LHN Ltd – Realising more value

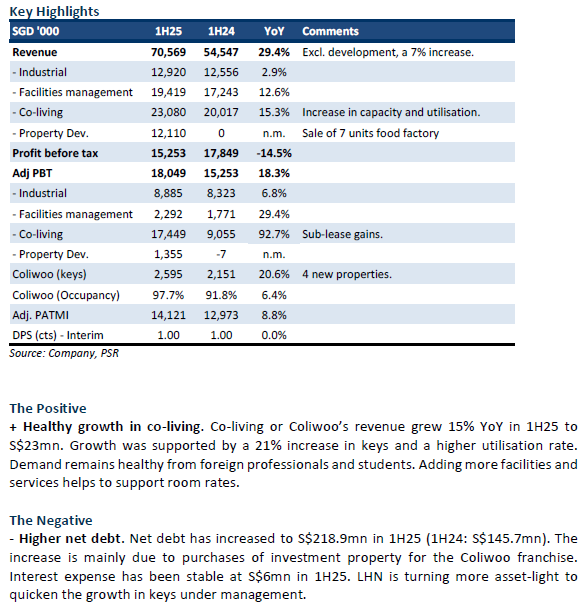

· 1H25 results were within expectations. 1H25 revenue and PATMI were 53% and 40% of our FY25e forecasts, respectively. Growth was driven by a jump in co-living and the sale of food factory units. Coliwoo keys increased 20% YoY to 2,593 units. The interim dividend was unchanged at 1 cent.

· LHN is trading at a 20% discount to its book value of S$0.634. We view the proposed spinoff of Coliwoo on the SGX Mainboard as a positive development, it will better realize the underlying value of the franchise. The additional capital and asset-light model can accelerate the growth of the franchise, especially overseas. If the listing is via the issuance of new shares, there is unlikely to be a special dividend by LHN. However, the plan to dispose of and lease back three freehold properties, we believe, is an avenue for special dividends.

· We maintain our FY25e earnings and BUY recommendation. We raised our target price to S$0.61 (prev. S$0.56) as we nudge up valuations from 6.5x to 7x PE. A discount to peer hospitality groups. The growth outlook remains intact for Coliwoo, with a pipeline of 428 additional keys (or 16%) under renovation. This excludes any future contracts secured for healthcare accommodation.

LHN Ltd – A year for harvesting

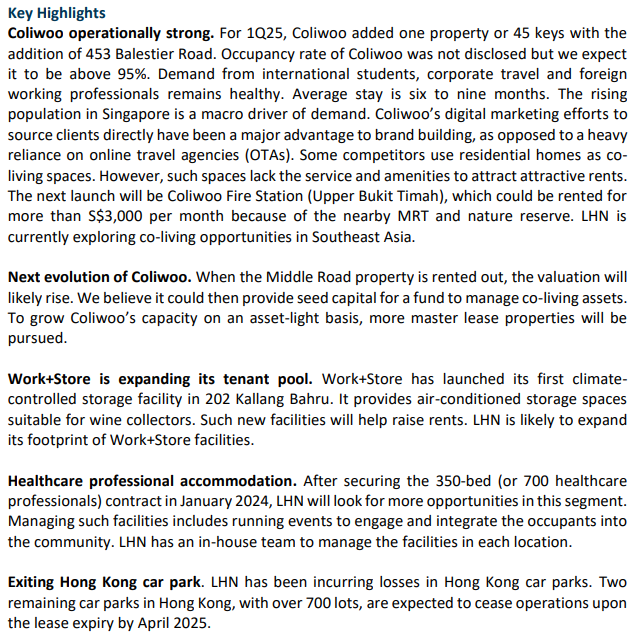

- Operational metrics for 1Q25 were healthy. The occupancy rate of over 95% for all the properties, an additional 45 keys for Coliwoo to 2,586 keys and securing 29 new facilities management contracts. LHN food chain factory has been launched and sales of the 49 units are underway.

- LHN has three freehold properties up for sale. We believe the properties will be leased back and continued to be used as Coliwoo. Any gains could be returned to shareholders as special dividends.

