Hyphens Pharma International – Bump in the road, scaling up journey intact

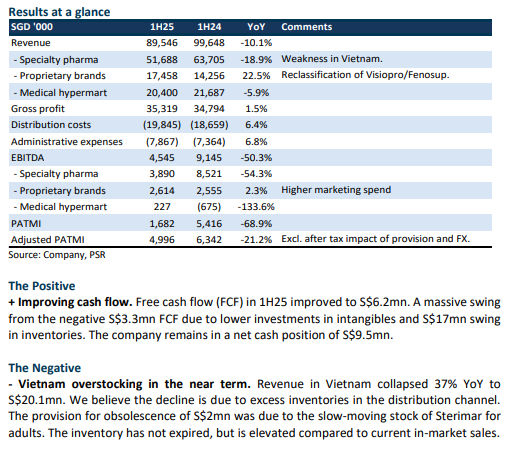

- 1H25 earnings were below expectations. Revenue and PATMI were 44%/42% of our FY25e forecast. Excluding the combined S$4.1mn losses from exchange translation and provision for ageing inventory, adjusted PATMI declined 21% YoY to S$5mn.

- We believe inventory buildup in Vietnam distribution channels has led to weaker sales in the near term. Revenue in Vietnam declined 37% YoY to S$25.3mn. Proprietary brand revenue growth expanded 22.5% led by Ceradan, Ocean Health and Visiopro.

- We lower our FY25e revenue and PATMI by 12% and 13% respectively. Our BUY recommendation is maintained. We raised our target price from S$0.35 to S$0.40, as we nudged lower our WACC and risk-free rate. Hyphens Pharma's valuation is attractive at 10x PE FY25e. The company continues to scale up its consumer healthcare and pharmaceutical presence in ASEAN. Building scale in its portfolio of brands and distribution requires investments, which pressure earnings in the near term.

Hyphens Pharma International – Investing for future growth

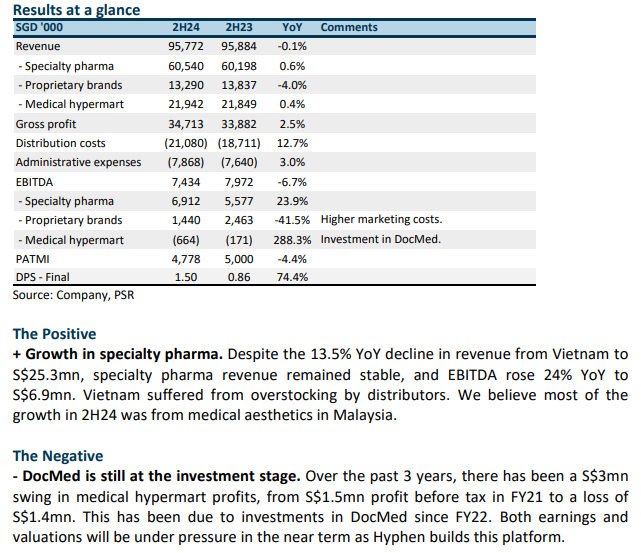

- FY24 earnings were below expectations. Revenue and PATMI were 102%/94% of our FY24e forecast. 2H24 PATMI declined 4% YoY to S$4.8mn due to weaker margins in proprietary brands, a decline in Vietnam sales and higher losses from DocMed.

- The softer earnings are from Hyphens expanding the distribution of proprietary brands into more SE Asian countries and retail chains. The DocMed platform (for doctors and pharmaceutical companies) requires further development, especially with the expansion into Malaysia and Vietnam.

- Our BUY recommendation, FY25e earnings and DCF target price of S$0.35 is maintained. Hyphens' earnings growth will be impacted in the near term from its expansion into new countries and additional investments into the DocMed platform. Hyphens' valuations are attractive at 7x FY25e PE with a net cash balance sheet of S$23mn. It is a branded consumer healthcare company (nutraceuticals, medical aesthetics and pharmaceuticals) with a regional presence.

