BRC Asia Ltd – Record order book

- 1Q25 revenue/PATMI were within expectations at 22%/22% of our FY25e forecast. Revenue declined by 12% YoY due to an estimated 9% YoY fall in steel prices and Safety Time-Out (STO) in November 2024. PATMI increased 14% YoY, which was impacted by major project delays.

- Order book increased 15% YoY to S$1.5bn as of 31 December 2024, the highest level ever achieved by BRC Asia. This is supported by strong construction demand in 2025 and over the next few years.

- We lowered WACC to 11.6% (prev. 12.6%) to reflect greater visibility of upcoming construction projects. Construction demand in Singapore increased to an average of S$42.5bn annually (prev. forecast S$34.5bn) over the next four years. BRC’s leading market share in steel rebars positions them favourably to capture this demand, and we believe that most of the order book can be completed within the next three years as major construction projects start to ramp, such as Terminal 5 beginning construction in the first half of 2025. We maintain ACCUMULATE with a higher TP of S$3.15 (prev. S$2.80). There is no change to our revenue/PATMI estimates. BRC Asia trades at an attractive FY25e dividend yield of 6.2%.

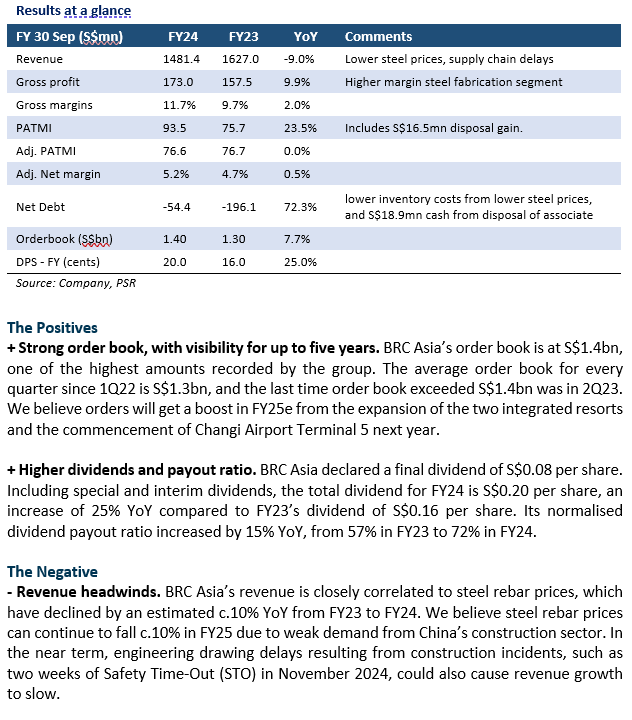

BRC Asia Ltd – Top-line headwinds but recovery in sight

- FY24 revenue was below expectations, 90% of our FY24e estimates. An estimated 10% fall in steel prices and engineering delays, has caused slower progress in project completion. Order book increased 8% YoY to S$1.4bn (4Q24: $1.3bn), one of the highest recorded by the group.

- FY24 PATMI/adjusted PATMI is within expectations, 99%/98% of our FY24e estimates. PATMI experienced a 24% YoY increase due to a one-off gain of S$16.5mn from the disposal of an associate in the previous quarter. Adjusted PATMI is almost flat YoY.

- Maintain ACCUMULATE with a higher TP of S$2.80 (prev. S$2.27). The higher fair value is due to a lower net debt from lower inventory costs and cash from disposal of associate. We lowered FY25e revenue and PATMI forecast by 4%. The strong order book from the expansion of the two integrated resorts and the commencement of Changi Airport Terminal 5 next year should boost revenue. Still, we expect it to be offset by project delays. Stock is currently trading at 8x PE FY25e.

