Keppel DC REIT – DPU growth despite the preferential offering

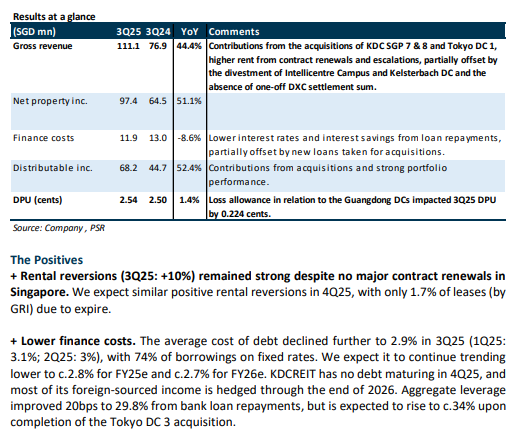

- 3Q25/9M25 DPU of 2.54/7.67 Singapore cents (+1.4%/+11.7% YoY) was in line with our expectations, forming 24/74% of our FY25e estimates. The YoY increase was driven by the acquisitions of KDC SGP 7 & 8 and Tokyo DC 1, stronger contributions from contract renewals and escalations, and lower finance costs. The 180.6mn new units from the preferential offering, listed on 22 Oct 2025 and entitled to distributable income from 1 Jul 2025, impacted DPU. Had the preferential offering not taken place, 3Q25/9M25 adjusted DPU would have been 2.74/7.87 cents.

- Portfolio occupancy remained stable at 95.8% QoQ. With no major lease renewals in 3Q25, rental reversions eased to 10% (vs. 51% in 1H25), still healthy. The 2.8% DPU accretive acquisition of Tokyo DC 3 is on track for completion by end-2025.

- We maintain NEUTRAL with a higher DDM-derived TP of S$2.40 (prev. S$2.33). We cut our FY25e DPU by 2% to reflect the impact of the preferential offering, but raised our FY26e DPU by 4% to reflect the expected full-year contribution from Tokyo DC 3 and lower interest rates. The potential recovery of >S$45mn in overdue rent from Bluesea remains a key catalyst, though still unresolved. We expect high single-digit rental reversions in 4Q25 for the 1.7% of leases expiring, with no major renewals in Singapore. The stock trades at an FY25e DPU yield of 4.3%.

Keppel DC REIT – Yet another quarter of exceptional rental reversion

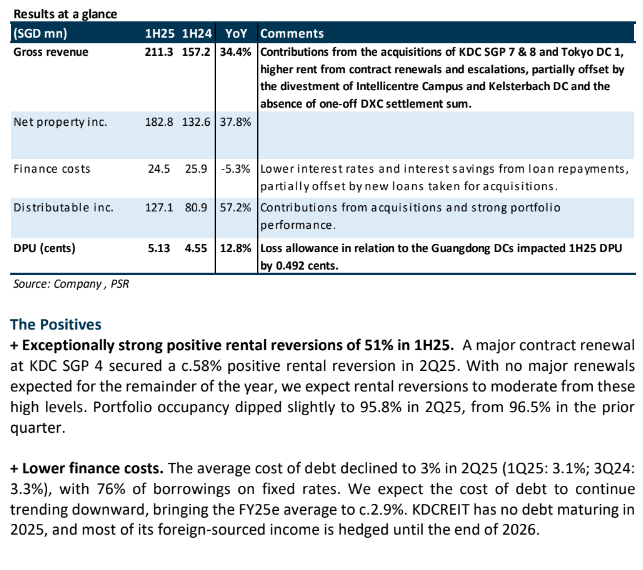

- 1H25 DPU of 5.133 Singapore cents (+12.8% YoY) was in line with our expectations, forming 51% of our FY25e estimates. The YoY increase was driven by the acquisitions of KDC SGP 7 & 8 and Tokyo DC 1, stronger contributions from contract renewals and escalations, and lower finance costs due to reduced interest rates and loan repayments.

