NetLink NBN Trust – More leverage needed

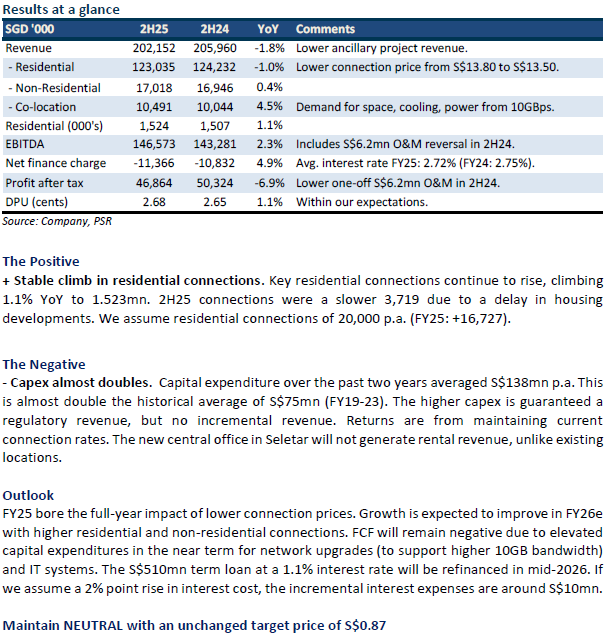

- 2H25 results were within expectations. Both revenue and EBITDA were 99% of our FY25e forecast. FY25 DPU of 5.36 cents, up 1% YoY, met our expectations.

- The ramp in capital expenditure has required NetLink to tap more on borrowings to fund distributions in the near term. An additional S$91mn of borrowings was drawn to distribute the FY25 S$208mn payout.

- We maintain our FY26e forecast. Our target price of S$0.87 and NEUTRAL recommendation is maintained. Operations were stable except for non-residential connections. Consolidation is leading to a loss of customer share. Capital expenditure remains elevated in FY26e with the upgrade of the network and IT systems. Higher capital expenditure is positive in the medium term with guaranteed returns under the regulatory framework. Refinancing of the S$510mn middle next year could raise interest expenses by S$10mn. Current yield is 5.9%.

NetLink NBN Trust – Resilient cash flows

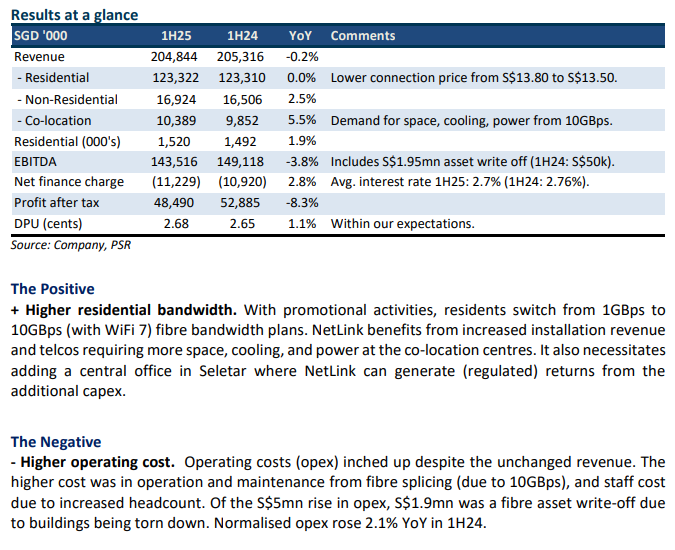

- 1H25 results were within expectations. 1H25 revenue and EBITDA were 49%/48% of our FY25e forecast, respectively. 1H25 DPU increased 1.1% YoY to 2.68 cents (1H24: 2.65 cents).

- 1H25 revenue was flat despite higher residential connections due to lower connection charges (effective Apr 24) and a decline in project revenue. EBITDA declined due to higher staff costs, operation and maintenance expenses, and equipment write-offs.

- 1H25 DPU is still dependent on S$45mn borrowing to sustain dividends. This is due to the jump in capex for the new Seletar central office. When capex normalises from the current S$130mn to S$70mn, we expect a free cash flow of S$210mn to sustain DPU without utilising debt. We lower our FY25e EBITDA by 4% due to higher operating expenses and 2% weaker revenue. Our target price of S$0.87 and NEUTRAL rating are unchanged. We expect distribution to be stable despite lower residential prices as connections continue to grow, supported by household formations and demand for higher fibre bandwidth.