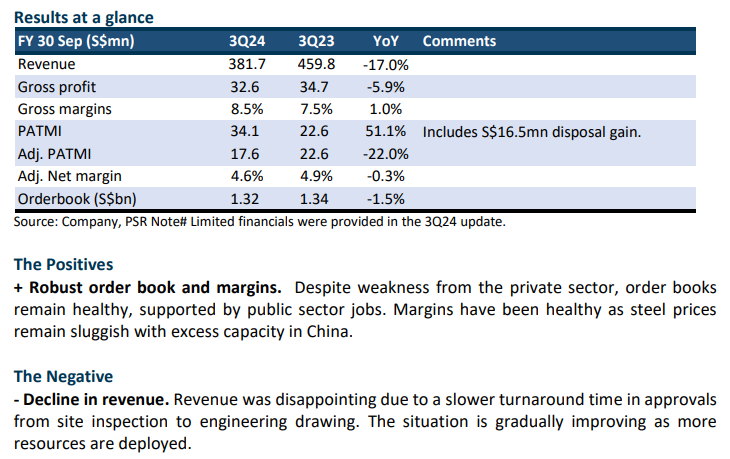

BRC Asia Ltd – Supply chain bottlenecks impacted revenue

- 3Q24 results were below expectations. Revenue and adj. PATMI were 66%/67% of our FY24e forecast. Adj. PATMI declined 22% YoY to S$17.6mn. Approval delays, from engineering to infrastructure, have hampered project deliveries. Headline results include a S$16.5mn gain from the disposal of associate Pristine for S$18.5mn (equity plus shareholder loan).

- The order book is resilient at S$1.32bn (3Q23: S$1.4bn). We believe orders will enjoy a huge boost in FY25e from the expansion of the two integrated resorts and the commencement of work on the new Terminal 5 at Changi airport.

- We lowered our FY24e adj. earnings by 6% to S$78mn due to project delays. Our ACCUMULATE recommendation and DCF target price of S$2.27 is unchanged. We expect growth to be robust for the next two years. Private sector orders will benefit from the recovery in residential projects and integrated resort expansion. Meanwhile, public sector infrastructure projects will enjoy an added increase from the commencement of Terminal 5. The key risk to our earnings will be bottlenecks in other parts of the supply chain.

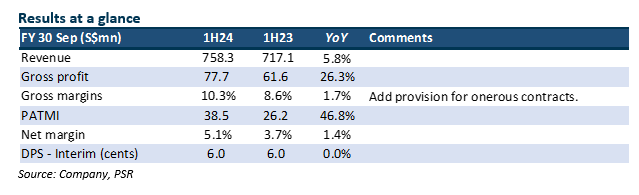

BRC Asia Ltd – Bountiful five years ahead

- 1H24 results were within expectations. Revenue and PATMI were 44%/46 of our FY24e forecast. 1H24 PATMI jumped 47% YoY to S$38.5mn. Revenue recovered as construction site disruptions normalized. Margins rebounded after the sharp price contraction last year. An interim dividend of 6 cents was announced (1H23: 6 cents).

- The order book remains healthy at S$1.3bn (1H23: S$1.4bn). Demand is strong, especially from the public sector. Industry steel bar demand climbed 34% YoY to 240k tons in YTDFeb24. The commencement of the Changi Airport Terminal 5 project will be another major boost to orders next year.

- We maintained our FY24e earnings. From higher growth assumptions, we raised our target price from S$1.99 to S$2.27. Our ACCUMULATE recommendation is unchanged. The availability of construction projects will remain elevated in the next five years. A golden era for construction. However, the timing to deliver the projects is less certain as the industry faces capacity constraints and bottlenecks.

The Positives

+ Recovery in revenue. 1H24 revenue rose 6% YoY to S$758mn. The recovery is after the 10% revenue decline in 1H23 following disruptions caused by worksite safety measures. Industry steel bar demand has remained healthy, with a rise of 34% YoY to 240k tons in YTDFeb24.

+ Gross margin normalised. As the pace of selling price eases, gross margins have started to recover to normalised levels of 10%. We expect margins to remain healthy due to a resilient order book and healthy flow of public and private projects in the coming 2-3 years. Steel bar prices contracted 12% YoY in 1Q24 (1Q23: -20%).

The Negative

- Constraints emerging in project delivery. The company mentioned that the lack of resources from the consulting engineering and architectural segments and regulatory challenges could cause delays or slow-down at project sites.

