Keppel Ltd – Earnings growth is more visible

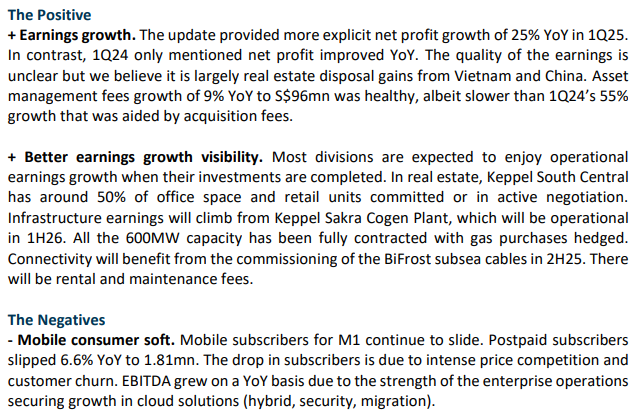

- Limited financials were provided except 1Q25 net profit was up 25% YoY. Growth was driven by infrastructure and real estate. Not disclosed was the contribution of valuation gains in net profit.

- Asset management fees grew 9% to S$96mn, supported by S$1.6bn of equity raised. Asset monetised has been S$347mn YTD. No change to the S$10-12bn monetisation target (cumulative: S$7.2bn). Part of the monetisation will include 63.36mn Seatrium shares available for sale from end Mar25.

- We maintain our FY25e forecast. Our SOTP-derived TP of S$8.00 and BUY recommendation is unchanged. There is improved visibility of (operating) earnings growth from 2H25 onwards from several projects namely leasing of Keppel South Central, commissioning of Bifrost cables and Keppel Sakra Cogen Plant.

Keppel Ltd – Rewarded as the company transitions

- FY24 adjusted PATMI was above expectations at 110% of our FY24e forecast. Adjusted PATMI declined 4.9% YoY to S$357mn. Losses in the real estate division stabilised but infrastructure was weaker than expected due to lower contributions from KIT and MET. Management is reiterating their target of S$10-12bn asset monetization by end 2026. Currently, S$7bn has been completed. The pool to monetize is at least S$17.5bn.

- We nudge our FY25e earnings by 2% from higher asset management income. Our SOTP-derived TP is raised to S$8.00 (prev. S$7.60). Our BUY recommendation is maintained.

- We expect lacklustre earnings in FY25e from muted real estate sales, competitive mobile markets, and softer renewable earnings. Vessel sales in assetco can materialise as charter income as cash flow builds up. Operating earnings will be strong in FY26e as the new Keppel Sakra Cogen power plant and Bifrost cables are operational. Keppel pays an attractive yield of 5% as the company transitions into an asset manager leveraged on data centre infrastructure and operations rollout through its fund management, renewable energy, cooling and subsea cable operations.

Keppel Ltd – Surfing the huge data centre wave

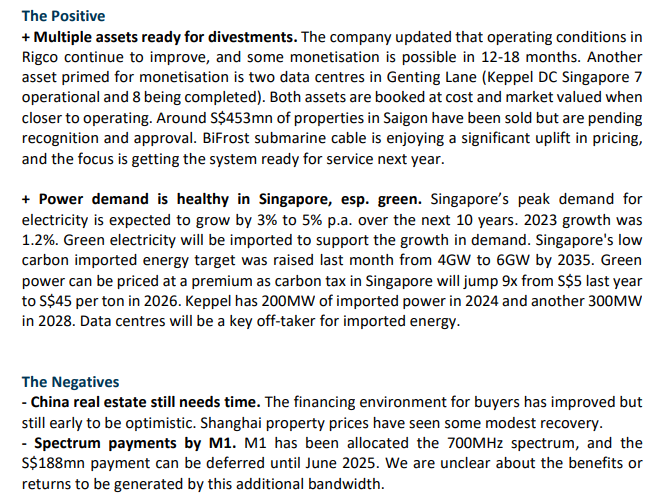

- Limited financials provided except 9M24 net profit comparable YoY. We believe 3Q24 net profit declined due to lower real estate earnings. Monetisation more than doubled by S$453mn to S$733mn.

