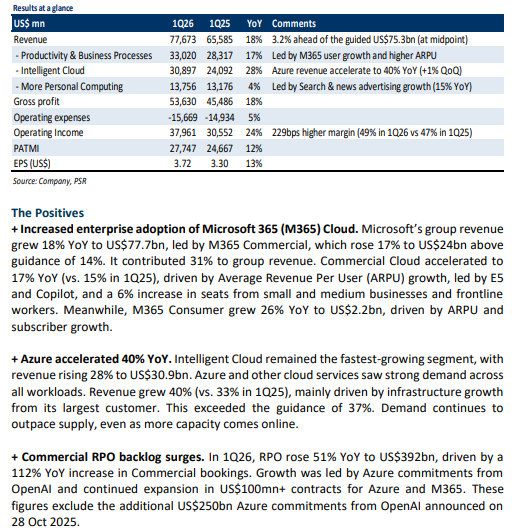

Microsoft Corp – US$35bn CAPEX exceeds expectations

- 1Q26 revenue/PATMI met our expectations at 24%/26% of our FY26e forecasts. Total revenue grew 18% YoY, driven by cloud services, with Azure revenue up 40% YoY.

- The Microsoft–OpenAI new agreement reinforces Microsoft’s Cloud and AI leadership, supported by IP rights through 2032 and a US$250bn Azure commitment. RPO backlog surged 51% YoY to US$392bn, fuelled by 112% YoY growth in Commercial bookings.

- We maintain ACCUMULATE recommendation at a lower target price of US$540 (from US$550). For FY26e, we raised PPE purchases paid in cash from US$80bn to US$83bn following CAPEX exceeding expectations. Net income remains slightly lower due to elevated OPEX from higher CAPEX, but is partially offset by higher M365 margins and workforce reductions.

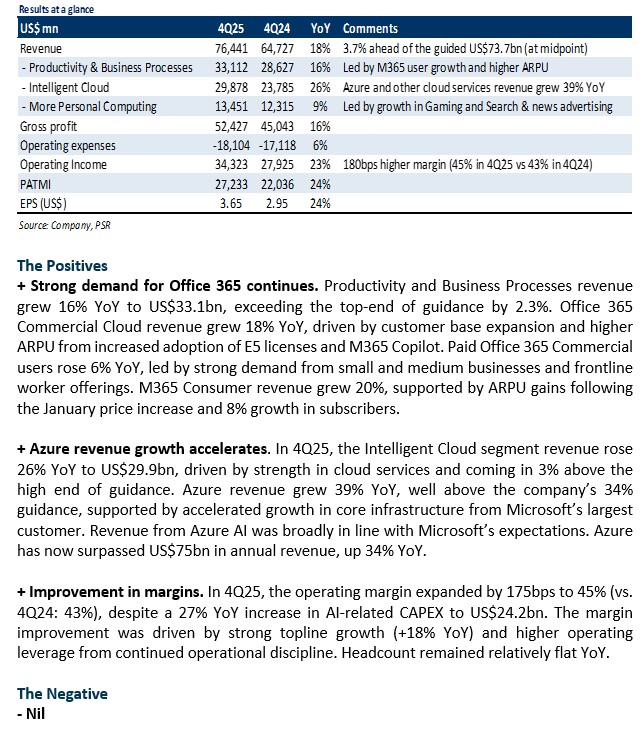

Microsoft Corp – Cloud services accelerate

• FY25 revenue and PATMI met our expectations at 101% of our forecasts. 4Q25 revenue

rose 18% YoY, driven by strength in the Cloud services business (Azure +39% YoY).

PATMI increased by 24% YoY to US$27.2bn due to higher operating leverage.

• For 1Q26e, Microsoft expects revenue to grow by 15% YoY to US$75.3bn, fuelled by a

37% YoY rise in Azure revenue and a 13% YoY increase in Office 365 commercial cloud

revenue. Microsoft's 1Q26e implied operating margin is ~46.6%, flat YoY despite

increased CAPEX for AI capacity expansion.