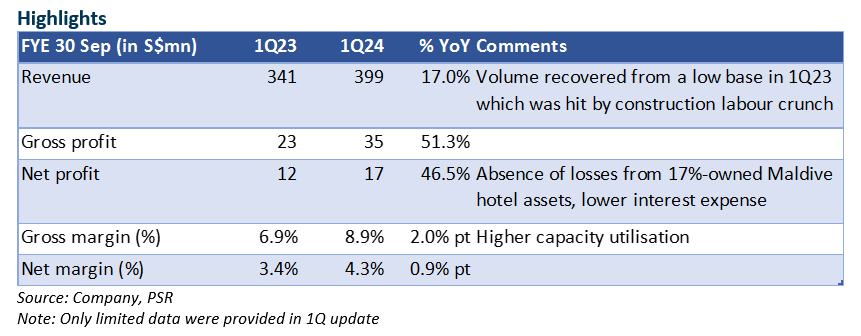

BRC Asia – Margins gained from higher volume

- 1Q24 net profit came in at 20% of our FY24e estimates. This is typically the lull quarter for construction output. Revenue jumped 17% YoY due to low volume in the year earlier, as the labor crunch affected activities and order deliveries. We estimate higher volume was partly offset by a 17% lower ASP for steel rebars. Net profit gained from the absence of associate losses, and lower interest expense as net gearing improved to 0.46x (Dec 22: 0.65x).

- We maintain our net profit estimates for FY24e, though there is a possible upside from a S$14mn divestment gain of the Maldives hotel assets. We estimate that the sale could also lift dividends by about S$0.05/share, which have not been factored into our numbers.

- Downgrade to ACCUMULATE (prev. BUY) due to the recent share price gain. Our TP remains unchanged at $1.99. BRC’s strong ROE of 18.6% in FY24e reflects market leadership that enables it to enjoy economies of scale. The tailwinds for FY24e are stronger construction output and the bottoming of steel prices.

The Positives

+ 1Q24 net profit surged by 46.5% YoY, on the back of volume recovery from a low base in the year earlier, the absence of losses from the 17%-owned Maldives hotel assets, and lower interest expenses. We estimate that steel prices were about 17% lower YoY.

+ Gross margin was 2.0% points higher YoY, which reflects a higher utilisation rate at its fabrication plant and possibly lower freight costs.

+ Net debt at end-Dec 23 of S$207mn was flat versus S$196mn at end-Sep 23, despite the jump in sales, suggesting still healthy working capital and no collection stress. Lower steel prices also free up trade financing needs. Net gearing as at end-Dec was 0.46x.

The Negative

- nil

BRC Asia – Construction progress to gather speed

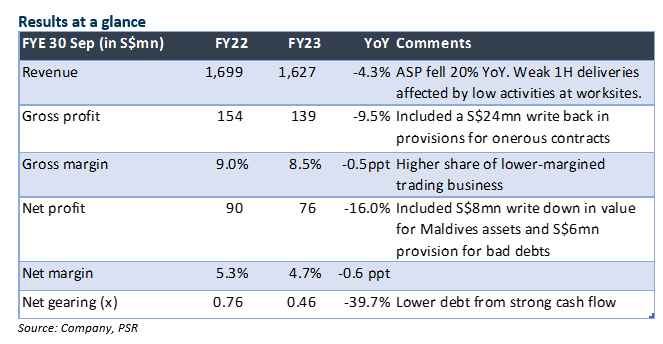

- FY23 net profit was 14.8% above our expectations due to S$24mn write-back in provisions for onerous contracts, offset by S$8mn write-down in value of its Maldives hospitality asset and S$6mn provisions for impairment/fair value loss on trade receivables.

- Net profit declined 16.0% YoY, due to 20% YoY fall in ASP (our estimate) and lower volume in 1H23 as customers faced safety measures and manpower constraints. 2H23 net profit was flat YoY. Demand remains strong, led by public sector jobs.

- Maintain BUY with unchanged TP of $1.99. We think the ASP has bottomed and will remain stable. We estimate volume could rise by 20% in FY24e as the construction sector plays catch up. We raise FY24e net profit forecast by 5.6% on less funding cost on improved gearing.

The Positives

+ Revenue and net profit rebounded in 2H23, after a weak 1H when sales of steel products were curtailed by safety rules imposed at construction sites. 2H23 revenue and net profit were flat YoY, despite the ASP decline of 27% YoY (our estimate), implying strong volume recovery.

+ Gross margin was lower (-0.5% pt to 8.5%) due to higher share of lower-margined trading business (25% of revenue). We expect it to recover to 9% in FY24e when fabrication and manufacturing volume rises. Demand for steel products remains strong. BRC’s orderbook of S$1.3bn is underpinned by mainly public sector projects.

