City Developments Limited – Divestment momentum continues

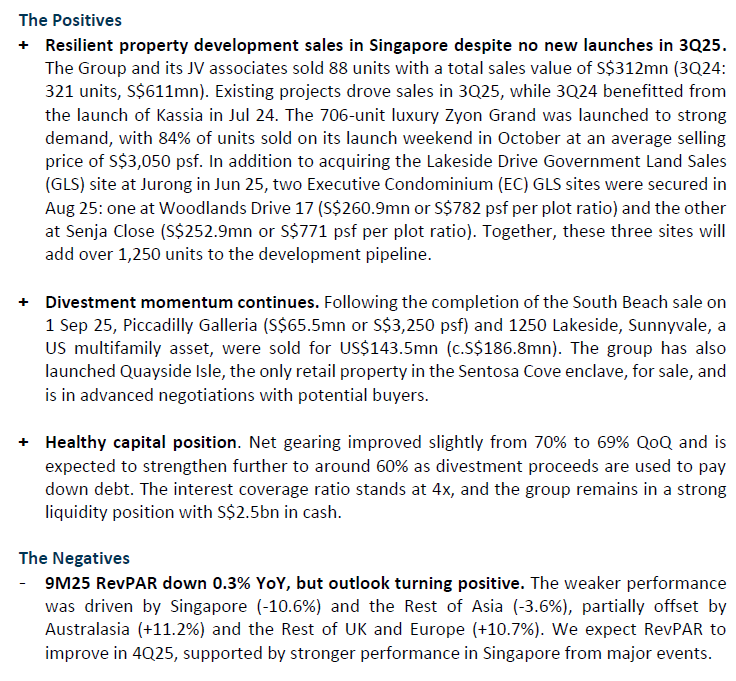

- No financials were provided for the 3Q25 operational update. Asset divestments remain a key focus, with momentum continuing following the completion of the South Beach sale on 1 Sep 2025, followed by the sales of Piccadilly Galleria (S$65.5mn or S$3,250 psf) and 1250 Lakeside, Sunnyvale, a US multifamily asset, for US$143.5mn (c.S$186.8mn).

- Under property development, sales were supported by existing projects as there were no new launches in Singapore in 3Q25. For 9M25, the hotel segment recorded a slight 0.3% YoY decline in RevPAR, mainly due to softer performance in Asia, particularly in Singapore (RevPAR down 10.6%), reflecting the high base in 2024 and the shift of the F1 Singapore Grand Prix from 3Q24 to 4Q25.

- Downgrade from BUY to ACCUMULATE with an unchanged RNAV TP of S$8.34 due to the recent share price performance, representing a 35% discount to our RNAV of S$12.82. There is no change to our forecasts. Strong take-up rates at launched projects, together with the accelerated pace of capital recycling and divestments, may help narrow the RNAV discount. A recovery in Singapore’s hospitality segment is expected in 4Q25, supported by significant events such as the F1 Singapore Grand Prix and the Blackpink concert. A special dividend at FY25 results is likely, fuelled by divestment proceeds.

City Developments Limited – All aboard the divestment train

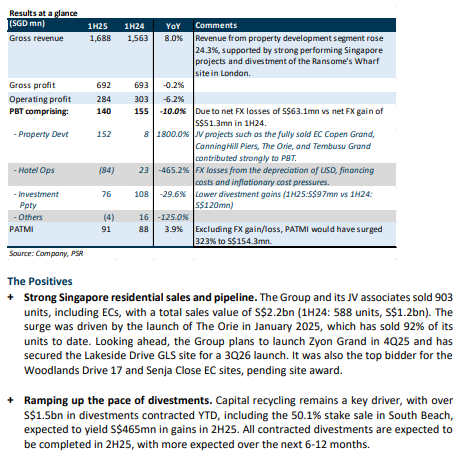

- 1H25 PATMI rose 3.9% YoY to S$91mn, but came in below expectations at 33% of our FY25e forecast, weighed down by a S$63.1mn unrealised net FX loss from USD depreciation. Excluding FX effects, PATMI would have jumped 323% YoY to S$154.3mn.

