Lendlease Global Commercial REIT – Minimal downtime from departure of Cathay

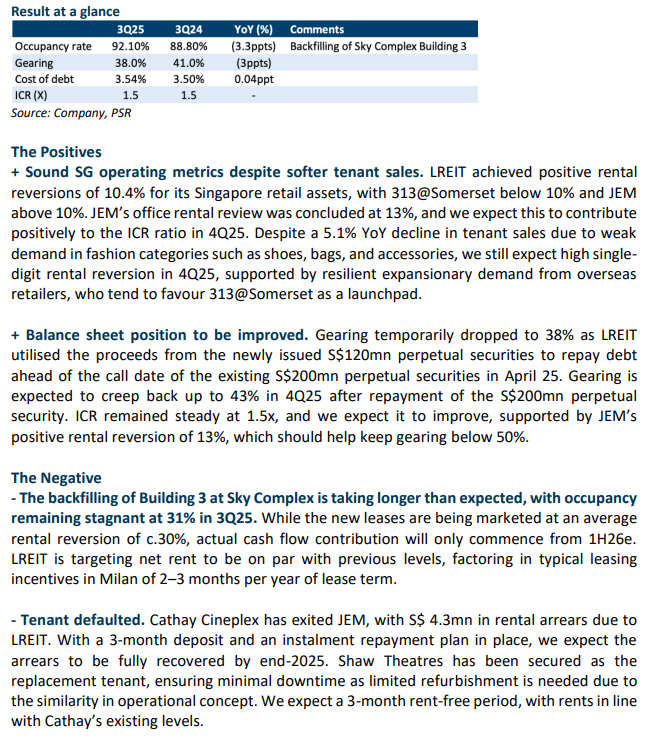

· While no financials were provided for 3Q25, LREIT reported sound operating metrics for its Singapore assets, with retail achieving 10.4% and the rental review for JEM concluded at 13%. We expect rental reversion to remain at high single-digit for 4Q25.

· Portfolio occupancy dipped slightly by 0.2ppt QoQ to 97.1%, with Building 3 of Sky Complex seeing stagnancy in backfilling its space. LREIT successfully replaced Cathay Cineplex with Shaw Theatres at a comparable rental rate and implemented an instalment plan to address the S$4.3mn in rental arrears.

· We maintain our BUY recommendation with a lower DDM-TP of S$0.69 (prev: S$0.74). We revised our FY25e/26e DPU forecasts down by 2%/0% to 3.60/4.05 cents and COE by 0.4ppt to 8.4%, reflecting slower-than-expected backfilling at Building 3 of Sky Complex and a 3-month income vacuum due to Cathay Cineplex’s delinquency. LREIT is trading at an FY25e dividend yield of 7% and P/NAV of 0.69x.

Lendlease Global Commercial REIT – Low-teens rental reversion expected for JEM office

· Gross revenue and NPI declined by 13.6% and 19.8% YoY, respectively, accounting for 46% and 45% of our FY25e estimates. This was due to the absence of pre-termination fee paid by Sky Italia and the longer-than-expected backfilling of Building 3 Sky Complex. NPI margin was impacted by a one-off expense of c.£1mn for equipment repairs, which has yet to be capitalized, along with higher marketing expenses.

· DPU plunged by 14.3% YoY to 1.8 cents, which was in line with our estimates and formed 48% of our FY25e forecast. Higher financing costs dragged down DPU since the cost of borrowing inched up by 20bps YoY.

· Retail rental reversion remained resilient in FY25e, achieving 10.7% for retail and 1.2% for office, despite tenant sales falling 5.2% YoY. We have revised our FY25e/26e DPU forecasts lower by 2%/2% to 3.70/4.05 cents, reflecting the slower-than-expected backfilling of Building 3 at Sky Complex. We maintain our BUY recommendation with a lower DDM-TP of S$0.74 (prev: S$0.76). While FY25e earnings are expected to benefit from low-teens rental reversion of both Singapore retail and Jem Office, DPU growth may be constrained by uncertainty surrounding the interest rate cut trajectory.