- The huge wave in data centre demand has catalysed multiple growth drivers for Keppel: 1) Around S$10bn of funds under management are available for greenfield data centres; 2) Prices for Bifrost transmission cable has more than doubled; 3) Imported green power into Singapore will more than double; 4) Huge demand from commercialisation of two data centres in Genting Lane. There are both divestment gains and long-term recurrent asset management, operations and maintenance fees from these opportunities.

- No change to our FY24e forecast and SOTP-derived TP of S$7.60. Our BUY recommendation is unchanged. Asset monetisation target of S$10-12bn from 2020 to end-2026 has not changed (or another S$4-6bn). Leading the asset sale is Rigco where operation conditions continue to improve. In the medium term, we believe the surge in data centre demand in driving demand for power in Singapore, more funds under management and raised the valuations of its greenfield submarine and data centre assets.

Keppel Ltd – Real estate and legacies depressed earnings

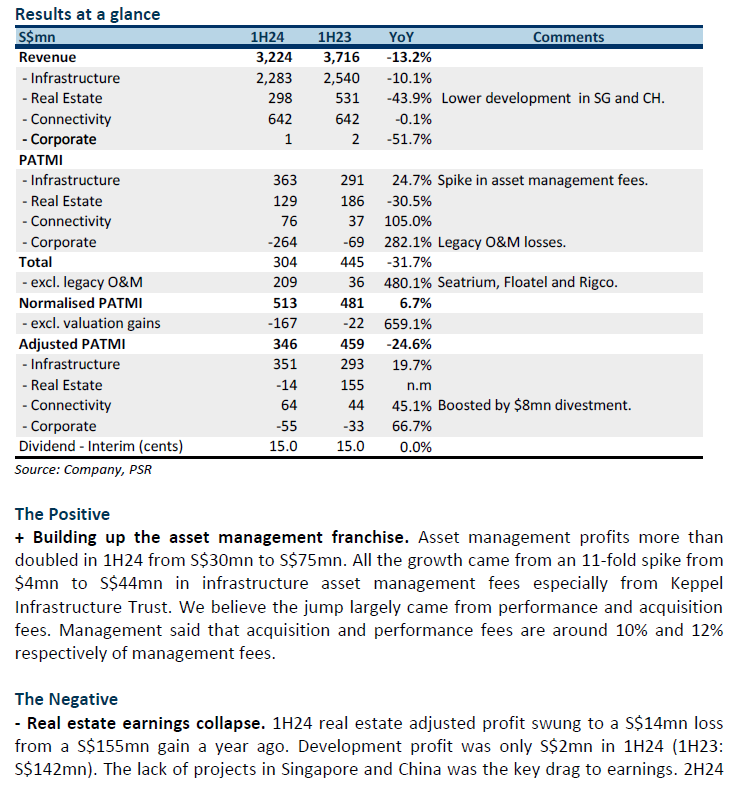

- 1H24 revenue and adjusted PATMI was below expectations at 42%/37% of our FY24e forecast. Adjusted PATMI declined 25% YoY to S$346mn due to losses in the real estate division. Headline earnings was dragged down by legacy assets including fair value losses at Seatrium, Rigco notes receivables and Floatel associate losses.

- Asset management profits more than doubled in 1H24 from S$30mn to S$75mn. All the growth came from an 11-fold jump in fee income from the infrastructure division largely due to Keppel Infrastructure Trust's performance and management fees.

- We cut our FY24e revenue forecast by 12% and earnings by 20% to account for the weakness in real estate and associate earnings. Our SOTP-derived TP is lowered to S$7.60 (prev. S$7.98) as we raise the RNAV discount on the property division. We upgrade from ACCUMULATE to BUY due to recent share price weakness. Keppel is building an operator-run infrastructure and real estate management global franchise. Funds under management have grown 13% YoY to S$60bn, excluding the additional S$25bn from Aermont. Operationally, we expect earnings to be under pressure from the decline in property development sales. The key share price driver will be the monetisation of Rigco and Floatel.