- KDCREIT delivered another quarter of exceptionally strong positive rental reversions, achieving 51% for 1H25 (2Q25: c.58%). The bulk of the uplift stemmed from a major contract renewal at KDC SGP 4. There are no major contract renewals in 2H25, with just 2.6% of leases by GRI expiring. Gearing remains low at 30%, though it is expected to rise to c.35% with the planned debt drawdown to finance the land lease extensions for KDC SGP 7 and 8.

- We downgrade from ACCUMULATE to NEUTRAL with a higher DDM-derived target price of S$2.33 (prev. S$2.25) due to the recent share price performance. We raise our FY25e/FY26e DPU estimates by 2%/1% as we factor in stronger rent reversions in our forecasts. The collection of over S$40mn in overdue rent from Bluesea is a potential catalyst, although it remains unresolved. We expect rental reversions to moderate in 2H25, with no major contract renewals in Singapore, the only location capable of achieving >50% reversions, supported by supply constraints and strong demand. The stock is currently trading at an FY25e DPU yield of 4.5%. With the recent acquisitions, KDCREIT’s enlarged portfolio and market capitalisation have led to its re-entry into the Straits Times Index, effective June 23, 2025.

Keppel DC REIT – Accretive acquisitions power growth

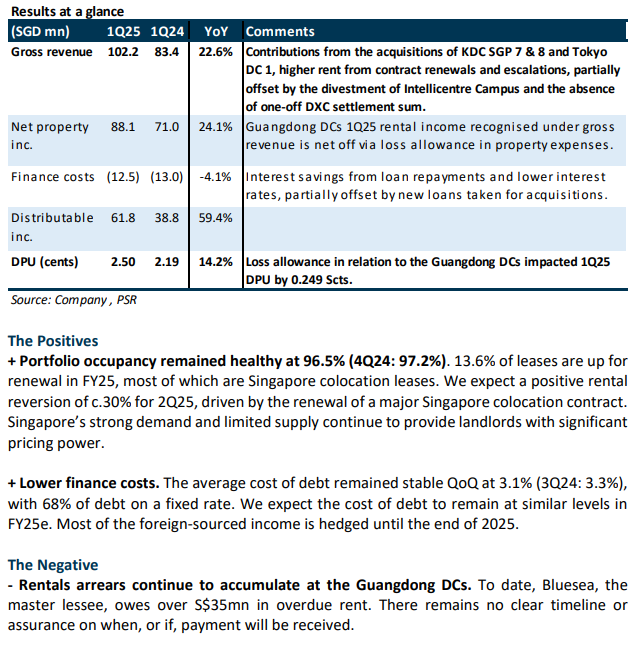

- 1Q25 DPU of 2.503 Singapore cents (+14.2% YoY) was in line, forming 25% of our FY25e estimates. The YoY growth in DPU was driven by the acquisitions of KDC SGP 7 & 8 and Tokyo DC 1, as well as lower finance costs from reduced interest rates and loan repayments.

- KDCREIT achieved healthy portfolio rental reversions of +7% in 1Q25, despite no major contract renewals during the quarter. Gearing improved to 30.2% following the completion of the divestment of Kelsterbach Data Centre in March 2025. It is expected to rise to c.35% with the planned debt drawdown to finance the land lease extensions for KDC SGP 7 and 8.

- We upgrade to ACCUMULATE with an unchanged DDM-derived target price of S$2.25 due to the recent share price performance. We expect rental reversions to be strong in 2Q25, possibly exceeding 30%, as major colocation contracts in Singapore are up for renewal. The collection of c.S$35mn in overdue rent from Bluesea is a potential catalyst, but it remains unresolved. The share is currently trading at an FY25e DPU yield of 5%. Our estimates remain unchanged.