- We maintain our FY25e earnings, target price of S$0.56, and BUY recommendation. We expect several monetisation efforts to be underway this year. It includes disposing of three properties, potential Golden Mile Car Park enbloc and unit sales of the LHN food factory. Any gains could be paid out as special dividends. Expansion in co-living capacity will be slower at 151 keys in FY25e. Growth will come in FY26e from the pending 210 keys in Middle Road, 150 keys in Armenian Street, and new healthcare accommodation. We believe the next evolution of the Coliwoo franchise is to become more asset-light and regional. Third-party funds could even be sourced and managed to expand faster and capture a large share of value created. The stock trades at a forward PE of 5.3x, dividend yield of 5.2% and 24% discount-to-book value of S$0.608.

LHN Ltd – Both capacity and occupancy rising

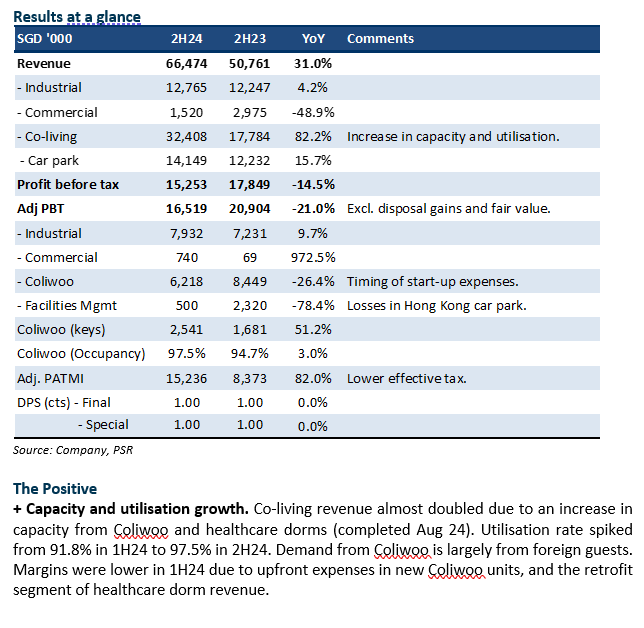

- FY24 revenue and adj. PATMI beat our expectations at 110%/119% of our FY24e forecast, respectively. Earnings beat expectations from lower administration expenses due to bonus provisioning and higher co-living revenue.

- Co-living remains the growth driver for LHN. The number of keys jumped 51% YoY to 2,541 (or +9.5% YoY excl. healthcare lodging). Occupancy climbed 3% points YoY to 97.5%. The strength of the Coliwoo brand is reflected by the estimated 70-80% direct sourcing of customers.

- We raise our FY25e earnings by 19% from lower administration costs and higher co-living revenue. Our target price is raised from S$0.42 to S$0.56 and the BUY recommendation is maintained. We peg our valuations to 6.5x FY25e P/E, a discount to the industry which is trading around 13x. Our valuations and forecast exclude the food processing development project, which we deem a one-off. Key earning drivers in FY25e are (i) Commencement of management fees from the 350 healthcare beds; (ii) Exit of loss-making Hong Kong car parks; and (iii) Sale of 49 food processing industrial units. FY26e will benefit from the addition of more than 330 Coliwoo keys. We believe LHN’s co-living franchise is expanding into healthcare accommodation, while the Coliwoo brand is enjoying premium pricing and recognition. The stock trades at a forward PE of 5.1x, dividend yield of 5.4% and 27% discount-to-book value of S$0.608.

