The Positives

+ Revenue at another high. Revenue rose 15% YoY to record S$18.7mn. Sales in China were up 28%, followed by +18% in the U.S. China’s growth reflected the industry’s pick-up in semiconductor demand while U.S. sales captured contributions from a new front-end programme that involves semiconductor parts for gas handling in a vacuum chamber. We believe these are likely vapour or chemical disposition machines.

+ Interim dividends up 20% YoY. MMH raised interim DPS by 20% to 6 cents. This was its second consecutive year of increase. Over two years, interim DPS has been raised 50%.

The Negative

Nil.

Outlook

High barriers to entry and the ongoing surge in semiconductor demand should provide runway of growth for the next two years. Management believes the industry is entering a multi-year supercycle of growth from skyrocketing demand for data centres, video streaming, remote work, 5G and automobile electrification. High barriers to entry persist for MMH’s core rubber tip product. For instance, only a handful of suppliers can supply such high precision, customised and proprietary materials to customers.

Downgrade to NEUTRAL, albeit with higher TP of S$3.35 (from S$2.93)

Recent share-price rally has priced in its positive outlook and long-term merits such as 4% yields, 35% ROEs and a net-cash balance sheet.

The Positives

+ Record quarterly revenue of S$18.1mn. Revenue rose 18% YoY. Countries responsible were Singapore (+129%) and the U.S. (+24%). New projects from the U.S. as well as a resumption of work in the U.S. and Malaysia following lockdowns in the June quarter likely played a part.

+ Gross margins at a 2-year high. Following its lumpy capacity expansion in FY18, economies of scale have kicked in and revenue has increased to cover its additional fixed costs. New products also typically command higher margins.

+ Operating cash flow more than doubled. 1Q21 operating cash flow of S$7.1mn was more than double the S$3.2mn achieved a year ago. Net cash was S$25.5mn, up from S$19mn a year ago.

The Negative

- Spurt in capex. Capex spiked 4x YoY to S$2mn. MMH continues to guide for S$4-5mn for FY21. Capex front-loading might have been due to a surge in demand from customers.

Outlook

The cycle recovery remains nascent and growth this year should be further supported by new projects from its front-end semiconductor customer in the U.S. We believe the contribution could be almost 10% of revenue in FY21e.

Downgrade to ACCUMULATE, albeit with higher TP of S$2.93 (from S$2.50)

We are downgrading our recommendation from BUY to ACCUMULATE. Our FY21e earnings have been raised by 9% as we lift revenue by 5% to S$75.1mn. MMH provides attractive financial metrics, namely ROE of 33%, a net-cash position and a dividend yield of 4.9% remains attractive.

The Positives

+ Healthy revenue despite the disruptions. MMH managed to grow revenues despite production disruptions during the quarter. In Malaysia, staff levels were down to 25% of capacity in April and May, it recovered fully only in June. Meanwhile, the U.S. operations operated at 60% to 80% of staffing levels throughout the quarter.

+ Gross margins expanded. MMH enjoyed gross margins of 55.5% in 4Q20, the highest in seven quarters. Margins were surprisingly high despite the weaker utilization rate of 56% compared to 58% a year ago. We believe there was better pricing power in 4Q20 as customers needed to create buffers in their inventory levels with worries over possible disruption to the supply chain. A move in inventory levels from just-in-time (JIT) to just-in-case (JIC).

+ Dividends raised by 17%. The final MMH for FY20 was unchanged but special dividends doubled to 2 cents. Worth noting that MMH has been paying special dividends for the past five years. It seems to be normal rather than special. Therefore, the blended increase is 17% and total dividends for FY20 (including interim 5 cents) has increased by 20% to 12 cents. A dividend yield of 5.5%.

The Negative

- Nil.

Outlook

We are upbeat on the outlook for MMH. The two major growth drivers are:

Upgrade to BUY from NEUTRAL with a target price of S$2.50.

We are raising our recommendation from NEUTRAL to BUY. MMH is entering a new upcycle in semiconductor volume and major penetration into a new business segment. MMH also pay an attractive dividend yield of 5.5% backed by a net cash balance sheet of S$20mn and unlevered ROE of 25%. We benchmark our valuations to 18x PE of the back-end semiconductor equipment sector (Figure 3). Our FY21e earnings has been raised by 25%.

