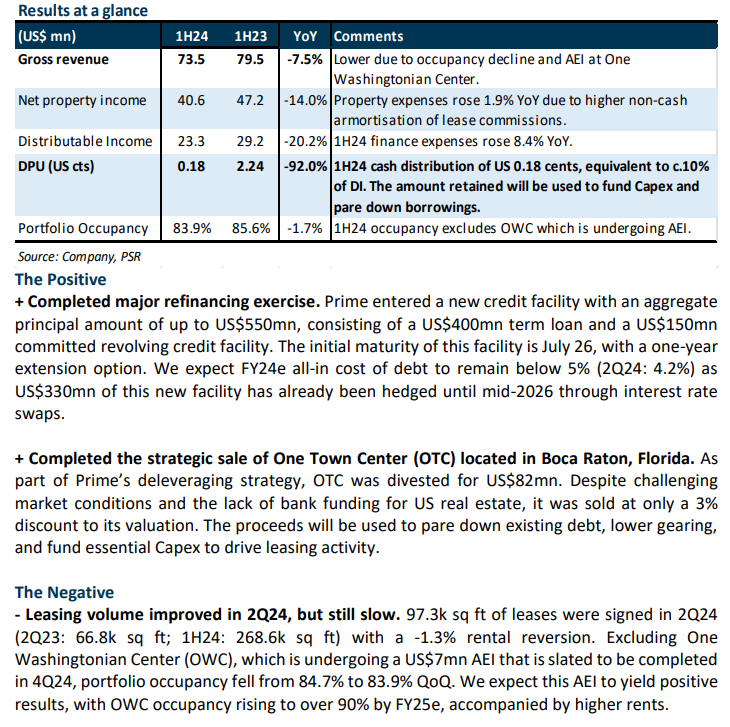

- 1H24 results were within expectations. Gross revenue/distributable income was 47%/45% of our FY24e forecast. DPU of 0.18 US cents missed our estimates as Prime paid out only c.10% of DI in 1H24, compared to our initial assumption of 25%.

- Completed the major refinancing exercise on 9 August 2024 with a US$550mn credit facility. This new facility has an initial maturity in July 2026, with an option to extend for an additional year. The facility will be used to repay S$504.3mn of loans, with the balance for working capital and capital expenditure.

- We upgrade from ACCUMULATE to BUY with a higher TP of US$0.22 from US$0.12. We revert our valuation methodology back to DDM (cost of equity: 15.95%, g: 1.75%) from 0.2x P/NAV after the successful securing of a new secured

loan facility. We lower our FY24e DPU forecast by 68% after accounting for the divestment of One Town Center and a lower payout ratio of 10% (previously assumed 25% payout ratio). Based on our assumption of a 10% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 1.8%, which is still considered favourable compared to its peers, which are not paying any dividends. We think there is potential for capital appreciation as Prime is currently trading at a steep discount at 0.32x P/NAV.

Prime US REIT – Pricing in some refinancing risk

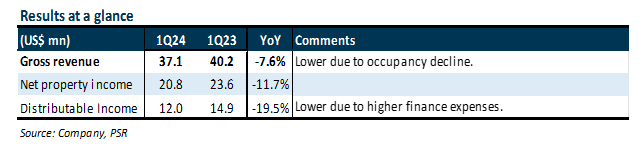

- 1Q24 results were within expectations. Gross revenue/distributable income was 23%/22% of our FY24e forecast. DI was 19.5% lower YoY due to lower portfolio occupancy (1Q24: 80.9%) and higher finance expenses.

- Management is confident that it will refinance the US$480mn (69% of total) debt before its July 2024 maturity as: 1) Prime is in the final stages of securing the loan, 2) the lenders are a syndicate led by Bank of Amerca. US banks are relatively more comfortable with financing US commercial real estate on a 65% LTV and an ICR of 1.5x, and 3) Prime’s assets are still generating income and cash-flows. However, credit spreads and interest cost may widen.

- Downgrade from BUY to ACCUMULATE with a lower TP of US$0.12 from US$0.30. We peg our TP to 0.2x P/NAV (from DDM), in line with its peers. We are pricing in the refinancing risk by changing our valuation from DDM to P/NAV that is in-line with US office peers. We believe this is warranted due to the short two-month window to refinance the debt. Prime is now focusing on deleveraging and has set a target to execute US$100mn of deleveraging in 2024. A successful refinancing of the US$480mn loan maturing in July 2024 we believe will help narrow the discount to NAV to 0.3x P/NAV and a target price of US$0.18. Based on our assumption of a 25% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 9.5%. Prime is currently trading at 0.19x P/NAV.