NetLink NBN Trust – Higher rates start to bite

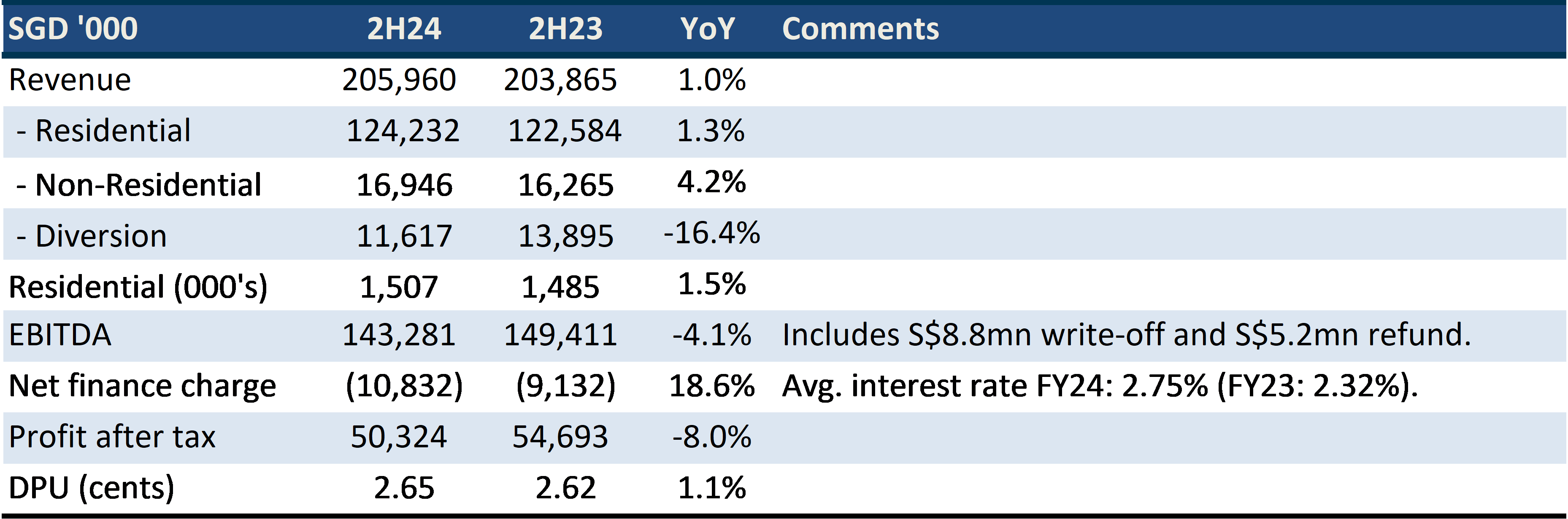

- 2H24 results were within expectations. FY24 revenue and EBITDA were 98%/97% of our FY24e forecast, respectively. Final DPU increased 1.1% YoY to 2.65 cents (FY24: 5.3 cents).

- 2H24 revenue was negatively impacted by a 16% decline in diversion revenue. EBITDA was weaker due to the S$8.8mn decommissioned asset write-off offset by a power charge refund of S$5.5mn. Residential connections recovered in 2H24 to annualised 21,726 (FY23: 21,054).

- FY25e cash-flows will be negatively impacted by the lower residential connection charges (from S$13.80 to S$13.50), elevated capex for a new central office, and higher interest rates. Our target price of S$0.87 and NEUTRAL rating are unchanged. The current distribution is sustainable, with the ability to tap on additional borrowings. Interest rate pressure on cash flow will persist, especially in FY26, when interest rate hedges on a substantial portion of the debt are unwound.

Results at a glance

The Positive

+ Rebound in residential connection. 2H24 net adds recovered 15,334 connections after the weak 1H24 of 6,392. Connection in FY24 was 21,726 and within our expectations of 22,000 per year or household formations per year. Connections are volatile on a quarterly basis due to the timing in the availability of sites.

The Negative

- Finance cost rose 19% YoY. Higher effective interest rate of 2.75% push interest expenses up by 19% to S$10.8mn. Netlink has raised its hedged debt to 78% in FY24 (FY23: 69%). We believe this resulted in some hedging gains, especially in 3Q24. With the elevated capex for the new central office in Seletar, interest expenses will remain a drag on DPU.

