CapitaLand Ascott Trust – Committed to maintaining stable dividends

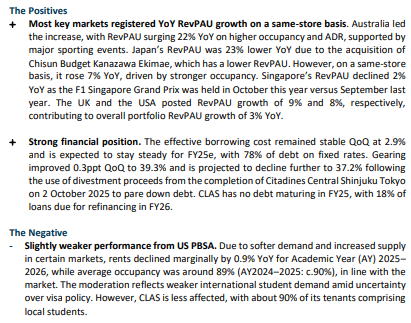

- Limited financial details were disclosed in this business update. 3Q25 gross profit rose 1% YoY, supported by stronger operating performance and portfolio reconstitution, partially offset by foreign currency depreciation against the SGD and a one-off land tax adjustment relating to a property in Australia. Excluding acquisitions and divestments, gross profit was 2% lower YoY due to the tax adjustment.

- 3Q25 portfolio RevPAU rose 3% YoY to S$163, driven by higher average occupancy of 83%, up from 79% in 3Q24. In the US, the student accommodation sector experienced softer performance due to increased supply in certain markets.

- Downgrade to ACCUMULATE from BUY with an unchanged DDM-TP of S$1.05 due to the recent share price performance. CLAS remains our top pick in the hospitality sector, underpinned by its balanced mix of stable (69%) and growth income sources, as well as strong geographical diversification that enhances resilience. We expect low single-digit portfolio RevPAU growth in FY25e, supported by improving occupancy. CLAS has guided for stable dividends YoY for FY25e at 6.1 Singapore cents. We therefore forecast a S$5mn top-up to distributable income from prior divestment gains, with c.S$350mn still available on its balance sheet. The current share price implies an FY25e dividend yield of 6.4%.

CapitaLand Ascott Trust – Committed to stable DPU despite upcoming AEIs

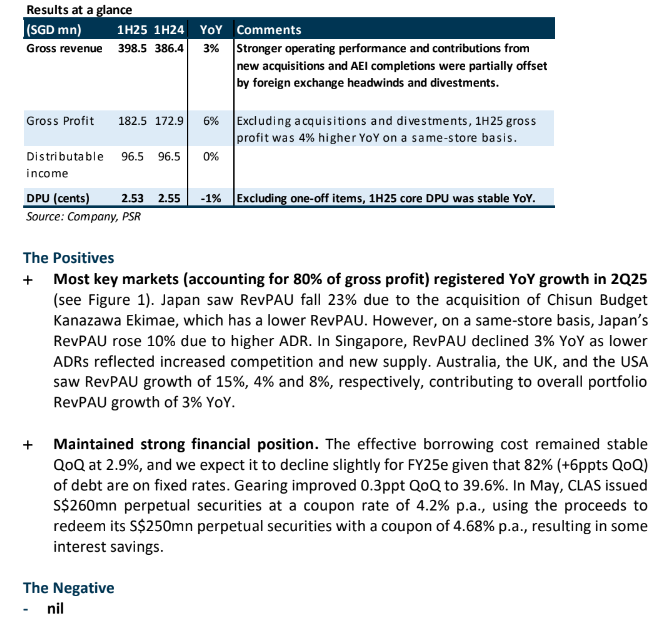

- 1H25 DPU of 2.53 cents (-1% YoY) was in line with our estimates at 42% of our FY25e forecast, with seasonally stronger performance expected in the second half of the year. Stronger operating performance, portfolio reconstitution, and asset enhancement initiatives (AEIs) drove a 6% YoY increase in gross profit. Excluding acquisitions and divestments, gross profit was 4% higher YoY on a same-store basis. Excluding one-off items, core DPU was stable YoY at 2.40 cents.

- Portfolio RevPAU rose 3% year on year to S$159, driven by higher average occupancy of 78% compared to 75% in 2Q24. Following six completed AEIs in FY24, three more were announced, with one completed in 2Q25. Four AEIs remain, including The Cavendish London, with a total CAPEX of c.S$205mn. The divestment of Somerset Olympic Tower Tianjin was completed in 2Q25 at a 50% premium to book value.