LHN Limited – Co-living profits tripled, more growth expected

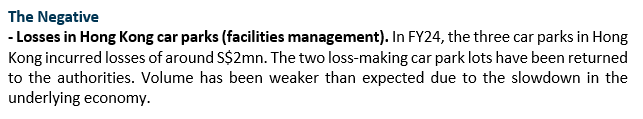

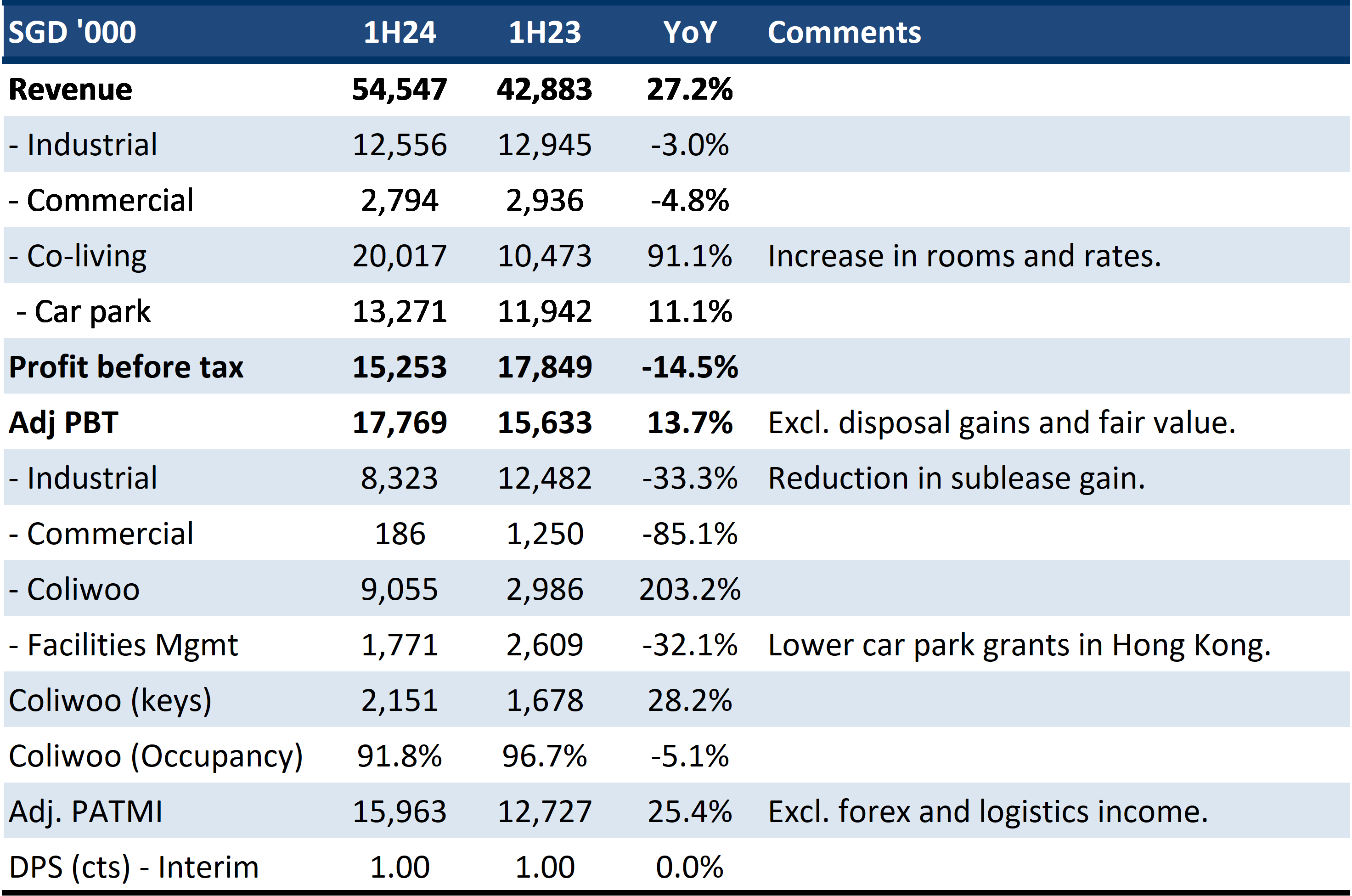

- 1H24 revenue was within expectations, but earnings exceeded. Revenue and adjusted PATMI were 51%/65% of our FY24e forecast, respectively. Margins for co-living were higher than expected due to the high occupancy and room rates.

- 1H24 adj. PATMI rose 25% YoY to S$16mn. Growth was driven by co-living revenue doubling and earnings tripled to S$9mn. The number of keys rose 28% YoY to 2,151, but occupancy dipped 5% points to 92%. We believe room rates rose around 70% YoY due to the commencement of Coliwoo Orchard and the overall health of the residential rental market. Coliwoo has also started to manage 3rd party properties. LHN targets to grow co-living by 800 keys every year.