• We maintain our ACCUMULATE recommendation and raise our DCF-based target price

to US$550 (from US$480), reflecting a higher terminal growth rate of 4.7% (previously

4.5%) and WACC of 7.2%. We have rolled over to a new year. Microsoft continues to

anticipate higher earnings from Azure (+37% YoY), despite facing supply constraints.

However, we see upside potential given the backlog of US$368bn (1.3x FY25 revenue).

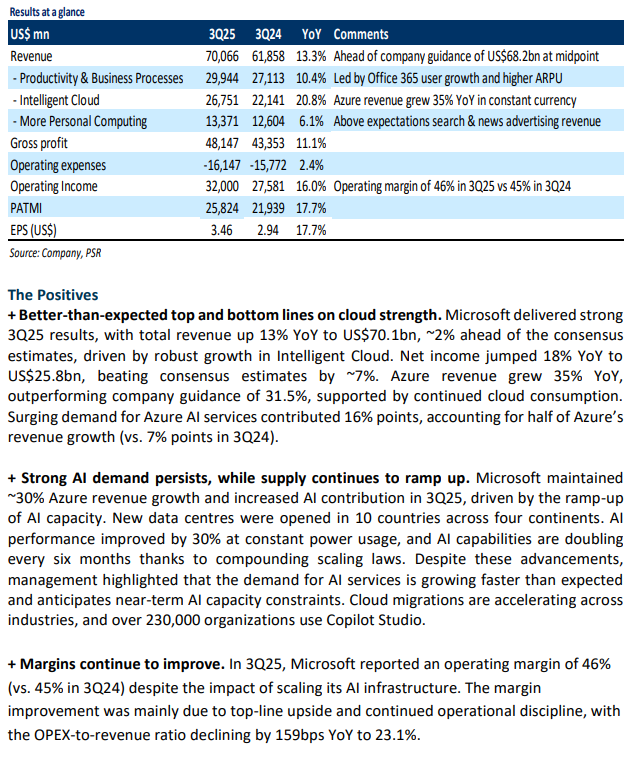

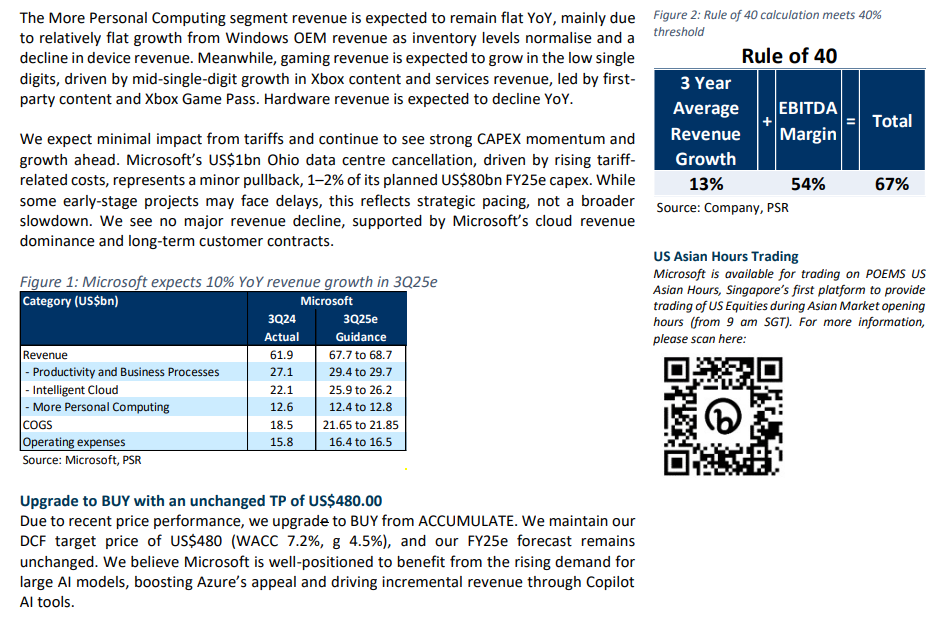

Microsoft Corp – Strong earnings despite uncertainty

- 3Q25 revenue/PATMI met our expectations at 74%/74% of our FY25e forecasts. Total revenue grew 13% YoY, driven by strong demand for Azure and cloud services.