- Maintain BUY with an unchanged DDM-TP of S$1.05. CLAS remains our top pick in the sector, supported by its mix of stable (66%) and growth income sources, as well as geographical diversification, which enhances resilience with stronger markets offsetting potentially softer ones. We expect low-single-digit portfolio RevPAU growth in FY25e, driven by improving occupancy. CLAS has over S$300mn in prior divestment gains on its balance sheet, which could be used to offset the absence of contributions from assets undergoing AEIs. Our estimates remain unchanged. The current share price implies an FY25e dividend yield of 6.6%.

CapitaLand Ascott Trust – Downside protected from stable income sources

- Limited financials were provided in this business update. 1Q25 gross profit rose 4% YoY, driven by improved operating performance and contributions from new properties, which offset the lost income from divestments. Excluding acquisitions and divestments, gross profit rose 1% YoY.

- 1Q25 portfolio RevPAU increased 4% YoY to S$141 due to higher average occupancy of 77% (1Q24: 73%). Two DPU-accretive acquisitions (1.6%) were made in Japan in 1Q25, namely Ibis Styles Tokyo Ginza and Chisun Budget Kanazawa Ekimae, at a blended NOI yield of 4.3%.

- Maintain BUY with an unchanged DDM-TP of S$1.05. We lower our FY25e/26e DPU estimates by 4% to account for downtime from upcoming AEIs. CLAS remains our top pick in the sector, supported by its mix of stable (70%) and growth income sources and geographical diversification, which enhance resilience amidst potential weakness in consumer sentiment from global uncertainties. We expect mid-single-digit portfolio RevPAU growth in FY25e, driven by improving occupancy and six AEI completions in FY24. CLAS has over S$300mn in prior divestment gains on its balance sheet, which the manager may deploy to offset the absence of contributions from assets undergoing AEIs. The current share price implies an FY25e dividend yield of 7%.

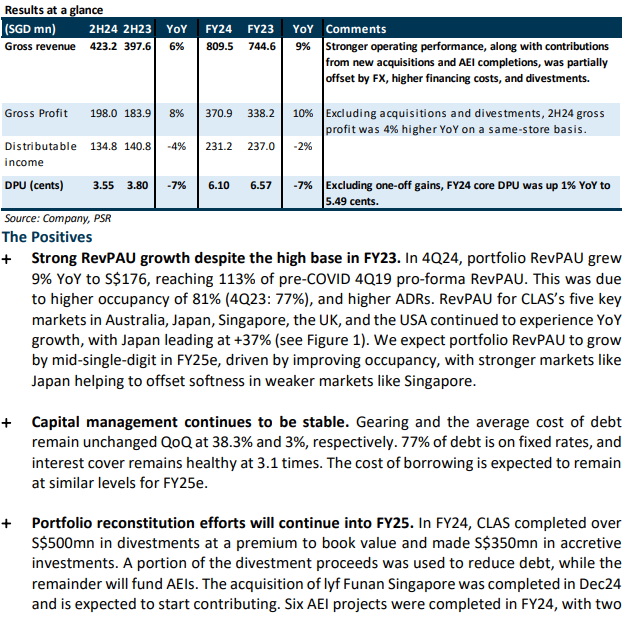

CapitaLand Ascott Trust – Growth on all cylinders

- FY24 DPU of 6.10 Singapore cents (-7% YoY) was in line with our FY24e estimates. Excluding one-off gains, the core DPU of 5.49 Singapore cents increased by 1% YoY, driven by stronger operating performance, acquisitions, and completed asset enhancement initiatives (AEIs). However, this was partially offset by divestments, ongoing AEIs, higher financing costs, and the depreciation of foreign currencies against the Singapore Dollar.

- 4Q24 portfolio RevPAU increased 9% YoY to S$176 despite the high base, reaching 113% of pre-Covid 4Q19 levels. This was driven by a higher average occupancy of 81% (4Q23: 77%) and increased average daily rates (ADR) across the portfolio. Over S$500mn in assets were divested at a premium to book value in FY24, unlocking S$74mn in net gains.

