ComfortDelGro Corp Ltd – Acquisitions delivering extra growth

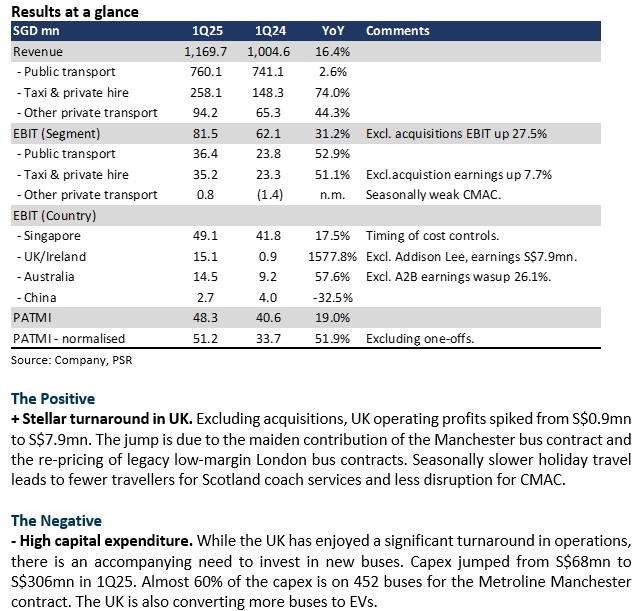

- 1Q25 results were within expectations. Revenue/PATMI was 24%/20% of our FY25e forecast. 1Q is typically a seasonally lower due to lower contributions from Scotland coach services and CMAC.

- 1Q25 operating earnings rose 45% YoY to S$81.5mn. Excluding acquisitions, operating earnings rose 27.5% YoY, due to a significant turnaround in the UK. Operating earnings spiked from S$0.9mn to S$8mn with the renewal of London bus routes and the contribution from the new Metroline Manchester contract.

- We maintain our FY25e forecast and DCF target price of S$1.68. Our BUY recommendation is unchanged. ComfortDelGro is delivering more stable and visible growth with acquisitions, new and re-pricing of bus contracts in the UK. The dividend yield of 6% is attractive as the company maintains a high payout ratio of 80%.

ComfortDelGro Corp Ltd – UK the shining light

- FY24 results beat expectations. Revenue/PATMI was 104%/112% of our FY24e forecast. UK operating profit spiked 4-fold to S$18mn from the renewal of higher margin bus contracts and acquisition of CMAC and Addison Lee.

- Excluding acquisitions, we estimate operating earnings declined 3% YoY in 4Q24 to S$77.3mn. Weakness was largely in the China taxi and the Singapore rail operations. Dividends per share rose 16.7% YoY to 7.77 cents, as the company continues with its aggressive 80% payout ratio. ComfortDelgro pays an attractive forward yield of 6.4%.

- We raised our FY25e revenue and PATMI by 4%/9% respectively. Our DCF target price has been increased to S$1.68 (prev. S$1.63) and we upgrade our recommendation to BUY from ACCUMULATE. Growth drivers in FY25e include the Addison Lee acquisition, improving Singapore rail earnings, expanding UK bus routes and margins, and better availability of bus drivers in Australia. Taxi operations will face competition in the near term from new ride-hailing operators in Singapore and softer revenue in China due to weak economic conditions.