Hyphens Pharma International – New products and wider distribution

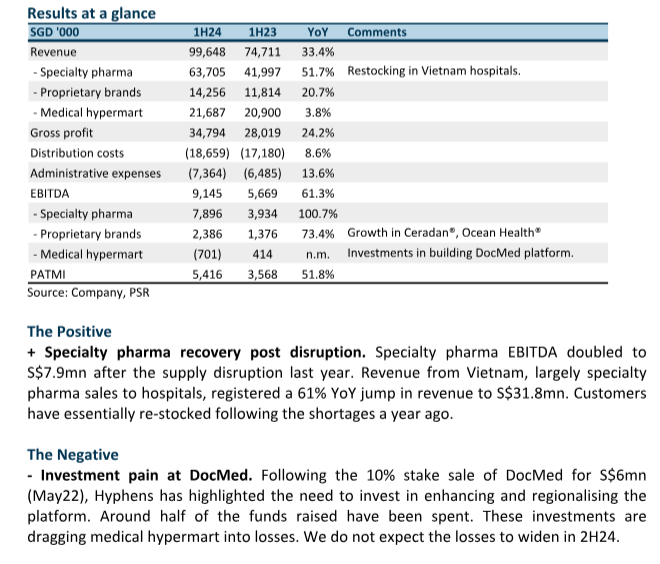

- 1H24 results were within expectations. Revenue and PATMI were 55%/46% of our forecast. PATMI surged 52% YoY to S$5.3mn in 1H24. Earning growth driven by restocking in specialty pharma as supply chains normalise, new products and expansion of the distribution network.

- Earnings were dragged by a S$0.7mn loss in medical hypermart earnings. Hyphens is investing in the enhancement and geographic expansion of the DocMed platform (for doctors and pharmaceutical companies).

- Our BUY recommendation and DCF target price of S$0.35 is maintained. The stock is only trading at 7.7x FY24e PE for a branded consumer healthcare company (nutraceuticals, medical aesthetics and pharmaceuticals) with a regional presence. We believe the company is building a foundation for sustainable growth from product innovation, expanding distribution points and securing new exclusive licensing partnerships. In addition, Hyphens is building a regional B2B platform (i.e. DocMed) for healthcare practitioners and pharmaceutical companies.

Hyphens Pharma International Ltd – More visible growth drivers

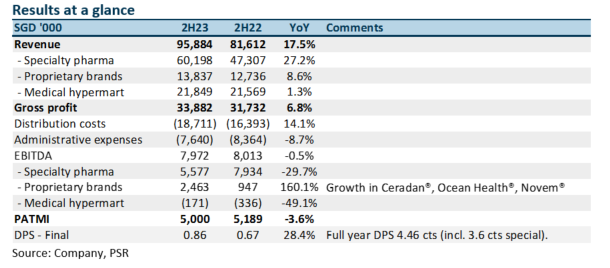

- 2023 results beat expectations. Both revenue and PATMI were 106% of our forecast. Other markets, such as Indonesia and the Philippines, grew faster than expected due to the maiden contribution from Laboratoires Gilbert S.A.S exports.

- Revenue in 2H23 was a record S$96mn following a 27% YoY jump in specialty pharma to S$60mn. However, margins declined from higher distribution costs.

- We expect earnings to recover as the supply chain for specialty products from Europe normalises. Other growth drivers for Hyphens include aggressively expanding the number of principals for its specialty products, exporting to new markets, and SKU extensions of its proprietary brands. Additional costs by DocMed are also at a more gradual pace. Our BUY recommendation and DCF target price of S$0.35 is maintained.

The Positive

+ Rebound in specialty pharma revenue. Despite the loss of Biosensor's S$5mn revenue contribution in 2023, revenue in 2H23 rose 27% YoY to a record S$61mn. The addition of new specialty products, namely Laboratoires Gilbert S.A.S, drove growth in the export sector. Revenue from other countries (Indonesia, Phillippines) tripled in 2H23 to S$13.7mn.

The Negative

- Weaker gross margins and higher opex. EBITDA margins declined 1.5% points YoY to 8.3% in 2H23. We believe a combination of higher export sales, an increase in headcount costs and additional expenses from DocMed drove down margins.

Outlook

Investments in a larger management team has resulted in more aggressive expansion in principals, products and distribution. We believe Hyphens is on a faster growth trajectory:

- Expanded its product line-up in specialty pharma in 2023, such as Byfavo®, Plinest, Nabota®, and Laboratoires Gilbert S.A.S. These brands can contribute in 2024.

- Build new or expand further into other countries, namely the Middle East, Indonesia, and the Philippines.

- Product extensions of its established proprietary brands such as Ocean Health® Joyful Gummies, women's multivitamins, immune support, etc.

- Platform-related costs at DocMed will weigh hypermart earnings down, but the business is expanding into Malaysia and Vietnam.

Maintain BUY with unchanged TP of S$0.35

Hyphen enjoys a dividend yield of 4% and trades at a PE ratio of 7x FY24e.