Keppel Ltd – A slow quarter

- Little financial details were revealed in this update. Revenue was S$1.5bn in 1Q24, down from S$1.6bn in 1Q23. Net profit was higher YoY if the impact of the disposed offshore and marine assets were excluded. The real estate segment underperformed.

- The pace of asset monetisation slowed in this quarter. Only S$169.9mn (FY23: S$947.4mn) was achieved, which includes the divestment of the Wuxi landbank for S$161mn.

- Net gearing hovered at 0.9x (Dec 23: 0.9x), suggesting muted operating cash inflow while capex is kept low. With its asset-light strategy, investments are made through funds under management and not through its balance sheet.

- Maintain ACCUMULATE and SOTP-derived TP at S$7.98. A near-term share price catalyst could be a potential redemption of the notes receivables.

Highlights

The Negatives

The pace of asset monetization was slow. S$169.9mn was unlocked (FY23: S$947.4mn), which included the proposed divestment of a residential landbank in Wuxi for S$161.6mn. The total value unlocked from the monetisation programme since 2020 is S$5.5bn. It maintains the monetisation target of 10-12bn by 2026.

- Net gearing hovered at 0.9x at end-Mar 24 (Dec 23: 0.9x), suggesting slow cash inflow. The average cost of debt was 3.81% (FY23: 3.75%). About S$2.4bn (22% of total debt) is due this year and S$400mn 2.9% perpetual securities are due for reset/refinance in Sep 24. Management expects cost of debt to be maintained at 3.81% when these are refinanced.

The Positives

+ It received S$71.3mn from Asset Co, which holds the legacy rig assets. The rigs are fully deployed on bareboat charters, buoyed by stronger offshore and marine activities. We believe these rigs could be monetized in the near term, which could return S$3.1bn cash to Keppel when the notes receivables from Asset Co are redeemed.

+ Fees from asset management grew 52% to S$88mn (FY23: S$283mn). About 90% of this is recurring. About S$436mn in equity was raised YTD (FY23: S$5bn). It has 19 active private funds currently and plans to launch three new funds for data centres, education assets and private credit in 2024.

Keppel Ltd – Energy buttressed bottom line

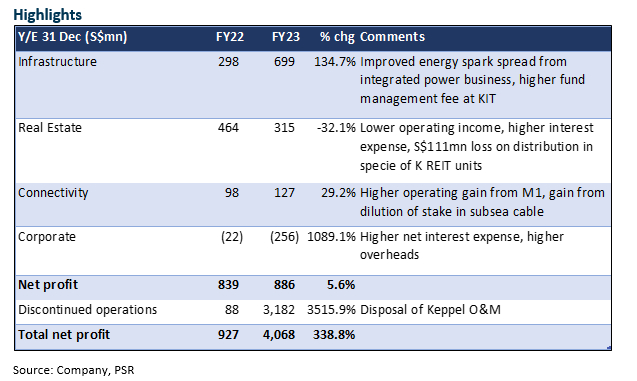

- FY23 core net profit grew 5.6% YoY, in line with our expectations. Recurring income grew 54% to S$773mn, or 88% of net profit. Infrastructure made up 90% of this.

- Growth was underpinned by a higher margin from energy sales, offset by the doubling of interest expense to S$328mn, and S$111mn loss on distribution of K Reit units to Keppel shareholders.

- Energy earnings are sustainable, with 60% of capacity locked in on long-term contracts for more than 3 years. A lower interest rate environment could rejuvenate M&A and fundraising, lifting funds under management. The sale of the rigs in AssetCo could return S$3.1bn to the group, we estimate.

- Downgrade to ACCUMULATE from BUY on recent share price gains. We raised FY24e net profit projections by 0.4%. Our SOTP-derived TP is revised higher to S$7.98 (prev S$7.52), as recurring income takes a bigger share of net profit.

The Positives

+ Integrated power business doubled operating income and margins, benefitted from improved energy spark spread and exit from low-margined legacy contracts. 90% of its capacity is contracted for >1 year, providing visible and sustainable earnings. KIT contributed higher fees after a change in fee structure.

