Stoneweg European REIT – Robust capital position to fuel growth opportunities

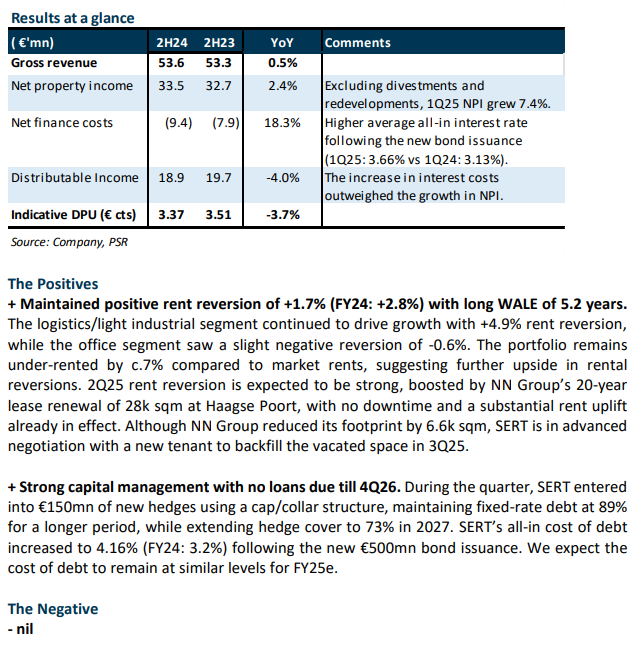

- 1Q25 DPU of 3.374 cents was in line with our estimates, making up 25% of our FY25e forecast. It declined 3.7% YoY due to higher interest expense from the new bond issuance. 1Q25 NPI rose 2.4% YoY, driven by higher rental income and the reversal of bad debt provisions in France following arrears repayment by two tenants. Excluding divestments and redevelopments, NPI increased 7.4% YoY.

- Portfolio occupancy declined QoQ from 93.5% to 92%, though management remains confident and is engaged in active discussions to relet the vacated space. 1Q25 portfolio rent reversion was +1.7%, led by logistics/light industrial at +4.9%. SERT has no debt maturing until 4Q26 and entered into €150mn of new hedges during the quarter using a cap/collar structure, allowing it to benefit from further declines in the 3-month Euribor.

- Maintain BUY, with an unchanged DDM-derived TP of €1.86. Our forecasts remain unchanged. We expect mid-single-digit positive rent reversion in the logistics/light industrial segment to persist in FY25e, with portfolio occupancy rising to c.94% as backfilling of vacated spaces is at advanced stages. While DPU is expected to decline YoY from higher finance costs, SERT continues to offer an attractive 9% yield and trades at a compelling 0.74x P/NAV.

Stoneweg European REIT – No refinancing requirements until 4Q26

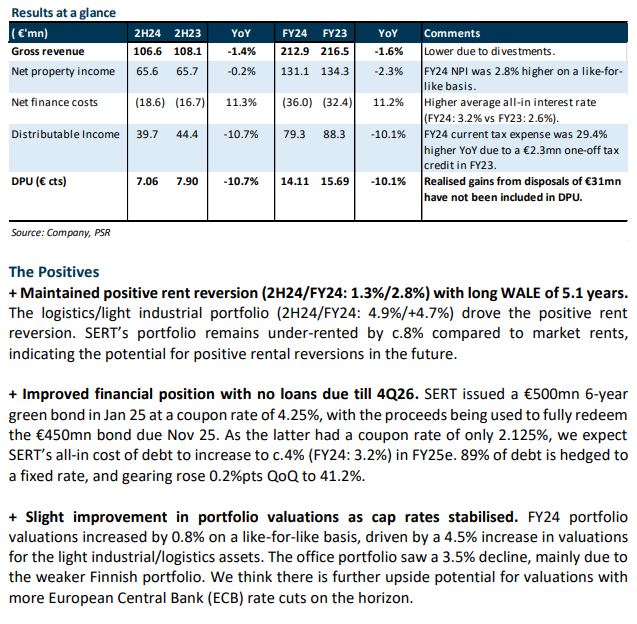

- 2H24/FY24 DPU of 7.056/14.106 €cents was in line with our estimates, forming 50%/99% of our FY24e forecast. It was 10.7%/10.1% lower YoY due to asset sales, higher finance costs, and higher current tax expense from the absence of a one-off tax credit. FY24 NPI was down 2.3% YoY, excluding divestments and redevelopments, it was 2.8% higher YoY. NPI for the office portfolio rose by 5% YoY, while the logistics/ light industrial portfolio grew by 1.5% YoY on a like-for-like basis.