The Positives

+ Revenue run-rate back to S$16mn per quarter level. Past two quarters, revenues have exceeded S$16mn per quarter. This will be the run-rate similar to their record performance in FY18.

+ Disruptions were well contained. Recall that on 29 January, MMH announced that their plant in Suzhou (30% of revenue) was temporarily closed till 11 February. MMH’s footprint of manufacturing bases spans more than nine countries, which allowed orders to be sourced from other locations.

The Negative

- Gross margins disappointed. Gross profit margins of 52% was below our estimate of 54% (and below FY18 stellar 57%). Despite the 13% YoY jump in revenue to S$16.2mn, capacity utilization fell to 52% from 54% a year ago. The plant closures in China and Malaysia negatively impacted margins and utilization levels.

Outlook

We are maintaining our FY20e earnings forecast unchanged. This implies a 40% YoY rebound in 4QFY20e earnings. Semiconductor demand is on a recovery track aided by the increased adoption of cloud solutions and 5G. But we do worry there will be a lagged impact from the collapse in consumer and corporate income on IT spending. Also, the partial closure on Malaysia (16% of revenue) and the U.S. (20% of revenue) will negatively impact the sales momentum*.

We raise our recommendation from REDUCE to NEUTRAL following the recent weakness in the share price. Our target price is unchanged at S$1.60 and FY20e earnings maintained. MMH is still an impressive company with enviable metrics – ROE 25%, net cash balance sheet, gross margins 54% and a dividend yield of 6.7%.

*On 19 March, MMH announced their factory in Penang will continue operations at a minimal level until 12 May. The factory at Morgan Hill in Santa Carla is permitted to perform minimum basic operations until 4 May.

The Positives

+ Revenue and earnings growths after five quarters of decline. A large part of the recovery was from China (+20% YoY) and Taiwan (+37% YoY). Sales in SE Asia was surprisingly subdued with a modest decline.

+ Interim dividends jumped 25% to 5 cents per share. We were pleasantly surprised by the rise in interim dividends. It is the first increase in two years. Full-year annual dividends of S$15mn (or 11 cents per share) is supported by the estimated operating cash-flows of S$21mn per annum (before capex of S$6mn).

The Negative

- Temporary closure of Suzhou plant. On 29 January, MMH announced the closure of their Suzhou plant. Suzhou accounts for 30% of group sales. The disruption to entire electronic supply chain in China will create downside risk to future revenues. A mitigating factor is MMH spread of factories across SE Asia as customer orders look shift to other locations.

Outlook

We are maintaining our FY20e earnings forecast unchanged. This implies a 40% YoY rebound in 2HFY20e earnings. We are modelling revenue growth of 12% in 2H20e, with gross margins improving to 54% (1H20: 53.7%). Industry volumes have started to recover in late 2019. The closure of Suzhou and an overall slowdown in global growth will place some downside risk to our forecast.

Our REDUCE recommendation is maintained and the target price unchanged at S$1.60. MMH still enjoys attractive margins, ROE, net cash balance sheet and a dividend yield of 6%. We believe share price has priced in the earnings recovery for 2H20e.

The Positives

+ Improvement in QoQ performance. A positive has been the (seasonal) rebound in sales and margins in the September quarter.

+ Net cash on balance sheet 2nd highest since listing. MMH exited the September quarter with net cash of S$24.3mn, 2nd highest since listing.

The Negatives

- 5th consecutive quarter of revenue contraction. Revenue fell for the 5th consecutive quarter YoY in 1Q20. Admittedly, it is also the 5th consecutive miss of our revenue estimates. After the bumper semiconductor ramp in 2018, revenues for MMH are returning to steady-state annual revenues in the mid-S$50mn. We are not lowering our revenue estimates as we are modelling in recovery in 2H20.

Outlook

Despite the laudable effort to lower total operating cost by 4% YoY, a lack of revenue growth is hurting net profit. Weak demand means lower unit production and less need by customers to replace consumables. It also triggers more pricing pressure from customers.

We see early signs of recovery in industry semiconductor unit volumes. The depth and length of a recovery are never clear but the current downturn looks extended compared to previous cycles, in our opinion.

We cut our rating from NEUTRAL to REDUCE as we left our target price and earnings estimates unchanged. MMH still possess high margins, high ROE and net cash balance sheet. However, we believe the recent rally has run ahead of the expected recovery in semiconductor demand.