- Maintain BUY with a higher DDM-TP of S$1.05 (prev. S$1.04) as we roll forward our forecasts. We lower our FY25e DPU estimates by 3% on higher finance costs assumptions. CLAS remains our top pick in the sector, supported by its mix of stable and growth income sources and geographical diversification, which enhance resilience amidst global uncertainties. We expect mid-single-digit portfolio RevPAU growth in FY25e, driven by improving occupancy, with overseas assets offsetting softer demand in Singapore due to the absence of major concerts. CLAS still holds over S$300mn in previous divestment gains on its balance sheet, some of which will be utilized in FY25e to offset the absence of contributions from assets that will be undergoing AEIs. The current share price implies an FY25e dividend yield of 7%.

CapitaLand Ascott Trust – Portfolio reconstitution efforts bearing fruit

- Limited financial details were provided in this business update. 3Q24 gross profit rose 8% YoY, driven by stronger operating performance and portfolio reconstitution initiatives, which included S$350mn in acquisitions and S$500mn in divestments at premium to book value YTD. Excluding acquisitions and divestments, gross profit rose 2% YoY.

- 3Q24 portfolio RevPAU increased 3% YoY to S$158 despite the high base, reaching 105% of pre-Covid 3Q19 levels. This was due to a higher average occupancy of 79% (3Q23: 77%), which was 92% of pre-Covid levels. Revenue from France grew 11% YoY, driven by the Paris Olympic Games.

- Maintain BUY with an unchanged DDM-TP of S$1.04. There has been no change in our estimates. CLAS remains our top pick in the sector owing to its mix of stable and growth income sources and geographical diversification, which provide resilience amidst global uncertainties. We have not factored in any capital gain top-ups from previous divestment gains in FY24e; any top-ups would represent potential upside. RevPAU YoY growth has reached its lowest level since 2Q21. We expect mid-single-digit portfolio RevPAU growth in FY25e, driven by improving occupancy, with overseas assets helping to offset softer demand in Singapore due to the absence of major concerts or events like Coldplay and Taylor Swift. The current share price implies an FY24e/25e dividend yield of 6.6%/7.1%.

CapitaLand Ascott Trust – Olympics to support stronger 2H24

▪ 1H24 DPU of 2.55 cents (-8% YoY) was in line with expectations and formed 43% of our

FY24e forecast, with seasonally stronger performance expected in the second half of the

year. 1H24 revenue increased by 11% YoY due to stronger performance of the existing

portfolio and contributions from new acquisitions, partially offset by divestments and

foreign currency exchange. Despite stable distributable income YoY, DPU was down due

to the enlarged share base from the equity fundraising exercise in 3Q23.

▪ 2Q24 portfolio RevPAU rose 4% YoY on a high base to S$155, reaching 102% of pre-

COVID 2Q19 levels. This was attributable to higher room rates; 2Q24 average portfolio

occupancy was stable YoY at 75%.

▪ Maintain BUY with an unchanged DDM-TP of S$1.04. We increase our FY24e/25e DPU

estimates by 1%/4% on stronger operating performance in Japan and France, partially

offset by higher interest expense. CLAS remains our top pick in the sector owing to its

mix of stable and growth income sources and geographical diversification, which provide

resilience amidst global uncertainties. Growth in RevPAU going forward will be driven

by portfolio occupancy as average daily room rates (ADR) stabilise. The current share

price implies an FY24e/25e dividend yield of 6.6%/7.1%.

CapitaLand Ascott Trust – Occupancy to improve with ADRs stabilising

- No financials were provided in this business update. 1Q24 gross profit rose 15% YoY due to stronger operating performance and contributions from new properties. It was 7% higher YoY on a same-store basis.

- 1Q24 portfolio RevPAU rose 6% YoY to S$135, in line with pre-COVID 1Q19 levels. 1Q24 average portfolio occupancy was stable YoY at 73%, and it was at 88% of pre-COIVD levels.

- Upgrade from ACCUMULATE to BUY with an unchanged DDM-TP of S$1.04 due to the recent share price performance. FY24e DPU is slightly lowered by 2% on higher interest costs assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income sources and geographical diversification, which provide resilience amidst global uncertainties. Growth in RevPAU going forward will be driven by portfolio occupancy as ADR stabilises. The current share price implies an FY24e/25e dividend yield of 6.6/6.8%.