- We raised our FY24e earnings by 7% to account for the better-than-expected earnings from Coliwoo. Our target price is raised from S$0.39 to S$0.42. We peg our valuations to 6.5x FY24e P/E, while the industry is trading around 13x. We expect growth to remain stable for LHN in 2H24, supported by stable room rates. FY25e will be a banner year of growth. The number of keys in co-living will expand by at least 900 (187 in Coliwoo GSM Building and 700 healthcare professionals). In addition, the sale of 49 food processing industrial units will be another one-off gain from the property development business. We maintain our BUY recommendation. The Coliwoo franchise is scaling up and expanding into 3rd party management contracts. The stock pays a dividend yield of 6% and trades at a PE of 5.2x and 40% discount-to-book value of S$0.55.

Results at a glance

The Positive

+ Stellar earnings for Coliwoo. Co-living profit before tax tripled in 1H24 to S$9mn. Revenue growth of 91% YoY to S$20mn was supported by 28% growth in keys to 2,151 and an estimated 70% jump in room rates to S$1,900 per month. The commencement of the 411 keys in Coliwoo Orchard in Feb 23 was a major boost to room rates. The residential rental index in Singapore is up 33% over the past 2-years but has started to stabilise.

The Negative

- Weaker facilities management earnings. Facilities management earnings declined 32% YoY to S$1.7mn despite revenue growth of 14% YoY to $17.2mn. The number of car parks under management rose from 74 (~20k lots) to 81 (~25k lots). We believe the margin weakness was due to a loss of government grants. Nevertheless, the number of car park lots will grow with the recent contract award of another 900 car park lots.

LHN Limited – Another growth driver emerges

- In the 1Q24 update, no financials were provided, but LHN reiterated that the occupancy of their portfolio of assets (industrial, commercial, co-living) is over 90%. The two major projects, 55 Tuas South and GSM Building, are proceeding as scheduled.

- On 25 January, LHN secured two sites to provide accommodation for 700 public sector healthcare professionals (mainly nurses and allied health professionals). Operations will commence in 2H24. We believe LHN’s advantage in securing this project is its operational experience in the co-living sector.

- We maintain our forecast and BUY recommendation. Our target price of S$0.39 is unchanged. We peg our valuations to 6.5x FY24e P/E, while the industry is trading around 13x. Earnings visibility has improved as planned projects are underway and occupancy rates remain vibrant. We view the healthcare accommodation project as a new growth driver. Margins are unclear, but the project is capital light as the authorities provide the premises. Eleven more potential sites may be tendered out.

Key Highlights

- Strong occupancy over 90%. All three assets—industrial, commercial, and coliving—enjoyed over 90% occupancy as of 31 December 2023. The two-week-old and 15th co-living property, Coliwoo Hotel Pasir Panjang, has already achieved 60% occupancy. A larger proportion of tenants are foreigners, mainly professionals and students. The average length of stay is 6 to 9 months. The 15 industrial properties are also 90% occupied with stable rents due to the current demand and supply conditions.

- Major planned projects are proceeding well. The two upcoming major projects 55 Tuas South and GSM building are developing as scheduled. 55 Tuas was purchased for S$21mn and to be developed into a 49-unit food factory or central kitchen for sale. Completion by August 2024. GSM Building was purchased for S$80mn and can be developed into 187 rooms for co-living with 1 floor commercial. Possible commencement is 2Q25.

- A new growth driver emerges. On 25 January, LHN secured the contract with MOH Holdings (holding company for Singapore's public healthcare institutions) to design, retrofit, and operate two lodging facilities for healthcare professionals at 100 Ulu Pandan Road and 60 Boundary Close. It will house 700 healthcare professionals and start operations 2H24. LHN secured two of the five tendered sites. A joint venture between The Assembly Place and the TS Group secured the three other sites to house 1,180 healthcare professionals. There is potential for another 11 sites once MOH monitors the usage of the current five sites. Around 58,000 healthcare professionals (nurses, allied health professionals, and support care) operate hospitals, clinics, and eldercare centres in 2022. The Ministry of Health estimates that this will need to grow to 82,000 by 2030.

Maintain BUY with unchanged TP of S$0.39

Our valuations are pegged to 6.5x FY24e P/E, while the industry trades around 13x. LHN is trading at 5.6x PE, a 37% discount to its book value of S$0.53.

