Netflix Inc. – Content, ads, and scale drive the next leg of growth

- Both 4Q25 revenue and PATMI were in line with expectations, exceeding the company’s own guidance for both 4Q25 and FY25. FY25 revenue/PATMI was at 100%/99% of our FY25e estimates.

- Revenue rose + 17% YoY, driven by membership growth (+8% YoY), raised prices, improving plan mix pricing adjustments, as well as the scaling of ad revenue (2.5x YoY). Management has projected 15% YoY growth for 1Q26.

- Upgrade to ACCUMULATE from SELL with a higher target price of US$100 (prev. US$95) as we roll over our valuations to FY26e. There is no change to our FY26e forecast, terminal growth, or WACC assumptions. NFLX continues to demonstrate clear leadership in the VOD space and strong pricing power. Volatility is expected due to the Warner Bros. deal, but we believe NFLX is well-positioned structurally and financially for long-term growth.

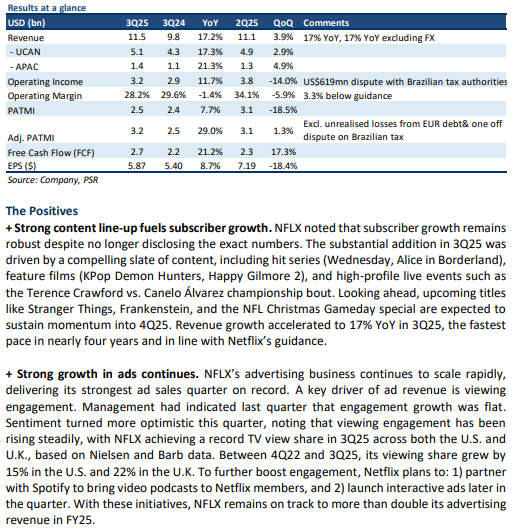

Netflix Inc.-Margin pressure raises concern

• 3Q25 revenue was in line with expectations, while PATMI missed on US$619mn dispute with Brazilian tax authorities. Excluding this effect, 9M25 revenue/PATMI was at 73%/83%, in line with our FY25e estimates.

• Membership growth, pricing adjustments, and increased ad revenue drove revenue growth of 17% YoY. Management has projected 17% YoY growth for 4Q25.

• Our valuation remains unchanged with a DCF target price of US$950. No change in our FY25e forecast. We maintain our SELL recommendation. Our terminal growth and WACC assumptions remain unchanged. NFLX continues to demonstrate clear leadership in the VOD space and strong pricing power. However, we maintain a cautious view given its elevated valuation and ongoing margin pressures.

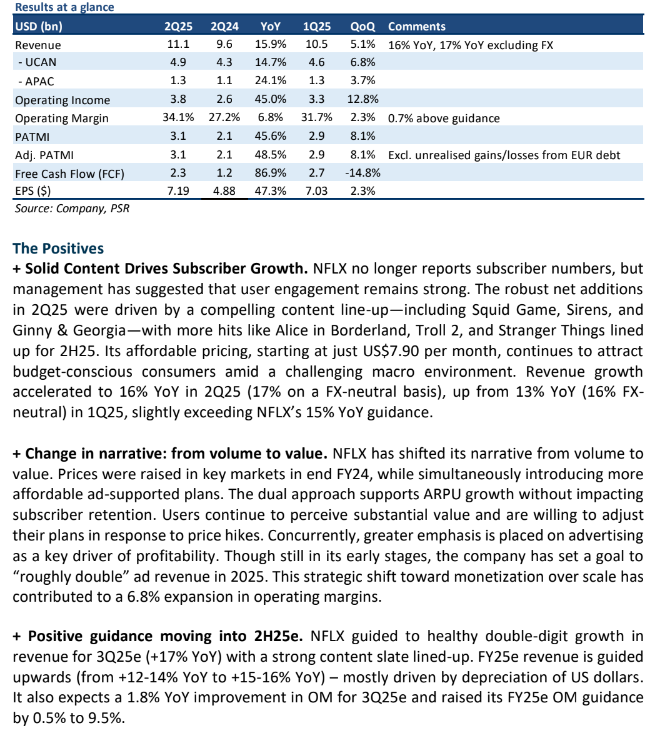

Netflix Inc.- Tough to surpass high expectations

- 2Q25 revenue/PATMI met our estimates. 1H25 revenue/PATMI was at 48%/54% of our FY25e forecasts.