ComfortDelGro Corp Ltd – Acquisition dependent

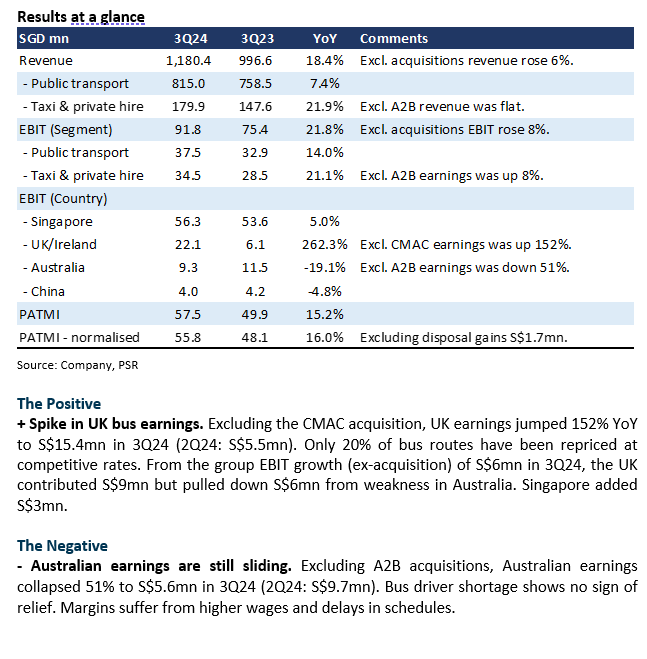

- 9M24 revenue was above expectation at 80% FY24e due to CMAC acquisitions. PATMI was within our expectations at 74%. 3Q24 PATMI rose 15% YoY. Profitability in Australia has suffered due to bus driver shortages collapsing margins.

- Excluding CMAC and A2B acquisition, total EBIT growth was 8% YoY, led by higher margins from repricing of UK bus operations. The largest drag was Australia, where EBIT collapsed 51% YoY after removing A2B due to bus driver shortages.

- We raised our FY24e revenue and PATMI by 9%/1% respectively. We maintain our DCF target price of S$1.63 but downgrade our recommendation from BUY to ACCUMULATE due to share price performance. Earnings growth is dependent on recent acquisitions at the expense of higher gearing. Organic growth drivers have largely stalled except for the repricing of London bus routes, which is starting to contribute materially this quarter. We believe the acquisition of CMAC and, recently, Addison Lee is earnings accretive. Both acquisitions allow the company to enter Europe's premium point-to-point transportation and accommodation service industry. We await the potential synergies from the S$750mn worth of acquisition.

ComfortDelGro Corp Ltd – Finally, UK is a source of growth

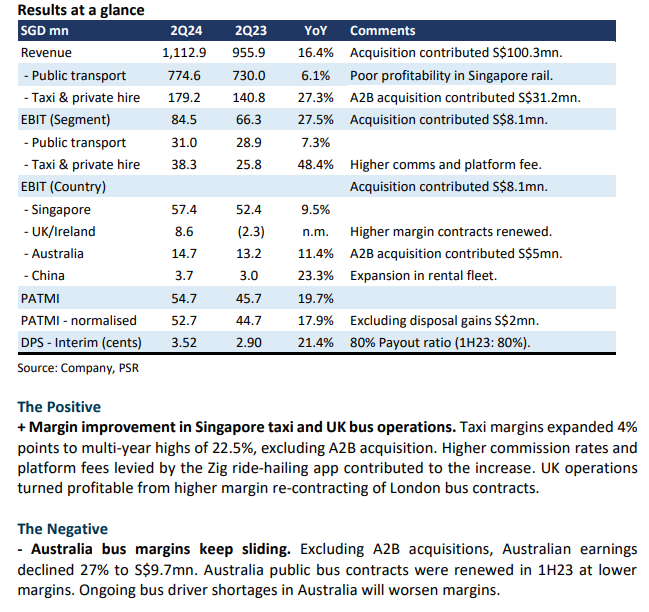

- 1H24 results were within our expectations. Revenue and PATMI were 52%/45% of our FY24e forecast. 2Q24 net profit rose 18% YoY driven by a strong turnaround in UK bus and Singapore taxi businesses. Interim dividend increased 21% to 3.52 cents.

- Around half of 2Q24 EBIT growth was from UK bus operations. It turned around from losses to a 3% operating margin. Taxi earnings spiked 48% YoY to S$38.3mn on the back of higher Zig ride-hailing commissions and platform fees. Excluding acquisitions, Australia's earnings in 2Q24 declined 26% YoY.