Keppel DC REIT – Strong rental growth expected in 2025

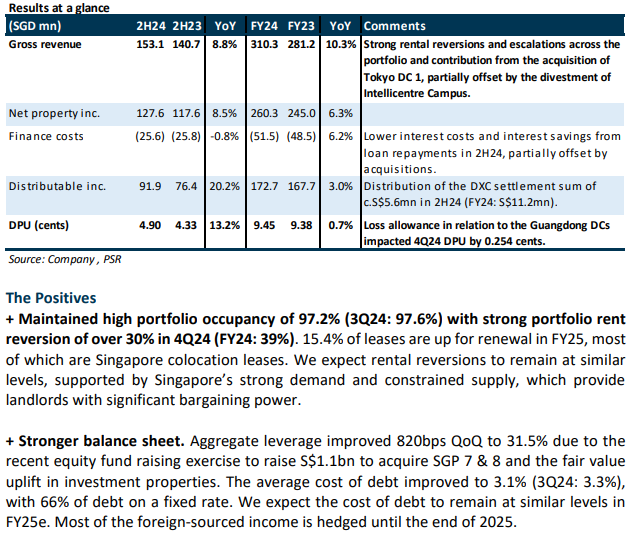

- FY24 DPU of 9.451 Singapore cents (+0.7% YoY) met our FY24e expectations. This was driven by the distribution of the DXC settlement sum of S$11.2mn, exceptionally strong positive portfolio rental reversions of 39% in FY24, and the contribution from the acquisition of Tokyo DC 1. However, it was partially offset by loss allowances for the Guangdong DCs and the depreciation of foreign currencies against the SGD.

- Completed the acquisition of a 99.49% economic interest in Keppel DC Singapore 7 & 8 (KDC SGP 7 & 8) in December. These AI-ready hyperscale data centres strengthen KDCREIT’s foothold in Singapore’s thriving data centre market, characterised by strong demand and constrained supply.

- We maintain NEUTRAL with a higher DDM-derived target price of S$2.25 from S$2.16. We lower our FY25e DPU estimates by 4% as we roll forward our forecasts, incorporating recent acquisitions, the expanded share base from the equity fund raising, and the continued non-collection of rental income from the Guangdong DCs. We expect rental reversions to remain strong, exceeding 30% for most of the 15.4% of leases due for renewal in FY25 by rental income, primarily from Singapore colocation renewals. The collection of overdue rentals from Bluesea remains potential catalyst. The share is currently trading at an FY25e DPU yield of 4.5%.

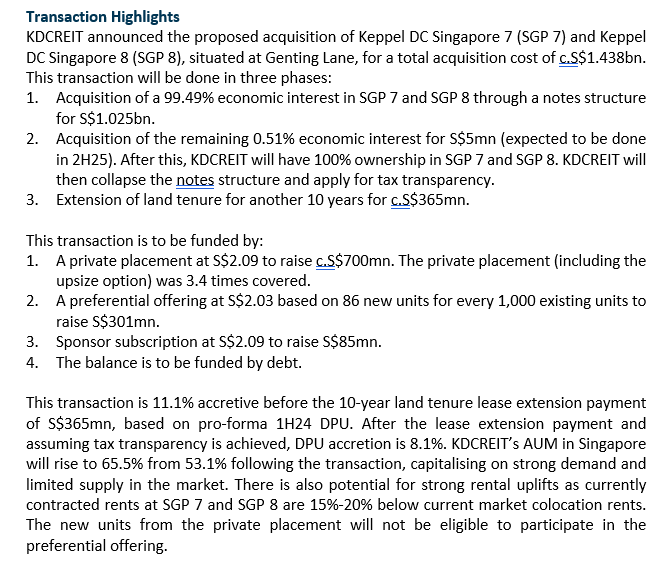

Keppel DC REIT – Acquisition of KDC SGP 7 and 8

- KDCREIT is proposing to acquire Keppel DC Singapore 7 (SGP 7) and Keppel DC Singapore 8 (SGP 8), situated at Genting Lane, for a total consideration of c.S$1.438bn (including 10-year land lease tenure extension).