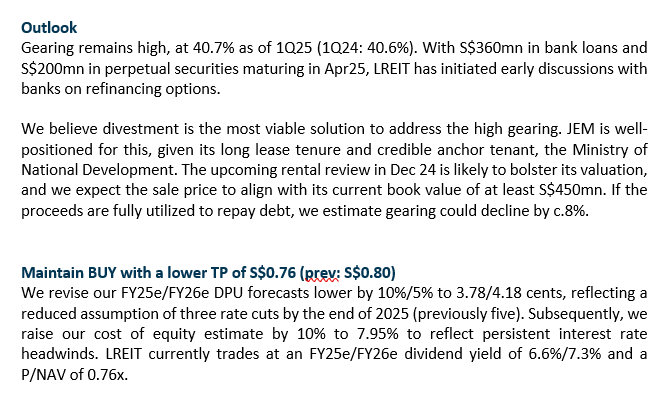

Lendlease Global Commercial REIT – Higher for longer interest rate

- Although interest rates have peaked, we expect that the all-in cost of borrowing for LREIT will hover at the current high level of c.3.7% in FY25e. This is due to the high proportion of loans tied to fixed rates, which will delay the benefit of any future interest rate cuts for LREITs.

- Sky Complex Milan is taking longer than expected to backfill the vacant building, dragging portfolio occupancy down to 75%. We expect the building to be fully tenanted by the end of the calendar year 2025, resulting in an income vacuum for FY25e.

- We reiterate our BUY recommendation with a revised DDM-TP of S$0.76 (prev: S$0.80). FY25e earnings are expected to be supported by low-teens retail rental reversion, with an upside from the JEM Office rental review, which we estimate at >5%. DPU will likely face another year of erosion due to higher-for-longer interest rates, as the rate cut trajectory under Trump’s presidency remains uncertain. We lower our FY25e/FY26e DPU forecasts by 10%/5% to 3.78/4.18 cents, reflecting a reduced expectation of three rate cuts by the end of 2025 (prev: five). LREIT is trading at an FY25e/FY26e yield of 6.6%/7.3% and a P/NAV of 0.76x.

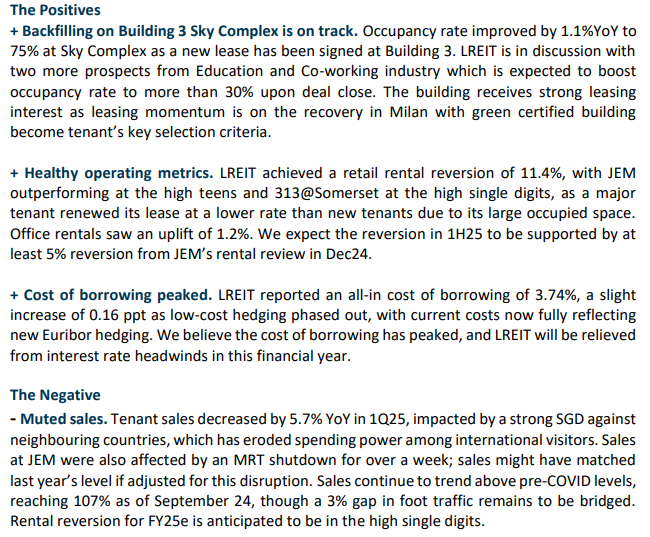

Lendlease Global Commercial REIT – Cost of borrowing peaks

- No financials was provided in 1Q25. LREIT achieved resilient retail rental reversion of 11.4% (4Q24: +12%) and office rental saw 1.2% uplift (4Q24: +1.2%). The portfolio occupancy rate stands at 89.5%, with Sky Complex at 75% occupancy.

- Tenant sales declined by 5.7% YoY due to train disruption and strong SGD, trending at 107% of pre-COVID levels, with a 4% QoQ decrease. We believe rental reversion would moderate from the high level in FY24 and 12.1% of GRI is due for renewal in FY2025.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.80. FY25e rental reversion is expected to be supported by marked-to-market rental upon successful backfilling on Building 3 Sky Complex and rental review of JEM office. DPU catalysts include the peak in borrowing costs and the potential divestment of JEM to deleverage, which could lead to lower financing costs. LREIT is trading at an FY25e/26e dividend yield of 7.31% / 7.60% and a P/NAV value of 0.76x.