- Our FY24e earnings and DCF target price of S$1.63 is unchanged. We maintain our BUY recommendation. The re-contracting of London bus routes over the next few quarters will provide strong earnings growth and visibility. Another boost will be a seasonal uptick in earnings from CMAC Group in 2H24. The Singapore taxi business is facing renewed ride-hailing competition. However, higher taxi fares and commission (from end-2023) will provide earnings support in 2H24. The weakness remains in Singapore rail, which is hardly profitable, and the margins in Australia are declining.

ComfortDelGro Corp Ltd – Zig platform led the recovery

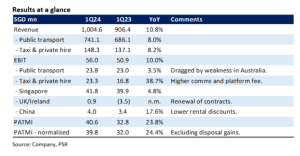

- 1Q24 results were within our expectations. Revenue and PATMI were 25%/20% of our FY24e forecast. 1Q24 net profit increased 24% YoY to S$40.6mn.

- Taxi operations enjoyed the strongest growth with a 39% YoY jump in 1Q24 earnings. Public transportation continues to earn paltry operating margins of 3%, dragged down by lower margin contract renewals in Australia. 1Q is typically the weakest seasonally.

- We maintain our FY24e and DCF target price of S$1.63. Our BUY recommendation is unchanged. Earnings growth is still underway led by higher platform fees and commission charged by Zig Singapore, continuous margin improvement from UK bus re-contracting and expansion, lower taxi rebates, contribution from CMAC acquisition and increased taxi fleet size in China and volume improvement in Singapore rail operations. Australia is the weak spot due to lower margin bus contract renewals.

The Positive

+ Operating leverage from Zig platform. Taxi earnings jumped around 39% YoY to S$23mn. The rise was due to higher commission rates and platform fee charged on the Zig ride-hailing app. Another boost to earnings was the turnaround in China from lower rental discounts.

The Negative

- Decline in Australia earnings. Australia's operating earnings declined by 16% to S$9.2mn. Lower margins in public bus renewals especially in Sydney and other New South Wales routes dragged earnings lower.

ComfortDelGro Corp Ltd – More growth ahead

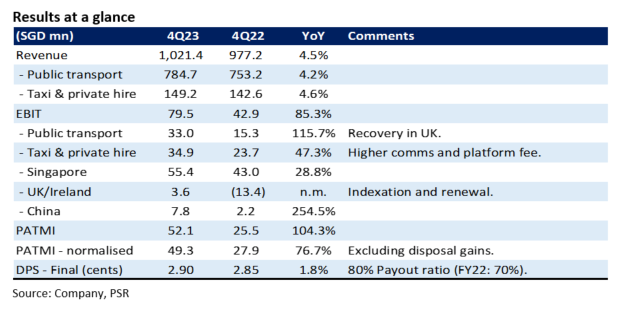

- FY23 earnings beat expectations at 117% of our forecast. Revenue was within our estimates at 98%. 4Q23 PATMI jumped 77% YoY to S$49.3mn.

- The turnaround in UK bus operations and growth in Singapore and China taxi operations were the major drivers of earnings.

- We raised our FY24e earnings by 24% to S$207mn. Our BUY recommendation is maintained and the DCF target price raised to S$1.63 (prev. S$1.57). We expect multiple earnings drivers in 2024; (i) higher platform fees and commission for Singapore taxis; (ii) UK bus indexation and re-contracting; (iii) Increased taxi fleet size in China; (iv) Margin recovery for Singapore rail operations as operating cost stabilises, rail passenger numbers grow and lagged re-pricing of fares.

The Positive

+ Jump in China taxi earnings. Operating profit in China jumped almost 4-fold to S$7.8mn in 4Q23. Earnings recovered as rebates were removed. Demand for vehicles has been strong, and ComfortDelGro is looking to expand its fleet to accommodate the demand.

The Negative

- Meagre rail earnings. We expect Singapore rail operations to be barely profitable. The rise in wages and electricity has impacted margins. We believe margin recovery will occur in FY24e from the lagged 7% rise in fares and slower rise in operating costs, especially electricity.