The Positive

+ Leasing volume more than doubled YoY. Over 171.3k sq ft of leases were signed in 1Q24 (1Q23: 64.4k sq ft; 4Q23: 304.1k sq ft). Rental reversion for 1Q24 was -1.8% due to a 31.8k sq ft 11-year lease renewal in Reston Square with rents below preceding rents but above market rents. Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at One Washingtonian Center (OWC), Park Tower, and 101 Hanley, albeit with relatively longer lead times.

The Negatives

- Two months left to refinance US$480mn or 69% of total debt due July 2024. Management is actively discussing refinancing this loan with lenders and believes it will be completed before maturity. 79% of total debt are either on fixed rate or hedged, with US$330mn of the US$480mn debt due for refinancing in July 2024 already hedged till June 2026. The cost of debt rose 0.1%pts QoQ to 4.1%. Aggregate leverage stood at 48.1%, with an ICR of 2.9x.

- 1Q24 Portfolio occupancy fell to 80.9% (FY23: 85.4%) after Sodexo vacated OWC. OWC is now undergoing an asset enhancement initiative to rejuvenate the asset, which is expected to be completed in 2H24. Excluding OWC, occupancy was 84.7%.

PRIME US REIT – No breach, but refinancing risks persist

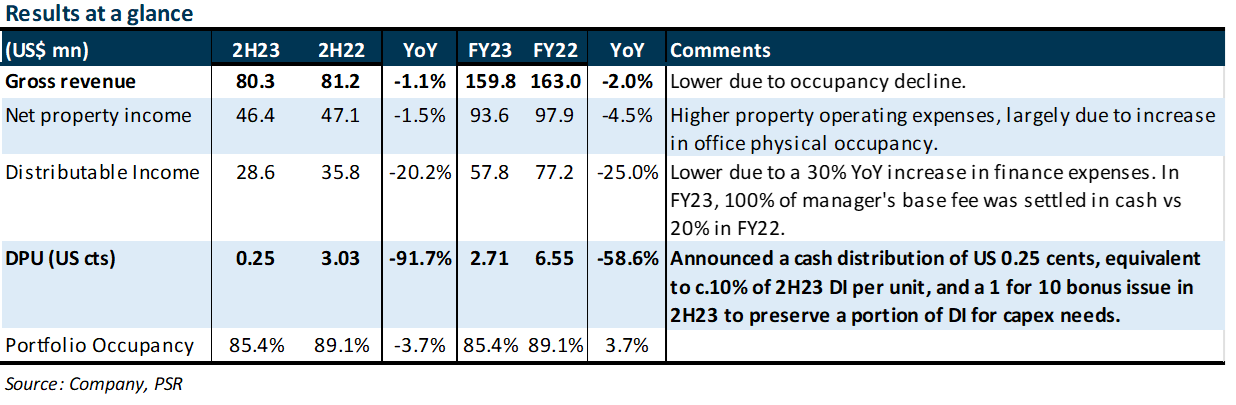

- FY23 DPU of 2.71 US cts (-58.6% YoY) was below our estimates due to Prime paying only 0.25 US cts in 2H23 (c.10% of 2H23 distribution) to preserve capital for capex needs. Assuming a 100% payout ratio, FY23 DPU of 4.86 US cts would have aligned with our FY23e forecast at 99%. Prime also announced a 1-for-10 bonus issue (c.43% of 2H23 DI), translating to a value of 1.03 US cts, based on a unit price of US$0.103.

- The YoY decline in FY23 distributable income (-25%) was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, and lower portfolio occupancy. Excluding the change in management fees paid in cash, distributable income is down 18.9% YoY. Portfolio valuations fell 8.7%, taking gearing to 48.4%, just under the MAS limit of 50%.

- Maintain BUY, DDM-TP lowered from US$0.37 to US$0.30 as we roll over our forecasts. FY24e DPU estimate lowered by 77% after factoring in the enlarged share base from the bonus issue, a lower portfolio occupancy, and a payout ratio of 25%. The key risk entails refinancing US$478mn (68% of total) debt under its main credit facility expiring in July 24, though management has expressed confidence in their ability to do so. Prime is now focusing on deleveraging and has set a target to execute US$100mn of deleveraging in 2024. Assuming a 25% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 8%. Prime is currently trading at 0.22x P/NAV.