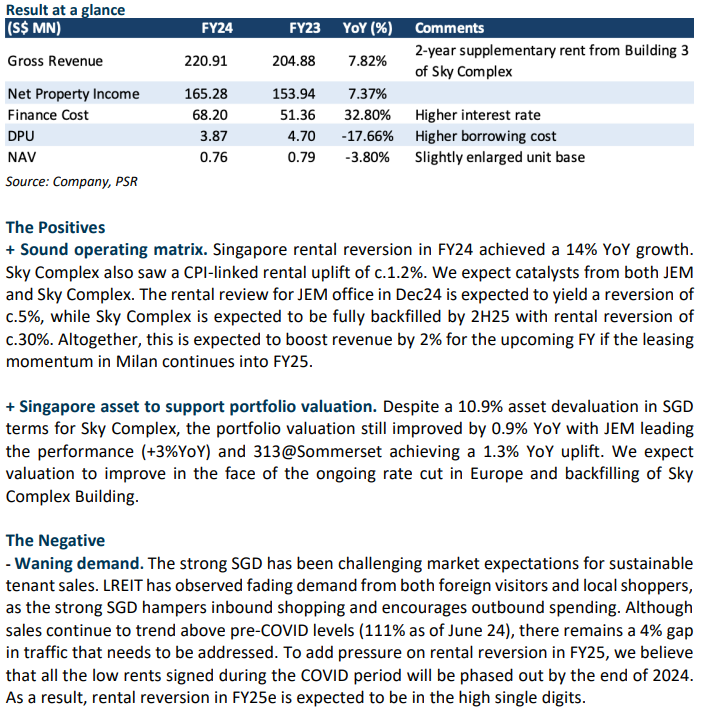

Lendlease Global Commercial REIT – DPU is bottoming out

- Gross revenue for FY24 surged by 7.8% YoY to S$220.9mn, in line with our estimates which includes the €10mn pre-termination fee recognized from SKY Complex Building 3.

- NPI and DPU missed our expectations by 6% due to elevated property operating expenses (which increased by 9.2% YoY), and rising financing costs (+32.8% YoY). Although the one-time €10mn pre-termination fee has been recognized, the distributable income will be adjusted to reflect amortization over a 2-year period. As a result, NPI and DPU stood at S$165.3mn (+7.4% YoY) and 3.87 cents (-17.7% YoY), respectively.

- We reiterate our BUY recommendation with a revised DDM-TP of S$0.80 (prev: S$0.83), as retail demand growth is expected to decelerate with the post-COVID recovery tailwinds waning. Moderated rental reversion and tenant sales have been factored in for the upcoming year due to the current macroeconomic backdrop. Nevertheless, we expect revenue to increase by c.3% in FY25e, driven by the c.30% rental reversion upon backfilling of Building 3 and a rental review of the JEM office. We have reduced our FY25e/26e DPU forecasts by 10% to 4.03/4.30 cents on the back of the elevating financing cost. LREIT is currently trading at an FY25e dividend yield of 6.9% and a P/NAV of 0.76x.

Lendlease Global Commercial REIT – Rental upside to come from Sky Complex Milan

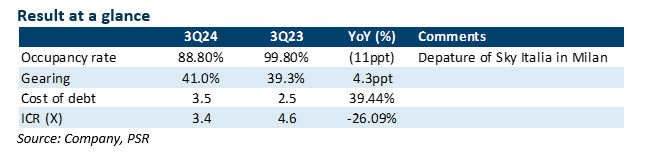

- No financials were provided for 3Q24. Portfolio committed occupancy plunged 11% YoY to 88.8% in the face of the departure of the anchor tenant of Sky Complex, which returned one-third of the space. However, on a QoQ basis, it improved by 0.9% due to the backfilling of Sky Complex by 8.1%.