- The transaction is 8.1% accretive based on 1H24 pro-forma DPU, assuming the extension of the land lease and tax transparency is achieved.

- We maintain NEUTRAL with an unchanged TP of S$2.16, post rights issue, our target price is S$2.14. While the transaction will provide immediate accretion to DPU, we believe there will be a share price overhang in the near term from the private placement new shares (c.15% of total units currently outstanding) of S$2.09. The current FY24e/25e DPU yields are 4.3%/4.7% (before acquisition).

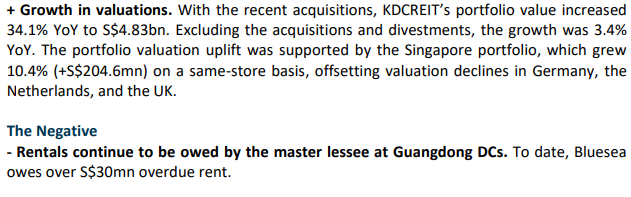

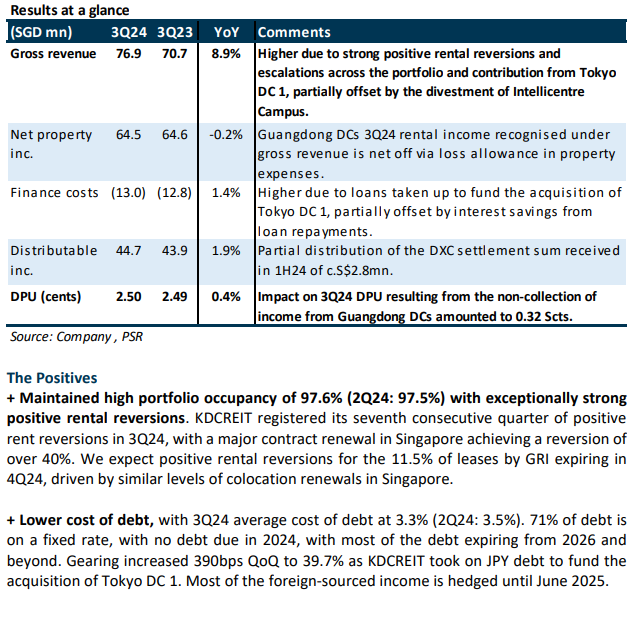

Keppel DC REIT – Rental reversions remain robust in 3Q24

- 3Q24 DPU of 2.501 Singapore cents (+0.4% YoY) exceeded our expectations, achieving 27% of our FY24e forecast. This was due to the exceptionally strong positive portfolio rental reversions, continuing the trend from 2Q24. A major contract renewal in Singapore secured a positive reversion of over 40%.

- Tokyo DC 1 has commenced contributions following the acquisition completion on 31 July 2024. The rental income from the Guangdong DCs continues to be net off via loss allowances, and the impact to 3Q24 DPU was 0.32 Scents.

- Upgrade to NEUTRAL from REDUCE with a higher DDM-derived target price of S$2.16 from S$1.93. We raise our FY24e/25e DPU estimates by 5%/9% after factoring in stronger positive rental reversions for the portfolio and lower finance costs. We lower our risk-free rate assumption to 2.5% from 3%, and as a result our cost of equity has fallen from 7% to 6.83%. We expect rental reversions to remain at similar levels, particularly the Singapore leases, given the strong demand and limited supply. Our FY24e forecast already assumes no rental contribution from the Guangdong DCs, so further loss allowances will not affect our forecasts. Potential catalysts include accretive acquisitions and the collection of rentals in arrears from Bluesea. Due to the recent share price rally, the FY24e/25e DPU yields are only at 4.2%/4.7%.