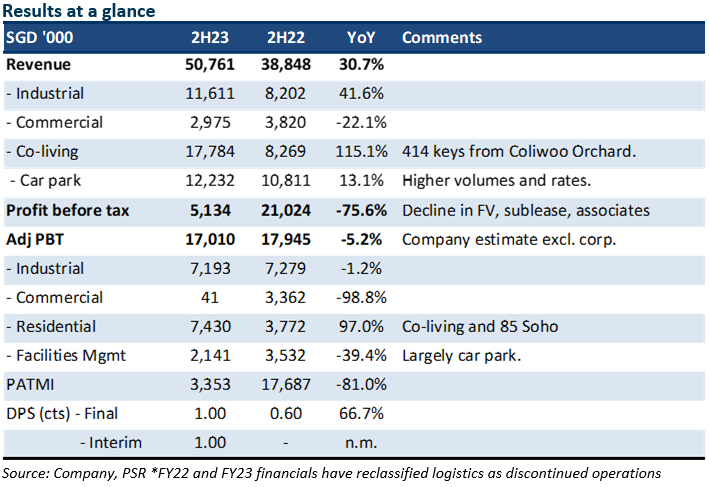

LHN Ltd – Co-living revenue doubles

- 2023 revenue was within expectations, but earnings were below expectations. Revenue and adjusted PATMI were 98%/90% of our FY23e forecasts (excluding logistics). 2H23 adjusted PBT was 5% YoY lower due to reduced sublease gains in the commercial segment.

- Co-living revenue and earnings jumped an estimated 115% and 97% YoY, respectively in 2H23. A special dividend of 1 cent was announced from the S$18.1mn gain from the disposal of LHN Logistics. Bulk of the proceeds will be redeployed to expand the co-living franchise in Singapore with a target of 800 keys p.a. for three years (or 30% CAGR).

- We lower our FY24e earnings by 24% following the disposal of LHN Logistics. Consequently, our target price is reduced from S$0.47 to S$0.39. We peg our valuations to 6.5x FY24e P/E, while the industry is trading around 13x. Growth for LHN in FY24e will be driven by the Coliwoo expansion of 347 keys in the pipeline in Singapore and potential overseas expansion. FY25e earnings will be supported by a food factory development project worth an estimated S$70mn. We maintain BUY. LHN is scaling up its co-living franchise and brand name in Singapore. The stock pays a dividend yield of 6%, and trades at a 39% discount-to-book value of S$0.53.

The Positive

+ Strong growth in co-living. Co-living revenue more than doubled to S$17.8mn. Growth was driven by the new 411 key Coliwoo Orchard, launched in Feb 23. Room rates have been rising for Coliwoo and occupancy remains high at 94.7%. We expect 1H24 growth will be driven by Coliwoo Orchard and additional new projects, 404 Pasir Panjang (63 keys) and 48 & 50 Arab Street (26 keys). Both assets will be operational in 2Q24.

The Negative

- Lumpy commercial earnings. 2H23 PBT for commercial declined significantly due to lower gains from sublease. Such gains are lumpy and represent the fair value of the remaining lease of the asset once tenanted. Commercial recognised a S$5.8mn upfront gain in FY22, based on pre-IFRS 16 reconciliation.

Outlook

We expect another year of growth for LHN in FY24e

- Residential: Co-living growth will stem from 411 Coliwoo Orchard contribution in 1H24, an additional 347 new keys (Figure 1) and firm rental rates in Singapore

- Facilities management: Growth in car park usage and new locations will be a driver to revenue. LHN currently manages 80 car parks (including 1 in Hong Kong), with over 26,000 parking lots.

- Industrial: Supply is tight due to difficulty in obtaining approval to sublet space. LHN’s work plus store concept catering to small and medium e-commerce operators will enjoy healthier demand.

- New areas: Other potential growth opportunities include co-living projects around the region and management of healthcare dorms.

The sale of 49 units of the food factory development project in 55 Tuas South Ave 1 will be the major engine for earnings growth in FY25e. Our forecast does not incorporate these development earnings.

Maintain BUY with lower TP of S$0.39 (prev. S$0.47)

We maintain a BUY with a lower TP of S$0.39. Our valuations are pegged to 6.5x FY24e P/E, while the industry is trading around 13x. LHN is trading at 5x PE and a 39% discount to book value of S$0.53.