ComfortDelGro Corp Ltd – Higher pricing supporting margins

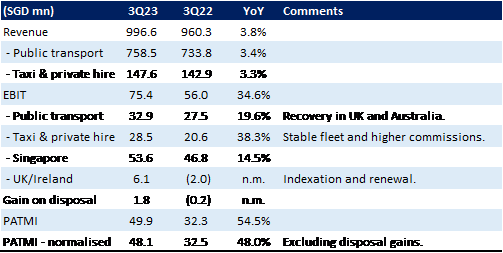

- 3Q23 normalised PATMI jumped 48% YoY to S$48mn and was within our expectations. Revenue was softer than expected. 9M23 revenue and PATMI were 73% and 78% of our FY23e forecast.

- Earnings growth was driven by a turnaround in the UK bus operation and growth in Singapore taxi operations. UK benefited from higher pricing through contract indexation and renewal. Singapore taxi margins expanded with platform fees.

- We lower our FY23e revenue by 4% and PATMI is maintained. Our BUY recommendation and DCF target price of S$1.57 is unchanged. Earnings momentum will be sustained by higher bus service fees in the UK, taxi platform fees in Singapore and lagged pricing of rail services in Singapore.

Source: Company, PSR #Note – Only selected financials are provided in the 3Q23 update.

The Positive

+ UK operations turnaround. A major part of earnings growth in 3Q23 was the turnaround in UK operations. From an operating loss of S$2mn, UK swung to a S$6mn profit. Around 70% of the routes have been re-indexed. Another boost to margins will be re-contracting of the bus contract routes that can expire up to 5 years. Recent re-contracting has seen a significant improvement in margins.

The Negative

- Rail profitability is still weak. We believe profitability in Singapore rail remains weak despite the jump in passenger traffic. Rail operations are burdened by the higher electricity and a lagged re-pricing of fares. The next round of higher fares will be in December this year.

Outlook

We expect earnings growth to sustain into FY24e, supported by re-pricing of bus contracts in the UK, improvement in bus efficiency in Australia as drivers return, platform fees raising taxi margins and higher fares driving up Singapore rail profitability. Taxi operations in Singapore have seen a resurgence in competitive pricing by other platforms but Comfort’s taxi fleet has remained stable with market share rising.

Maintain BUY with an unchanged TP of S$1.57

ComfortDelgro pays around 4.6% dividend yield, enjoys a net cash balance sheet of S$500mn and visibility of earnings recovery.

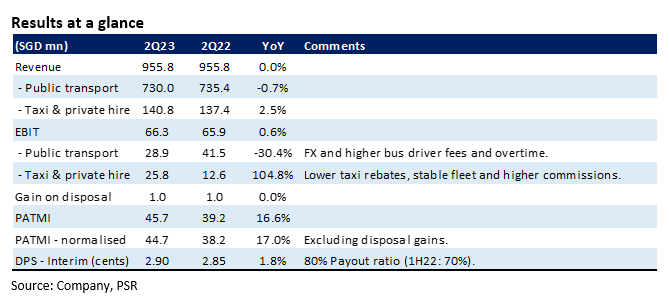

ComfortDelGro Corp Ltd – Recovery building momentum from repricing

- 2Q23 results were within expectations. 1H23 revenue and PATMI were 45% and 47% of our FY23e forecast. PATMI grew 17% YoY to S$45mn as taxi earnings doubled.

- Public transport remains a drag on earnings from weaker foreign exchange and higher bus driver costs in the UK. We expect a strong rebound in earnings as bus contracts service fees in the UK are repriced higher from inflation indexing and more rational pricing.

- No changes to our FY23e forecast but we raised our FY23e DPS to 6.08 cents (prev. 5.3 cents), as the company increased their minimum payout ratio from 50% to 70%. Our BUY recommendation and DCF target price of S$1.57 is unchanged. The largest driver to earnings in 2H23 will be the repricing of services in the key public transport and taxi operations. We believe the key earnings driver in 2H23 include higher bus service fees in the UK, increased hiring of Australian bus drivers, the introduction of taxi platform fees in Singapore and lower taxi rental rebates in Singapore and China.