+ Net gearing improved to 0.5x (Sep 22: 0.8x) from strong operating cash flow. EBITDA to interest expense improved to 1.5x (FY22: 2.3x).

The Negative

- nil

Outlook

Net profit growth is expected to resume with a stable ASP and stronger order deliveries. Construction demand is expected to remain robust, led by public housing, record government land sale programmes and infrastructure projects.

Maintain BUY with unchanged TP of $1.99

BRC trades at an attractive 8.9% dividend yield and 1x P/B for FY24e.

BRC Asia – 3Q23 in line, construction progress still muted

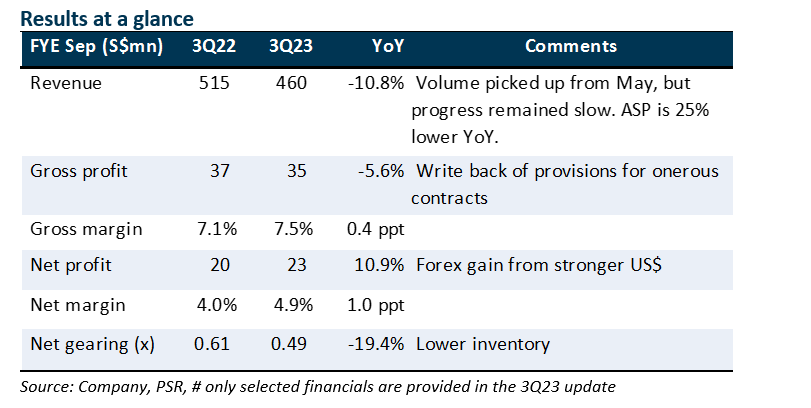

- 3Q23 net profit was in line. The marginal 10.9% gain was driven by forex gain from a stronger US dollar, and writeback in provisions for onerous contracts with a fall in steel price (about -25% YTD). Volume remains below pre-COVID though safety controls at worksites were lifted in May.

- Demand remains robust, though construction progress is still inhibited by shortage of manpower and new enforcement measures by the authorities. BRC’s orderbook is S$1.34bn at end June.

- Maintain BUY with unchanged target price of $1.99.

The Positives

+ Volume and construction activities picked up from May (>2x higher MoM), though they are still below pre-COVID levels. Construction progress is hampered by the shortage of dormitory beds, workers and step-up in safety enforcement on worksites and construction personnel. Demand, however, remains robust, underpinned by public housing, record government land sales for private housing, and infrastructure projects. BRC has an orders on hand of S$1.34bn.

+ BRC is largely insulated from potential bad debts through credit insurance. Some construction companies are facing financial stress due to lower-margin legacy projects, project delays and rising costs. For BRC, the impact is non-delivery/cancellation of outstanding orders, but there is no collection risk for jobs that have been delivered.

The Negative

- Net margin remains low at 4.9%. We think margins might not return to FY22’s 5.3% due to higher share of trading business which are lower-margin, and large-scale infrastructure projects.

BRC Asia – Disappointing 1H23, strong uptick expected in 2H23

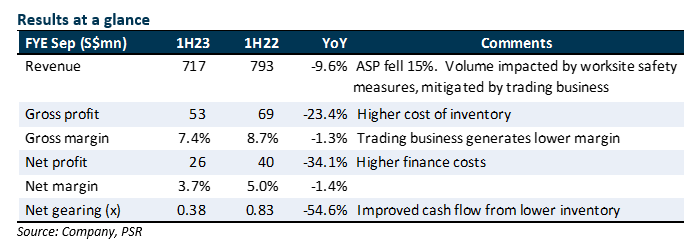

- 1H23 net profit was below our expectations, at 31% of our FY23e forecasts. Net profit fell 34.1% YoY, due to 1) 15% decline in ASP; and 2) slow construction progress with safety measures implemented at worksites, which caused deliveries to be deferred. Lower order delivery was mitigated by trading volume, which reduced gross margin by 1.3% pt to 7.4%.

- Construction activities have picked up since April. Demand remains strong, underpinned by pent-up demand in residential and infrastructure development. BCA has projected 2023 construction demand at S$27bn-32bn (2022: S$29.8bn) and progress payment to grow by 9-20%. BRC’s orderbook has further grown to S$1.42bn. Rebar prices have stabilized from Feb 2023.

