PropNex Ltd – Bumper 25th anniversary expected

- FY24 results were below expectations. Revenue and PATMI were 94%/82% of our estimates. Revenue from new home sales fell 27% YoY to S$94mn. The pick-up in unit sales only occurred in 4Q24, with revenue recognition only in 1H25.

- Momentum in new home sales is robust. Response to new project launches is 3-4x available units. Rising public housing prices, population growth, falling interest rates, and a stable employment market support demand.

- We raised our FY25e earnings by 9% to S$59.7mn. New home sales will drive growth. Units sold for the industry in 2025 are expected to jump by 31% to 8,500 units, with prices climbing 3%. HDB and private resale volume growth are estimated to grow by 2% and 7%, respectively, in 2025. We increased our DCF target price to S$1.33 (prev. S$0.89). The WACC is lowered to 9.5% (prev. 11.8%) as we reduce our risk-free and volatility assumption. PropNex earnings and balance sheet have been much more resilient than expected. The company enjoys a 64% market share in the units transacted backed by 12,636 real estate agents in Singapore. It pays a dividend yield of 5.8%, supported by net cash (and fixed income securities) of S$152mn and a potential special dividend for its 25th anniversary.

PropNex Ltd – Expecting a stronger 2H23

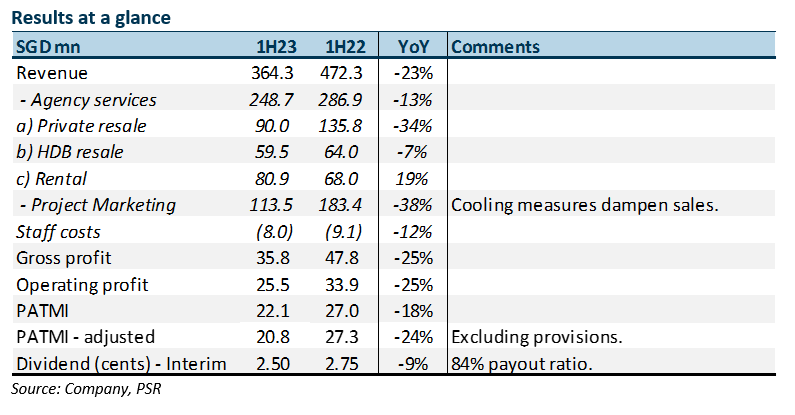

- 1H23 results were below expectations. Revenue and PATMI were 33%/30% of our FY23e forecast. Adjusted PATMI declined 24% YoY to S$20.8mn. Cooling measures and a dearth of new launches pushed revenue lower.

- We expect the pick-up in new launches and market share to drive a stronger performance in 2H23. We expect 8,100 units to be launched in 2H23 compared with 1H23’s 3,400. Market share from the recent launches has been around 43%.

- We lower our FY23e earnings by 9% to S$62.1mn and reduce the DCF target price to S$1.16 (prev. S$1.20). Our recommendation is downgraded from BUY to ACCUMULATE. The dividend yield is attractive at 6.3%, well supported by FCF and S$140mn net cash on balance sheet. We expected a rebound in 2H23 as it will benefit from larger number of new launches and market share gains. Meanwhile, private resale support will come from its large price discounts compared to new launches and surge in completions. HDB resale will be resilient from attractive grants and more units reaching their minimum occupancy period.

The Positive

+ Returning the surge in cash-flow. The highly cash generative model was evident despite the weakness in earnings. FCF generated in 1H23 improved to S$30.0mn (1H22: S$23mn). Capital expenditure remained minimal at S$0.5mn. The net cash was generally stable at S$139.6mn (1H22: S$133.9mn). PropNex announced an interim dividend of 2.5 cents by raising the payout ratio from 75% to 84%. Our forecast dividends of 6.5 cents or S$48mn is well sustained by FCF and strong net cash balance sheet.

The Negative

- Weakness in revenue. Revenue contraction has been larger than expected. Weakness was especially in private new launches and resale. Lack of new launches over the six months 4Q22 till 1Q23 and softness in sentiment post cooling measures drove volumes down.

PropNex Ltd – Coping well in a softer year

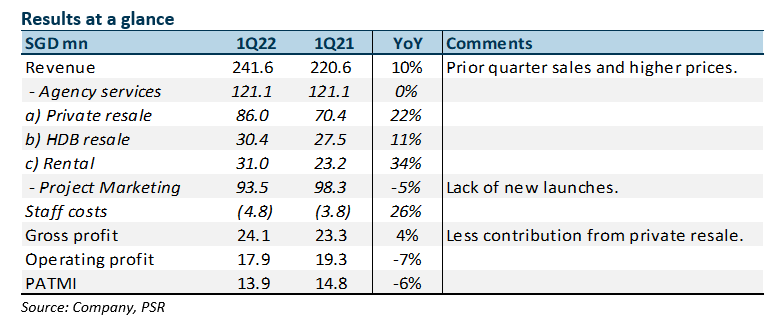

- 1Q22 PATMI and revenue were within expectations at 32%/32% of our FY22e forecast. We expect a deeper decline in earnings in the following quarters.

- Private residential resale and new launch volume declined around 30% YoY in 1Q22. PropNex’s 1Q22 results were supported by higher selling prices and recognition of prior quarter transactions.

- We expect a 28% YoY decline in earnings for FY22e. Transaction volumes are expected to remain weak in 2022 after the 16 December cooling measures. The recent ruling to impose ABSD on residential property transfers to a living trust is expected to impact less than 5% of property transactions. Our FY22e PATMI and target price of S$1.74 are maintained. We keep our NEUTRAL recommendation. Dividends remain attractive at 5% for FY22e well supported by net cash of S$162mn as at March 2022.

The Positive

+ Strong operating cash-flows. 1Q22 generated free cash flow of S$22mn (1Q21: 13mn). The strength of PropNex’s asset light cash generative business model was again on display.

The Negative

- Sluggish new launch revenue. There were only 172 units launched in 1Q22. The unsold inventory of developers is at decade lows of 14,087 units. An expected 6046 residential units are expected to be launched in 2022.

Outlook

No change in PropNex transaction volume expectations in 2022. Private resale volumes are expected to decline by 20-25% to 15-16k. New home sales volume to fall 20-30% to 9k-10k. HDB resale to decline around 5-10%. PropNex’s revenue should be better due to market share gains, higher transacted prices and maiden en-bloc revenues. The opening of borders has also seen a higher presence of foreign buyers in the residential market. Market share gains will be driven by the continued expansion of the agency force which increased by around 1900 over the past year to 11,268 salespersons.

Maintain NEUTRAL with an unchanged TP of S$1.74

We keep our FY22e PATMI unchanged.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report