The Positives

+ Taxi profits doubled. 2Q23 margins improved with higher booking volumes, additional booking commissions, lower rebates in Singapore (15% to 10% from Apr23) and reduced taxi rebates and costs in China. Another driver to earnings has been a stable taxi fleet in Singapore. Comfort’s taxi fleet grew 0.8% YoY to 8,782, after several years of decline.

+ Cash piling up and returning to shareholders. Comfort continues to generate healthy free-cash-flows (FCF). 1H23 FCF was S$86.4mn (1H22: S$88.5mn), pilling up the net cash to S$565mn. Capital expenditure is now trending at S$350mn p.a. compared to pre-pandemic S$450-500mn. Comfort has raised its minimum dividend payout ratio from 50% to 70%. We estimate S$131mn of dividends to be paid out this year.

The Negative

- Lethargic in margins for public transport. Public transport operating margin has been the weakest spot for Comfort. 2Q23 margins was 4%, an improvement over 3.4% in 1Q23 but far below pre-pandemic 8%. Bus operations across the UK, Australia and Singapore are depressing margins. The worst hit is the UK which reported an operating loss of S$0.5mn. A combination of irrational tendering activity and a spike in bus driver fees has negatively impacted margins. Australia is suffering from higher overtime salaries and other “running time” charges due to the lack of bus drivers.

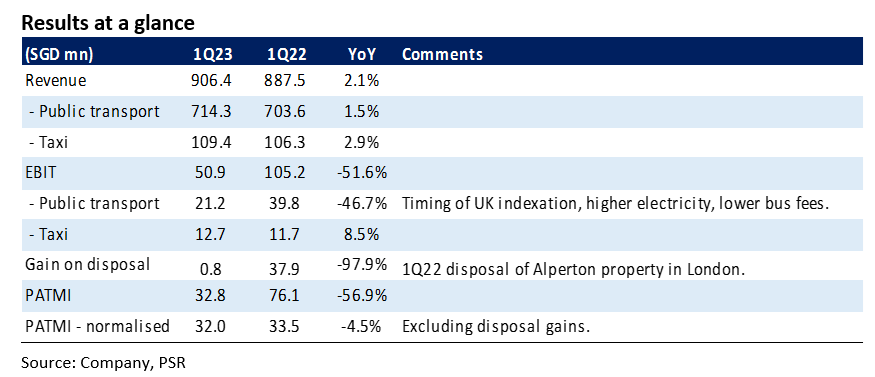

ComfortDelGro Corp Ltd – Inflationary pressures gradually abating

- 1Q23 revenue was within expectations but PATMI disappointed. 1Q23 revenue/PATMI was 22% and 18% of our FY23e forecast.

- The cost recovery from higher indexation of bus fees is underway in UK but the full benefit will be more evident in 2H23. Taxi earnings were hampered by incentives in China to attract taxi drivers, especially in Beijing. Balance sheet continues to strengthen with net cash of S$718mn

- The recovery in Singapore disappointed. Improvement in rail passenger volumes and prices could not offset the higher electricity and lower bus contracting fee. We are lowering our FY23e PATMI by 8% to S$164.7mn. Recovery in FY23e will stem from increased passenger volumes for both taxis and trains, a reduction in taxi rental rebates in Singapore by 5% points, indexation of UK bus contracts and lower taxi rebates in China. We maintain BUY with a reduced DCF target price of S$1.57 (prev. S$1.63).

The Positives

+ Taxi revenue improvement is still underway. Recovery of taxi revenue was due to booking commissions introduced last year (May 22: 4%, Oct 22: 5%) and a more stable taxi fleet. The improvement in taxi revenue would have been stronger but for incentives in China to attract drivers. Utilisation rate of taxis remains sluggish, especially in Beijing. Operating profit in China declined 46% to S$3.4mn.