- De-risked the balance sheet with the issuance of a new €500mn 6-year green bond in Jan 25 at a coupon rate of 4.25% to refinance the €450mn Nov 25 bond maturity. Portfolio occupancy dipped 0.4%pts QoQ to 93.5%, with FY24 portfolio rent reversion at +2.8%. Portfolio valuations rose 0.8% YoY on a like-for-like basis.

- Maintain BUY, with a lower DDM TP of €1.86 (previous €1.95) as we roll forward our forecasts. There is no change to our FY25e DPU estimate. SERT’s pivot towards a 60% target asset class weight in light industrial/logistics aims to capitalise on positive structural trends, such as increased e-commerce penetration and the nearshoring of supply chains. We expect the mid-single digit positive rent reversion for the logistics/light industrial segment to continue in FY25e. Despite the YoY decline in DPU expected from higher finance costs in FY25e, SERT still trades at an attractive yield of 9.5%, and a P/NAV of 0.70x.

Cromwell European REIT – Secured debt facilities to refinance bond

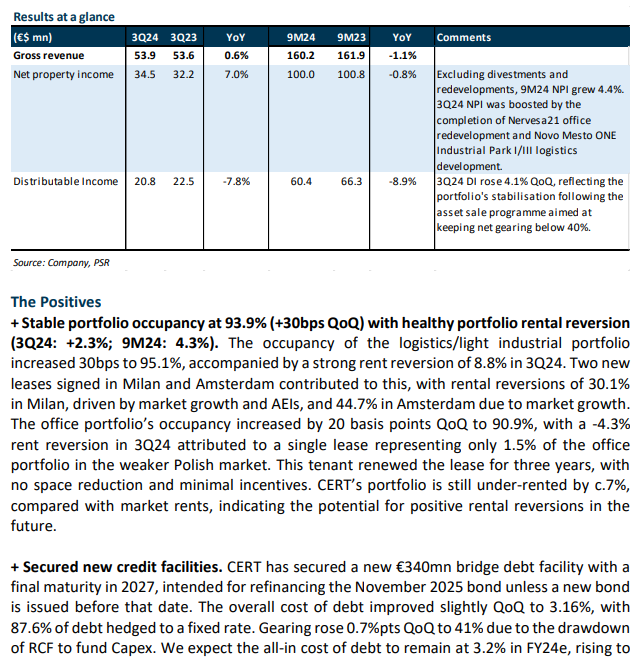

- 3Q24/9M24 DI was in line with our estimates, forming 26%/77% of our FY24e forecast. 3Q24 NPI rose 7% YoY, boosted by the completion of Nervesa21 office redevelopment in Milan, and Novo Mesto ONE Industrial Park I/III logistics development near Bratislava. 3Q24 DI was 7.8% lower YoY due to asset divestments and higher interest costs.

- Portfolio occupancy improved by 30bps QoQ to 93.9%. With the new €340mn bridge debt facility and current undrawn RCF, CERT can repay the €450mn November 2025 bond if needed but will wait to optimise timing and pricing for a new, longer-dated bond. 9M24 portfolio rental reversion was healthy at +4.3%. CERT’s overall passing rents are c.7% lower than market rents, indicating potential for positive rental reversions in the future.