Hyphens Pharma International Ltd – Year of investment and challenges

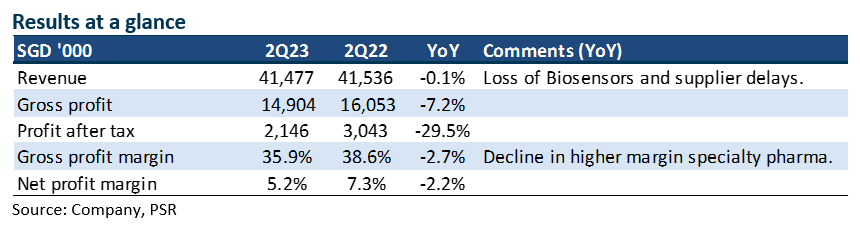

- 2Q23 PAT was down 29% YoY and below expectations. 1H23 revenue and PATMI were 46%/39% of our forecasts. The discontinuation in Biosensors distribution, absence of a major hospital tender and supply disruptions of several specialty pharma products was a drag on earnings.

- Hyphens announced a 3.6 cents special interim dividend for the 5th anniversary of its IPO.

- We maintain our FY23e revenue but lower our PATMI by 11% to S$8.0mn. Our operating expense forecast is raised as Hyphens will be investing more in senior hires and building up the DocMed platform. Our DCF target price is lowered to S$0.35 (prev. S$0.39). Our BUY recommendation is maintained.

The Positive

+ Healthy balance sheet and special dividend. The company announced a 3.6 cents special interim dividend for the 5th anniversary of its IPO. The payout of S$11mn is well supported by its net cash of S$33mn as of Jun23.

The Negative

- Weakness in specialty pharma. Specialty revenue was down 13% YoY in 1H23 to S$41mn. The drop was from the discontinuation of distributing Biosensors products (Dec22), the absence of one-off hospital tenders and supply disruptions of several specialty pharma products. Vietnam bore the brunt of the supply disruption with revenue contracting 27% in 1H23.

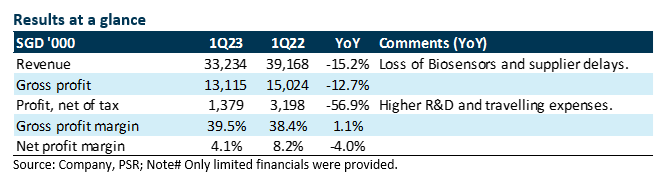

Hyphens Pharma International Ltd – Disruption in specialty pharma supply

- 1Q23 results were below expectations. Revenue and PATMI were 19%/10% of our forecasts. Revenue suffered from the cessation of Biosensors and delay shipments in Vietnam.

- Specialty pharma revenue declined by 27%. The loss of Biosensor distribution in Dec 22 was well flagged. The surprise was supply disruption from three specialty pharma manufacturers.

- We cut our FY23e earnings by 31% to S$9.1mn and the DCF target price is lowered to S$0.39 (prev. S$0.445). Our BUY recommendation is maintained. We expect the supply constraints to spill over into 2Q23. Proprietary brands have performed well with 16% growth. It will be a multi-year journey for proprietary brands to reach scale and compete even more effectively in the region. Investments into DocMed, another $5.4mn over the next 2-3 years could drag earnings but can be deemed as one-off upfront cost to develop the platform.

The Positive

+ Healthy growth in proprietary brands. Proprietary brands revenue increased by 16% in 1Q23 supported by higher demand for Ceradan® dermatological products. Ceradan® and Ocean Health® have a pipeline of new products to be launched this year. The Group launched Ceradan® Advanced Emollient Wash in Singapore and Malaysia during 1Q2023.

The Negatives

- Supply disruption in specialty products. Specialty revenue fell 27% due to the cessation of the distributorship of Biosensors products in Dec 22 and the delay in the shipment of key products in Vietnam. Of the three suppliers facing production disruption, two resumed production in 2Q23.

- Weaker operating margins. Net profit margin suffered from higher R&D and travelling expenses. Margins will be weighed down further from DocMed investments into the platform.