+ M1 grew revenue by 6%, after the acquisition of a Malaysian ICT in late 2022. Key drivers were higher enterprise customer sales (+27%) and total customers (+2%), and recovery of roaming services to 80% of pre-COVID.

The Negatives

- Real estate division was impacted by higher interest expense, lower fair value gains on investment properties and higher overheads at asset management units. The distribution of K Reit units to Keppel shareholders led to a S$111mn loss as the book value exceeded the market value.

- Recurring fee income from fund management fell 5.5% to S$86mn. About S$5bn new funds was raised in FY23. Investors’ appetite was muted amidst rising interest rates and tighter credit conditions. But the pace could pick up in FY24, as recently-acquired Aermont Capital extends its investor reach, and the interest rate environment turns favourable.

- Net gearing rose to 0.9x. Management has an internal net gearing threshold of 1x. Free cash flow was negative S$228mn. Net debt as at end Dec was S$9.7bn, at an average interest cost of 3.75%. Interest expense doubled to S$328mn.

Keppel Corporation Ltd – Stable energy sales, weak real estate markets

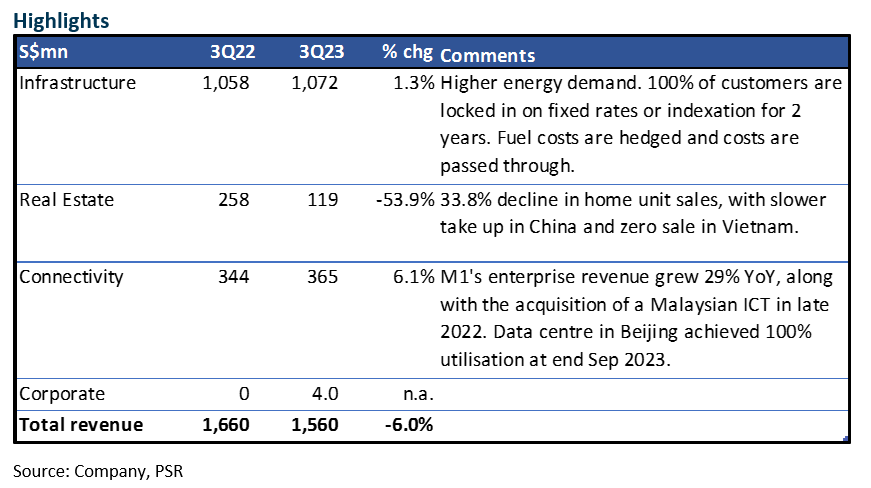

- 3Q23 revenue fell 6.0% YoY, dragged lower by weak property sales in China and India, after the rebound in 1H. 3Q23 net profit was higher YoY, but no financial detail was provided.

- The distribution-in-specie of 1 KREIT unit for every 5 Keppel shares has been approved by shareholders. This is equivalent to S$0.18 per Keppel share.

- Upgrade to BUY due to recent price correction. We maintain our earnings projections. After accounting for the KREIT distribution, our TP is revised lower to S$7.52 (prev. S$7.70).

The Positives

+ 3Q23 Infrastructure revenue grew 1.3% YoY, in spite of a volatile gas price and the implementation of temporary price control measures. 100% of its customers for integrated power sales are locked in on fixed rates, or indexed electricity price plans, for next 2 years. This provides stability to 68% of the group’s revenue. The fuel input costs are hedged, and costs are passed through, including the higher carbon taxes in 2024.

+ M1 expanded customer base by 7.2% YoY to 2,548. It grew enterprise revenue by 29.4% YoY, due to the acquisition of a Malaysian ICT in late 2022.

The Negatives

- Real estate 3Q revenue fell 53.9% YoY, as reflected in the weak property sentiment and rising interest rates. 3Q23 home unit sales fell to 260 units in China (1H23: 1,200 units) and 160 units in India (1H23: 870 units). No sales were recorded in Vietnam for this year.