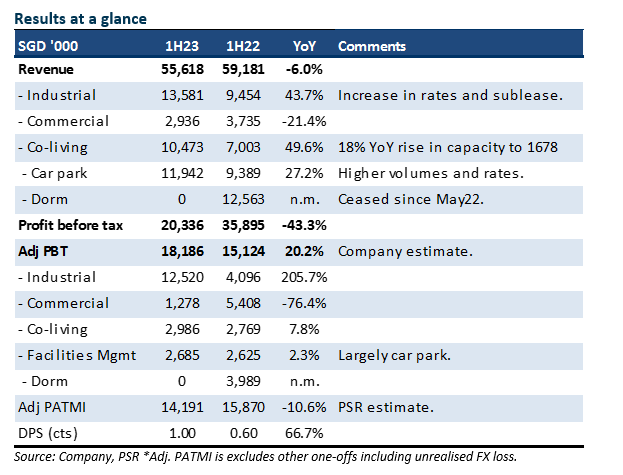

LHN Limited – Growth from new capacity

- 1H23 earnings was within expectations. Revenue and adjusted PATMI were 45%/48% of our FY23e forecasts. 1H23 adjusted PATMI declined 11% YoY to S$14.1mn due to the completion of a worker dormitory contract in May22.

- Co-living and car park revenues jumped 50% and 28% YoY respectively in 1H23. The interim dividend was raised 67% to 1 cent, implying an annualised yield of 6%.

- 2H23e earnings growth will be supported by: 1) additional 516 keys of co-living capacity; and 2) Expansion of 2,800 car park lots. Meanwhile, FY24e will benefit from 3) commencement of a new ISO Tank Depot; 4) launch of food factory development project. Our FY23e earnings is unchanged. We maintain a BUY with an unchanged TP of S$0.47. Core business valuations are pegged to 6.5x FY23e P/E, while the industry is trading around 13x. LHN is trading at 4x PE and a 28% discount to book value of S$0.487.

The Positive

+ Growth in co-living and car park. Co-living revenue surged 50% to S$10.4mn. The improvement came largely from higher room rates and a new 105 keys Coliwoo Lavender (opened in Sep22). The 411 key Coliwoo Orchard started only in Feb23. And contribution in 1H23 has been minimal. Car park revenue rose on the back of increased volumes. This was despite the number of car parks remaining flat at 74 (or ~21,500 vehicle parking lots).

The Negative

- Higher interest expense due to expansion. Interest expense almost doubled to S$4.4mn in 1H23 due to higher interest rates and an increase in net debt to S$144mn (1H22: S$98mn). The rise in debt was due to acquisition of 404 Pasir Panjang and 48 Arab Street. Other options for LHN to de-gear include monetising its properties. A further source of recycling capital is the completion of the 55 Tuas food factory project, where strata units will be sold.

LHN Limited Building a real estate franchise with scale

- We visited LHN’s recently launched 411 keys co-living property in Orchard. The new project will raise LHN co-living capacity by around 40%.

- Co-living is a product with a flexible lease to serve the medium-term residential lease market. It fits in between tenants requiring longer stays than a hotel and shorter than a rented apartment. It is more affordable than service apartments with an added community experience.

- No change to our FY23e forecast. Coliwoo is a major earnings driver for LHN in FY23e. Capacity over FY21-FY23e is expected to double to around 1,600 keys. The current pipeline is 2,500 keys. Coliwoo Orchard can generate more than S$15mn in revenue, doubling FY22 co-living revenue. We maintain a BUY with a lower TP of S$0.47. Core business valuations are pegged to 6.5x FY23e P/E, while the industry is trading at 13x. The stock is also trading at 38% discount to book value of S$0.455 with a dividend yield of around 6%.

Highlights

- Demand is healthy with a waiting list. Since launch, the take-up rate has been encouraging. The good location near Orchard MRT and access to shopping, entertainment and Mount Elizabeth hospital will cater to a wide mix of tenants. Rental per month is more than S$3,000. This is compared with surrounding area apartment rents of around S$5,000 per month with a 1-2 year commitment. Another advantage of co-living over rental apartments is the ability to occupy immediately with all available utilities including internet, etc.

- Riding on the strong rental market. Co-living will benefit from the buoyant rental market. The residential rental index is up 30% in 2022 and the re-opening of borders will further boost demand. The breakdown of tenants is around 70% foreigners, 20% locals and 10% students. LHN conducts direct marketing to corporates and nearby hospitals in addition to other marketing channels such as the internet, social media and property agents.