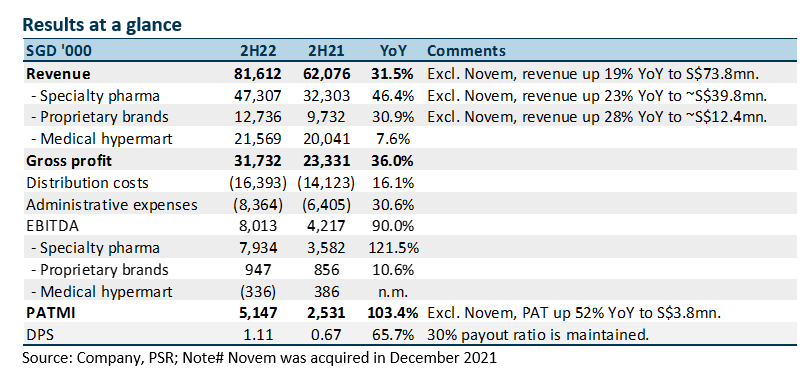

Hyphens Pharma International Ltd – Assembling multiple growth engines

- FY22 results exceeded expectations. FY22 revenue and PATMI were 109%/118% of our forecasts. Revenue jumped across all segments in 2H22, in part driven by pent-up demand after the re-opening. Dividends surged by 66% to 1.11 cents.

- We believe the re-opening saw the return of surgeries deferred during the pandemic, and increased visits drove specialty pharma revenue. Around 86% of FY22 earnings is from specialty pharma.

- We raise FY23e earnings by 31% to S$13.2mn and the DCF target price is nudged up to S$0.445 (prev. S$0.43). Our BUY recommendation is maintained. We underestimated the rebound in sales post re-opening. Hyphens has assembled multi-franchise drivers in the medium term, namely DocMed, proprietary skincare brands and specialty pharma distribution into public sector verticals. A near-term headwind is the upfront costs to develop the DocMed healthcare platform.

The Positive

+ Strong growth in specialty pharma. The largest earning driver was specialty pharma. EBITDA more than doubled to S$7.9mn with the inclusion of recently acquired Novem. We believe the re-opening has increased surgeries and visits to hospitals and specialists, thereby driving up revenue.

The Negative

- Softer proprietary margins. EBITDA margins for proprietary brands declined by 1.4% points YoY to 7.4% in 2H22. We believe higher production and product development costs contributed to the weakness in margins.

Outlook

We expect slower growth post the pent-up demand after the re-opening. New products launched will support sales, such as Nabota® (botox), Meradan® (steroid eczema cream) and Winlevi® (acne cream). Hyphens continue to build medium-term franchises: (i) DocMed - a platform for doctors, drug companies and other healthcare providers; (ii) Proprietary brands in skin health products; (iii) Novem - expand specialty products distribution into the public sector.

Hyphens Pharma International Ltd – Digital healthcare catalyst emerges

- Raised $6mn for a 10% stake in Hyphens Pharma digital assets – DocMed Technology.

- DocMed Technology owns POM (B2B digital hypermart) and WellAway (Singapore’s first and only HSA registered e-pharmacy).

- We raised FY22e earnings by 40% to S$9.2mn to incorporate earnings from the acquisition of Novem. Our DCF target price is raised from S$0.345 to S$0.43 due to higher earnings. WACC is increased from 7.3% to 9% from raising our risk-free rate assumption. We upgrade our recommendation from ACCUMULATE to BUY. Hyphens underlying growth strategy is to be a leading portfolio of proprietary skin health products and brands across Asia. Digital healthcare is a new growth and stock catalyst. We have not incorporated the new valuation of DocMed into our target price. We view the transaction as a funding event rather than crystallisation or monetization of Hyphens digital assets. The proceeds have the potential to enhance the B2B platform with more doctors, pharmaceutical companies, transactions and new sources of revenue. Such milestones could drive further rounds of financing and higher valuations.

Event

Metro Holdings Limited will invest S$6mn through new preference shares for a 10% stake in Hyphens wholly owned subsidiary DocMed Technology (DocMed). DocMed owns Hyphens medical B2B hypermart (POM Medical Hypermart) and a licensed e-pharmacy (WellAway).

- POM is a B2B platform that serves doctor's drug and other medical supply needs. For instance, a clinic can order and receive all its drugs and supplies from POM. Revenue in FY21 was S$41mn including offline sales.

- WellAway serves the telemedicine industry as a licensed e-pharmacy. After tele consultation with patients, a doctor will be able to prescribe and arrange delivery of the drugs to their patients through WellAway. Doctors do not need to stock up with multiple and expensive drugs and can tap on WellAway’s extensive range. WellAway supports telemedicine fulfilment needs.