- Net gearing rose to 0.89x from 0.86x at Jun 2023, after the distribution of interim dividend.

Keppel Corporation Ltd – Building strategic infrastructure assets

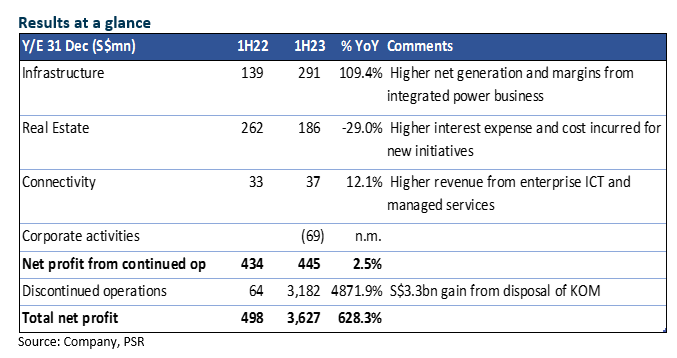

- 1H23 earnings were in line. Net profit from continuing operations rose marginally by 2.5% YoY, due to strong energy sales and spreads, which offset lower development and fair value gains from real estate, and higher interest expense.

- It booked S$3.1bn exceptional gain from the disposal of Keppel Offshore & Marine (KOM) and 2-month share of KOM’s loss. Distribution-in-specie of SembCorp Marine shares lowered equity by S$3.8bn (S$2.19/share).

- Proposed a distribution-in-specie of 1 Keppel REIT (KREIT) unit for every 5 Keppel Corp shares, equivalent to about S$0.18 per Keppel Corp share. Its stake in KREIT will reduce by 9.4% to 37%.

- Maintain ACCUMULATE and raised our TP to S$7.70, from S$7.01 previously. Keppel has garnered several leading-edge renewable energy projects that position it as a first-mover in the transition to new energy technology.

The Positives

+ Higher net generation and margins from integrated power business. 1H23 revenue and operating profit from sale of gas, utilities and electricity rose 65.7% YoY and 183% YoY, thanks to a surge in wholesale energy prices in 2Q. We estimate energy sale accounted for 60% and 68% of group revenue and net profit, respectively. More than 99% of their contracts are locked on fixed or indexed electricity price plans, hence the profit is sustainable.

+ Distribution-in-specie of KREIT units. Keppel proposed to distribute 1 KREIT unit for every 5 Keppel Corp shares, equivalent to S$0.18 per Keppel share, based on KREIT’s current share price. This will lower its stake in KREIT by 9.4% to 37%.

The Negatives

- Net profit from Real Estate fell 29%, due to lower development profit, and lower fair value gains on investment properties. Sentiment in the Chinese property market headed south in 2Q after a promising 1Q. Management sees an uncertain market ahead.

- Net gearing has risen to 0.86x (Dec 22: 0.78x). It recorded free cash outflow of S$732mn (1H22: outflow S$127mn), of which about S$470m net outflow was due to the divestment of KOM. As a group, interest expense rose 89.3% with average interest cost at 3.53%.