NetLink NBN Trust – Stable as usual

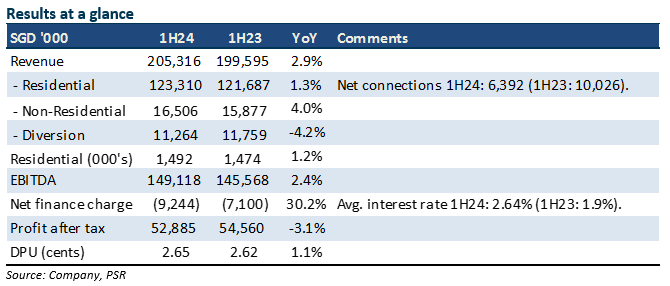

- 1H24 results were within expectations. Revenue and EBITDA were 49%/50% of our FY24e forecast, respectively. DPU increased 1.1% YoY to 2.65 cents.

- 1H24 EBITDA grew 2.4% YoY to S$149mn, in line with the revenue growth of 2.9%. Residential connections during the quarter were 4,023, below our trendline growth of 5,500 per quarter.

- We maintain our FY24e forecast and DCF target price of S$0.87. Our NEUTRAL rating is unchanged. The regulatory review of fibre rates is likely to be announced by this year. We believe the current distribution is sustainable. The repricing of the S$510mn interest rate hedges in 2026 will place some downward pressure on distributions.

The Positive

+ Higher distribution. Interim distribution rose 1.1% YoY 2.65 cents. This is modestly higher than our expectations of unchanged distribution for the year. NetLink is paying out S$103mn in distributions from free-cash flow of around S$80mn. The balance is topped up from cash held in reserves.

The Negatives

- Another weak quarter of residential connections. Residential connections increased by only 2,369 in 2Q24, the weakest in eight quarters. We believe delays or renovation periods before moving into the new homes drove the sluggishness.

- Finance cost rose 30% YoY. The unhedged portion of S$735mn gross debt continued to be a drag on cash-flows. Net finance cost rose 30% to S$9.2mn. Assuming the current interest rate hedged loan of S$510mn is repriced upwards by 300 bps, the distribution could be negatively impacted by around 7.5%.

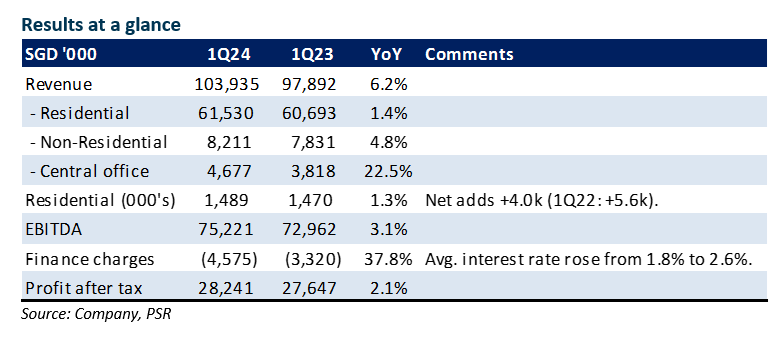

NetLink NBN Trust – Waiting for tariff review

- Results were within expectations. 1Q24 revenue and EBITDA were 25%/25% of our FY24e forecasts. Core residential fibre revenue was up 1.4% YoY to S$61.5mn.

- 1Q24 EBITDA was up 3% YoY to S$75mn excluding the 38% surge in interest expense to S$4.3mn. Residential connections during the quarter was 4,023, below our trendline growth of 5,500 per quarter.

- No change to our FY24e forecast and DCF target price of S$0.87. Our NEUTRAL rating is unchanged. The new fibre rates NetLink can charge its customers is expected to be announced soon. Our base case is that fibre rates will see a modest decline. The distribution yield is sustainable from stable operating cash-flows from 1.48mn subscribers and access to financing.

The Positive

+ Opportunity in higher broadband bandwidth. As 10GBps broadband speeds become more available over the next few years, there will be more demand from telcos at Netlink central offices. Demand is for larger space, more cooling and increased power supply in the central office. The timeline to roll out more 10GBps will ultimately depend on customer end demand and use cases.

The Negatives

- Slower than expected residential connections. Residential connections increased by 4,023 in 1Q24, the slowest in four quarters. The weakness is caused by delays or time taken to renovate and move into the vacant units.

- Continued rise in interest expenses. Although the borrowings at a fixed rate is stable at 69.4%, the effective average interest rate in 1Q24 rose by 0.8% points YoY to 2.6%, driving interest expense up.