- Rental reversion for both retail and office remained resilient, achieving 15.3% and 1.5%, respectively. We expect rental reversion to maintain at the current level for FY24e and earnings to be supported by the long-lease office tenant, which accounted for c.22% of the total income.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.83 and FY24e-25e DPU forecast of 4.16-4.59 Singapore cents. We expect potential upside from the high rental reversion upon the successful backfilling of Building 3 Sky Complex Milan and the completion of Live Nation in Grange Road.

The Positives

+ Robust retail rental reversion of 15.3% with 313 achieving c.20% and Jem delivering resilient performance of c.10%. Rental reversion for offices saw a slight cooling down, landing at 1.5% in 3Q24. However, stable support comes from tenants with long lease periods, contributing to c.22% of the total gross rental income. We expect rental reversion for the whole year FY24e to be c.15% (FY23: 4.8%).

+ Potential rental uplift from Jem and Sky Complex. We anticipate rental upside from Building 3 Sky Complex Milan, driven by healthy office demand in the surrounding area and lower-than-average rental rates previously signed by Sky Italia. In 3Q24, LREIT secured 8.1% of the net lettable area (NLA) leases through internal sourcing. LREIT expects backfilling to be completed by 50% by the end of 2024, with the rental reversion of c. 30-40% to match current market rates. Jem is also reviewing its rental at the end of 2024, and the current market rental is c.20% higher than the previous rent signed five years ago. We expect rental escalation to be in the high-teens, resulting in an improvement in revenue by c.2% upon successful negotiation.

The Negative

- NIL

Lendlease Global Commercial REIT – High rental reversion and rental upside from Sky Complex

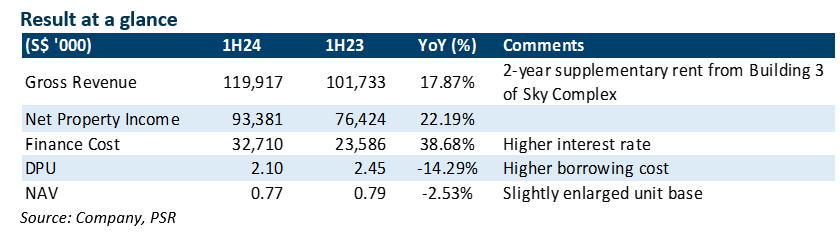

- Gross revenue increased by 17.9% to S$9mn with the 2-year supplementary rental from Building 3 of Sky Complex and form 55% of our FY24e forecast.

- NPI increased 22.2% YoY while DPU slid 14.5% YoY to 2.1 cents, and were 54%/52% of our FY24e estimates. High rental reversion was sustained with 313@somerset at c.20%, and Jem provided a stable contribution at c.10%.

- We reiterate our BUY recommendation with lower DDM-TP of S$0.83 and FY24e-25e DPU forecast of 4.16-4.59 Singapore cents. Erosion of DPU brought by higher-for-longer interest rates will still be apparent. We expect FY24e earnings will be supported by strong rental reversion.

The Positives

+ Resilient rental reversion of 15.7%, with 313@somerset contributing c.20%, and Jem delivering stable support of c.10%. Due to the lingering effects of COVID-19 base rents, we expect a rental reversion in the high teens for 313@somerset and in the low teens for Jem in 2025, as 20.3% of the lease by GRI is set to expire.

+ Stable operating metrics. Tenant sales continue to trend above pre-COVID levels and increased 0.6% YoY in 1H24. F&B, entertainment, and necessities outperformed. Despite lower contributions from GTO, we expect sales to benefit the top line with the influx of Chinese tourists, facilitated by the 30-day visa-free policy.

The Negative

- Borrowing cost inched up. There was no indication of a near-term reversal in the interest rate trajectory. LREIT having hedged 61% of its borrowings, will not experience much benefit from a potential interest rate cut in the future. With the implementation of the new rate, the expected interest rate for FY24e is c.3.5% (1H24: 3.37%).