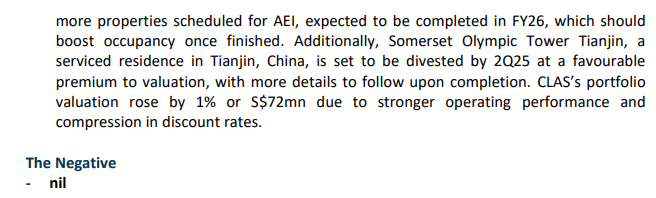

The Positives

- 1Q24 RevPAU grew 6% YoY to S$135, in line with pre-pandemic 1Q19 pro-forma RevPAU mainly due to higher ADRs. Average portfolio occupancy was stable YoY at 73% - it was down 4ppts QoQ due to seasonality. RevPAU for CLAS’s five key markets in Australia, Japan, Singapore, UK, and the USA continued to improve YoY (see Figure 1) and exceed pre-COVID 1Q19 levels on a same-store basis (excluding units under renovation).

- Strong capital management. Gearing and interest cover remained healthy at 37.7% and 3.7x, respectively. CLAS’s effective borrowing cost increased 60bps QoQ to 3%, mainly due to a higher proportion of GBP and EUR debt arising from the new acquisitions. Despite this increase, CLAS’s borrowing costs remain relatively low compared to those of its industry peers. 82% of debt on a fixed rate. Additionally, we think CLAS will recall its S$150mn, 3.88% perpetual bond at its first call date in Sep 24 to save on interest costs. Gearing will remain below 40% even if debt fully funds this.

- Portfolio recycling is in full swing. In Jan 2024, CLAS acquired Teriha Ocean Stage, a rental housing property in Fukuoka, Japan, for JPY 8bn with an estimated net operating income yield of 4% on a stabilised basis. Five properties were divested in 1Q24, and they were Courtyard by Marriott Sydney-North Ryde in Australia, Hotel WBF Kitasemba East, Hotel WBF Kitasemba West and Hotel WBF Honmachi in Osaka, Japan, and Citadines Mount Sophia Singapore. All assets were divested at a premium above book value, locking in net gains of over S$25mn. Proceeds from the divestments have been used to par down higher interest rate debt.

The Negatives

CapitaLand Ascott Trust – Further upside from occupancy growth

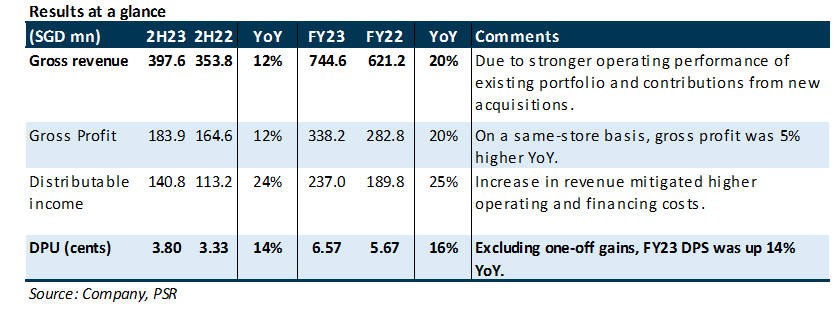

- FY23 DPU of 6.57 cents (+16% YoY) exceeded our expectations by 11.7% due to a one-off realised exchange gain. Excluding one-off items, adjusted DPU increased 14% YoY to 5.44 cents, which was 93% of our forecast.

- 4Q23 portfolio RevPAU rose 4% YoY to S$161, reaching 103% of pre-COVID 4Q19 levels mainly due to higher average daily rates (ADR). Average portfolio occupancy was stable QoQ at 77% (4Q22: 78%), and it was at 92% of pre-COIVD levels.

- Downgrade from BUY to ACCUMULATE with an unchanged DDM-TP of S$1.04 as we roll forward our forecasts. FY24e/FY25e DPU is raised by 3%/6% after lowering our interest costs assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income sources and geographical diversification. Growth in RevPAU going forward will come from higher portfolio occupancy, as ADR growth would slow from the high base. The current share price implies an FY24e/25e dividend yield of 6.5/6.8%.