Keppel DC REIT – Stronger-than-expected positive rent reversion in 1H24

§ 1H24 DPU of 4.549 Singapore cents (-9.9% YoY) slightly exceeded our expectations, reaching 53% of our FY24e forecast. This was due to stronger-than-expected positive portfolio rental reversions, with a major contract renewal in Singapore securing over 40% positive reversion. 1H24 DPU was down 9.9% YoY mainly due to the loss allowance for doubtful receivables from the Guangdong DCs, which amounted to S$10.5mn in 1H24, and higher finance costs.

§ S$11.2mn from the settlement with DXC will be distributed in two equal tranches on a half-yearly basis for FY24. This will partially offset the loss from the non-collection of income at the Guangdong DCs.

§ Maintain ACCUMULATE with a higher DDM-derived target price of S$1.93 from S$1.86. We raise our FY24e/25e DPU estimates 5%/2% after factoring in the Japan acquisition and higher positive rental reversions for the portfolio. Organic growth will stem from renewals in FY24e (20.2% of leases by rental income expire in 2H24). Our FY24e forecast already assumes no rental contribution from the Guangdong DCs, so further bad debts will not affect our forecasts. Potential catalysts include accretive acquisitions and the collection of rentals in arrears from Bluesea. The current share price implies FY24e/25e DPU yields of 4.7%/5.1%.

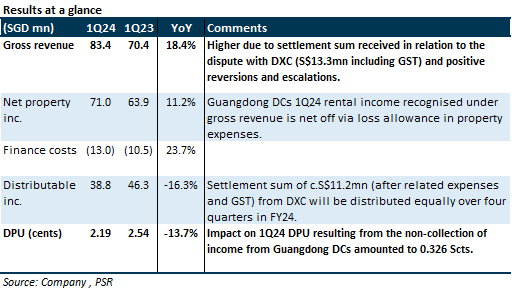

Keppel DC REIT – DXC settlement offers partial relief from uncollected rents

- 1Q24 DPU of 2.192 Singapore cents (-13.7% YoY) was in line with our expectations at 25.5% of FY24e forecast.

- The settlement sum of S$13.3mn related to the dispute with DXC has been received in full. After deducting related expenses and GST, the remaining S$11.2mn will be distributed equally across four quarters in FY24. This will partially offset the loss from the non-collection of three months of rent at the Guangdong DCs, which amounted to c.S$5.3mn in 1Q24.

- Maintain ACCUMULATE with an unchanged DDM-derived target price of S$1.86. Organic growth will stem from renewals in FY24e (26.7% of leases expire in 2024); we expect portfolio rental reversions of c.4% for FY24e. Our FY24e forecast already assumes no rental contribution from the Guangdong DCs, so further bad debts will not affect our forecast. Potential catalysts include accretive acquisitions and the collection of rental in arrears from Bluesea. The current share price implies FY24e/25e DPU yields of 5.2%/5.8%. There is no change in estimates.

The Positives

+ Maintained high portfolio occupancy of 98.3% (unchanged QoQ), with a portfolio WALE of 7.4 years. 26.7% of leases by rental income will expire in 2024. Leases signed in 1Q24 were at positive rental reversions.

+ Steady capital management, with 1Q24 average cost of debt declining 0.1ppts QoQ to 3.5% and a healthy ICR at 4.7x. 73% of debt is on a fixed rate, and only 4% of debt is up for refinancing in 2024, with most of the debt expiring from 2026 and beyond. Gearing increased 20bps QoQ to 37.6%, still below KDCREIT’s internal cap of 40%. The majority of foreign-sourced income is also hedged until December 2024.

The Negative

- Rentals are owed by the master lessee at Guangdong DCs. Currently, Bluesea owes c.8.5 months of rents totalling c.S$15.8mn.We are waiting to see how long before management decides to pull the plug and take over the property. KDCREIT reserves its rights to terminate the acquisition of GDC 3; there is currently a RMB100mn deposit on GDC 3. Additionally, there might be a risk of asset devaluations for the Guangdong DCs if KDCREIT cannot recover the overdue rent.