- Over S$1.5bn of divestments have been contracted YTD, including the sale of a 50.1% stake in the hotel, office, and retail components of South Beach, which is expected to generate a gain of S$465mn upon completion in 2H25. In 1H25, property development was the standout, with PBT surging 1800% YoY to S$152mn, underpinned by strong Singapore residential sales and the full profit recognition of Copen Grand EC.

- Maintain BUY with a higher RNAV TP of S$8.34 (prev. S$6.02), representing a 35% (prev. 45%) discount to our RNAV of S$12.82. We raise our FY25e PATMI by 20% to account for the announced divestments that are expected to be completed in 2H25, including South Beach, partially offset by FX losses and higher interest expenses. Strong take-up rates of launched projects, together with the accelerated pace of capital recycling/divestments, may help narrow the RNAV discount. CDL declared a special interim dividend of 3 cents, with potential for a special dividend at FY25 results, fueled by divestment proceeds.

City Developments Limited – Strong residential sales in Singapore

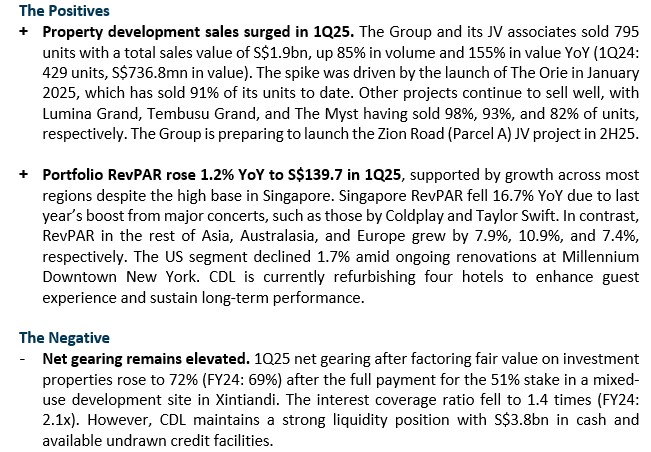

- No financial information was provided in this operational update. The Orie, launched in January 2025, has seen strong demand with 91% of its 777 units sold to date. Other projects continue to sell well, with Lumina Grand, Tembusu Grand, and The Myst 98%, 93%, and 82% sold to date, respectively.

- On 13 May, CDL launched an off-market equal access scheme to repurchase up to 26.8mn preference shares (10% of outstanding) at S$0.78 per share. This follows a similar buyback completed in May 2024, which was oversubscribed by four times the maximum allowable amount.

- Maintain BUY with an unchanged RNAV TP of S$6.02, representing a 45% discount to our RNAV of S$10.95. Our estimates remain unchanged. We believe establishing a fund management franchise, strengthening recurring income streams, and strong take-up rates of launched projects are key earnings drivers for CDL, potentially supporting its share price recovery. In addition, continued asset monetisation and the completion of development projects could help narrow the discount to RNAV.

City Developments Limited – Road to recovery

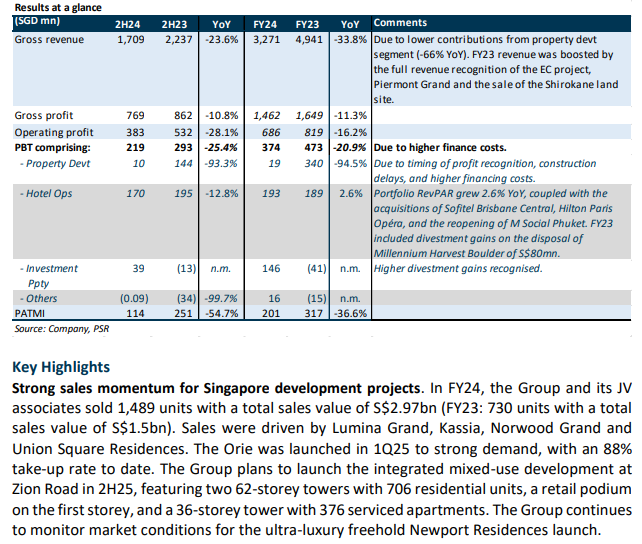

- FY24 PATMI of S$201mn (-36.6% YoY) was below our expectations, forming 70% of our FY24e forecast. This was due to the timing of profit recognition under the property development segment and a 21% rise in interest expenses. FY24 revenue fell 34% YoY due to lower contributions from property development as FY23 included the full recognition of the EC project, Piermont Grand, and the sale of the Shirokane land site.