+ With stable capex, cash piles up. Comfort generated free cash flow of around S$76.8mn in 1Q23 (1Q22: S$92.5mn). Net cash continues to pile up on the balance sheet. 1Q23 net cash is S$718mn, similar to last years S$754mn. Net cash is at record levels. Annualised capex is now S$200mn p.a., compared to the S$350mn-400mn p.a. pre-pandemic. We expect the large cash hoard will also boost earnings through higher interest income.

The Negative

- Poor margins in public transport. Public transport operating margins are a paltry 3% vs pre-pandemic 8%. Margin pressure comes from low bus contracting fees in Singapore, higher electricity and increased bus driver fees in Australia and UK. Despite the jump in rail fees (via subsidies) and volumes in Singapore, margins were under pressure. UK suffered an operating loss of S$3.5mn in 1Q23, compared to S$1.6mn profit a year ago.

ComfortDelGro Corp Ltd – Weighed by upfront costs

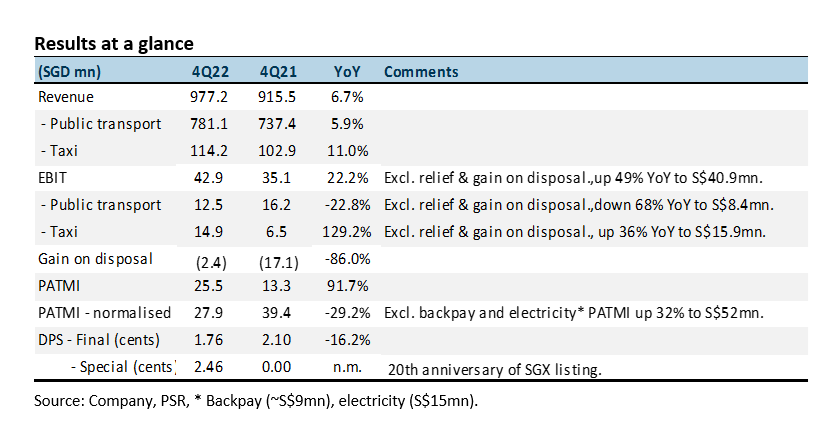

- FY22 revenue met expectations at 99% of our forecast. Adjusted PATMI was 13% below due to an additional S$15mn rail electricity expense from the new contract in Singapore. Cost recovery will come from the 13.5% fare adjustment effective late December 2022.

- Special dividend of 2.46 cents was declared to mark the 20th anniversary of the SGX listing. FY22 total special dividend was 3.87 cents while the ordinary dividend was 4.61 cents (3.8% yield).

- We lowered our FY23e PATMI by 20% to S$178.4mn as the timing of the indexation of the UK bus contract is unclear. Nevertheless, we expect earnings growth in FY23e from increased passenger volumes for both taxis and trains, re-pricing of rail fares in Singapore, indexation of UK bus contracts and reduction of taxi rebates in China. We maintain BUY with a reduced DCF target price of S$1.63 (prev. S$1.75).

The Positives

+ Taxi recovery on track. 4Q22 operating profit (excluding relief and gain on disposal) jumped 36% YoY to S$15.9mn. Earnings recovery on the back of lower rental discounts and introduction of booking commissions (May 22: 4%, Oct 22: 5%). Booking volumes in FY22 rose 31% to 34mn.

+ Piling up cash. Net cash in FY22 rose S$97mn to S$675mn. Free cashflow generated during the year was S$266mn. Gross CAPEX on vehicles was around S$300mn. FY23e CAPEX might be slightly higher for EV taxis, the PHV car rental fleet and EV charging stations. CAPEX is still below the S$400mn-500mn p.a. spent pre-pandemic.

The Negative

- China, UK and Ireland's weak operating performance. We estimate UK and Ireland suffered a S$13mn operating loss in 4Q22 due to the one-off S$9mn UK bus driver pay deal backpay agreement. China operating earnings were down 60% to S$10.3mn in FY22 due to taxi rental rebates of S$11mn.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report