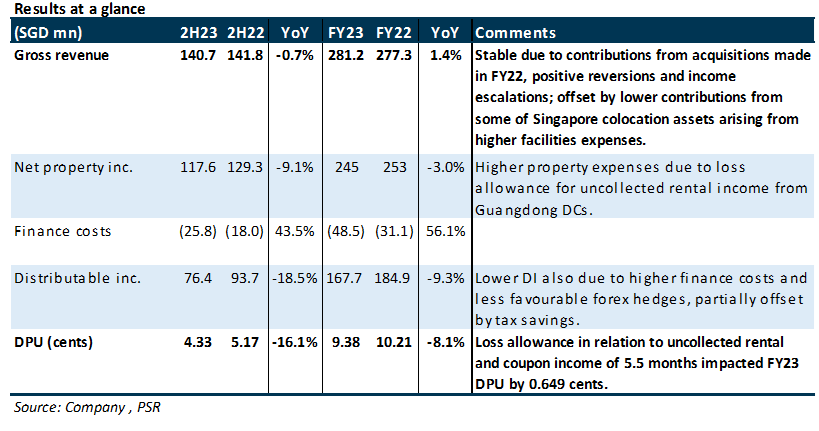

Keppel DC REIT – Uncollected rents impact DPU

- FY23 DPU of 9.383 Singapore cents (-8.1% YoY) fell short of our expectations at 94.7% of our FY23e forecast, mainly due to the uncollected rental and coupon income of c.5.5 months amounting to S$10.5mn at the Guangdong DCs.

- To date, Guangdong Bluesea Data Development (Bluesea), the tenant at Guangdong Data Centre (GDC) 1, 2 & 3, has only settled RMB0.5mn of the RMB48.3mn in arrears. Therefore, we think that Bluesea will likely be unable to meet its rental obligations, and KDCREIT will have to eventually replace the tenant.

- Downgrade from BUY to ACCUMULATE with a lower DDM-derived target price of S$1.86 from S$2.26. FY24e, FY25e, and FY26e DPU estimates are cut by 14%, 11%, and 8%, respectively, after we factor in the default and eventual replacement of Bluesea. Organic growth will stem from renewals in FY24e (27.5% of leases expire in 2024); we expect portfolio rental reversions of c.4% for FY24e. Potential catalysts include accretive acquisitions and the collection of rental in arrears from Bluesea. The current share price implies FY24e/25e DPU yields of 5.4%/5.8%.

The Positives

+ Maintained high portfolio occupancy of 98.3% (unchanged QoQ), with a portfolio WALE of 7.6 years. 27.5% of leases by rental income will expire in 2024. Leases signed in FY23 were at positive rental reversions. Additionally, some of the leases signed were restructured into power pass-through leases, which should improve NPI margins.

+ Prudent capital management, with 74% of debt on a fixed rate. The average cost of debt increased 0.1ppts QoQ to 3.6% in 4Q23, and ICR remains healthy at 4.7x. Only 4% of debt is up for refinancing in 2024 with the majority of debt expiring from 2026 and beyond. Gearing increased 20bps QoQ to 37.4%, still below KDCREIT’s internal cap of 40%. Forecast foreign-sourced income is also substantially hedged till Dec 2024.

+ Stable portfolio valuations (+0.4% yoy), with no write-down for China assets yet. In local currency terms, higher valuations were achieved in Singapore, Australia, Ireland, Italy, and the Netherlands. KDCREIT has not written-down valuations for the China assets, but we see a risk of impairment should they be unable to recover the rental arrears.