- The Orie, launched in 1H25, had a take-up rate of 88% at an average selling price of S$2,704. Other launched projects in 2024 continue to sell well, with Norwood Grand, Kassia, and Lumina Grand having sold 84%, 71%, and 89% of units, respectively. CDL missed its S$1bn divestment target for FY24, achieving just over S$600mn in divestments in Singapore, Suzhou and London.

- Maintain BUY with a lower RNAV TP of S$6.02 (previous S$6.87), representing a 45% discount to our RNAV of S$10.95. We lower our FY25e PATMI by 38% to factor in higher interest costs and construction delays. We believe asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, strengthening recurring income streams, and strong take-up rates of launched projects are key earnings drivers for CDL, potentially supporting its share price recovery. A final dividend of 8 cents was declared, bringing FY24 DPS to 10 cents or a dividend yield of 2%.

City Developments Limited – Improving residential demand

- No financials were provided for the 3Q24 operational update. The net gearing ratio stood at 70%, following several acquisitions, including the Hilton Paris Opéra hotel and four Japan PRS properties.

- Strong sell-through rate for new launches—Kassia, launched in July, and Norwood Grand, launched in October, have sold 65% and 84% of units, respectively. Other projects continue to sell well, with Tembusu Grand and The Myst having sold 91% and 73% respectively.

- Maintain BUY with an unchanged TP of S$6.87, representing a 45% discount to our RNAV of S$12.50. There is no change to our estimates. We believe asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and the continuous recovery in the hospitality portfolio are potential catalysts for CDL, which could help drive the share price recovery.

City Developments Limited – Accelerating capital recycling efforts

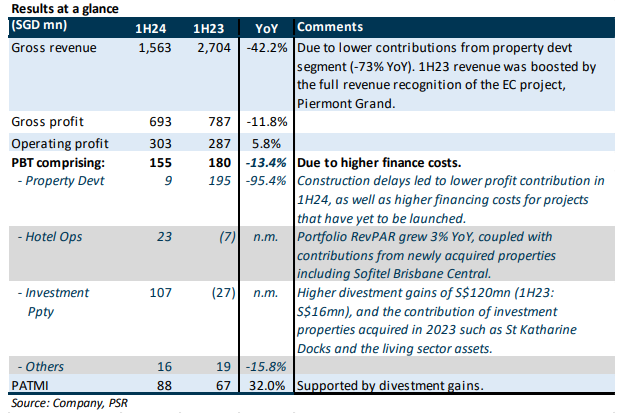

- 1H24 PATMI of S$87.8mn (+32% YoY) was below expectations, forming 31% of our FY24e forecast. The shortfall was due to construction delays, which pushed back the timing of profit recognition of property development projects. The increase in PATMI YoY was driven by higher divestment gains as part of CDL’s capital recycling efforts.

- Year-to-date, CDL has achieved c.S$271mn in divestments, short of management’s S$1bn target for FY24e. Divestments for FY24e are likely to range between S$400mn and S$500mn, unless the larger assets in the UK are sold, which could bring the total closer to the S$1bn target.

- Maintain BUY with an unchanged TP of S$6.87, representing a 45% discount to our RNAV of S$12.50. There is no change to our estimates. CDL’s share price has underperformed since its deletion from the MSCI Singapore Index on 31 May. We believe asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and the continuous recovery in the hospitality portfolio are potential catalysts for CDL, which could help drive the share price recovery.