- Optimising space, sustainability driven and asset light. After taking over the previous Fraser Residence, LHN drew on its sustainability-driven method to optimise the rental space without having to demolish and reconstruct the building. From the previous building’s 72 units, 135 units with 411 keys product was created. LHN has built its chain of Coliwoo properties on a master lease basis.

- Multiple attractions. Every unit comes complete with an attached bathroom, queen bed, TV, washing machine, kitchenette and refrigerator. Housekeeping of the unit is done once a week. The average daily rate per night is $200 compared to nearby service apartments that are close to S$400.

- Other co-living operators in Singapore. The other co-living operator includes lyf (Ascott), YOLOLive, Hmlet, Login Apartment (Shanghai), COVE, CP Residences and Commontown (S Korea).

Maintain BUY with unchanged TP of S$0.47

We maintain a BUY with an unchanged TP of S$0.47. Valuations are attractive at 4x PE and a dividend yield of 6%. The two major earnings drivers will be the expansion of the Coliwoo footprint across Singapore and the completion of a new ISO depot by mid-2023.

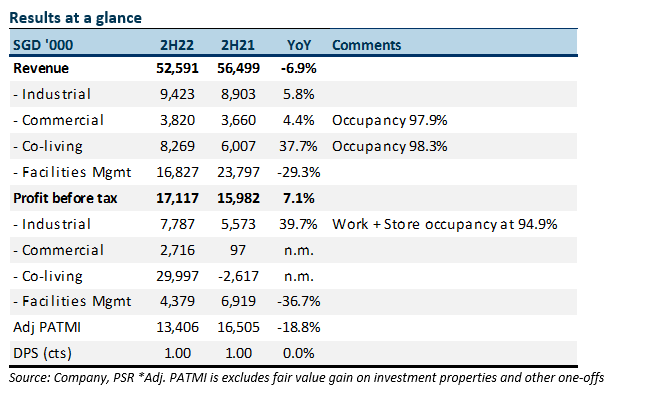

LHN Limited – Co-living the growth driver

- FY22 revenue and adjusted PATMI was 91%/100% of our FY22e forecasts. 2H22 adjusted PATMI declined 19% YoY to S$13.4mn due to the absence of worker dormitory earnings.

- Co-living revenue continues to grow strongly with 38% YoY growth in 2H22. Growth was driven by an estimated 25% growth in rooms and a mid-teens rise in room rates.

- Earnings in FY23e will be supported by an estimated 60% expansion in co-living capacity (under Coliwoo brand) by 600 rooms to around 1,600. The new 411 units in Mount Elizabeth will be one of the largest sites for Coliwoo. The absence of dorm earnings will be a drag in 1H23. We maintain a BUY with lower TP of S$0.47 (prev. S$0.51) due to decline in valuations of listed LHN Logistics (LHNL SP, Not Rated). Core business valuations are pegged to 6.5x FY23e P/E, while the industry is trading at 13x. Stock is also trading at 35% discount to book value of S$0.455 with a dividend yield of around 6%.

The Positive

+ Co-living riding on surge in rental rates and capacity. Co-living revenue jumped 38% YoY from higher rental rates and a 25% rise in room capacity in FY22e. New capacity additions were 320 Balestier Road, 75 Beach Road, 115 Geylang Road and a JV properties at 40 and 42 Amber Road and 471 Balestier Road. Fair value gains caused a spike in PBT for co-living.

The Negatives

- Facilities management dragged down by dormitory. Facilities management earnings dropped 37% YoY in 2H22 to S$4.4mn. The decline was due to the exit of the dormitory business in mid-2022. The drag from dorm earnings will persist into 1H23.

- Rise in net debt from investment properties. Net debt has risen from S$63mn to S$107mn in FY22. The increase in net debt was due to S$53mn invested in investment properties. We expect stability in FY23e cash-flows, as the focus will be on launching and raising occupancy levels of Mount Elizabeth Coliwoo. Bulk of the debt is on fixed rates for the next two years.