- Revenue growth of 17% YoY was driven by higher subscription revenue (due to a strong content slate and flexible pricing of subscription plans). Management has projected 17% YoY growth for 3Q25. FY25e revenue growth is advised upwards but mainly due to US dollar depreciation.

- Our valuation remains unchanged with a DCF target price of US$950. No change in our FY25e forecast. We downgrade our recommendation from NEUTRAL to SELL, due to the recent share price rally. Our terminal growth and WACC assumptions remain unchanged. NFLX showcases leadership within the VODS and strong pricing power. We remain cautious given the stretched valuation.

Netflix Inc.- Ability to withstand recession

- 1Q25 revenue met our estimates while PATMI outperformed due to better monetization and favourable timing of expenses. 1Q25 revenue/PATMI was at 24%/26% of our FY25e forecasts.

- Revenue growth of 13% YoY was driven by higher subscription and recent price adjustment (+16% for standard plans & +14% for ad plans). This growth is partially attributed to NFLX's continued focus on its ad-supported business. Management has projected strong growth for 2Q25, anticipating minimal impact from the broader economic slowdown.

- We raise our FY25e revenue/PATMI by 1% each to account for gradual price increases, thriving ads business, and increasing operating leverage. We raised terminal growth from 3.0% to 3.5% due to its long-term monetization potential through advertising. We raise our DCF target price to US$950 (prev. US$870), and upgrade from REDUCE to NEUTRAL. Our WACC assumptions remain unchanged. A strong content pipeline and the expansion of its ad-supported tier position will enable NFLX to navigate potential economic slowdowns. However, trading at 37x FY25e P/E—well above the industry average of 17x—NFLX’s current valuation suggests limited near-term upside.

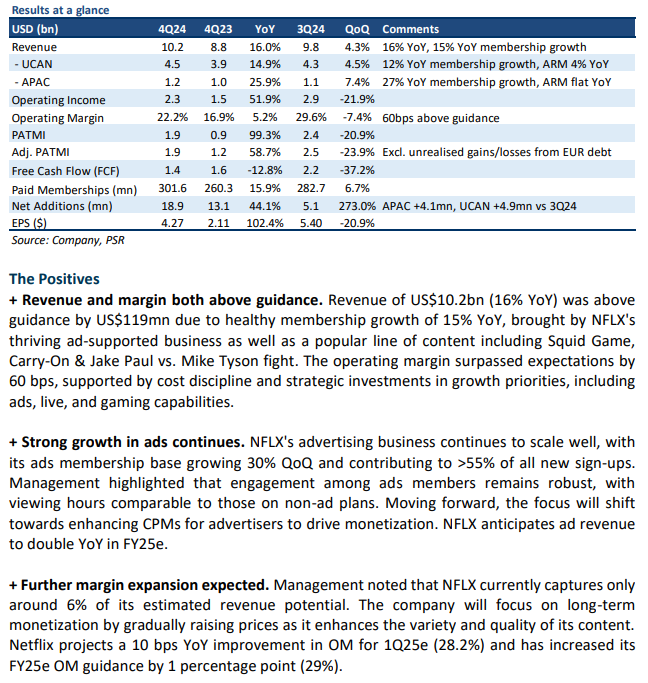

Netflix Inc. – Stretched valuations

- 4Q24 revenue/PATMI were in line with our estimates. FY24 revenue/PATMI was at 101%/101% of our FY24e forecasts.

- Revenue growth of 16% YoY was driven by a 19mn new membership additions (+15% YoY), the largest quarterly increase in company history (followed by 13mn in 4Q23 & 5mn in 3Q24). This growth is partially attributed to NFLX's thriving ad-supported business (30% QoQ vs 35% QoQ in 3Q24). NFLX raised prices by 16% for standard plans and 14% for ad plans.

- We raise our FY25e revenue by 4% due to robust membership additions and thriving ads business. We raise PATMI by 6% to account for the higher margins due to increasing operating leverage, cost discipline, and continued gradual price increases. We raise our DCF target price to US$870 (prev. US$695), but downgrade to REDUCE from NEUTRAL to account for recent share price strength. Our WACC/growth rate assumptions remain unchanged. NFLX continues to solidify its dominance in the VoD streaming market, expanding its user base while increasing average revenue per member (ARM) through a combination of premium content and strategic pricing.