+ Positive outcome for DXC litigation, as the high court ruled in favour of KDCREIT on its intepretation of contractual rights. KDCREIT is claiming S$3mn from DXC as the sum outstanding from Apr 21 to Dec 21, as well as loss suffered as a result of DXC’s refusal to pay for the space it unilaterally gave up from Apr 21 to Mar 25. The dispute is set for trial in February 24 to determine the actual quantum to be paid by DXC to KDCREIT.

The Negatives

- Rentals owed by master lessee at Guangdong DCs. To date, Bluesea has only settled RMB0.5mn of the RMB48.3mn in arrears, and that excludes the top-up of RMB32.2mn of security deposits that KDCREIT requested. We therefore expect further loss provisions in FY24e. Management is working with Bluesea on a recovery roadmap and is also reserving its rights to terminate the acquisition of GDC 3. There is currently a RMB100mn deposit on GDC 3.

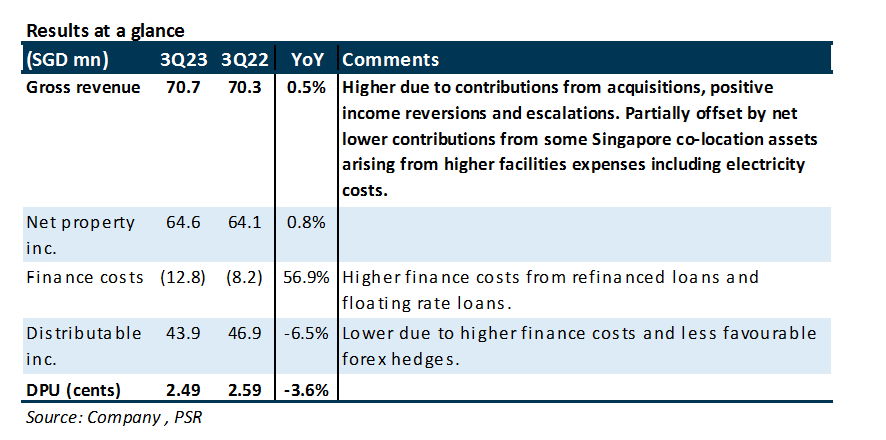

Keppel DC REIT – Waiting for acquisitions

- 3Q23 DPU of 2.492 Singapore cents (-3.6% YoY) was in line with our expectations. It formed 25.1% of our FY23e forecast.

- 3Q23 revenue/NPI growth of 0.5%/0.8% YoY, driven by contributions from acquisitions and positive income reversions and escalations, was more than offset by higher finance costs (+56.9% YoY) and less favourable forex hedges.

- Upgrade from NEUTRAL to BUY with an unchanged DDM-derived target price of S$2.26 due to the recent share price performance. DPU growth catalysts include more accretive acquisitions and lower-than-expected interest costs. Organic growth will stem from renewals in FY24e (27.7% of leases expire in 2024). We expect revenue growth of c.4% for FY24e, barring contributions from potential acquisitions. The current share price implies FY23e/24e DPU yields of 5.2%/5.4%. No change to our forecasts.

The Positives

+ Maintained high portfolio occupancy of 98.3% (dipped by 0.2% QoQ), with a portfolio WALE of 7.8 years. 27.7% of leases by rental income will expire in 2024, with only 1% expiring for the rest of 2023. Leases signed in 3Q23 were in Singapore, Australia, Ireland and the Netherlands, and were at positive rental reversions. Additionally, some of the leases signed were restructured into power pass-through leases, which should improve NPI margins.

+ Prudent capital management, with 72% of debt on fixed rate. Average cost of debt increased 0.2ppts QoQ to 3.5% in 3Q23, and ICR remains healthy at 5.4x. Only 4.2% of debt is up for refinancing in 2024 with the majority of debt expiring from 2026 and beyond. However, gearing increased 90bps QoQ to 37.2%. A 100bps increase in interest rates would lower DPU by c.2.4%. Forecast foreign sourced income is also substantially hedged till June 2024.

The Negatives

- Nil

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report