- For 4Q25e, Microsoft expects total revenue to grow by 14% YoY to US$73.7bn, driven by 34.5% YoY rise in Azure revenue and 14% YoY increase in Office 365 commercial cloud revenue.

- We downgrade to ACCUMULATE from BUY due to recent price performance. Our DCF target price of US$480 (WACC 7.2%, g 4.5%) and FY25e estimates remain unchanged. We believe Microsoft is well-positioned to benefit from the rising demand for large AI models, boosting Azure’s appeal and driving incremental revenue through Copilot AI tools. Microsoft remains less impacted by tariffs, as its strong growth is driven by cloud-based offerings and supported by a broad base of enterprise customers.

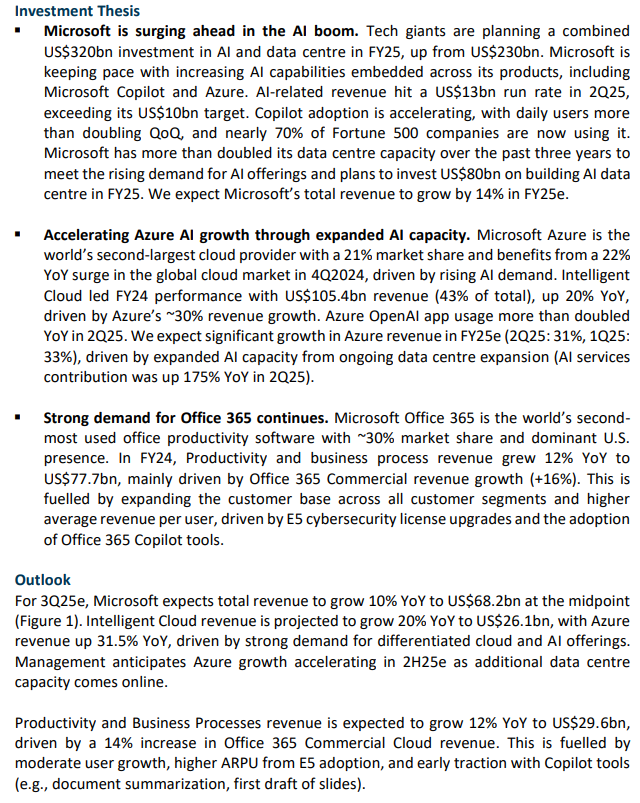

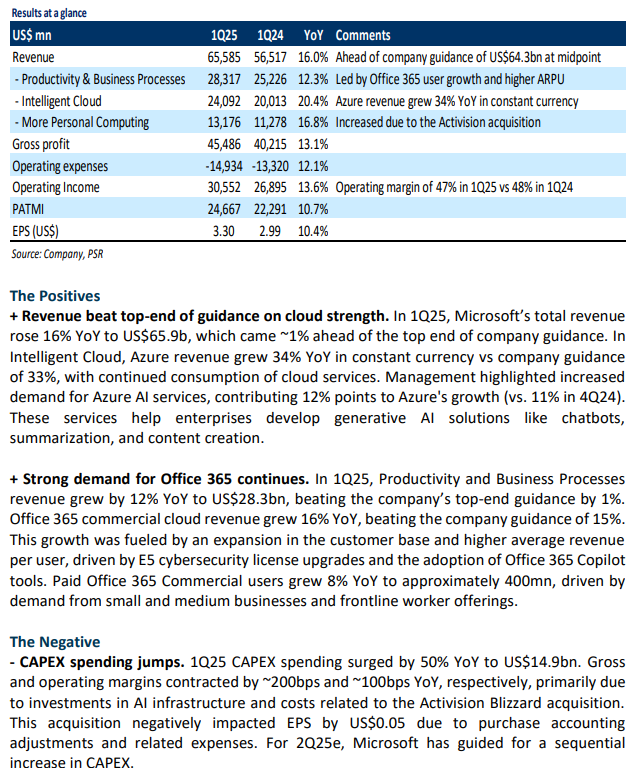

Microsoft Corp – Cloud and AI-powered growth

-

Microsoft’s Intelligent Cloud segment leads performance, with Azure AI growth set to accelerate as new data centre capacity comes online in 2H25e.