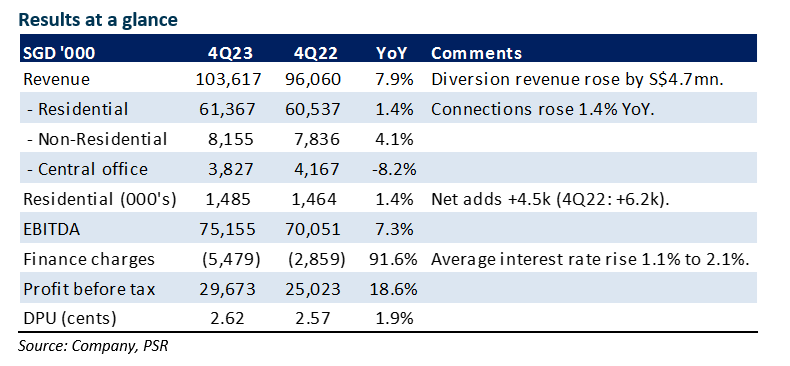

NetLink NBN Trust – Stable but higher rates start to nibble

- FY23 revenue and EBITDA were within expectations, at 101%/103% of our FY23e forecasts. A diversion revenue spike of 130% YoY in 4Q23 surpassed our expectations.

- Core residential revenue was stable at S$61.4mn, up 1.4% YoY. Interest expense almost doubled to S$5.4mn due to higher interest rates and capital expenditure.

- The new fibre rates NetLink can charge its customer is expected to be announced soon. Our base case is that fibre rates will be nudged marginally lower. Any impact on dividends is muted due to the ability to raise borrowings. Our FY24e EBITDA is raised by 2% and DCF target price nudged up to S$0.87 (prev. S$0.85). Our NEUTRAL recommendation is maintained. The distribution yield is sustainable from stable operating cash-flows and access to financing.

The Positive

+ Of the S$7.5mn improvement in revenue, $4.7mn is from diversion. Diversion revenue comes from removing old fibre ducts to new locations due to the construction of new highways, MRT network and property development projects. Increased construction activity will speed up the completion of new homes and will aid in residential fibre connections.

The Negative

- Extra capex and interest expenses jump. CAPEX rose 31% YoY to S$96.7mn. The extra spending is for a new Seletar Central Office (CO). CAPEX is expected to remain elevated this year. Capital commitments have almost tripled to S$138mn (FY22: S$52mn). The extra CAPEX required an increase in borrowing by around S$70mn, leading to higher interest expenses. As the country heads towards 10GBps broadband, more equipment will be required in the COs. To cater for the extra equipment, NetLink will need to expand power, cooling and space in the COs. The push toward Wifi 6e and 7, will be additional catalysts to drive up broadband demand.

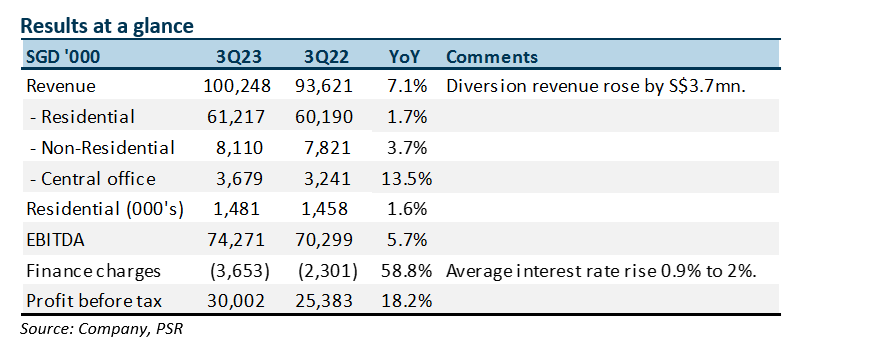

NetLink NBN Trust – Yield not attractive enough

- 9M23 revenue was within expectations but EBITDA exceeded, at 76%/80% of our FY23e forecasts. 3Q23 revenue was up 7% driven by a spike in diversion revenue to S$5.6mn.

- Completion of the regulatory review of fibre prices is expected to be completed by the March quarter. Points of discussion include WACC, allocation of cost by segments and how much of the recent spike in interest rates and inflation should be considered.

- Our base case is that fibre rates will be nudged marginally lower. Any impact on dividends is muted due to the ability to raise borrowings. Our FY23e EBITDA is raised by 5%, from higher diversion revenue and more stable staff and other operating expenses. Our NEUTRAL recommendation and DCF target price of S$0.85 is maintained. We find the dividend yield of 6% less attractive, especially with limited growth in dividends and headwinds from rising interest expense.