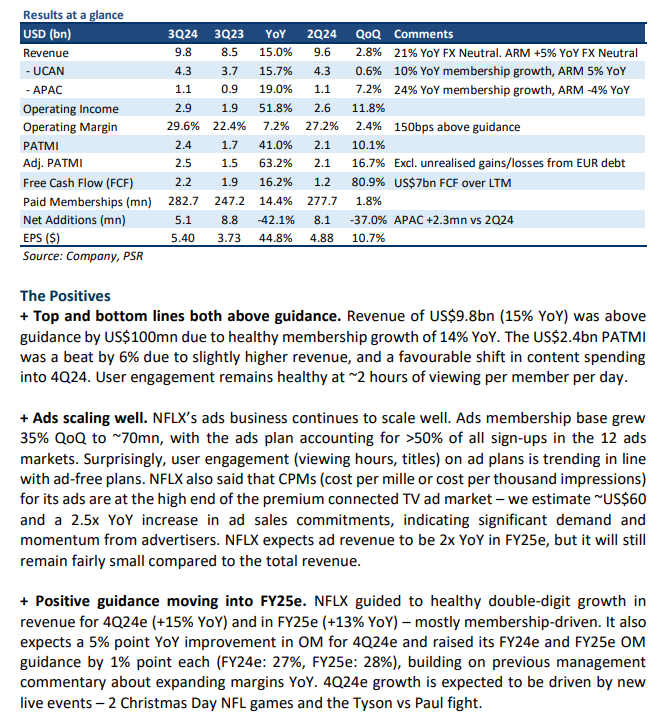

Netflix Inc – Solid results, but valuations look full

- 3Q24 revenue was slightly above our estimates, while PATMI was higher due to better topline growth and favourable timing of content spend. 9M24 revenue/PATMI was at 74%/84% of our FY24e forecasts.

- Revenue continues to grow in healthy double-digits YoY, while 41% PATMI growth beat estimates by 6% on higher revenue and better operating leverage.

- We raise our FY24e PATMI by 6% on higher margins due to price increases, increasing operating leverage, and cost discipline. We raise our DCF target price to US$695 (prev. US$675), but downgrade to NEUTRAL from ACCUMULATE to account for recent share price strength. Our FY24e revenue and WACC/growth rate assumptions remain unchanged. NFLX is still building on its leadership position in the VoD streaming industry, growing both users and ARM through quality content and effective pricing. Its ARM is ~2x more than its nearest competitor, Disney.

Netflix Inc. – All according to plan

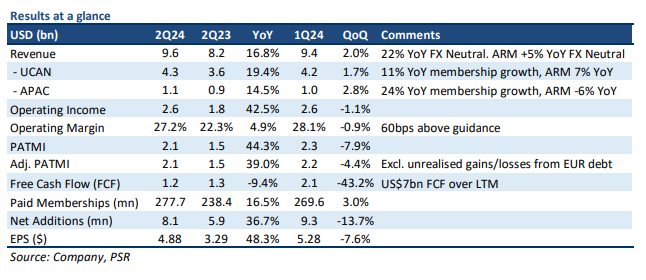

- 2Q24 revenue aligned with our estimates, while PATMI was above due to higher operating leverage. 1H24 revenue/PATMI was at 49%/59% of our FY24e forecast.

- Better-than-expected 8.1mn net additions (or +37% YoY) continue to support growth, partly due to NFLX’s thriving ads business (ad tier 34% QoQ). Revenue growth accelerated to 17% YoY.

- We raise our FY24e PATMI by 6% on higher margins due to better-than-expected membership growth, increasing operating leverage, and cost discipline. We maintain ACCUMULATE with a raised DCF target price of US$675 (prev. US$640). Our FY24e revenue assumptions remain unchanged. We continue to expect NFLX to drive user growth through its wide range of affordable subscription plans. We believe ARM growth will begin to accelerate due to increasing advertising revenue because of its growing scale. Our WACC/growth rate assumptions remain the same at 12.2%/3%, respectively.