LHN Limited – Maintaining strong occupancy levels

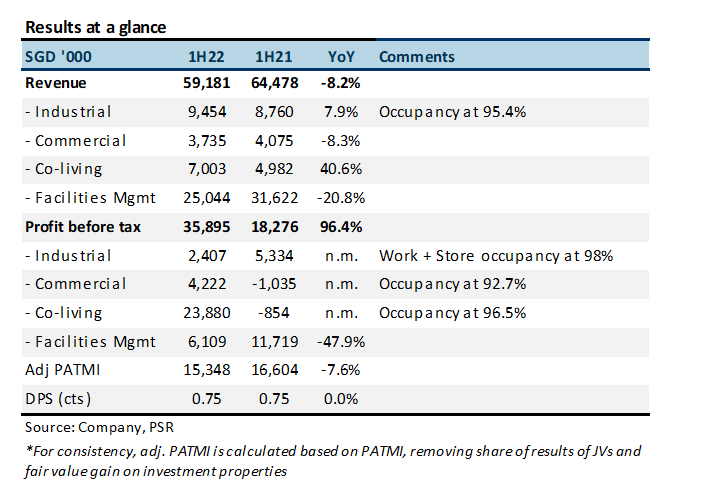

- 1H22 results within expectations, with revenue and adjusted PATMI at 46%/55% of our FY22e forecasts. Excluding one-off items, adjusted PATMI was down 7.6% YoY.

- Co-living is the major revenue driver, up 40.6% in 1H22. We expect the number of rooms to double over the next two years.

- Maintain BUY with a higher TP of S$0.51, from S$0.49. FY22e forecasts remain largely unchanged. Valuation for all business segments except for LHN Logistics (LHNL SP, Not Rated) is pegged to 6.5x FY22e P/E, while the industry is trading at 13x. This gives us S$0.40/share. We add another S$0.11/share from the market value of its listed subsidiary, LHN Logistics. We build in a 20% discount buffer to account for any volatility in its share price.

The Positive

+ Co-living (Coliwoo) is main driver of revenue and profit growth. Co-living revenue was a record S$7mn. This was due to full half-yearly revenue recognised from the property at 1557 Keppel Road, which turned operational in 3Q21. Two other properties, including 320 Balestier Road, and a JV property at 40 and 42 Amber Road commenced operations in 1H22. Profit of S$23.9mn in 1H22 was mainly due to fair value gain on investment properties of S$10.8mn and on JV investment properties of S$9mn.

The Negatives

- Lower revenue from commercial properties and facilities management. Revenue from commercial properties decreased but profit was higher. This was due to the disposal of loss-making properties. Revenue from the carpark business under facilities management continues to perform well, but overall revenue dropped due to lower demand for dormitory management services.

- Higher net debt. In 1H22, LHN recorded net debt of S$97.9mn, which is up 51% from S$64.6mn in 2H21. Long-term bank borrowings were up 28% to S$115.4mn, mainly used to finance the acquisition of the property at 55 Tuas South Avenue 1, renovation and working capital for the co-living business.

Other updates

Strong demand for industrial properties. The Work Plus Store outlets are seeing full occupancy, as demand from e-commerce business owners remains strong. The online retail sales proportion remains elevated at an average of 16% in the first quarter of 2022.

According to Edgeprop, industrial rents in Singapore climbed 1% in the first quarter of 2022, which marks the sixth consecutive quarter of rental increase. Industrial leasing demand is expected to be strong, as demand for logistics remains high, combined with tight supply. Supply chain disruptions and demand for storage requirements from semiconductors, pharmaceutical and biomedical sectors are expected to remain strong.

In 1H22, occupancy rate for LHN’s industrial properties inched up 1.9 ppts to 95.4%.

Aggressively expanding Coliwoo portfolio. LHN continues to ride on the promising prospect of the residential rental market in Singapore. Despite hitting a seven-year high, the local private residential property rental index has continued rising, and by 12% YoY in the first quarter of 2022. Amidst the various options, LHN provides flexible and affordable residential offerings. As the Singapore borders reopen, we are expecting stronger demand from expats and international students returning to the country.

In 1H22, the property at 320 Balestier Rd, and a joint venture property at 40 and 42 Amber Road have commenced operations. There are four other residential properties expected to commence operations in 2H22 under the Coliwoo co-living portfolio. In FY22, we expect the six properties to add 250 keys in total, which implies an increase of 30% on a full-year basis.

LHN has also entered into a master lease for a block of serviced residences at 2 Mount Elizabeth Link, Singapore. The company expects operations at this property to commence in 1Q23, which would be adding 411 keys to the portfolio. We are expecting the number of keys to increase by 50% in FY23.

From FY21 to FY23, the number of keys is expected to double.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report