Frasers Centrepoint Trust – Back to 99.9% occupancy

- No financials were provided in the 1Q26 business update. Retail portfolio occupancy was unchanged QoQ at 98.1% but improved to 99.9% post-1Q26 following the backfilling of cinema spaces at Causeway Point and Century Square.

- Phase 1 of the Hougang Mall AEI was successfully completed in November 2025, introducing 33 new-to-Hougang retail concepts. The AEI at NEX is scheduled to commence in 2Q26, adding c.44k sqft of NLA with a targeted 7% ROI. 1Q26 shopper traffic and tenants’ sales remained healthy at +1.3% and +2.7%, respectively (FY25: +1.6% and +3.7%).

- Upgrade to BUY from ACCUMULATE with an unchanged TP of S$2.74 due to the recent share price performance. There is no change to our forecast. We expect FY26e rental reversions to remain healthy at +5%, supported by limited new retail supply and a low occupancy cost of c.16%, below historical averages (pre-COVID: c.17%). FCT remains our top pick in the retail sub-sector, underpinned by its resilient suburban mall portfolio anchored by essential services that continue to perform well even amid consumption slowdowns. Organic growth is expected from successful AEI completions, driving higher asset yields and income growth. FCT is trading at a forward FY26e yield of 5.6%.

The Positives

+ Portfolio occupancy improved to 99.9% post-1Q26 with healthy operating metrics. The

cinema spaces at Causeway Point and Century Square have been successfully backfilled by

SAS Cineplex and Golden Village, respectively. Shopper traffic and tenant sales remained

resilient, increasing by 1.3% and 2.7% in 1Q26, respectively.

+ Stable financial metrics. In 1Q26, the quarter average all-in cost of debt remained stable

at 3.5% QoQ, with 81.2% of borrowings hedged to fixed rates. Aggregate leverage increased

slightly from 39.6% to 40.3% QoQ, reflecting ongoing capex at Hougang Mall. With interest

rates still trending lower, the all-in cost of debt is expected to decline further in FY26e,

potentially reaching 3.3% (FY25: 3.5%).

The Negative

- nil

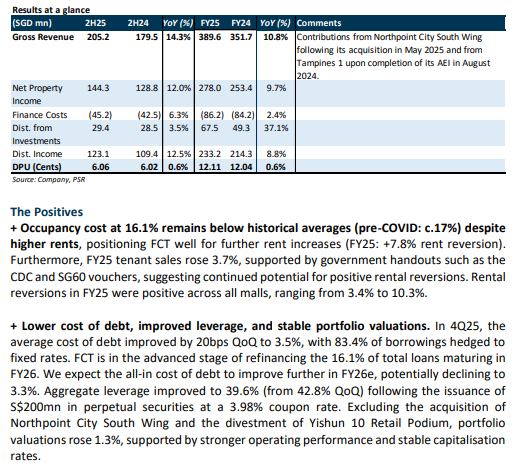

Frasers Centrepoint Trust – Continued positive rental reversions expected

- 2H25/FY25 DPU of 6.06/12.11 Singapore cents was 0.6%/0.6% higher YoY, in line with our estimates and formed 50%/100% of our FY25e forecast. 2H25/FY25 NPI increased 12%/9.7% YoY from the contributions from Northpoint City South Wing following the completion of its acquisition in May 2025, +7.8% positive rental reversions, and Tampines 1 following the completion of its AEI. This was partially offset by a lower occupancy of 98.1% (3Q25: 99.9%) due to the exit of Cathay Cineplexes at Causeway Point and Century Square.

- Excluding Hougang Mall due to its ongoing AEI, 4Q25 shopper traffic and tenants’ sales saw healthy YoY growth at +1.5% and +3.9%, respectively (FY25: +1.6% and +3.7%). The average cost of debt fell 20bps QoQ to 3.5%, down from the 4% peak in 1Q25.

- We maintain ACCUMULATE with a higher TP of S$2.74 (prev. S$2.44). We raise our FY26e DPU forecast by 2% on lower interest rate assumptions and reduce our cost of equity from 6.9% to 6.38% on a lower risk-free rate as we roll forward our forecasts. We expect FY26e rental reversions to remain similar to FY25’s +7.8%, supported by limited new retail supply and a low FY25 occupancy cost of 16.1%, which remains below historical averages. FCT remains our top pick in the retail sub-sector, underpinned by its resilient suburban mall portfolio anchored by essential services that continue to perform well even amid consumption slowdowns. It is trading at a forward FY26e yield of 5.2%.