- Maintain BUY with a lower DCF-derived target price of $1.99 (prev. $2.14). We cut our forecasts by 23.2% and 27.7% for FY23e and FY24e to reflect the lower 1H23 earnings. We expect steel prices to stabilize for the rest of the year, though this implies a 20.4% YoY decline in 2H23. Order deliveries should rise as construction activities are ramped up.

The Negative

- 1H23 earnings came in at only 31% of our FY23e estimates. The shortfall was due to lower order deliveries, which was impeded by low construction progress at work sites to meet heightened safety measures. The measures are mandated to last till end-May, but activities are picking up with improved safety conditions. BRC booked more lower-margined trading businesses during the period, and gross margin fell 1.3% pt to 7.4%. Interest costs rose 170% YoY to S$6.3mn, resulting in 34.1% YoY decline in 1H23 net profit.

The Positives

+ Net gearing improved to 0.38x (Sep 22: 0.76x). With easing of steel prices and freight costs, inventory holdings were brought down. Credit terms from suppliers become more favourable, leading to strong operating cash inflow of about S$0.608/share.

+ Orderbook edged higher to S$1.42bn (Sep 22: $1.4bn), as demand remains robust. BCA estimates that progress payments, which represent work done and revenue booked, to grow by 9-20% in 2023. We estimate about 60% of the orderbook are for jobs in the public sector which are less volatile and payments are more certain. While the delay in construction work had affected cash flow and credit conditions of some contractors, we do not see any risk of default that could impact building material suppliers.

BRC Asia – Earnings declined 12.2% YoY for 1Q23

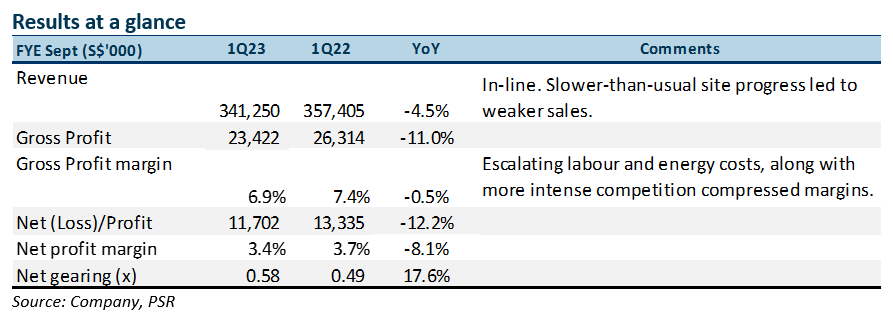

- 1Q23 net profit was below our expectations at 11% of our FY23e forecasts. Earnings were below expectations even as we accounted for a seasonally weaker 1H as margins weighed from the more intense competition in the sector.

- Group to see slower 9M23 from Heightened Safety period extension by the Ministry of Manpower (MOM) by another three months till end-May.

- Local construction demand remains robust with the Building and Construction Authority (BCA) projecting total construction demand for 2023 to be between $27-32bn (unchanged from 2022).

- Maintain BUY with a lower target price of $2.14 (prev. $2.30). We trim FY23e earnings by 9.8% as we expect the construction recovery to take longer than expected as it grapples with near-term headwinds. Our TP is lowered to $2.14, still based on 7x FY23e P/E, 15% discount to its 10-year average, on account of the uncertain external environment. Catalysts expected from an end to the Heightened Safety period.

The Negatives

- 1Q23e earnings below expectations, at 11% of our estimates. Revenue was in line with our estimates, as we accounted for a seasonally weak 1H23 that was further weighed down by the Heightened Safety period that was in place. Margins however, were ~1% below our estimates as escalating costs, particularly for labour and energy weighed along with more competition for new contracts, as the industry competed to overcome the shortfall in delivery volumes.

- Heightened Safety period extended by another three months. As a result of the Heightened Safety period imposed by the MOM, local construction projects are, in general, progressing slower than expected. The time-outs and punitive measures imposed on the sector have slowed construction progress. We expect the Heightened safety period to continue to weigh on earnings for 9M23 after the MOM extended the Heightened Safety period by another three months till end-May.