Comment

With the proceeds, DocMed will build up its manpower (technology, operations, marketing) and enhance its B2B platform to serve doctors. The platform can be enhanced with more pharmaceutical offerings, mobile features and a regional footprint across ASEAN. The expected timeline to enhance and expand the B2B platform is two years.

Key operational milestones of the platform will include a larger number of doctors joining and purchasing through the platform. Pharmaceutical companies are constantly looking to reach out and engage doctors. DocMed platforms will be an important platform to showcase their drugs to doctors. In turn, DocMed can generate new sources of revenue such as advertising and promotion from pharmaceutical companies.

We upgrade our recommendation to BUY with a higher TP of S$0.43 (prev. S$0.345)

Hyphen's multiple-year growth strategy is to expand its proprietary brands of skincare products (e.g. Ceradan and tDf) across the region. The creation and development of the digital healthcare platform DocMed is an additional growth and share price catalyst. Near-term earnings drivers are the acquisition of Novem and growth in specialty pharma sales due to the return of elective surgeries after the pandemic.

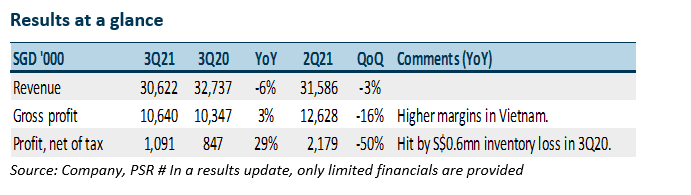

Hyphens Pharma International Ltd – Speedbump in Vietnam

- Results were above expectations. 9M21 PATMI is at 88% of our FY21e forecast.

- Despite the pandemic lockdown in Vietnam, Hyphens managed to sustain earnings better than expected in 3Q21.

- The new acquisition of healthcare distributor Novem for S$16.3mn has the potential to raise EPS by 25% to 30%.

- Maintain ACCUMULATE unchanged DCF TP (WACC 7.2%) of S$0.345. We raise our FY21e by 6% due to the higher margins from the increased mix of proprietary products. Hyphens is undertaking a long-term investment and journey to build a leading portfolio of proprietary skin health products and brands across Asia.

The Positive

+ Proprietary brands growth. Hyphens mentioned that proprietary brands have enjoyed robust growth. Skin healthcare products namely Ceradan and TDF likely performed better in Singapore due to border closure and branding efforts. Ocean Health supplements faring well in corporate sales but retail remains competitive due to the presence of multiple brands.

The Negative

+ Hurt by severe lockdown in Vietnam. Hyphen’s main products in Vietnam are specialty pharma products. Due to the tight movement controls and lockdown, non-essential medical tests and procedures such as X-rays, CT scans and cardiac stents were delayed. For instance, contrast media, a dye used in X-rays and CT scans, will face lower demand due to the reduced amount of medical tests conducted.

Outlook

We view specialty pharma* as a stable cash-flow generator for Hyphens. Lockdowns in Vietnam will stifle sales momentum into 4Q21. The longer-term journey for Hyphens is to grow, invest and expand their portfolio of proprietary products namely Ceradan, TDF and Ocean Health. Hyphens has expanded Ceradan skincare creams from selling exclusively to doctors into retail pharmacies. Doctors prescribe Ceradan Advance whilst consumers can purchase the other range of Ceradan products. There is a sizeable pool of brand recognition from existing users of Ceradan when dispensed by doctors. TDF is another skin health product focused on ageing, pigmentation and age defence. The range of products was extended with a new range of sunscreen products. In August 2020, Hyphens introduced scalp care products under the CG 210 brand. Ocean Health supplements growth will primarily come from new export markets and continuous roll-out of innovative formulations.

*Specialty pharma – Selling more than 30 products to doctors and specialist. Doctors will in turn prescribe the products to their patients for consumption or use in procedures and tests. Hyphens typically have exclusive distribution agreements with their principals. The business is rather sticky because doctors seldom change such products.

Maintain BUY with an unchanged target price of S$0.345.

Our FY21e PATMI is raised by 6% due to higher margins as the mix of proprietary brands increase.

New Acquisition – Novem

Hyphens has proposed to acquire Novem for S$16.28mn (S$13.83mn cash and 8.3458mn new Hyphens shares worth S$2.44mn). The new shares issued is 2.7% of the enlarged share capital. Around 2/3 or 5.56mn of the consideration shares are under a 3-year moratorium. Novem is a distributor of pharmaceutical products for over 20 years. The majority of its customer base are government hospitals and polyclinics. This compares with only 10% for Hyphen. We view the acquisition as a positive for Hyphens. There is a potential 25% to 30% uplift in EPS, expansion of Hyphens product range, widening of customer especially into the public sector and raising of margins due to the higher margin profile of Novem (FY20 PAT margin of 18% vs Hyphens 5-6%).