-

Strong demand for Office 365 continues, driven by higher ARPU and increasing adoption of E5 upgrades and Copilot tools.

-

We upgrade to BUY from ACCUMULATE recommendation due to recent price performance. We maintain our DCF target price of US$480 (WACC 7.2%, g 4.5%), and our FY25e forecast remains unchanged. We believe Microsoft is well-positioned to benefit from the rising demand for large AI models, boosting Azure’s appeal and driving incremental revenue through Copilot AI tools.

Microsoft Corp – Azure remains a key growth engine

- 1Q25 revenue/PATMI was in line with expectations at 24% of our FY25e forecasts. Total revenue grew 16% YoY, driven by strong demand for its cloud and AI-enabled services.

- For 2Q25e, Microsoft expects revenue to grow by 11% YoY to US$68.6bn, fueled by a 32% YoY rise in Azure revenue and a 14% YoY increase in Office 365 commercial cloud revenue. Microsoft's 2Q25e implied operating margin is ~44%, flat YoY despite increased CAPEX for AI capacity expansion.

- We maintain our ACCUMULATE recommendation with an unchanged DCF target price of US$480 (WACC 7.2%, g 4.5%). Our FY25e forecast remains unchanged. We believe Microsoft is well-positioned to benefit from the rising demand for large AI models, boosting Azure’s appeal and driving incremental revenue through Copilot AI tools.

Microsoft Corp – Continued strength in cloud services

- FY24 revenue/PATMI met our expectations at 100% of our forecasts. 4Q24 revenue growth of 15% YoY was supported by strength in its cloud services and gaming segments, led by Azure and Xbox.

- For 1Q25e, Microsoft expects total revenue to grow by 14% YoY to US$64.3bn fueled by a 29% YoY rise in Azure revenue and a 14% YoY increase in Office 365 Commercial revenue. Microsoft’s implied operating margin for 1Q25e is ~45%, down from 48% in 1Q24 due to rising CAPEX on capacity expansion.

- We maintain our ACCUMULATE recommendation but raise our DCF target price to US$480.00 (prev. US$465.00), with an unchanged WACC of 7.2% and terminal growth rate of 4.5%. We nudge lower our FY25e revenue estimates by 1% due to moderating client spend, while increasing our PATMI by 2% to account for lower operating expenses. We roll over an additional year of valuations but increased our FY25e CAPEX by about 30%. We believe Microsoft is well-positioned to benefit from the rising demand for large AI models, boosting Azure’s appeal and driving incremental

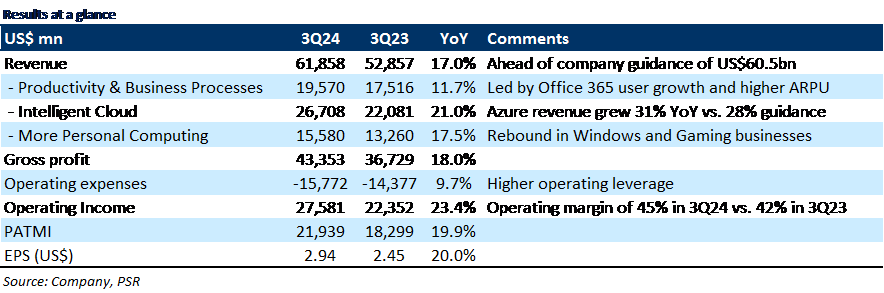

Microsoft Corp – Azure strength fuels revenue growth

- 9M24 revenue/PATMI was in line with expectations at 74%/77% of our FY24e forecasts. 3Q24 revenue growth of 17% YoY was supported by strength in cloud computing business Azure. PATMI rose by 20% YoY to US$21.9bn due to higher operating leverage.

- For 4Q24e, Microsoft expects total revenue to grow by 14% YoY to US$64bn fueled by Azure revenue growth of 31% YoY and Office 365 Commercial revenue growth of 14% YoY. Microsoft’s implied operating margin for 4Q24e is ~42%.