The Positives

+ Better-than-expected net additions are driving an acceleration in revenue growth. NFLX added 8.1mn net membership additions, driven by beats in all markets (particularly in India). The net additions outperformance was attributed to 1) a strong content slate, 2) some positive impact from paid sharing, and 3) a lower price point appealing to more cost-conscious consumers. Revenue growth in 2Q24 accelerated to 17% YoY (22% FX neutral) vs 15% YoY (18% FX neutral) in 1Q24, modestly above NFLX’s guidance of 16% YoY.

+ Ads business continues to scale meaningfully. NFLX continues to scale its ads business rapidly, increasing its ad tier membership base 34% QoQ to ~52mn (~19% of NFLX’s total membership) in 2Q24. Ad tiers now account for >45% of all new signups in markets where NFLX has rolled out its Ad tiers. NFLX continues to also grow its Ad inventory to support the business. It still does not expect advertising to be a primary driver of revenue for FY24e or FY25e due to 1) near-term challenges in monetisation – NFLX lacks adequate features for advertisers, and 2) an outsized proportion of existing subscription revenue. We view advertising as the next big margin driver for NFLX (behind price increases).

+ Positive forward guidance for FY24e. Given the better-than-expected membership additions so far this year, NFLX again revised upwards its FY24e targets for revenue growth (13%-15% to 14%-15%) and operating margin (from 25% to 26%). Its 26% OM target would be a YoY improvement of 540bps, indicating significant operating leverage due to its larger scale and cost discipline. NFLX expects consistent YoY margin expansion moving forward. We increase our FY24e operating income and PATMI estimates by 6% each as a result.

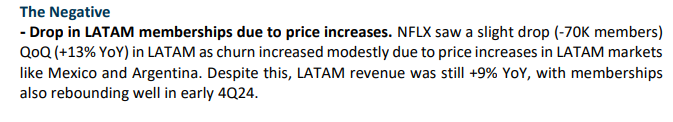

The Negative

- Nil

Netflix Inc. – Pricing power on display

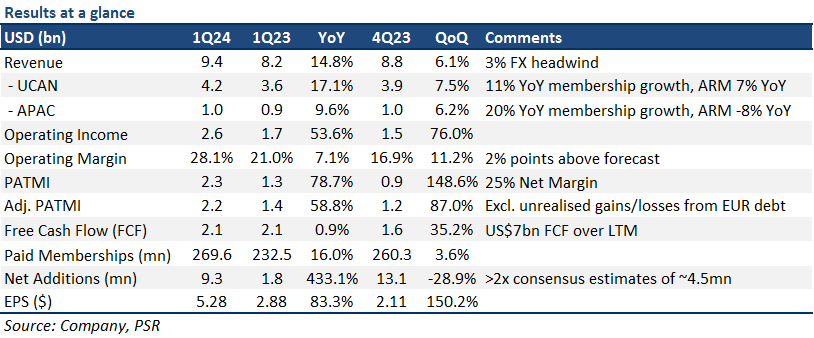

- 1Q24 revenue was in line with our estimates, while PATMI was above due to higher operating leverage. 1Q24 revenue/PATMI was at 25%/33% of our FY24e forecast.

- 1Q24 net additions of 9.3mn were driven by 11%/19% YoY growth in the US/EU, demonstrating NFLX’s ability to raise prices and volume simultaneously. FY24e OM was revised up to 25% (from 24%), with commentary indicating a focus on growing margins.

- We raised our FY24e PATMI by 9% on higher margins due to better-than-expected membership growth and a faster-growing ads business. We maintain ACCUMULATE with a raised DCF target price of US$640 (prev. US$570). NFLX remains our top choice for streaming entertainment given its pricing power, scale, growing membership base, huge advertising opportunity and strong cash flows compared to its peers. Our WACC/growth rate assumptions remain the same at 12.2%/3%, respectively.

The Positives

+ Better-than-expected membership additions despite price hikes. NFLX outperformed consensus expectations with 9.3mn net additions in 1Q24, driven by an 11%/19% YoY growth in its US/EU membership base – reaffirming our investment thesis of its undoubted ability to grow both volume and prices (NFLX increased prices in its US/EU markets mid-4Q23). As a result, revenue growth accelerated to 15% YoY (18% YoY FX neutral). We expect net additions for FY24e to remain fairly resilient (~24mn) due to: 1) continued momentum in Paid Sharing (converting password borrowers) and 2) higher take-up of its lower-priced ads plan. NFLX also translated its subscriber outperformance into a 79% YoY increase in PATMI, showcasing an increase in operating leverage – it beat consensus estimates on its bottom line by ~25%.