- Maintain BUY, with a higher DDM TP of €1.95 (previous €1.91). We nudge up both our FY24e and FY25e DPU estimates by 2% on stronger operating performance. We expect FY24e year-end portfolio valuation to remain stable. CERT’s pivot towards a 60% target asset class weight in light industrial/logistics aims to capitalise on positive structural trends, such as increased e-commerce penetration and the nearshoring of supply chains. Catalysts include further ECB rate cuts to secure a low coupon rate for the new bond issuance. Despite the recent share price rally, CERT still trades at attractive FY24e/25e DPU yields of 8.7%/8.2%, and a P/NAV of 0.78x.

Cromwell European REIT – Positive reversions expected to continue

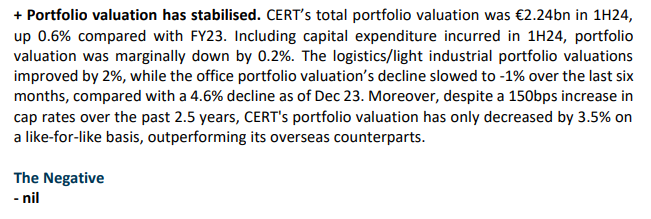

- 1H24 DPU of 7.050 €cents was within expectations at 51% of our FY24e forecast. It was 9.5% lower YoY, due to asset sales and higher finance costs. NPI fell 2.7% YoY mainly due to the divestments of Bari Europa, Bari Trieste and Piazza Affari, which were crucial at keeping net gearing below 40%. Excluding these, NPI was 2.3% higher YoY on a like-for-like basis.

- Portfolio occupancy improved by 20bps QoQ to 93.6%. The recently completed redevelopment of Nervesa21 is fully leased, and the remaining three tenants have signed at a 74.4% positive reversion. Portfolio rental reversion was strong at +5.2% 1H24. CERT’s overall passing rents are c.6.1% lower than market rents, indicating potential for positive rental reversions in the future.

- Maintain BUY, with an unchanged DDM TP of €1.91. We nudge up our FY24e DPU by 1% on stronger operating performance, while lowering FY25e DPU by 13% after factoring in a higher all-in cost of debt post-refinancing of the bond. We expect portfolio valuation to improve from stabilising cap rates and a higher light industrial/logistics portfolio weightage, which currently stands at 54%. CERT has a long-term 60:40 target asset class split between light industrial/logistics and well-located Grade A offices. Despite accounting for the loss of income from the divestments and higher finance costs, CERT still trades at attractive FY24e/25e DPU yields of 10.2%/9.7%, and a P/NAV of 0.65x.

Cromwell European REIT – A resilient 1Q24

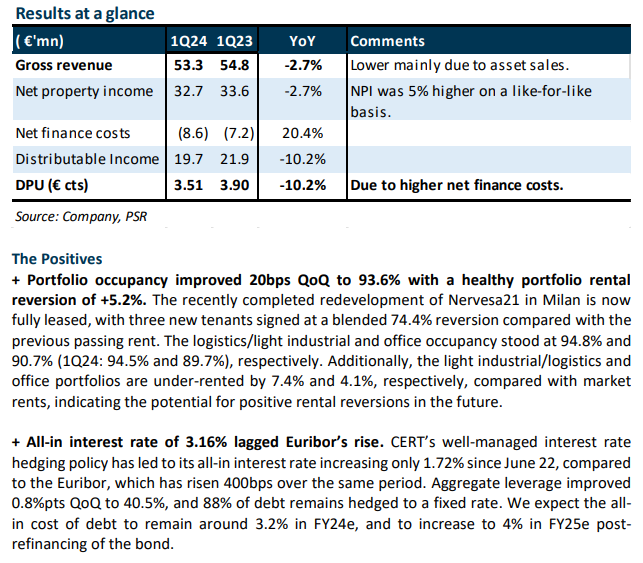

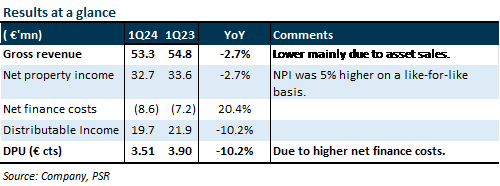

- 1Q24 DPU of 3.505 €cents was within expectations at 25.5% of our FY24e forecast. It was 10.2% lower YoY, due to higher finance costs. NPI fell 2.7% YoY mainly due to the divestments of Bari Europa, Bari Trieste and Piazza Affari. Excluding these, NPI was 5% higher YoY on a like-for-like basis.