The Positive

+ Leasing activities picked up in 4Q23. Prime signed 304.1k sq ft of leases in 4Q23, more than the previous three quarters combined (9M23: 276.8k sq ft), at 9.6% positive rental reversion. Portfolio occupancy improved 0.4% QoQ to 85.4%, but it will dip in 2024 due to Sodexo (5.4% of income) vacating c.166k sq ft of space (c.3.8% of portfolio occupancy) at One Washingtonian Center (OWC). Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at OWC and Park Tower, albeit with relatively longer lead times.

The Negatives

- Portfolio valuation fell US$134.3mn or 8.7% YoY, due to an average 54bps expansion in cap rates across the portfolio. The decline in valuation was lower than we anticipated. As a result, there was no breach in financial covenants as gearing increased to 48.4%, just under MAS limit of 50% if ICR is above 2.5x; Prime’s ICR is 3.1x. Prime is now working on deleveraging alternatives and is targeting up to US$100mn of deleveraging in 2024 to pare down gearing.

- Yet to refinance US$600mn in credit facilities (US$478 outstanding) due July 24. Management indicated they are actively discussing refinancing this loan with lenders, which constitutes 68% of Prime’s total debt. The cost of debt for the quarter was flat QoQ at 4%, with 79% of debt either on fixed rate or hedged, with 62% of debt hedged or fixed through to 2026 or beyond.

Outlook

Prime has not committed to future distributions going forward and will evaluate the situation dynamically, depending on capital requirements. Management continues to prioritize net effective rents with lower capex deals over headline rents in a challenging US office environment. In-place rents are c.6.5% below asking rents, and the potential for favourable rental reversions going forward remains promising. Prime US Reit has no exposure to WeWork, which filed for Chapter 11 bankruptcy.

Maintain BUY, DDM TP lowered from US$0.37 to US$0.30. FY24e DPU estimate lowered by 77% after factoring in the enlarged share base from the bonus issue, a lower portfolio occupancy, and a payout ratio of 25%. Assuming a 25% payout ratio, the current share price implies an FY24e DPU yield of 8%.

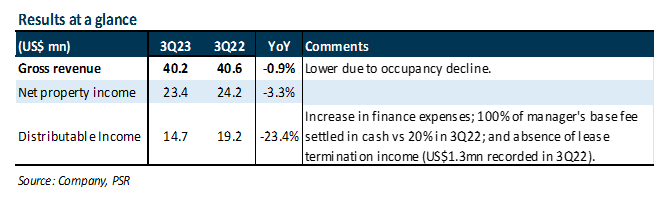

Prime US REIT – Challenges remain, but manageable

- 3Q23 distributable income of US$14.7mn (-23.4% YoY) was in line with our expectations and formed 25% of our FY23e forecast. The YoY decline was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, lower portfolio occupancy, and absence of lease termination income (US$1.3mn recorded in 3Q22). Excluding the change in management fees paid in cash, distributable income is down 16.6% YoY.

- Portfolio occupancy dropped to 85% from 85.6% in 2Q23, with overall rental reversions of -2%. Prime is prioritising net effective rents (deals with lower capex) over headline rents in this challenging US office environment in a bid to shore up occupancy.

- Maintain BUY, DDM-TP lowered from US$0.39 to US$0.37. FY24e DPU lowered by 7% on lower occupancy and higher finance costs assumptions. Prime is currently trading at 0.21x P/NAV. We believe that most of the negatives are already priced in. The key risk will be on the year-end valuation impact to gearing (43.7%) and bank covenants. There is a refinancing of US$484mn (69% of total) debt under its main credit facility which expires in July 24. The current share price implies FY23e/FY24e DPU yield of 30%.

The Positive

+ Leasing activities picked up in 3Q23. Prime signed 145.6k sq ft of leases in 3Q23, more than the previous two quarters combined (1H23: 131.2k sq ft). This was mainly due to the lease extension of top tenant Charter Communications for 94k sq ft at Village Center Station I (VCS I). Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at VCS I and Park Tower, albeit with relatively longer lead times. One of its top 10 tenants, Matheson Tri-Gas, has indicated interest to expand its space at Tower 909, and discussions are ongoing.

The Negatives

- Portfolio occupancy dipped from 85.6% to 85% QoQ. We expect further decline in occupancy going forward as Sodexo, Prime’s second largest tenant (5.3% of income), vacates One Washingtonian Center (OWC). It will vacate 166k sq ft of 191k sq ft leased by Dec 2023 - the balance space is currently sublet to other tenants who will likely remain. Prime is making use of this downtime to re-amenitize OWC, with enhancement initiatives costing c.US$5mn underway to modernize the asset to improve leasing interests. Backfilling at this asset is in progress, with encouraging signs as it has already secured a 19k sq ft 11-year lease with a healthcare tenant in Oct 23.