- We maintain ACCUMULATE recommendation but raise our DCF target price to US$465.00 (prev. US$450.00), with an unchanged WACC of 7.2% and terminal growth rate of 4.5%. Our FY24e revenue estimates remain unchanged, while we increased our PATMI by 2% to account for lower expenses. We believe that the growing demand for large AI models could help attract customers to Microsoft’s Azure platform for storage and computing solutions.

The Positives

+ Azure revenue growth accelerates. In 3Q24, Intelligent Cloud segment revenue grew 21% YoY to US$26.7bn led by strength in cloud services. Azure revenue grew 31% YoY, beating the company’s guidance of 28% YoY growth. The significant growth was primarily driven by an increase in the size and duration of the deals as customers migrated workloads (e.g., SAP/Oracle) from on-premises to the cloud. Management noted accelerating demand for its Azure AI services, which contributed 7% points to Azure growth (vs. 6% in 2Q24). Azure AI services help enterprises create their own generative AI solutions, including the development of chatbots, summarization, and writing documents.

+ Windows and Gaming continued to rebound. In 3Q24, More Personal Computing segment revenue grew 18% YoY to US$15.6bn, 3% above the top end of company guidance. Notably, Windows OEM revenue grew by 11% YoY, beating the company’s guidance that it would be relatively flat. The growth was mainly driven by a recovery in the PC market and a shift to developed markets. Meanwhile, Gaming segment revenue grew by 51% YoY to US$5.5bn as the integration of Activision Blizzard titles like Call of Duty into Xbox Gamepass drove higher player engagement.

+ Improvement in margins. In 3Q24, the operating margin expanded by 300bps YoY to 45% despite elevated AI-related CAPEX, beating the company’s guidance of 43%. The margin improvement was mainly due to top-line upside, higher operating leverage from prudent headcount control (down 1% YoY), and lower sales-related costs. CAPEX jumped 66% YoY to US$11bn due to cloud and AI infrastructure build-out.

The Negatives

- Nil

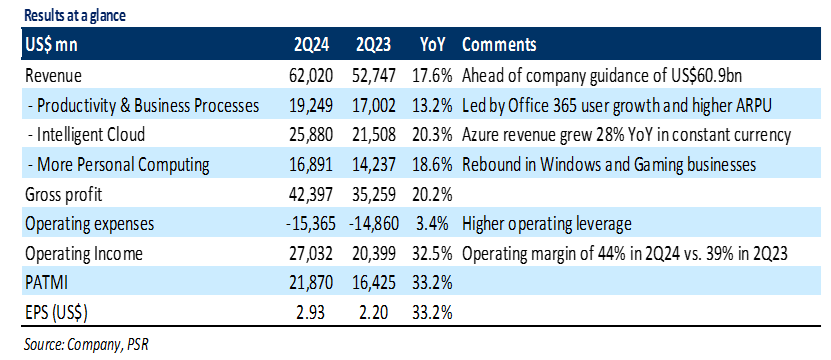

Microsoft Corp – AI demand boost cloud revenue

- 2Q24 revenue was in line with our expectation, while earnings exceeded. 1H24 revenue/PATMI was at 49%/53% of our FY24e forecasts. 2Q24 revenue grew 18% YoY driven by a robust 28% YoY growth in Azure cloud revenue. PATMI rose by 33% YoY to US$21.9bn due to higher operating leverage.

- For 3Q24e, Microsoft expects total revenue to grow by 15% YoY to US$60.5bn fueled by Azure revenue growth of 28% YoY and Office 365 Commercial revenue growth of 15% YoY. Microsoft’s implied operating margin for 3Q24e is ~43%.

- We maintain our ACCUMULATE recommendation with an increased DCF target price of US$450.00 (prev. US$375.00), with an unchanged WACC of 7.2%, and an increased terminal growth rate of 4.5% (prev. 4%). We believe that the growing demand for large AI models could help attract customers to Microsoft’s Azure platform for storage and computing solutions. Also, strong adoption of Office 365 AI tools could provide incremental revenue growth opportunities. Our FY24e revenue/PATMI has been increased by 1%/3% to account for the continuation of AI tailwinds and lower OPEX.