The Positives

- 4Q23 RevPAU grew 4% YoY to S$161, reaching 103% of pre-pandemic 4Q19 pro-forma RevPAU mainly due to higher ADRs. Average portfolio occupancy was stable QoQ at 77% (4Q22: 78%). RevPAU in Australia, Japan, Singapore, UK and USA continued to exceed pre-COVID 4Q19 levels on a same-store basis. Japan saw a spike in RevPAU by 90% YoY after its re-opening to independent leisure travellers in Oct 2022. Performance in China and Vietnam continued to improve, with RevPAU at 86% and 88% of 4Q19 levels respectively.

- Proactive capital management. Gearing and interest cover remained healthy at 37.9% and 4x, respectively. CLAS’s effective borrowing cost remained unchanged at 2.4% QoQ, with 81% of debt on a fixed rate. We expect the FY24 cost of debt to increase to c.2.9% after refinancing 18% of its total debt (c.S$563mn) due in FY24. A 50bps increase in CLAS’s borrowing cost will impact full-year DPU by 0.08 Singapore cents.

- Higher portfolio valuation. CLAS’s portfolio valuation rose 2% as stronger operating performance and outlook mitigated the impact of higher discount and cap rates across all markets (except for Japan). Markets with valuation gains include Australia, Europe, Japan, Singapore, and UK. Separately, CLAS is divesting Citadines Mount Sophia Singapore for S$148mn, 19.4% above book value. The exit yield for this transaction is 3.2%, and CLAS will recognise a net gain of c.S$14.6mn. The divestment is expected to be completed in 1Q24.

The Negatives

CapitaLand Ascott Trust – Occupancy to trend upwards

- 3Q23 gross profit rose 13% YoY to reach 103% of pre-COVID 3Q19 levels.

- 3Q23 portfolio RevPAU rose 17% YoY to S$154, reaching 102% of pre-COVID 3Q19 levels on the continued improvement in portfolio occupancy (77% vs 70% in 3Q22) and average daily rates (ADR). We expect effective borrowing cost to rise from 2.4% in 3Q23 to c.3% for FY24e after refinancing all loans due in FY24.

- Upgrade from ACCUMULATE to BUY due to recent share price performance, DDM-TP lowered from S$1.20 to S$1.04. FY23e/FY24e DPU is lowered by 6%/14% after accounting for the higher share base (+9%) from the equity fund-raising exercise, proposed acquisitions, and higher finance costs. CLAS remains our top pick in the sector owing to its mix of stable and growth income and geographical diversification. Growth in RevPAU going forward will come from higher portfolio occupancy. The current share price implies an FY23e/24e dividend yield of 6.6%.

The Positives

- 3Q23 RevPAU grew 17% YoY to S$154 reaching 102% of pre-pandemic 3Q19 pro-forma RevPAU. Average daily rates (ADRs) remained above pre-COVID levels, while occupancy improved 2ppts QoQ to 77% in 3Q23 (3Q22: 70%). All markets experienced RevPAU growth YoY (see Figure 1), with Singapore, Australia, USA, UK, and Japan performing above pre-COVID levels. Japan saw a spike in RevPAU by 198% YoY after its re-opening to independent leisure travellers in Oct 2022. Performance in China and Vietnam continued to improve, with RevPAU at 80% and 84% of 3Q19 levels respectively. The stabilisation of the newly rebranded The Robertson House, which saw a 30% increase in room rates during early-bird sales, will provide further uplift to revenue from Singapore once renovation works complete in 1Q24.

- Resilience from stable income sources. All 7 French master leases due in 2023 have been renewed in Oct 23 with total projected rents to be c.28% above existing rents under the new structure. Occupancy at the rental housing properties remained stable at >95%. 4Q23 will be the first full quarter contribution for Standard at Columbia, the student accommodation development in South Carolina, USA, which began receiving students from Aug 23 and was >90% occupied upon opening.