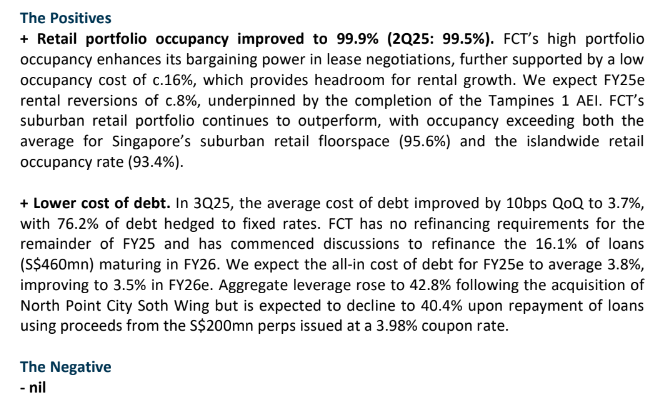

Frasers Centrepoint Trust – 99.9% retail portfolio occupancy

- No financials were provided in this 3Q25 business update. The acquisition of Northpoint City South Wing was completed on 26 May 2025 and will start contributing from 2H25 onwards.

- Retail portfolio occupancy was at 99.9% (2Q25: 99.5%). 3Q25 shopper traffic and tenants’ sales saw healthy YoY growth at +2.1% and +4.4%, respectively (1H25: +1% and +3.3%). The average cost of debt continues to trend down, falling 10bps QoQ and 50bps YoY to 3.7%.

- We maintain ACCUMULATE with an unchanged TP of S$2.44. There are no changes to our estimates. We expect FY25e rental reversions to be similar to FY24’s 7.7%, supported by limited upcoming retail supply and a low occupancy cost of c.16% which remains below historical averages. Trading at a yield of 5.5%, FCT remains our top pick in the retail sub-sector, backed by its resilient suburban mall portfolio anchored by essential services that tend to perform well even in a consumption slowdown.

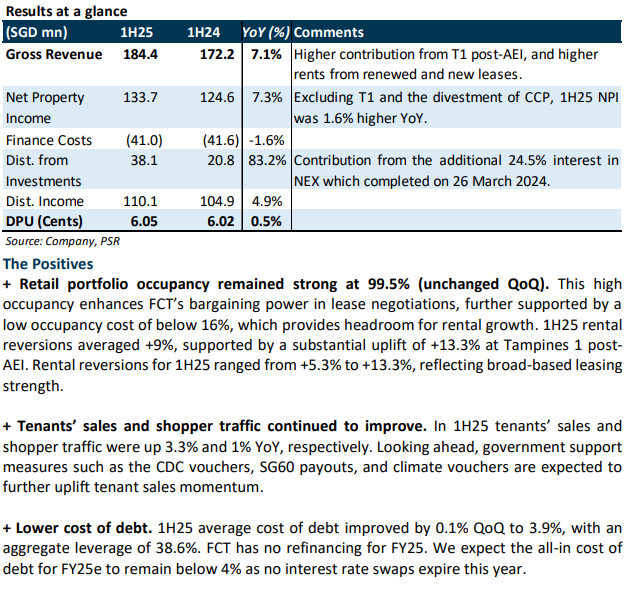

Frasers Centrepoint Trust – Defensive earnings from suburban malls

- 1H25 DPU of 6.054 Singapore cents was 0.5% higher YoY, in line with our expectations and formed 49% of our FY25e forecast. NPI grew 7.3%, driven by higher rents at Tampines 1 following AEI completion and stronger rents across the portfolio. Excluding Tampines 1 and the divestment of Changi City Point, 1H25 NPI was up 1.6% YoY.

- Portfolio occupancy remained high at 99.5%. 1H25 shopper traffic and tenants’ sales saw healthy YoY growth at +1% and +3.3%, respectively. Rental reversions were strong at +9% (FY24: +7.7%), supported by a 13.3% rent increase at Tampines 1 following the completion of its AEI. The placement and preferential offering to fund the proposed acquisition of Northpoint City South Wing were 4x and 1.2x oversubscribed, respectively, raising S$421mn.