The Positive

+ Construction order book remained healthy at $1.4bn (vs $1.4bn in 4Q22), above our $1.35bn estimates. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books. BRC Asia is benefitting from the backlog of projects that were postponed during the Covid-19 pandemic and the higher number of public housing projects that are being launched to meet demand. The construction sector is also recovering at a faster pace with 4Q22’s growth at 10.4% YoY vs 7.8% in the preceding quarter. We estimate that half of its order book will be fulfilled within the next 15-18 months.

BRC Asia – Earnings ahead, 1H23 to be impacted by “Heighted Safety”

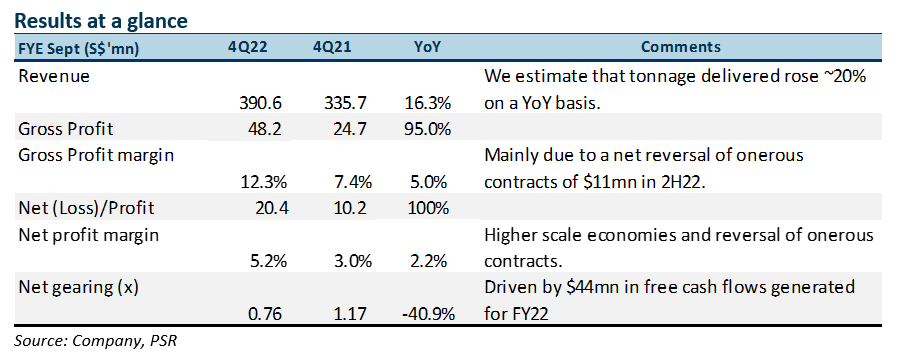

- FY22 net profit was ahead of our expectations at 112% of our FY22e forecasts. Revenue was in line at 99% of FY22e. Earnings were above expectations as higher-than-expected volume moved despite the “Heightened Safety” period imposed.

- $11mn net reversal for onerous contracts made. With steel rebar prices declining ~20% in 2H22, the Group benefitted from write-backs. GP margins improved 500bps for the period.

- Construction order book grew to $1.4bn from $1.135bn in the previous quarter. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books.

- Maintain BUY with a higher target price of S$2.30. Our TP is based on 7x FY22e P/E, lowered from 8x previously, on account of the uncertain external environment. But our TP is raised to $2.30 from $2.26 as we roll forward our valuation to FY23e. We kept FY23e earnings unchanged as we expect construction activity to continue its recovery after 1H23.

The Positives

+ FY22 net profit ahead of our expectations at 112% of our FY22e forecasts. Revenue was in line at 99% of FY22e. Earnings were above expectations as higher-than-expected volume moved despite the “Heightened Safety” period imposed by the Ministry of Manpower (MOM) from 1 Sept to 28 Feb 2023. The measures were announced after a spate of workplace fatalities since the start of the year prompted the MOM to intervene in the sector.

In view of its strong results, the Group has declared a total of 12 cents of dividends (~55% payout), comprising 6 cents final and 6 cents special dividend to reward shareholders. FY22 dividends of 18 cents represents a dividend yield of 9.8%, exceeding our 16 cents estimate.

+ $11mn net reversal for onerous contracts made. With steel rebar prices declining ~20% in 2H22, the Group benefitted from $11mn of write-backs in onerous contracts. For FY22, the Group generated a net reversal of provision of onerous contracts of $12.8mn. Correspondingly, GP margins improved 500bps for the period.

The management has guided for further reversals in onerous contracts for FY23 should steel prices remain at these levels.

+ Construction order book grew to $1.4bn (vs $1.135bn 3Q22), above our $1.2bn projections. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books. BRC Asia is benefitting from the backlog of projects that were postponed during the Covid-19 pandemic and the higher number of public housing projects that are being launched to meet demand.

The Negatives

- Construction site activity levels adversely affected by workplace fatalities and dengue. As of 1 Sept 2022, the number of workplace fatalities stands at 36 for whole of 2022, up from the 28 workplace fatalities reported for the first six months of 2022, many of which were in the construction industry. As a result of the Heightened Safety period imposed by the MOM, local construction projects are, in general, progressing slower than expected. The time-outs and punitive measures imposed on the sector has slowed construction progress.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report