The Positives

+ Azure maintained solid growth. In 2Q24, Intelligent Cloud segment revenue grew 20% YoY to US$25.9bn led by Azure and other cloud services. Azure revenue grew 28% YoY in constant currency, beating the company’s guidance range of 26% to 27% YoY growth. Management highlighted that the generative AI applications built by enterprises on Azure’s infrastructure started scaling up leading to higher usage and revenue growth. AI provided a 6% uplift to Azure’s growth in 2Q24 vs 3% in 1Q24 and was largely made up of inference workloads instead of training. Also, the number of Azure AI customers increased to 53,000 (vs 18,000 in 1Q24) and one-third of that number represents customers new to the Azure platform within the past year suggesting early traction.

+ Strong demand for Office 365 continues. Office 365 Commercial revenue (under productivity and business processes) grew by 16% YoY, in line with the company guidance. Consistent with previous quarters, user growth and higher average revenue per user due to E5 upsell at renewals continued to drive this business segment. Paid Office 365 Commercial users grew by 9% YoY to more than 400mn driven by demand from small and medium businesses and frontline worker offerings.

+ Margins continue to improve. In 2Q24, Microsoft reported an operating margin of 44% (vs 39% in 2Q23) despite elevated AI investments and the impact of the Activision acquisition. The margin improvement was mainly due to top-line upside and continued focus on higher operating leverage through disciplined cost controls (headcount down 2% YoY).

The Negatives

- Nil.

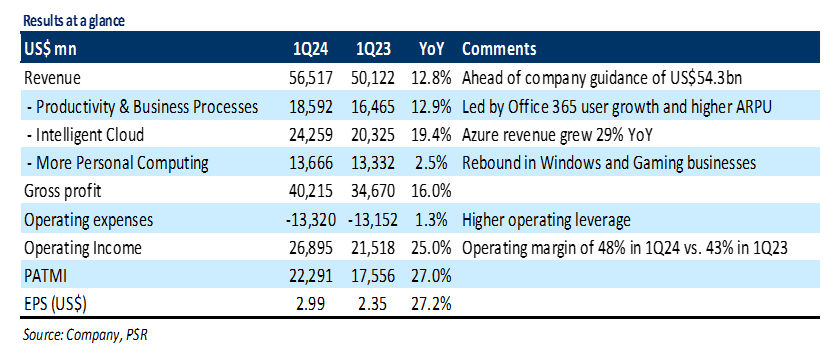

Microsoft Corp – Azure growth re-accelerates

- 1Q24 revenue/PATMI was in line with expectation at 24%/26% of our FY24e forecasts. Total revenue grew 13% YoY as Azure growth re-accelerated to 29% YoY. PATMI rose by 27% YoY due to higher operating leverage.

- For 2Q24e, Microsoft expects total revenue to grow 15% YoY to US$60.9bn driven by corporate cloud-computing demand and increase in gaming revenue. Management reiterated its expectation of flat operating margins for FY24e (~42%) despite absorbing Activision Blizzard. Office 365 Copilot AI tools (US$30 per user per month) to commercially launch on Nov. 1.

- We maintain ACCUMULATE recommendation and nudge our DCF target price to US$375.00 (prev. US$372.00) using a WACC of 7.2% and terminal growth rate of 4%. Our FY24e revenue/PATMI is increased by 2%/0.4% to account for Activision acquisition and continuation of AI tailwinds. Microsoft is well-positioned to benefit from shifting workloads to the cloud, demand for its AI-enabled products, and cybersecurity upgrades.

The Positives

+ Azure revenue growth re-accelerates. Microsoft showed signs of recovery in its cloud-computing unit, with Azure revenue expanding 29% YoY. The growth came ahead of the company's guidance of 26% YoY growth as more enterprises move to the cloud and growing contributions from AI-enabled services (3 percentage points). Management highlighted that Azure OpenAI service now has 18,000 customers compared with 11,000 last quarter (up 60% QoQ) indicating early traction for its AI services.