- We downgrade FCT to ACCUMULATE from BUY with an unchanged TP of S$2.44 following recent share price performance. We trim our FY25e/26e DPU estimates by 1%/3%, factoring in the enlarged unit base from the equity fund raising, a three-month contribution from Northpoint City South Wing in the last quarter of FY25e, and occupancy disruptions at Hougang Mall due to ongoing AEI. We expect a healthy mid-single-digit positive rental reversion in FY25e, supported by limited upcoming retail supply and a low occupancy cost of <16%. The share trades at an FY25e DPU yield of 5.4%. FCT remains relatively resilient in an economic slowdown due to its suburban mall portfolio anchored by essential services.

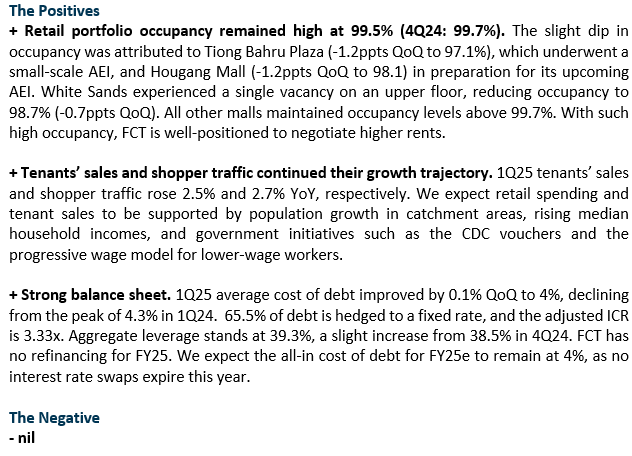

Frasers Centrepoint Trust – Key metrics remain healthy

- No financials were provided in the 1Q25 business update. Retail portfolio occupancy remained high at 99.5% (4Q24: 99.7%).

- 1Q25 shopper traffic and tenants’ sales registered healthy YoY growth at +2.7% and +2.5%, respectively. Rental reversions remained strong, similar to FY24’s +7.7%. The AEI at Hougang Mall has achieved c.50% pre-commitment and the Mall continues to operate during the AEI. FCT targets a 7% ROI on a S$51mn Capex for this project.

- Upgrade to BUY with an unchanged TP of S$2.44 due to the recent share price weakness. Our estimates remain unchanged. We expect a healthy c.5% positive rental reversion for FY25e, supported by limited retail supply in the coming years. Share price catalysts include accretive AEIs and the acquisition of Northpoint City South Wing. The share trades at an FY25e DPU yield of 5.8%.

Frasers Centrepoint Trust – Upside from Tampines 1 AEI completion

- 2H24/FY24 DPU of 6.02/12.04 Singapore cents was unchanged/0.9% lower YoY, in line with our expectations and formed 50%/99% of our FY24e forecast. 2H24/FY24 NPI was down 0.6%/4.6% YoY but excluding the divestment of Changi City Point and the lower contribution from Tampines 1 due to its AEI works, NPI was 4.7%/3.4% higher YoY.

- Retail portfolio occupancy remains high at 99.7%. Rental reversions for FY24 were robust at +7.7% (FY23: +4.7%). In FY24, shopper traffic and tenants’ sales were up 4.2% and 1.2% YoY, respectively. Tenants’ sales are now at 20% above pre-COVID 2019 levels. The AEI at Tampines 1 was completed on schedule with a return on investment exceeding the 8% initial target. Portfolio valuation rose 1.2% YoY to S$7bn with unchanged cap rates.

- Maintain ACCUMULATE with a higher DDM TP of S$2.44 (previously S$2.38) as we roll forward our forecasts. We lower our FY25e/26e DPU estimates by 1% to reflect partial downtime at Hougang Mall from the planned AEI. We expect c.5% positive rental reversion for FY25e supported by the low occupancy cost of 16% that averaged 17% pre-pandemic. Share price catalysts include more accretive acquisitions and lower-than-expected interest costs. The share trades at an FY25e DPU yield of 5.4%.