+ Rapid scaling of its ads business. NFLX continues to scale its ads business rapidly, growing its ad tier membership base 65% QoQ to ~40mn members (~14% of NFLX’s total membership) in 1Q24. Ad inventory has increased, while engagement and CPMs still remain strong. Its ads business is currently under-monetised due to existing supply-demand dynamics, although we expect this to ease as more advertisers come on board – NFLX’s ads business started in 4Q22.

+ Positive FY24e guidance indicating further margin expansion. NFLX revised its FY24e operating margin target to 25% (prev. 24%), which would be a 4% point increase vs FY23. NFLX’s commentary surrounding margins also suggests that the capital-intensive portion of building out its business is behind them, with a clear focus on margin expansion ahead. We expect the company to manage this by pulling on its three main levers: 1) organic membership growth through more engaging content, 2) increasing pricing, and 3) driving higher margin advertising revenue while maintaining current cash content spend levels.

The Negative

- Nil.

Netflix Inc. – Subscribers and margins re-accelerating

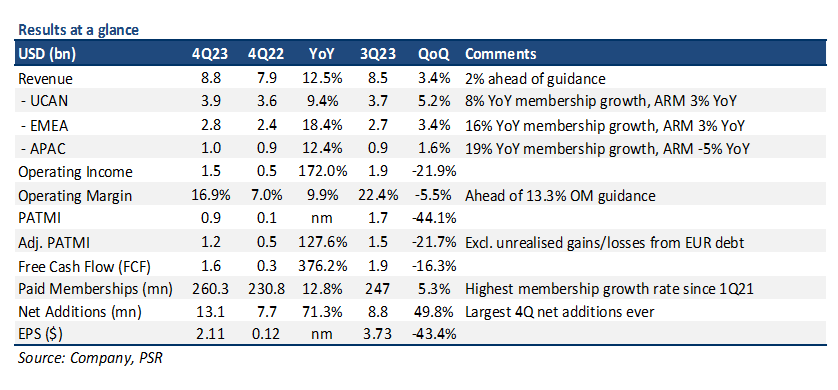

- 4Q23 results were in line with our estimates. FY23 revenue/PATMI were at 98%/100% of our FY23e forecast. Paid memberships grew 13% YoY - its highest growth rate in 3 years, with 13.1mn net paid additions the largest 4Q ever.

- Growth drivers for FY24e are: 1) lower-priced ad-tier supporting 8% YoY subscriber growth; 2) ~20% price increase in developed markets. NFLX also raised FY24e operating margin guidance to 24% vs 20.6% in FY23, and expect steady margin expansion from ads.

- We raise our FY24e PATMI by 6% on higher margins due to price increases and scaling of its ads business, while also forecasting 13%/18% YoY FY25e revenue/PATMI growth. We maintain ACCUMULATE with a raised DCF target price of US$570.00 (prev. US$455.00). NFLX remains our top choice for streaming entertainment given its pricing power, growing membership base, and huge advertising opportunity. Our WACC/growth rate assumptions remain the same at 12.2%/3%, respectively.

The Positives

+ Increasing subscriber momentum driving revenue growth. 4Q23 ended on a high, with 260mn paid memberships (13% YoY). Subscriber growth momentum increased for a 4th straight quarter. NFLX also added 13.1mn paid memberships (vs. 8.9mn est.) in the quarter, the most in 4Q. We believe the outperformance was driven by NFLX capturing price-sensitive consumers with its lower-priced ad-tier. Moving into FY24e, we expect revenue growth to be supported by: 1) membership growth of 8% YoY; and 2) 3% YoY ARM growth due to a combination of price increases and scaling of its advertising business.

+ Ads business scaling well; laying the ground work for future margin expansion. NFLX continues to scale its ads business well, with 70+% QoQ growth in the last 3 quarters. It has 23mn users on its ads tier, with 40% of new paid memberships opting for the cheaper subscription. Scaling its ads business is important because advertising revenue remains a long-term margin expansion opportunity for the company. However, we only expect advertising to contribute more meaningfully to revenue as it reaches scale in FY25e.