+ Office 365 momentum continues. Office 365 commercial revenue grew by 18% YoY led by strong growth in its users and higher average revenue per user as customers upsell to E5 license for its advanced functionalities. Paid Office 365 commercial users grew by 10% YoY to approximately 400mn driven by continued demand from small and medium businesses and frontline worker offerings. We believe that the commercial launch of Office 365 AI tools (US$30 per user per month) on Nov. 1 should enable Microsoft to maintain double-digit Office 365 growth rates.

+ Improvement in margins. In 1Q24, Microsoft reported operating margin of 48% compared with 43% in 1Q23. This was the highest over the last decade despite AI investments. The margin improvement was mainly due to top-line upside and continued focus on operational discipline (headcount down 7% YoY).

The Negatives

- Nil.

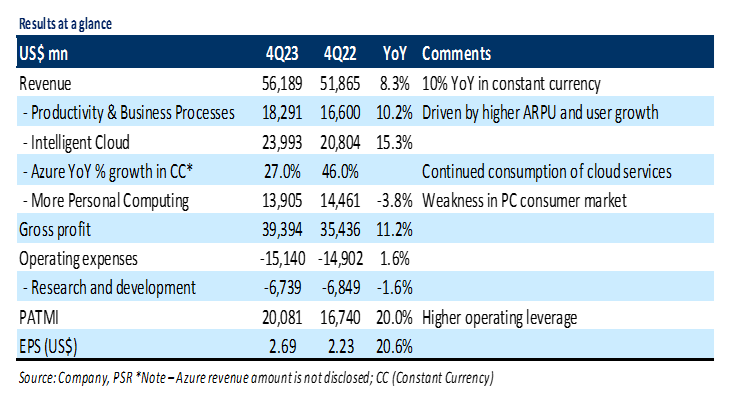

Microsoft Corp – Stabilizing cloud spending

- FY23 revenue/PATMI was in line with expectations at 100%/101% of our forecasts. In 4Q23, total revenue grew by 8% YoY driven by a 15% YoY rise in intelligent cloud business. PATMI rose by 20% YoY due to higher operating leverage.

- For 1Q24e, Microsoft expects total revenue to grow by 8% YoY to US$54.3bn driven by corporate cloud-computing demand. The company’s implied operating margin for 1Q24e is 44%. Microsoft plans to charge US$30 per user per month for its Office 365 Copilot AI tools.

- We upgrade to ACCUMULATE with a raised DCF target price of US$372.00 (prev. US$328.00) using a WACC of 7.2% and terminal growth rate of 4%. We are raising our target price as we increased our growth rate assumptions. Microsoft enjoys long-term tailwinds from shifting workloads to the cloud, demand for its AI-enabled products, and cybersecurity upgrades.

The Positives

+ Azure continued to be a bright spot. In 4Q23, Azure cloud revenue grew by 27% YoY on a constant currency basis, at the high end of management’s guidance range, with about a 1 percentage point benefit from AI services. Growth continues to be fueled by corporate cloud-computing demand as enterprises look to lower OPEX and digitize their operations. Management highlighted that Azure OpenAI service now has 11,000 customers (IKEA and Volvo Group) compared with 4,500 in mid-May indicating early traction for its next-generation AI services.

+ Strength in Office 365 commercial revenue. Office 365 commercial revenue (under productivity and business processes) grew 17% YoY in constant currency driven by subscriber growth and ongoing ARPU increases as customers upgrade to the E5 license for its advanced security and analytics functionality. Microsoft reported paid Office 365 commercial user growth of 11% YoY again led by small-to-medium business and frontline worker offerings. While it is early days, we believe the adoption of Office 365 Copiplot AI tools can lead to an uplift in revenue (US$30 per user per month) and should enable Microsoft to maintain double-digit Office 365 growth rates.

The Negatives

- Deteriorating PC market hurt Windows and Devices. In 4Q23, more personal computing revenue fell by 4% YoY to US$13.9bn mainly due to Windows and Devices businesses. Windows OEM revenue, which includes the sales of Windows software to PC makers, declined by 12% YoY. Additionally, Devices revenue, including Microsoft Surface tablets and computers, HoloLens, and PC accessories, fell by 18% YoY. This is mainly due to weakening consumer demand for PCs and macro economic uncertainty.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report