The Positives

+ Dividend per share was maintained. MMH maintained the final dividend per share of 6 cents (final 5 cents, special 1 cent). Full-year dividend per share was 10 cents and a 107% payout ratio.

+ Record free-cash flows. Despite the weaker earnings, free cash flow in FY19 was a record high of S$15.8mn. Capex in FY19 was $3mn, a major reversal from last year’s S$12.1mn.

The Negatives

- Gross margin was sluggish. GP margins for MMH are still attractive at above 50% and representative of the value add vis-à-vis material costs. Excluding the prior quarter, 4Q19 GP margins stood at 52.3%, the lowest in five years. Weakness is due to lower utilisation of 58% (4Q18: 60%). MMH is still experiencing a higher fixed cost structure after FY18 spike in capex of S$12mn.

- The revenue decline is accelerating. 4Q19 revenue missed our estimates by 9%. Of concern is that the contraction on YoY basis is accelerating, albeit modestly.

Outlook

There is a high correlation between the growth of MMH sales and Taiwan IC packaging volumes (Figure 1). MMH revenue is more dependent on volumes than semiconductor prices.

Semiconductor backend volumes are highly cyclical. When we used historical data of Taiwan IC packaging volumes (Figure 2), the longest period of contraction has been 13 months since the 1980s. The average was 10 months (Figure 3). The current downturn is already on its 11th consecutive month. We are in the late stages of the decline. The worry is that the trade war between US-China will exacerbate the downturn longer.

The company highlighted that its competitive position has not been affected by the downturn. On the contrary, it is becoming harder for competitors to meet the exacting standards required by customers. Some of the barriers include cleanliness on the production facilities to avoid contamination, parts become smaller and flatter in geometry and more advanced material science to reduce electrostatic discharge. Higher capex is also required for more automated and complex machines such as machines that measure the precision of the parts from one micron in the past to now 0.30 to 0.70-micron accuracy.

Recommendation

We marginally lowered our target price to S$1.60 (previously S$1.63). Our FY20e earnings have been reduced by 5%. We peg our valuations to 15x FY20e PE, in-line with back-end semiconductor supply chain valuations. The downturn in back-end semiconductor volumes is at the late stage. Based on the past cycles, a rebound should be materialising from the December quarter onwards. Investors are paid a 6% yield as they wait for the recovery. Our NEUTRAL recommendation is unchanged. MMH still enjoys some of the best operating and balance sheet metrics in the industry such as >50% gross margins, a dividend yield of 6.3%, ROE of 22% and net cash of S$21.9mn

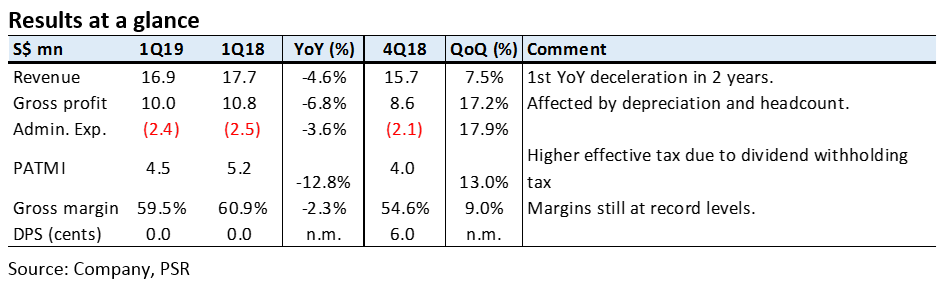

Results at a glance

Source: Company, PSR

The Positives

+ U.S. operations maintained revenues. The U.S. was the best performing geography. Revenues were up almost 8% YoY in 3Q19. The resilience of this division is likely due to new customer programmes in front-end semiconductor equipment parts. Front-end is the next source of secular growth for MMH.

The Negatives

- Gross margin was sluggish. GP margin fell for the third consecutive quarter to 49.3%, the lowest in six years. Margins were weak due to the increase in headcount (499 people, +5% YoY) and rise in depreciation (+10% YoY) after last year’s lumpy S$12mn capex. However, revenues did not grow to support this higher fixed cost.