Frasers Centrepoint Trust – Low occupancy cost to drive rental reversion

Frasers Centrepoint Trust – Robust operating performance in 1H24

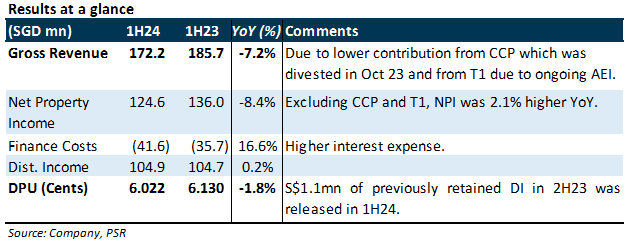

- 1H24 DPU of 6.022 Scts was 1.8% lower YoY, in line with our expectations. Gross revenue/NPI fell 7.2%/8.4% YoY due to the divestment of Changi City Point (CCP) in Oct 23, and ongoing AEI work at Tampines 1 (T1). Excluding these factors, gross revenue/NPI would have risen 2.9%/2.1% YoY.

- 1H24 retail portfolio occupancy was high at 99.9%, with portfolio rental reversions at +7.5%. 2Q24 shopper traffic and tenants’ sales were up 8.1% and 4.3%, respectively. This was an improvement from 1Q24 shopper traffic growth of 3.1% and tenants’ sales decline of 0.7% YoY.

- Maintain ACCUMULATE, with an unchanged DDM TP of S$2.38. We expect 7% positive rental reversion for FY24e, supported by the low occupancy cost of 15.5%. Share price catalysts include more accretive acquisitions and lower-than-expected interest costs. The share trades at an FY24e DPU yield of 5.6%. There is no change in our estimates.

The Positives

+ 2Q24 retail portfolio occupancy remained almost full at 99.9% (unchanged QoQ). Occupancy was at least 99% across all the malls. 1H24 rental reversion of +7.5% exceeded our expectations, and it was above 1H23 rental reversion of +4.3%. We expect this healthy positive rental reversion trend to continue for the remaining 14% of leases (by GRI) that expire in FY24.

+ Improvements in tenants’ sales and shopper traffic. 2Q24 tenants’ sales and shopper traffic were 4.3% and 8.1% higher YoY, respectively. Portfolio shopper traffic is now only 2% below pre-COVID levels, while tenant sales are c.20% higher than pre-COVID levels. We expect tenants’ sales to remain robust, supported by the various government handouts to Singapore residents in 2024.

+ All-in cost of debt improved 10bps QoQ to 4.2%, as FCT used the proceeds from the divestments of Changi City Point and interest in Hektar REIT to pay off some of the higher-cost debt. Aggregate leverage rose 1.3%pts QoQ to 38.5% as loans were drawn down to finance the increased stake in NEX and the Tampines 1 AEI. 68.5% of debt is hedged to a fixed rate. FCT has no debt expiring in FY24, and its ICR is 3.26 times. FY24e all-in cost of debt is expected to be low 4%.

The Negative

- nil

Frasers Centrepoint Trust – Increasing stake in NEX

- No financials were provided in the 1Q24 business update. Retail portfolio occupancy increased 1.5ppts YoY and 0.2ppts QoQ to 99.9%, with rental reversions exceeding FY23’s +4.7%.

- DPU-accretive acquisition of an additional 24.5% stake in NEX, with further upside potential if tax transparency is achieved.

- Maintain ACCUMULATE; DDM TP raised from S$2.29 to S$2.38. We increase our FY24e-26e DPU estimates by 0.4-1% after accounting for the acquisition. We expect c.5% positive rental reversion for FY24e, supported by the low occupancy cost of 15.5% post-acquisition. Catalysts include more accretive acquisitions and tax transparency treatment for FCT’s stake in NEX. The current share price implies a FY24e DPU yield of 5.2%.

The Positives

+ Retail portfolio occupancy is almost full at 99.9% (+1.5ppts YoY; +0.2ppts QoQ). Management guided that rental reversions for the quarter were above FY23’s +4.7%, and we expect this positive rental reversion trend to continue for the 20.3% of leases (by GRI) that expire in FY24.

+ Gearing improved from 39.3% to 37.2%, after using the proceeds from the divestments of Changi City Point and interest in Hektar REIT to pay off some debt. The all-in cost of debt increased 20bps QoQ to 4.3%, and the proportion of fixed-interest rate borrowings stands at 63.4%. Green loans now account for 72.5% of total borrowings. FCT has no debt expiring in FY24.