- Portfolio occupancy stood at 93.4%, down 0.9%pts QoQ. It is expected to increase to 95% with the full lease-up of the recently completed developments. Portfolio rental reversion was strong at +9.2%, with no debt expiring until November 2025.

- Maintain BUY, with an unchanged DDM TP of €1. We like CERT for its clear divestment and redevelopment strategies, which will help to keep gearing below 40% and foster organic growth. It will also take CERT closer to its long-term 60:40 target asset class split between light industrial / logistics and well-located Grade A offices. Despite accounting for the loss of income from the divestments, CERT still trades at an attractive FY24e DPU yield of 9.2%. There is no change in our estimates.

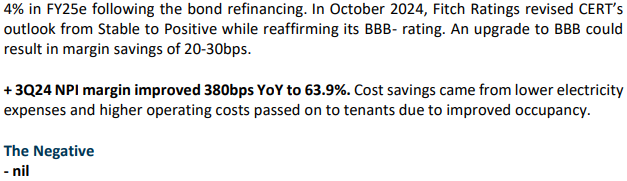

The Positives

+ Portfolio occupancy is expected to improve to 95% as recently completed developments are fully leased. It dipped 0.9%pts QoQ to 93.4% in 1Q24 due to these projects being included in the occupancy statistics, though they were not fully leased yet. Logistics/light industrial and office occupancy stood at 94.5% and 89.7% (4Q23: 95.6% and 90.3%), respectively. Additionally, CERT had a strong portfolio rental reversion of +9.2% (FY23: 5.7%), with light industrial/logistics and office reversions coming in at 5% and 10.3%, respectively.

+ Making full use of the cheap 2.125% bond due November 2025. CERT plans to delay refinancing this bond for as long as possible to take advantage of the cheap cost and potential interest rate cuts. Given its strong operating performance, we believe it will be able to refinance this bond without issue in due time. Additionally, more accretive bond buybacks may be possible if its asset sale program stays on track. Aggregate leverage increased 1%pt QoQ to 41.3%, while the all-in cost of debt increased 0.9%pts QoQ to 3.28% in 1Q24. As 86% of debt remains hedged to a fixed rate, we expect the all-in cost of debt to remain around 3.3% in FY24e.

+ Divestments continue. In 1Q24, Grojecka 5, Poland, was sold for €15.8mn, 7.5% above the most recent valuation. In late April, two more assets were divested for €7.2mn at a blended 2.1% premium. CERT has c.€150mn in potential divestments that are earmarked for sale over the next two years, with €60mn in advanced discussions.

The Negative

- nil

Cromwell European REIT – Asset rejuvenation strategy to drive organic growth

- Resilient portfolio in terms of portfolio occupancy (FY23: 94.3%) and rent reversions (FY23: +5.7%). Occupancy is expected to remain stable this year, with only 13.5% of portfolio leases due for renewal.

- CERT’s long-term 60:40 target asset class split between light industrial / logistics and well-located Grade A offices stands to benefit from the growth in e-commerce and the nearshoring trend, as well as flight to quality.

- Divested €237mn at a 14.6% premium. Another €170mn of assets remaining that are earmarked for sale. The loss of income from divestments and redevelopments is a near-term softness but will keep gearing at their target range of 35-40%. We initiate coverage with a BUY recommendation on Cromwell European REIT with a DDM-derived target price of €91. The FY24e forward dividend yield is 10% based on the current share price. CERT is trading at a P/NAV of 0.65x.