The Positive

+ Pick up in diversion. Bulk of the growth came from the almost tripling of diversion revenue to S$5.6mn. The rise is due to heavy infrastructure projects - from MRT to highways - to which demand for diversion has jumped. Pre-pandemic, diversion revenue was trending at similar levels of S$5.4mn per quarter. Other segments that enjoyed revenue growth were NBAP (+38^ YoY) and central office (+13.5% YoY).

The Negative

- Interest rates start to bite. Net finance charge jumped almost 59% to S$3.6mn in 3Q23. Of the S$690mn of gross debt, 73.9% or S$510mn is fully hedged til 2026. The balance is an unhedged S$180mn floating rate loan at SORA plus a margin. Effective average interest rates have risen from 1.1% to 2.0%.

Outlook

The pressure points from higher interest rates remain. High-interest rates (and increased CAPEX for a new central office) will cap the growth in operating cash flows and the attractiveness of the current 6% dividend yield.

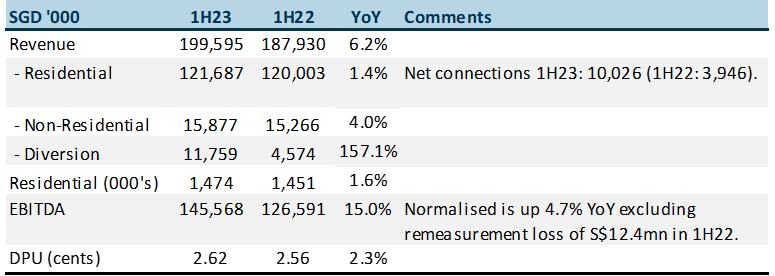

NetLink NBN Trust – Stable may not be enough

- 1H23 revenue and EBITDA were within expectations, at 52/53% of our FY23e forecasts. 1H23 DPU was 2.62 cents, an improvement of 2.3% YoY.

- Residential fibre connections increased by 10,026 in 1H23 (1H22: +3,946). The jump follows the resumption of new home construction as restrictions were lifted. New connections are normalising to 20,000-25,000 p.a. in household formations.

- We nudged up our FY23e EBITDA by 2% to account for the higher diversion revenue. Regulatory review of fibre prices is still ongoing with possible completion by the middle of next year. Our base case is the regulatory review will have minimal impact on cash available for distribution as dividends. Our NEUTRAL recommendation is maintained. The DCF target price is lowered to S$0.85 (prev. S$0.96) as we raised our risk-free rate assumption.

Results at a glance

Source: Company, PSR

The Positive

+ Rebound in diversion revenue. Diversion revenue picked up as construction activity returned especially for MRT and other infrastructure activity. Margin on diversion revenue is around 35% against the group EBITDA margin of 73%.

The Negative

- Higher interest expenses and rates. 1H23 finance cost jumped 42% to S$7.6mn. The effective interest rate has risen to 1.9% (1H22: 1.1%). Around 74% of the loans have been hedged at a fixed interest rate, namely the 5-year term loan of S$510mn was hedged at 1% till May 2026.

Outlook

Cash-flows will remain stable with residential connection revenue rising around 1 to 2% p.a. Regulatory review may lower fibre rates due to the expanded base of connections after the previous review. Nevertheless continued CAPEX and a high WACC could keep any price changes minimal.

Our NEUTRAL recommendation is maintained with an lower TP of S$0.85 (prev. S$0.96)

Limited growth in DPU will be a challenge in a rising interest rate environment. Investors will look towards a higher dividend yield as risk-free rates rise. NetLink dividend yield spread over 10-year risk free has averaged 3.5% historically. It is now narrowed to 2.4%.

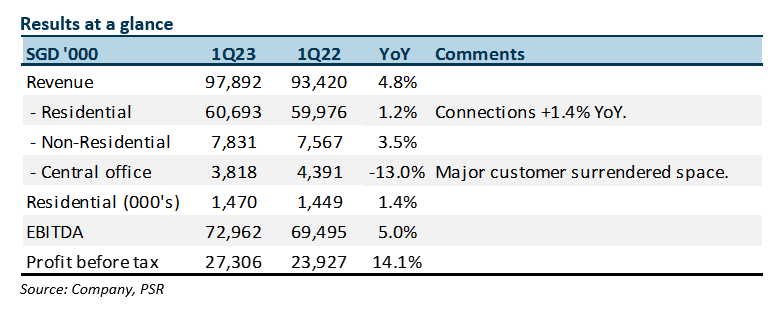

NetLink NBN Trust – Residential connections normalising

- 1Q23 revenue and EBITDA were within expectations, at 25/27% of our FY23e forecasts. Revenue rose 4.8%, supported by a sharp rebound in diversion revenue. Central office remains a drag as customers surrender more equipment space.