The Negative

- Tenant sales were down 0.7% YoY in 1Q24 due to several key anchor tenants undergoing renovations, and from a higher base in 2023. Excluding this, it was up 1.1% and was 18% above pre-COVID levels. Portfolio shopper traffic was 3.1% higher YoY, and F&B continues to be the key demand driver. Occupancy cost remains healthy at 15.5%.

Frasers Centrepoint Trust – High portfolio occupancy with stable valuations

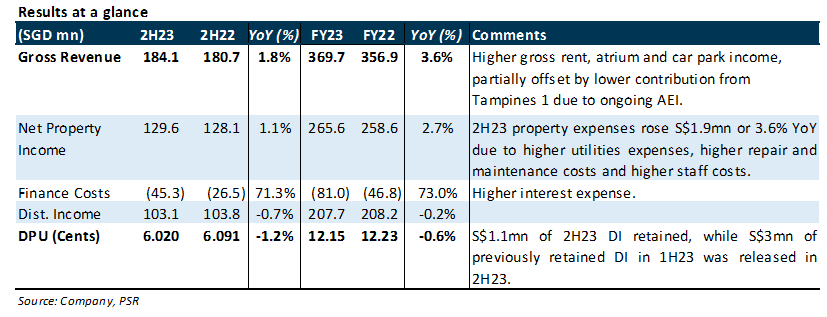

- 2H23/FY23 DPU of 6.02/12.15 Singapore cents was 1.2%/0.6% lower YoY, but in line with our expectations and formed 49%/100% of our FY23e forecast. Retail portfolio occupancy increased 2.2ppts YoY to 99.7% (3Q23: 98.7%).

- FY23 tenants’ sales and shopper traffic improved 7.3% and 24.7% YoY respectively. YTD tenants’ sales averaged c.17% above pre-COVID levels. Retail portfolio valuation rose 0.6% YoY to S$8.74bn with unchanged cap rates.

- Maintain ACCUMULATE, DDM TP lowered from S$2.35 to S$2.29 as we roll forward our forecasts. We have reduced both FY24e and FY25e DPU forecasts by 5% after accounting for the divestments of Changi City Point and FCT’s stake in Hektar REIT. We expect positive rental reversions to remain intact for FY24e, supported by the low occupancy cost of 15.6% and tenants’ sales growth. The current share price implies a FY24e DPU yield of 5.9%.

The Positives

+ Retail portfolio occupancy nearly full at 99.7% (+2.2ppts YoY; +1.0ppts QoQ). Excluding Tampines 1 which is undergoing AEI, occupancy at all nine malls came in at 99% or higher. Rental reversions for the retail portfolio were +4.7% for FY23; and we expect similar rental reversions for FY24e, when 29.3% of leases by GRI will be expiring.

+ Tenants’ sales and shopper traffic continued to grow 7.3% and 24.7% YoY respectively for FY23 indicating robust demand. FY23 tenants’ sales averaged c.17% above pre-COVID levels. Improving tenants’ sales should lower occupancy costs further (currently at 15.6% and 6-year lows), and this should support FCT’s ability to raise rents.

+ Retail portfolio valuation increased by S$52.7 million, or 0.6%, to S$8.74bn with unchanged cap rates. This suggests that suburban retail malls in Singapore continue to exhibit resilience despite rising interest rates. The below-historical-average and low retail supply of 1.21mn sq ft through to 2025 makes up only 2.4% of the current private retail stock, and this is expected to support valuations and rental rates going forward.

+ No refinancing risks in FY24. After S$353.5mn, or 16%, of total debt that was originally due in FY24 has been refinanced to FY29, there are no more refinancing requirements in FY24.

63% of total debt has been hedged to fixed rate, and the YTD all-in cost of debt increased 10bps QoQ to 3.8%. We expect the all-in cost of debt to increase to above 4% in FY24e. ICR remains healthy at 3.47x. Gearing, currently at 39.3%, is expected to drop to 36.1% on a pro forma basis assuming the net proceeds from the divestment of Changi City Point and interest in Hektar REIT are used to repay certain debts.

The Negative

- Higher operating costs from higher energy and water prices, as well as higher manpower costs, will likely eat into NPI margins in FY24e. We expect NPI margins to drop from 71.8% in FY23 to 70.6% in FY24e.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report