Lendlease Global Commercial REIT – High rental reversion could hold up valuation

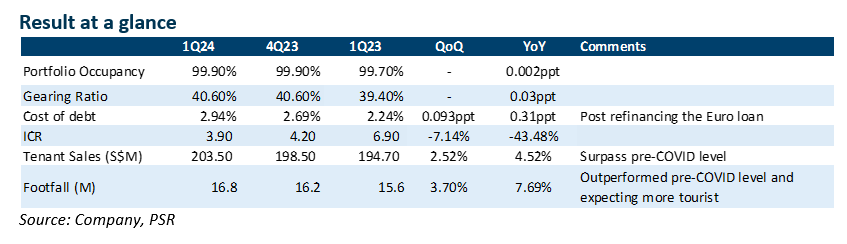

- No financials were provided for 1Q24. Portfolio committed occupancy remains high at 99.9%, with strong rental reversion of 16.3%. We expect the momentum to continue for the rest of FY24, with 313@Somerset leading the performance as international travellers return.

- Inorganic growth in the near term is off the table and LREIT has no plan for equity fund raising (EFR).

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.86 and FY24e-25e DPU forecasts of S$4.38 - 4.63 cents. We expect FY24e earnings will be supported by strong rental reversion and fading headwinds from the interest rate hike.

The Positives

+ Robust rental reversion of 16.3%, with 313@somerset achieving c.20%, and Jem achieving high single digits. In FY24, 7.8% of leases by gross rental income (GRI) are set to expire, and we anticipate the momentum of high reversion to persist, with 313@somerset benefiting from the return of tourism and Jem maintaining stability.

+ Healthy operating metrics. Portfolio occupancy remains high at 99.9%, with 313 experiencing a slight 10bps decrease to 98.9%, Sky Complex in Milan and Jem remained at 100%. The Milan asset has been efficiently utilized, achieving a physical occupancy rate of c.70% following tenant footprint consolidation.

+ Resilient valuation. There is no downward pressure on the valuation in the Singapore market and the portfolio valuation remained unchanged compared to 4Q23. Jem has seen a 2.5% increase in valuation due to healthy rental reversion and a stable occupancy rate. The valuation of 313@Sommerset improved by 4% YoY as a result of the development of the multifunctional event space (Live Nation), which is expected to be in operation in 2025. The stress is more visible in overseas assets. SKY Complex in Milan is valued down by 10.5% due to a terminal cap rate expansion of 75bps as the rental is under the market rate.

The Negative

- Cost of borrowing inched up to 2.94% (+25bp QoQ) upon refinancing of the Euro loan. With the new rate taking effect, the interest rate for FY24e is expected to be around the low 3% which is in line with our forecast.

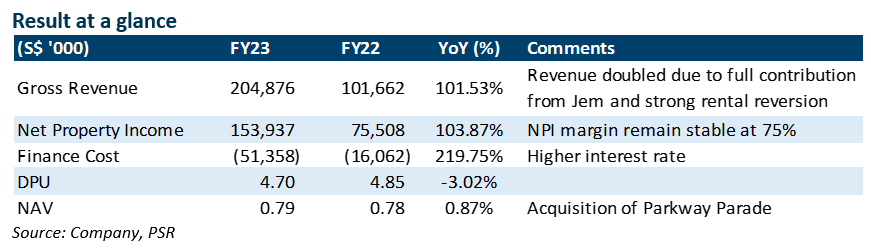

Lendlease Global Commercial REIT – Higher reversion for longer

- FY23 revenue and NPI doubled to S$204.9m and S$153.9m, respectively, and were below our expectations at 94% and 91%. Healthy retail rental reversion of 4.8% and increasing contribution from Jem were the main driving factors. We anticipate these trends to continue in FY24e, with additional upside potential from 313@somerset.

- FY23 DPU was at 101.5% of our expectations. DPU decreased to 4.7 cents (-3.2% YoY) due to rising interest costs at 2.69% (+1% YoY).

- We reiterate our BUY recommendation with a decrease in FY24e-25e DPU forecasts to S$4.38 - 4.63 cents on the back of rising interest rates. Our DDM-TP adjusted down to S$0.86. We expect FY24e earnings will be supported by stronger rental reversion and potential inorganic growth.