Company Background

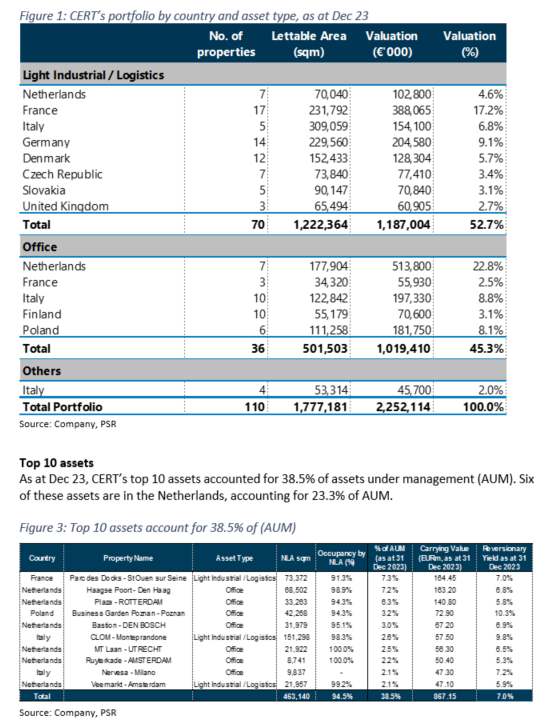

Cromwell European REIT (CERT) was listed on the SGX in Nov 2017. Its €2.3bn portfolio comprises 110 predominantly freehold properties in or close to major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, Slovakia, the Czech Republic, and the UK, with an aggregate lettable area of c.1.8mn sq m and over 800 tenant-customers. CERT’s portfolio consists predominantly of light industrial/logistics (53%) and office (45%) assets. It is managed by Cromwell EREIT Management Pte. Ltd., a wholly owned subsidiary of CERT’s sponsor, Cromwell Property Group, a real estate investor and manager with operations in 14 countries and is listed on the ASX.

Key Investment Merits

- Resilient portfolio with high occupancy and rent reversions. As at Dec 23, portfolio occupancy remained high at 94.3% (Dec 22: 96%) despite the challenging economic environment. Portfolio occupancy is expected to remain stable in 2024, with only 13.5% of leases due for renewal. CERT observed its sixth consecutive half of positive rent reversions, with FY23 reversions coming in at 5.7%. This was due to positive reversions from both the light industrial/logistics (FY23: 3.7%) and office (FY23: 7.5%) segments.

- Divestments to keep capital management in check. Since FY22, CERT has made eight divestments for €237mn at a blended 14.6% premium to the most recent valuation - of which three were divested in FY23 for €196.5mn at a blended 13.6% premium. CERT has €170mn of assets remaining that are earmarked for sale, with most coming from the weaker Polish and Finnish office assets. The proceeds from the divestments could either be used to pay off debt to lower interest costs and keep gearing within the management target range of 35-40% or to recycle capital into accretive redevelopments of some of CEREIT’s trophy projects. The successful divestments in the weaker Polish and Finnish office assets would also bring CERT closer to its long-term 60% light industrial/logistics target weightage to capitalize on the growth of e-commerce and nearshoring.

- CPI-indexed rental escalations. Most of CERT’s leases contain annual rental escalation clauses that are based on 100% of the YoY increase in CPI except for leases in Italy, where it is based on 75% of the YoY increase in CPI. This will help CERT tide through difficult periods of high inflation.

We initiate coverage on Cromwell European REIT with a BUY rating and a DDM-derived target price of €1.91, based on a COE of 10.2% and a terminal growth rate of 2%. We forecast a DPU of 13.76 cents for FY24e, translating into a forward yield of 10%.

Background

Cromwell European REIT (CERT) was listed on the SGX in Nov 2017. It has a principal mandate to invest, directly or indirectly, in income-producing real estate assets across Europe that are used primarily for light industrial/ logistics and office purposes. Its €2.3bn portfolio comprises 110 predominantly freehold properties in or close to major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, Slovakia, the Czech Republic, and the UK, with an aggregate lettable area of c.1.8mn sq m and over 800 tenant-customers. CERT’s portfolio consists predominantly of light industrial/logistics (53%) and office (45%) assets. It is managed by Cromwell EREIT Management Pte. Ltd., a wholly owned subsidiary of CERT’s sponsor, Cromwell Property Group, a real estate investor and manager with operations in 14 countries and is listed on the ASX.