- Residential fibre connections rose 5,598 in 1Q23 (1Q22: +2,292). Last year was impacted by lockdowns and movement restrictions.

- Interest rate risk is well hedged, with 76% of the debt fixed at 1% until May 2026. Regulatory review of fibre prices is ongoing. Recent inflationary pressures and higher interest rates are positives. The planned capital expenditure (or regulated asset base) and WACC under consideration will be higher. No change to FY23e forecast. Our NEUTRAL recommendation and DCF target price of S$0.96 is maintained.

The Positive

+ Rebound in construction and installation activity. Residential connections are normalising post-pandemic. In the past two quarters, net connections were 11,842, triple the 3,946 a year ago. The rebound in construction and installation post-pandemic increased diversion revenue by S$1.8mn or 136% YoY. Customers in diversion include HDB and LTA.

The Negative

- Central office revenue sliding. Major customer Singtel is renting less space as less telecommunication equipment is housed in Netlink’s seven central offices. Netlink will look to alternate users for their central office space.

Outlook

On the regulatory review, we expect a mild decline in the fibre price for residential connections. It is unlikely to impact dividend payout. Higher borrowings or lower capital expenditure can tide through any near-term shortfall, in our opinion.

Our NEUTRAL recommendation is maintained with an unchanged TP of S$0.96

The modest growth in DPU reduces the attractiveness of NetLink as an income-yielding investment. NetLink’s dividend spread over bond yields and other interest-yielding assets has not widened since interest rates started to climb this year.

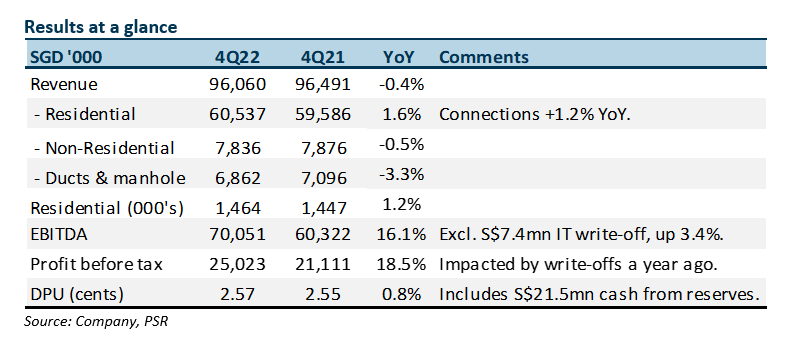

NetLink NBN Trust – Stable dividends but limited growth

- FY21 revenue and EBITDA were within expectations, at 101/103% of our FY22e forecasts. 4Q22 revenue was flat and EBITDA up 3% YoY excluding write-offs. 2H22 DPU improved a modest 0.8% YoY to 2.57 cents.

- Residential fibre connections increased by 6,244 during the quarter. The annualised run-rate of residential connections is around our modelled 25,000 connections per annum.

- A regulatory review of fibre prices is underway. New fibre prices are to be implemented on 1 January 2023. Compared with five years ago, the regulated asset base is higher. However, the number of residential connections is one-third higher. Our forecast assumes no change in tariffs. We have kept our FY23e forecast intact. Our NEUTRAL recommendation and DCF target price of S$0.96 is maintained.

The Positive

+ Recovery in residential connections. During the pandemic, residential connections were around 15k in 2021. We have seen a significant recovery in connections, back to an annualised run-rate of 25k-26k. The lifting of COVID-19 restrictions is improving the construction of new residential homes.

The Negatives

- Ducts and manholes see multi-quarter decline. The weakest revenue segment has been the 3% reduction in duct and manhole revenues. Major customer Singtel will see less use of the ducts for their copper lines.

Outlook

The upcoming regulatory review will determine the residential tariffs for the next five years. Factors considered will be WACC, size of the regulated asset base, future capital expenditure and the number of connections. Our model assumes no change in tariff. Nevertheless, lower tariffs may impact cash available for distribution. However, there are other levers to maintain near-term dividends such as higher borrowings or lower capital expenditure.

We maintain our NEUTRAL recommendation with an unchanged TP of S$0.96

We expect distribution per unit to be stable. The continuous rise in interest can taper the attractiveness of the distribution as earnings growth will be limited.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report