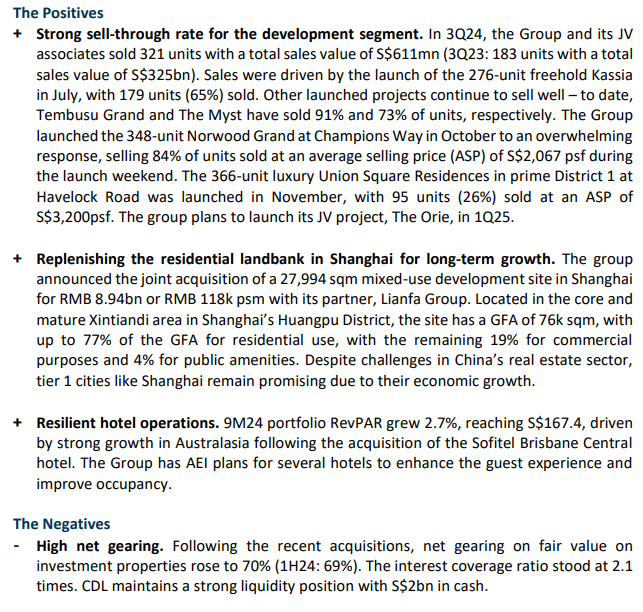

The Positives

+ Resilient sales under the property development segment. In 1H24, the Group and its JV associates sold 588 units with a total sales value of S$1.2bn (1H23: 508 units with a total sales value of S$1.1bn). Sales were driven by the launch of Lumina Grand, with 399 units

(78%) sold to date. The group plans to launch two projects in 2H24 - Union Square Residences (366 units) and Norwood Grand (348 units). To replenish its development landbank, CDL and its JV partner acquired a GLS site at Zion Road for S$1.1bn or S$1,202 psf ppr in April 2024. Additionally, CDL has submitted two joint bids for the Jurong Lake District (JLD) master developer site with four other partners.

+ Hospitality segment continues to improve, albeit with slower growth. 1H24 portfolio RevPAR increased by 3% YoY to S$156, driven by strong growth in Australasia, where RevPAR surged 30% following the acquisition of the Sofitel Brisbane Central hotel. Occupancy continued its upward trajectory, improving by 1.9%pts, while the average room rate increased slightly by 0.1% YoY to $217.1. All markets experienced RevPAR growth YoY, except for London (-2.4%) and Regional US (-0.5%). Portfolio RevPAR growth is expected to remain at similar levels in 2H24, with its Europe portfolio benefitting from the Paris 2024 Olympics.

The Negatives

- Higher gearing. Following the recent acquisitions (1H24: S$1.1bn in acquisitions and investments) and the share buyback of CDL’s ordinary shares and preference shares, net gearing on fair value on investment properties rose to 69% (1Q24: 63%). The interest coverage ratio fell to 2x in 1H24 from 2.8x in FY23. 40% of debt is at a fixed rate and the average cost of debt is expected to increase to c.4.8% for FY24e (1H24: 4.5%) as some loans get refinanced. Nevertheless, CDL maintains a strong liquidity position with S$1.7bn in cash. CDL aims to bring gearing down to below 60% by 2025.

- Behind on its S$1bn divestment target for 2024. Year-to-date, CDL has divested c.S$271mn of assets, primarily strata units in Singapore. Management is currently engaged in discussions to divest certain large assets but will not proceed with divestments at undervalued prices merely to comple the transaction. Cautious buying sentiment persists in the market, making divestments challenging.

City Developments Limited – Buying back shares

- No financials were provided in this operational update. The launch of Lumina Grand was well received, with 381 units (74%) sold to date. Hotel operations continue to improve, with portfolio RevPAR growing 5.3% YoY to S$139.4.

- Bought back 13mn shares (1.4% of issued shares) since 8 March 2024 for a total consideration of S$76.4mn. In April 2024, CDL announced an off-market equal access scheme to buy back up to 30mn preference shares (10% of total) at an offer price of $0.78.

- Maintain BUY with an unchanged TP of S$6.87, a 45% discount to RNAV of S$12.50. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and the continuous recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Strong sales under the property development segment. In 1Q24, the Group and its JV associates sold 429 units with a total sales value of S$737mn (1Q23: 88 units with a total sales value of S$213mn). Sales were driven by the launch of Lumina Grand, with 381 units (74%) sold to date. Tembusu Grand and The Myst continued to sell well, with 62% (4Q23: 60%) of its 638 units and 59% (4Q23: 51%) of its 408 units sold to date, respectively. The group plans to launch two projects in 2H24 - Union Square Residences (366 units) and a project at Champions Way (348 units). To replenish its development landbank, CDL secured a 164,451 sq ft GLS site with JV partner Mitsui Fudosan (Asia) Pte. Ltd. in April 24, for S$1.1bn or S$1,202 psf ppr. Located along Zion Road, this site is directly connected to Havelock MRT station. The plan is to develop the site into an integrated mixed-use project comprising two blocks (69 and 64 stories) with 740 residential units and a retail podium.