- Gearing increased 0.9ppts QoQ to 43.7%, leaving a c.12.9% buffer from FY22 year-end valuations before it reaches 50%. 78% of debt is either on fixed rate or hedged (2Q23: 80%), with 62% of debt hedged or fixed through to 2026 or beyond. The remaining 16% of hedges expire in July 24. Prime’s YTD all in interest cost rose to 4% from 3.9% in 1H23, and its interest coverage ratio is at 3.2x. Prime is in talks with lenders to refinance US$484mn (69% of total) debt that expires in July 24.

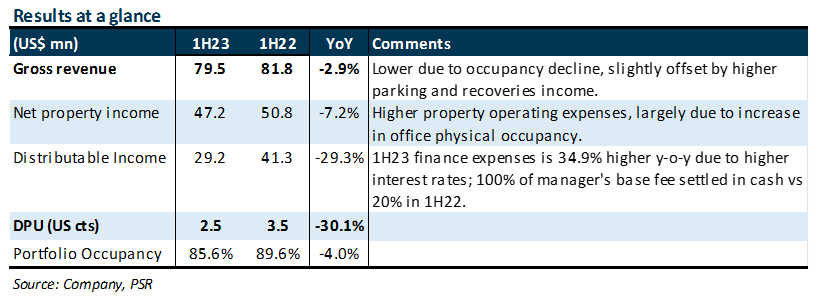

Prime US REIT – Navigating through the storm

- 1H23 DPU of 2.46 US cts (-30.1% YoY) was in line with our estimates at 50% of FY23e forecast. The decline of was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, lower occupancy, and higher operating expenses. Excluding the change in management fees paid in cash, DPU is still down c.24% YoY.

- Portfolio occupancy dropped to 85.6% from 88.6% in 1Q23, with overall rental reversions of +9.5%.

- Maintain BUY, DDM-TP lowered from US$0.46 to US$0.39. Our cost of equity increased from 13.75% to 15.95% due to the inherent weakness of the US office sector. Catalysts include improved leasing and a greater return to the office. Prime is currently trading at 0.25x P/NAV, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 25/27%.

The Positive

+ Extension of debt maturities. During the quarter, Prime extended the maturity of its term loan and revolver under its main credit facility (c.34% of total loans) by one year to July 2024. As a result, Prime has no refinancing obligations till July 2024. This gives Prime more time to secure refinancing and some respite amid the credit crunch situation in the US.

+ Gearing decreased 0.9ppts QoQ to 42.8%. 80% of debt is either on fixed rate or hedged (79% in 1Q23), with 63% of debt hedged or fixed through to 2026 or beyond. Prime’s effective interest cost for the quarter increased marginally QoQ from 3.7% to 3.8%, and its interest coverage ratio is at 3.4x. Prime has a buffer of c.5.1% and c.15% from 2022 year-end asset valuations before gearing hits 45% and 50% respectively.

The Negatives

- Portfolio occupancy decreased to 85.6% from 88.6% in 1Q23. The biggest contributors to the decline were 171 17th Street (-14.5ppts QoQ to 80.5%) and Park Towers (-11.4ppts QoQ to 74.3%).

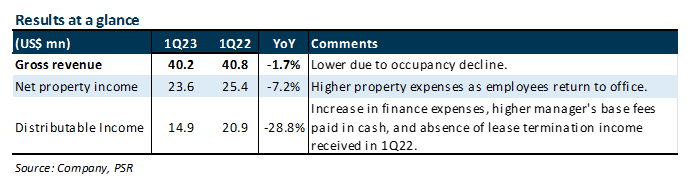

Prime US REIT – Leasing is the top priority

- 1Q23 distributable income was below expectations and 21% of FY23e forecast. The decline of 28.8% to US$14.9mn was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, absence of lease termination income, and higher operating expenses. Excluding the higher proportion of management fees in cash, distributable income is still down 22.5%.

- Portfolio occupancy dipped slightly to 88.6% from 89.1% in 4Q22, with overall rental reversions of -2.6%.

- Maintain BUY, DDM-TP lowered from US$0.70 to US$0.46 as we lower our FY23e DPU forecast by 18% due to management fees paid all in cash, lower occupancy, and higher costs. We also cut FY24e and FY25e DPU by 18% and 15% respectively. Catalysts include improved leasing and a greater return to the office. Prime is currently trading at 0.3x P/NAV and below pandemic lows, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 23/25%.