The Positives

+ Strong rental reversion continues in FY24e, with LREIT achieving an overall retail rental reversion of 4.8%, driven by Jem's improved performance. The Sky Complex in Milan (tied to the CPI index) experienced a 5.9% rental escalation. Tenant sales at the portfolio level increased 2.5 times, surpassing pre-COVID levels by over 16% in Jun23 while Footfalls have normalized to 100%. We expect the rental trend of Jem to stabilize in 2H23, while 313@somerset's rental is projected to gradually increase as international visitors return.

+ Portfolio occupancy stays at 99.9% as of Jun23 and tenant retention at 82.4%. Thanks to healthy operating metrics, the portfolio valuation experienced a 1.4% uplift, driven by Jem (+2.5% YoY) and 313@somerset (+4.0% YoY). The Sky Complex in Milan was the main setback (-9.2% YoY), attributed to a 0.75% increase in the terminal cap rate due to inflation and rising interest rates.

The Negative

- Gearing nudged up to 40.6% (+1.3% QoQ) upon completion of the Parkway Parade (PP) acquisition (7.7% stake). Rising borrowing costs are expected to continue into FY24e. LREIT has already refinanced the €285m Loan in Aug23, which accounts for one-third of its total borrowing. With the new rate taking effect, the interest rate for FY24e is expected to be around 3.5%.

Lendlease Global Commercial REIT – Resilient performance

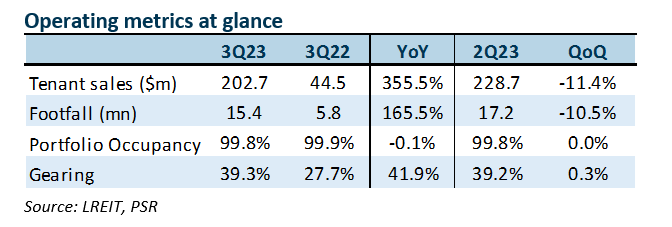

- No financials provided in this operational update. Portfolio occupancy remained stable at 99.8% QoQ but experienced a slight drop of 0.1% YoY. With higher rental reversion in retail, 3QFY23 reversions of c.3.3% improved from 1HFY23’s c.2%.

- Tenant sales at 313@Somerset and JEM are still trending above pre-Covid levels, c.15% and c.20% higher respectively. Cost of debt currently at 2.51% (+0.16% QoQ and +1.53% YoY).

- Maintain Buy with unchanged target price of S$0.91. We expect the organic growth from the additional GFA, higher positive rental reversion from the retail and onboarding of Live Nation to potentially offset the headwinds in borrowing cost. There is also an estimated S$5bn of assets in the pipeline from the sponsor.

The Positive

+ Retail recovery on track. Tenant sales have increased by 355.5% YoY at the portfolio level due to acquisition of Jem. Despite the slow return of Chinese tourists, tenant sales were still at c.120% of the pre-pandemic level since 80-90% of the sales are contributed by local demands. Portfolio occupancy remained strong at 99.8% (-0.1% YoY). As only 1.4% of leases expire in FY23, we expect the occupancy rate to remain stable. The retail side generated a positive rental reversion of 3.3% (+1.3% QoQ) while office rental escalation remained unchanged at 4%. With higher sales driving occupancy cost below average by c.3-5% at the portfolio level, there is still upside for the rental reversion.

The Negative

- The cost of debt has increased to 2.51% (+0.16% QoQ, +1.53% YoY). After the refinancing of the €285m loan in FY24, we expect the overall cost of debt to increase to c.3% and further deteriorate the adjusted interest coverage ratio (ICR) to c.2.1x. The gearing ratio is 39.3% (+0.1% QoQ, +11.6% YoY). As 61% of the borrowing is hedged for the next 18 months and there will be no refinancing risks till FY25, we expect the gearing to remain at its current level.

Outlook

In order to maintain gearing, we believe inorganic growth is unlikely unless LREIT is willing to take equity fundraising. However, there are still catalysts generated by organic growth, such as the additional 10,200 GFA at 313@Somerset. Upon full deployment, this could lift the NPI by 2-3%. We also expect rental reversion from the retail side to remain positive.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report