Keppel Corporation Ltd – Asset monetisation drives its valuation

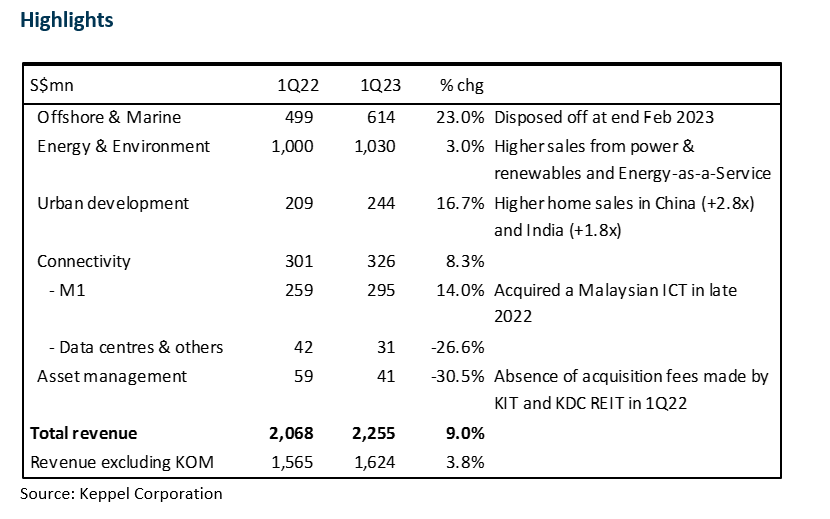

- 1Q23 revenue only rose marginally by 3% YoY, excluding the divested offshore and marine division. Urban development led the growth, driven by higher home sales in China and India. Net profit was only slightly higher.

- Disposal of Keppel Offshore & Marine resulted in a gain of S$3,300mn, but equity is reduced by S$3,845mn with the distribution-in-specie of SembCorp Marine (SMM) shares. Out-of-scope assets were sold to Asset Co in exchange for vendor notes, perpetual securities and a 10% equity stake, amounting to S$2.50/Keppel share.

- Downgrade to ACCUMULATE with a lower TP of S$7.01, from S$7.21 previously. Keppel plans to announce further transformation plans in May which could include more monetization initiatives to reach its goal of S$17.5bn.

The Positives

+ Urban development led the charge with 16.7% gain in sales. Keppel Land recorded 72% higher home sales to S$740mn, underpinned by strong China (+2.8x YoY to 830 units) and India (+1.8x YoY to 800 units). It has increased focus on trading projects, which have faster turnaround and require lower working capital. About S$280mn was raised from the disposal of 3 assets in the Philippines, Myanmar and Vietnam. We believe Keppel Land remains the key earnings driver. It accounted for 44.8% of FY22 net profit.

+ Higher sales of power, renewables and energy-related services under a subscription model. Energy and environment posted 3% growth in revenue to S$1.03bn. In addition to higher sales from power and renewable energy, Energy-as-a-Service (EaaS) offering has gained traction with > S$320m subscriptions secured. The tenure, however, is not disclosed. This covers services such as energy supply, cooling services, energy optimisation and analytics and electric vehicle charging. Renewable generation capacity grew 9% since end-2022 to 2.8GW, of which 65% is operational.

+ Disposal of Keppel Offshore and Marine resulted in a gain of S$3,300mn. It has also distributed S$3,845mn worth of SembCorp Marine shares (equivalent to S$2.19/Keppel shares) to its shareholders at end Feb. About 5% of SMM shares are still held in escrow, equivalent to S$0.237/Keppel share.

The Negatives

+ Net gearing has risen to 0.83x from 0.78x at end 2022, due also to lower total equity after the distribution-in-specie.

Keppel Corporation – SMM shareholders clear way for divestment

- Sembcorp Marine (SMM) shareholders have cleared the way for the proposed combination of Keppel O&M (KOM), voting overwhelmingly in favour of the acquisition.

- We believe the focus will now shift towards transforming its Urban Development business towards an asset-light model with a focus on growing its recurring income.

- Maintain BUY with unchanged SOTP TP of $9.54. Our TP translates to about 1.2x FY23e book value, a slight premium to its historical average as the Group’s transformation plans gain traction. Catalysts expected from a further transformation of its business towards an asset-light model.

The news

SMM shareholders have cleared the way for the proposed combination of KOM, voting overwhelmingly (95.28%) in favour of the acquisition.

Positives

+ Another step towards an asset-light business model. With SMM shareholders voting in favour of the acquisition, the completion of the KOM restructuring is expected to take place on or prior to 28 Feb 2023. We see the divestment of KOM, along with the divestment of Asset Co (previously approved by Keppel shareholders) as an important milestone for the Group as it continues its journey toward an asset-light model.

+ Focus shift towards transforming Urban Development business. With the divestment of KOM, we believe the attention will now shift towards the Group’s transformation of its Urban Development business. We believe the Group will pivot towards real estate-as-a-service solutions by having an asset-light model and one focused on strengthening its recurring income (67% of FY22 earnings).

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report