The Positive

+ Extension of debt maturities. Prime is in the process of extending its 4-year term loan and RCF under its main credit facility (c.34% of total loans) by one year to July 2024 for an extension fee of 10bps. Expected completion is June 2023. This gives Prime some respite amid the credit crunch situation in the US.

The Negatives

- Portfolio occupancy dipped to 88.6% from 89.1% in 4Q22. The biggest contributors to the decline were Tower 1 at Emeryville (-7ppts QoQ to 69.1%) and Sorento Towers (-2.8ppts QoQ to 94.4%).

- Slowdown in leasing volumes. Prime signed 64.4k sq ft of leases in 1Q23 (-62% YoY and -55% QoQ). However, leasing activity picked up in April 23 with c.38k sq ft of leases executed. Portfolio rental reversions for the quarter were -2.6%, impacted by two renewals with minimal upfront tenant improvements Capex, but with high positive net effective rent reversions. Excluding the two abovementioned renewals, 1Q23 rental reversions would have been +3.2%.

- Gearing increased 1.6ppts QoQ to 43.7%, due to the increase in borrowings to fund 2H22 distribution at the end of March 2023. 79% of debt is either on a fixed rate or hedged (82% in 4Q22), with 62% of debt hedged or fixed through to 2026 or beyond. After the extension of debt, Prime has no refinancing obligations till July 2024. Prime’s effective interest cost for the quarter increased 30bps QoQ to 3.7%, and its interest coverage ratio is at 3.8x.

Prime US REIT – Strong rental reversions to drive growth

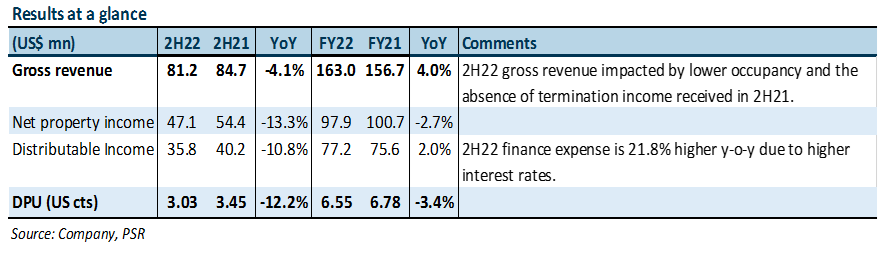

- FY22 DPU of 6.55 US cts was slightly below our estimates, mainly due to higher interest expense (+27.2%) and lower occupancies (89.1%).

- Despite portfolio valuation declining 6.7% on higher discount and cap rate assumptions, gearing at 42.1% and interest coverage at 4.1x remains well within regulatory limits.

- Maintain BUY, DDM-TP lowered from US$0.88 to US$0.70 as we lower our FY23e-FY25e DPU forecasts by 12-15% due to lower occupancy and higher financing costs. Our cost of equity increased from 10.55% to 11% as we roll forward our forecasts. PRIME is our top pick in the US office sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office. Prime is currently trading at 0.6x P/NAV and below pandemic lows, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 13.6/14.7%.

The Positives

+ Strong positive rental reversions of 20.2% for 4Q22, continuing the trend of positive rental reversions for 11 consecutive quarters. Occupancy remained relatively stable, declining 0.5% QoQ to 89.1%. Leasing remains active, with activity coming from sectors such as scientific R&D services, finance, biotechnology, manufacturing and legal services. The 20.2% reversion was substantially from Crosspoint, where an existing tenant downsized from 84k sq ft to 57.5k sq ft and extended the lease to 2032, and a new tenant backfilled space and signed a lease till 2034 at >25% reversions.

+ 82% of debt is on fixed rate or hedged, with 66% of the total debt hedged or fixed through to mid-2026 and beyond. Prime has no refinancing obligations till July 2024. Prime’s gearing increased to 42.1% from 38.7% QoQ, mainly due to the decline in portfolio valuation, but remains well within regulatory limits. Its interest coverage ratio of 4.1x is also well above MAS’ threshold of 2.5x to bring gearing limits up to 50%. Prime’s effective interest rate crept up to 3.4%, from 3.1% in 3Q22.

The Negative

- Portfolio value declined 6.7% due to higher discount and cap rate assumptions used by valuers. Across the board, cap rates increased by 50bps. All assets saw a valuation decline, with Reston Square (-14.2%, due to the non-renewal of anchor tenant), Village Center Station I (-12.1%) and One Town Center (-10.6%) having the biggest percentage declines.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report