- Initiated share buyback programme. On 8 March 24, CDL initiated a share buyback programme for its ordinary shares, and since then, a total of 12.9mn shares (1.43% of issued shares) have been bought back for a total consideration of S$76.4mn. The ordinary shares will be held as treasury shares and may be used for CDL’s long-term incentive plans. In April, CDL announced an off-market equal access scheme to buy back up to 29mn preference shares (10% of total preference shares in issue) at the offer price of $0.78 in cash. The low trading volume of preference shares gives preference shareholders an exit opportunity to partially monetise their holdings. All preference shares acquired by the company pursuant to the off-market equal access offer will be cancelled.

- Hospitality segment continues to improve. 1Q24 portfolio RevPAR rose 5.3% YoY to S$139.4, due to strong growth in Australasia and Singapore. With higher room rates (+0.7% YoY), occupancy (+3.1%pts), and cost optimisation, 1Q24 GOP margins improved 1.7% points YoY to 26.7%. CDL will be refurbishing several hotels in FY24, and they include 1) Millennium Hotel London Knightsbridge, 2) M Social Phuket, 3) Millennium Downtown New York, and 4) The M Social Hotel Sunnyvale in California for a total cost of S$278mn. Additionally, CDL acquired the 268-room Hilton Paris Opera Hotel for €240mn (S$350mn) in May 24. This acquisition complements its expansion plans in Europe ahead of the upcoming Paris 2024 Olympics.

The Negatives

- Higher gearing and lower interest cover. Net gearing on fair value on investment properties inched up to 63% (FY23: 61%). The interest coverage ratio fell to 1.2x in 1Q24 from 2.8x in FY23. Nevertheless, CDL maintains a strong liquidity position with S$2.4bn in cash.

Outlook

CDL is targeting S$1bn in divestments in 2024 to recycle capital, and successful divestments could translate into significant divestment gains as it carries assets at cost in its books - some of which have been held at book value for several decades. The property cooling measures introduced in 2023 continue to stifle demand – foreign buyers have disappeared since the ABSD hike to 60%. The hospitality segment should continue to improve on the back of mega-concerts and MICE events in Singapore, as well as the upcoming Paris 2024 Olympics.

Maintain BUY with an unchanged RNAV TP of S$6.87

We view CDL as a proxy for the Singapore residential market and hospitality recovery. CDL is trading at an attractive 53% discount to our RNAV/share of S$12.50.

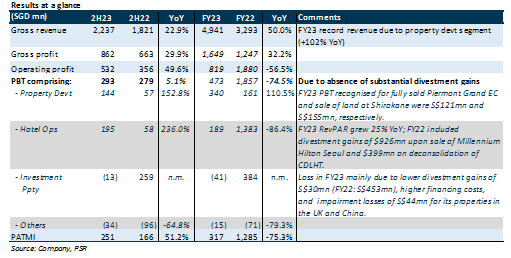

City Developments Ltd – Record revenue driven by property development

- FY23 PATMI of S$317.3mn (-75.3% YoY) missed our estimate by 15% due to higher-than-expected finance costs (+73% YoY). The YoY decline in PATMI was largely attributable to the absence of outsized divestment gains from the divestment of Millennium Hilton Seoul (S$926mn) in FY22.

- Excluding divestment gains and impairment losses, FY23 PATMI quadrupled YoY to S$188.6mn (FY22: S$47mn); PBT grew 90% YoY to S$352.7mn (FY22: S$186mn). This was mainly due to the contribution of Piermont Grand EC in its entirety in Jan-23 and the sale of land at Shirokane in Jul-23 under the property development segment.

- Maintain BUY with a lower TP of S$6.87 from S$8.22, a 45% discount to RNAV of S$12.50. We raise our FY24e PATMI estimate by 15%, factoring in higher contributions from hotel operations. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and the continuous recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Record revenue in FY23 boosted by property development segment (+102% YoY). This was due to the fully sold Piermont Grand EC, which obtained TOP in Jan 23, and the sale of land at Shirokane in July 23. In FY23, the group and its joint venture associates sold 730 units with a total sales value of S$1.5bn (FY22: 1,487 units with a total sales value of S$2.9bn). Sales were largely driven by The Myst and Tembusu Grand, which sold 60% of its 638 and 51% of its 408 units to date respectively. The launch of Lumina Grand EC in Jan 24 was well received, with 55% sold to date. The group plans to launch two projects in 2H24 - Union Square Residences (366 units) and Champions Way (348 units). It is still monitoring market conditions to determine the appropriate time to launch Newport Residences, which has no ABSD deadline.