+ Raising margin expectations for FY24e and beyond. NFLX raised its FY24e operating margin guidance by ~150bps from a range of 22-23% to 24%, indicating a sharp ~340bps increase vs 20.6% in FY23. This expectation reflects: 1) FX tailwinds vs FY23; and 2) better-than-expected 4Q23 subscriber additions combined with price increases flowing into FY24e. Moving beyond FY24e, NFLX also expects to steadily improve margins YoY through a combination of price increases and advertising revenue growth.

ARM (Average Revenue Per Membership): Streaming revenue divided by average number of streaming paid memberships during a given period.

The Negative

- Nil.

Netflix Inc. – Gaining subscriber momentum

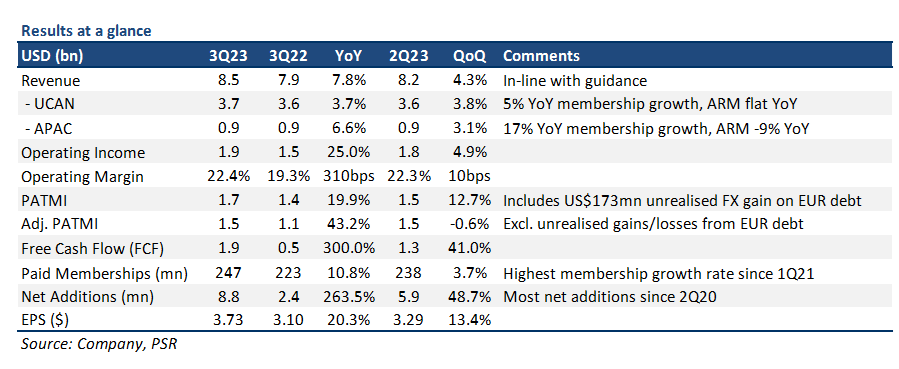

- 3Q23 results were in line with our estimates. 9M23 revenue/PATMI at 72%/82% of our FY23e forecasts. Paid memberships grew 11% YoY, its highest growth rate since 1Q21.

- 8mn net additions were the most in 3 years for a quarter, mainly due to the conversion of password borrowers. NFLX ended 3Q23 with 247mn paid memberships.

- Guided acceleration in revenue growth of 11% YoY for 4Q23e on the back of continued success of its Paid Sharing program, and price increases in its US/UK/FR markets.

- We nudge our FY24e EBITDA by 3% on higher content amortization, and upgrade to an ACCUMULATE recommendation from NEUTRAL with a raised DCF target price of US$455.00 (prev. US$446.00). NFLX remains our top choice for streaming entertainment given its pricing power, growing membership base and quality content. Our WACC/growth rate assumptions remain the same at 12.2%/3% respectively.

The Positives

+ Most membership additions in a quarter since 2Q20. NFLX added 8.8mn new members to its platform, the most in a quarter since 2Q20, and the most for a 3Q in 6 years. A bulk of this was attributed to the success of NFLX’s Paid Sharing program as it converts password borrowers into paying members. There is also an expectation for incremental membership additions from Paid Sharing to continue into the next few quarters, alleviating concerns on near-term growth. NFLX ended the quarter with 247mn paid memberships (11% YoY growth).

+ Guiding acceleration in revenue growth for 4Q23e; margins to also expand moving into FY24e. NFLX issued very encouraging guidance for 4Q23e, with revenue growth accelerating to 11% YoY on the back of growing paid memberships and increasing monetisation. Additionally, the company expects FY23e operating margin to be at the top end of their 18%-20% range, with further margin expansion into FY24e by another 200bps. FY23e Free Cash Flow (FCF) was also increased by US$1.5bn to US$6.5bn – supported by healthier cash flow generation and ~US$1bn in lower content spend due to writer/actor strikes.

+ Price hikes in developed markets continue to show pricing power. NFLX announced that it would be raising prices for some of its subscription plans in the US/UK/FR. In the US, its basic plan will see a price increase of US$2 to US$11.99, while its premium plan will be costlier by US$3 at US$22.99. With the price adjustments, churn rates are still expected to be relatively low – in-line with similar adjustments in the past, and should immediately benefit the company’s bottom-line. This is the first price hike for NFLX in >18 months.

The Negative

- Nil.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report