- Revenue back to 2017 levels. After the spike in revenues for FY18, revenue for FY19 is trending back to FY17 levels. The big bump up in semiconductor revenues in 2018 for the whole industry was not sustainable.

Outlook and Recommendation

Weakness in semiconductor backend volumes has been sharper than envisaged. When we used the Taiwan IC packaging volume data, the longest period of contraction has been 13 months. The average was 9 months. We are already in the 8th month. Based on these previous cycles since 1990, we are at the later stages of the downturn.

Nevertheless, we are lowering our recommendation to NEUTRAL on MMH. As mentioned in the past, the company maintains one of the highest gross margins and ROE in the semiconductor back-end industry. Our target price of S$1.63 (previously S$1.70) is based on 15x FY20e PE. This is in-line with back-end semiconductor supply chain valuations. We rolled over our target price to FY20e. We believe FY20e will be a better reflection of the earnings power after this cyclical downturn. As operating cash-flows are healthy and balance sheet is in net cash of S$19mn, we expect MMH to still pay a dividend yield of 6%. This is an attractive yield while waiting for the semiconductor cycle to recover, in our opinion.

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.

Results at a glance

Source: Company, PSR

The Positives

+ U.S. operations still enjoying healthy growth. The revenue in the U.S. grew 8% YoY in 2Q19. This division targets front-end semiconductor equipment parts. It will be the next major leg of growth after the current back-end segment. However, little was shared in terms of projects or programmes.

The Negatives

- Gross margins the weakest since 4Q14. GP margins fell to 52.4%, the weakest in 18 quarters. We assume the weak margins was due to customer pricing pressure, higher production headcount and the rise in depreciation after last year’s lumpy S$12mn capex. Depreciation rose 15% YoY in 2Q19.

- Revenue dragged by China. Revenue in 2Q19 contracted for the second consecutive quarter. Revenues from MMH largest division, China , fell by 7% YoY. Uncertainty over trade negotiations between the U.S. and China has created caution in the supply chain and hesitation in carrying inventory.

Outlook and Recommendation

The revenue slowdown has been steeper than expected. 2018 was a bumper year due to the surge in memory semiconductors. The core competitiveness of the company has not changed. MMH provides customized (and even the single source) consumables for the die attach process. As wafer circuitry shrink to nanometers, it will increase the fragility and electrostatic discharge sensitivity of the die. MMH strength is their ability to constantly ride the technological wave together with their customers and resolve their ever-present challenges. We lowered our recommendation to ACCUMULATE on MMH. The company maintains one of the highest gross margins and ROE in the semiconductor back-end industry. Our target price of S$1.70 (previously S$2.05) is based on 15x FY19e PE. This is in-line with back-end semiconductor supply chain valuations. MMH pays an attractive dividend yield of 6% as we wait for the semiconductor cycle to recover.

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.

The Positives

+ Gross margins close to record levels. Despite the decline in earnings, MMH still managed to enjoy gross margins of 59.5%. On a QoQ basis, the incremental rise in revenue of S$1.2mn flowed directly to margins. There was huge operating leverage. Margins were encouraging because utilization was only 58%. This is the lowest in almost two years.

+ Strong balance-sheet. MMH maintains a net-cash balance sheet of S$23.9mn. Capex guidance is S$6mn, but only S$0.7mn was spent this quarter.

The Negatives

- Revenue fell almost 5% YoY. Revenue in 1Q19 contracted for the first time in eight quarters. By geography, the weakest revenue growth was from Singapore and Japan. U.S. bucked the trend with 8% YoY rise in revenue.

Outlook

MMH will experience a cyclical slowdown in FY19. Higher margins can help offset the revenue weakness if U.S. operations is able to undergo a turnaround faster than expected. Recall that the U.S. segment grew the fastest from a swing of S$0.6mn PBT loss in FY17 to S$0.5mn gain in FY18. This geography can contribute the highest operating leverage.

We maintain our BUY recommendation on MMH. The company maintains one of the highest gross margins and ROE in the semiconductor back-end industry. Our target price of S$2.05 (previously S$2.30) is based on 16x FY19e PE. This is in-line with back-end semiconductor supply chain valuations. MMH pays an attractive dividend yield of 5.6%.

The report is produced by Phillip Securities Research under the ‘SGX StockFacts Research Programme’ (administered by SGX) and has received monetary compensation for the production of the report from the entity mentioned in the report.