- Hospitality segment continues to improve. FY23 portfolio RevPAR rose 25.3% YoY to S$168.7, exceeding pre-COVID FY19 levels by 22%, fuelled by higher room rates (+10%) and occupancy (+9ppts). FY23 GOP margin improved 3.7ppts to 34.5% led by Asia markets. The group's strategic expansion of its hotel portfolio continued in FY23 as it acquired three hotels with a total of 1080 rooms and opened another three hotels with a total of 916 rooms.

The Negatives

- Average cost of debt rose from 2.4% in FY22 to 4.3% in FY23, resulting in a 73% jump in finance costs. Net gearing on fair value on investment properties rose to 61% (FY22: 51%). As only 45% of debt is on a fixed rate, CDL will benefit significantly from any interest rate cuts.

City Developments Limited – Business as usual

- No financials were provided for the 3Q23 operational update. The group’s net gearing ratio (after factoring fair value on investment properties) now stands at 58% following the completion of various acquisitions in 2023.

- In Nov 2023, the group announced a proposal to buy back up to 10% of its preference shares through an off-market equal access scheme at S$0.78 in cash for each preference share.

- We maintain BUY with an unchanged TP of $8.22, a 45% discount to RNAV of S$14.94. No change in our forecasts. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Singapore residential market remained resilient despite cooling measures. In 3Q23, the group and its joint venture associates sold 183 units with a total sales value of S$325mn (3Q22: 95 units with a total sales value of S$281mn). Sales were largely driven by the launch of The Myst in July 2023, with 169 units (41%) sold to date at an ASP of S$2,065 psf. Looking ahead, the group plans to launch Newport Residences in 1H24 after it was delayed due to the cooling measures, as well as the 512-unit Lumina Grand EC at Bukit Batok West Avenue 5 in 1Q24. We anticipate strong demand for Lumina Grand EC as it is near three MRT stations and the new Anglo-Chinese School (Primary), which is relocating to Tengah in 2030. Also, the group has secured a 155k sq ft residential Government Land Sales (GLS) site at Champions Way for S$295mn (or $904 psf ppr) in Sep 2023, pipping five other keen competitors. This project is slated for launch in 2H24 and will comprise about 350 residential units.

- Hospitality segment continues to improve. 9M23 portfolio RevPAR rose 31.6% YoY to S$163.6, exceeding pre-COVID 9M19 by 20% mainly due to higher room rates. All regions had higher RevPAR YoY, with Asia and Australasia having the greatest improvement of 62.1% and 67.5%, respectively. We expect RevPAR to continue growing in FY24, albeit at a slower pace. The group's strategic expansion of its hotel portfolio continued in 3Q23 as it acquired the 408-room Nine Tree Premier Hotel Myeongdong II in Seoul for KRW140bn (c/S$143.9mn), and the 256-room Bespoke Hotel Osaka Shinsaibashi in Osaka for JPY8.5bn (S$78.5mn).

- Expansion of the living sectror. In Sep 2023, the group acquired a residential rental portfolio in Tokyo comprising 25 freehold assets with 836 units for JPY 35bn (S$321.9mn). It now owns 35 operational Private Rented Sector (PRS) assets in Japan with an occupancy of above 95%.

- Buying back shares to strengthen capital structure. In Nov 2023, the group announced a proposal to buy back up to 10% of its preference shares through an off-market equal access scheme. Preference shareholders are entitled to sell 10% of their preference shares owned for S$0.78 in cash for each preference share. After the completion of the offer, the group plans to cancel any preference shares purchased, reducing its finance cost in relation to the coupon payment of the shares.