Cromwell European REIT – A portfolio of gems

- We visited 12 assets in three of CERT’s key markets, namely the Netherlands, France, and Italy, which account for 62% of CERT’s portfolio. Assets visited were enviably located near highways and train stations.

- Key office and logistics markets benefitting from positive fundamentals; portfolio largely insulated from inflation.

- Local expertise championing value creation through off-market deals and portfolio optimisation through AEIs/redevelopments and divestment of non-core assets.

Company Background

Cromwell European REIT (CERT) was listed on the SGX in November 2017. Its portfolio comprises 115 predominantly freehold properties with an appraised value of approximately €2.5bn as of April 2022. Its assets are located in or near major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, Slovakia, the Czech Republic and the United Kingdom with an aggregate lettable area of c.1.8mn sqm and more than 800 tenant-customers. The portfolio consists predominantly of office and light industrial/logistics assets which make up c.52% and c.43% of total assets respectively.

Investment Merits

- Key office and logistics markets benefitting from positive fundamentals. Approximately 43% of CERT’s portfolio is in light industrial and logistics assets. Demand for these asset types is well supported by increased e-commerce penetration, pivot to just-in-case inventory management and on-shoring of production. While structural, economic and geopolitical risks headwinds for the Polish and Finnish office markets remain, the Netherlands office market, which represents 23% of CERT’s AUM, continues to experience rental growth on the back of favourable demand-supply imbalances.

- Largely insulated from inflation. CERT’s portfolio occupancy is at an all-time high of 94.8% with a WALE/WALB of 4.6/3.4 years. European leases have inflation-linked annual escalations embedded in the lease, while energy and utility costs are passed through to the tenant, minimising impact to CERT’s earnings.

- Boots on the ground executing rebalancing strategy in spades. Local expertise has allowed CERT to source off-market deals at favourable yields and discounts to valuation, while simultaneously divesting non-core assets above valuations. Having boots on the ground allows CERT to accelerate its rebalancing strategy, pivoting towards its target 60% light industrial/logistics and 40% office asset allocation from its current 52% office and 43% light industrial/logistics allocation. CERT completed €212.6mn/€344mn in light industrial/logistics acquisitions at a blended 6.3%/6.5% NOI yield since FY21/FY20.

- €250mn in redevelopment and new development potential to be unlocked. CERT has identified a €250 million development pipeline over the next few years. Initiatives are expected to rejuvenate the portfolio, command higher rents, and in some cases, increase portfolio NLA.

Key Risks

- Country risk. CERT is exposed to country risks including economic, political or policy changes in the EU or in countries where its assets are located.

- Foreign currency risks. While DPUs are Euro denominated, earnings from three out of nine - Denmark, Poland and the Czech Republic - are paid in their respective currencies. and account for c.15% of earnings.

Investment Actions

No stock rating or price target provided, as we do not have coverage on CERT.

We visited 12 assets in three of CERT’s key markets, namely the Netherlands, France, and Italy, which account for 62% of CERT’s the portfolio. We met with the local asset managers and independent property consultants to gain deeper understanding of CERT’s top three key markets.

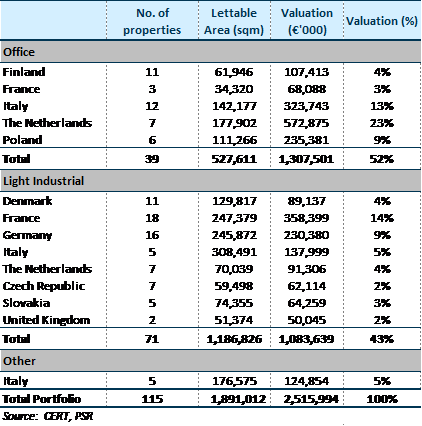

Figure 1: Portfolio breakdown by country and asset type

Other property assets consist of 3 government-let campuses, 1 retail asset and 1 hotel, all located in Italy.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report