Hyphens Pharma International Ltd-Repositioning for growth

- 9M20 earnings of S$5.1mn were 17% below our estimate due to other losses arising from inventory obsolescence.

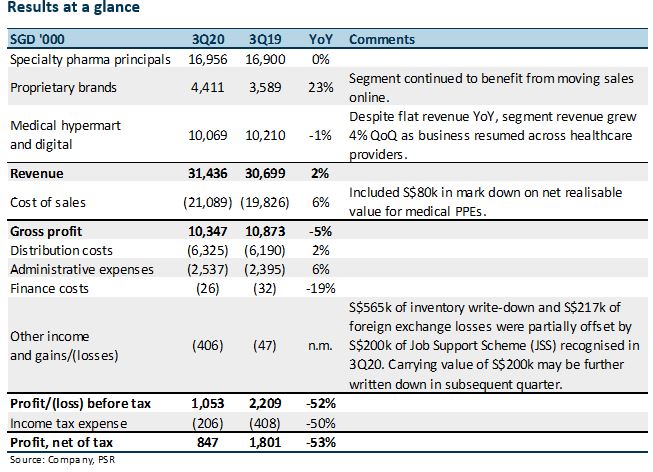

- 3Q revenue grew 2% YoY to S$31.4mn as strength in proprietary brands offset specialty pharma and medical hypermart weakness.

- COVID-19 led to S$565k in inventory obsolescence and S$217k FX losses.

- Short-term weakness expected as company reorganises operations to manage thinning margins and heightened inventories.

- Signed two distribution agreements in past month, to develop proprietary-brand business.

- Maintain ACCUMULATE with reduced DCF TP (WACC 7.2%) of S$0.365 from S$0.495. We cut FY20e and FY21e earnings by 20% to reflect a recovery only in FY22.

The Positive

+ Proprietary brands sustained growth

Proprietary-brand revenue grew 23% YoY as the company continued to move sales online. Revenue was down 2% QoQ due to S$1mn of exceptional corporate sales of Ocean Health® supplements in the previous quarter. Stripping that out, QoQ growth would have been 26%, underscoring the strong organic growth of proprietary-brand products.

Specialty pharma and medical hypermart revenue was flat YoY though up 6%/4% QoQ. This reflected their recovery as Singapore gradually reopened.

The Negatives

- Inventory obsolescence hurt earnings

Inventory in excess of S$600k was marked down as a result of disruptions from COVID-19 across products:

- Personal protective equipment like masks was marked down due to high supply resulting in lower selling prices and an influx of supply in the market, resulting in a net realisable value write-down of S$80k under cost of sales.

- COVID-19 test kits that were procured in anticipation of high demand from widespread testing in Singapore had to be written off after the Singapore authorities centralised supply of test kits. However, the company is exploring options to re-sell the kits to other markets. About S$300k in value was written off with S$200k on the books remaining. This may be written off subsequently if no buyers are found.

- S$100k of flu vaccines had to be written off due to lack of demand following travel restrictions. Flu vaccines have short shelf lives due to the different seasonal strains of flu viruses.

- A further S$200k was written down for an assortment of products due to lockdowns in different markets which affected demand.

FX exposure

About S$217k in FX losses was recognised from SGD weakness against the USD/EUR as well as depreciation of the rupiah and peso.

Outlook

Repositioning business to capture long-term growth

The company continued to expand its proprietary-brand business with the signing of two distribution agreements: one for the distribution of Ocean Health® in Sri Lanka with Healthguard Pharmacy Limited (non-listed) and another for Ceradan® in China with Shanghai Good Luck International Trading Co. Ltd. (non-listed). We expect the company to continue investing in this business on account of better margins.

Normalisation expected in FY22

Inventories, receivables and payables may only normalise in FY22 after the company’s reorganisation of its operations.

Investment Action

Maintain ACCUMULATE with reduced DCF TP of S$0.365 from S$0.435

FY20e and FY21e earnings have been shaved by 20% to reflect a total write-off of COVID-19 test kits in the fourth quarter and a pushout in recovery to FY22e. We have also reduced margin expectations from their high base in FY19 and incorporated higher expenses from possible reinvestments in its own-brand business.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report