The Negatives

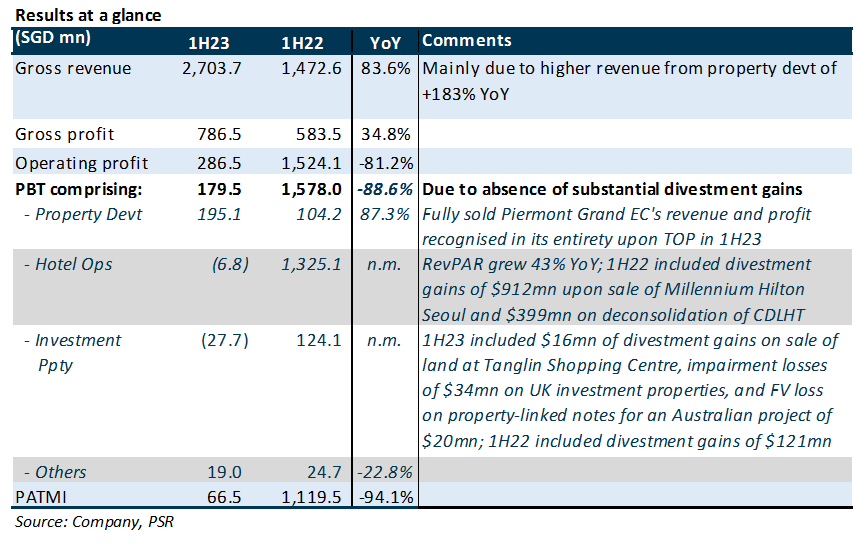

City Developments Limited – Anticipating stronger growth in hospitality

- 1H23 revenue of S$2.7bn (+83.6% YoY) was in line and formed 71% of our FY23e forecast due to the full revenue recognition of Piermont Grand Executive Condominium (EC) upon completion in 1H23. PATMI underperformed at S$66.4mn (-94.1% YoY) due to the absence of divestment gains in 1H22, as well as higher financing costs and impairment/ fair value losses in 1H23.

- Excluding divestment gains and impairment losses, EBITDA and PBT increased 48%; PATMI increased 1% YoY to S$104.3mn.

- Upgrade to BUY with a lower RNAV-derived TP of $8.22 from $8.33, a 45% discount to RNAV of S$14.94. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV. CDL declared a special interim dividend of 4 Singapore cents per share.

The Positives

- Singapore residential market remains resilient despite cooling measures. In 1H23, the group and its joint venture associates sold 508 units with a total sales value of S$1.1bn (1H22: 712 units with a total sales value of S$1.6bn). Sales picked up in 2Q23 with the launch of the 638-unit Tembusu Grand in April with 58% of units sold to date. In July, the Group launched The Myst, a 408-unit development at Upper Bukit Timah and it is 32% sold to date at an ASP of S$2,057 psf. Looking ahead, the Group will be launching a 512-unit EC at Bukit Batok West Avenue 5 in 1Q24 and we anticipate strong demand for this project as it is near three MRT stations and the new Anglo-Chinese School (Primary), which is relocating to Tengah in 2030.

- Hospitality segment remains robust. Excluding divestment gains and impairment losses, EBITDA grew 69% due to stronger RevPAR performance across the portfolio (+42.7% YoY to S$151.5). It was driven by both an 18.3% increase in average room rates to S$216.8 and an 11.9% points (69.9% from 58%) increase in occupancy. Compared with pre-COVID 1H19, RevPAR grew 17.2%. We expect RevPAR to continue growing in 2H23, albeit at a slower pace. However, this segment reported a loss before tax of S$6.8mn, due to one-off expenses and higher interest expense. The group's strategic expansion of its hotel portfolio continues as it recently completed the acquisition of the 408-room Nine Tree Premier Hotel Myeongdong II in Seoul in July 2023 for KRW140bn. Furthermore, the group has entered into a significant agreement to purchase the 416-room Sofitel Brisbane Central hotel in Australia for A$177.7mn, or about A$427,000 per key.

The Negatives

- Borrowing costs rose sharply to 4.1% for 1H23 compared with 2.4% for FY22. Consequently, net finance cost rose 3.8x YoY to S$147mn. Net gearing (including fair value on investment properties) also increased to 57% from 51% as at Dec22.

- Sizable impairment/ fair value losses on investment properties of $54mn. There were impairment losses of $34mn on UK investment properties due to a 30-50bps expansion in cap rates, leading to a drop in valuations. There was also a fair value loss on property-linked notes for an Australian project of $20mn.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report