- Proactive capital management. CLAS’s effective borrowing cost remained unchanged at 2.4% QoQ. The percentage of loans on fixed rate increased from 80% to 83% QoQ, and interest cover remained healthy at 4.2x. Gearing improved from 38.6% to 35.2% QoQ after proceeds from the EFR in Aug 23 were partially used to pare down loans maturing in FY23 and higher floating rate debt, pending deployment into acquisitions in 4Q23. We expect FY24 cost of debt to increase to c.3% after refinancing 18% of its total debt (c.S$496mn) due in FY24 denominated in EURO, USD and JPY. A 0.6% increase in CLAS’s borrowing cost to 3% will impact full-year DPU by 0.1 Singapore cents.

The Negatives

No financials were provided in this business update.

CapitaLand Ascott Trust – Still room for RevPAU growth

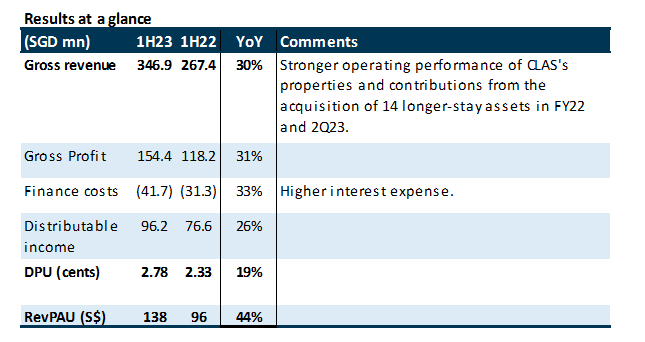

- 1H23 DPU of 2.78 cents (+19% YoY) was in line with expectations and formed 43% of our FY23e forecast, with seasonally stronger performance expected in the second half of the year. Excluding one-off items relating to realised exchange gain from the repayment of foreign currency bank loans and settlement of cross currency interest rate swaps, DPU increased 37% YoY.

- 2Q23 portfolio RevPAU rose 20% YoY to S$149, reaching 98% of pre-COVID 2Q19 levels on the continued improvement in portfolio occupancy (75% vs 70% in 2Q22) and average daily rates (ADR).

- Downgrade from BUY to ACCUMULATE, DDM-TP trimmed from S$1.26 to S$1.20. FY23e/FY24e DPU is lowered by 4%/6% on higher interest assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income and geographical diversification. The current share price implies an FY23e dividend yield of 5.7%.

The Positives

- 2Q23 RevPAU grew 20% YoY to S$149 and is at 98% of pre-pandemic 2Q19 pro-forma RevPAU. YoY improvement was driven by both higher average daily rates (ADRs), which is up c.12% YoY in 2Q23, and higher occupancy of 75% in 2Q23 (2Q22: 70%). All markets experienced RevPAU growth YoY (see Figure 1), with Singapore, Australia, USA, UK, and Japan performing above pre-COVID levels. Japan saw a spike in RevPAU by 247% YoY after its re-opening to independent leisure travellers in Oct 2022. Performance in China and Vietnam strengthened and are currently at 78% and 83% of 2Q19 levels respectively.

- Portfolio reconstitution strategy. During the quarter, CLAS entered into conditional sale and purchase agreements to divest 4 properties in France for €44.4mn (S$63.4mn) to a third party. The price is at a 63% premium to book value and an exit yield of c.4%, unlocking a net gain of €0.2mn (cS$0.3mn). The expected completion of this divestment is in 4Q23. Standard at Columbia, the student accommodation development in South Carolina, USA, has obtained its temporary certificate of occupancy and is ready to receive students for the academic year 2023-24. It has a pre-committed occupancy of 87%. CLAS also has five properties that are currently undergoing AEIs to enhance return, as well as the redevelopment of Somerset Liang Court which is expected to complete in 2H25.

- Effective capital management. Including capitalised interest, CLAS’s effective borrowing cost remained unchanged at 2.4% QoQ. The percentage of loans on fixed rate increased from 75% to 80% as CLAS entered into more interest rate swaps during the quarter. Gearing improved marginally from 38.7% to 38.6% QoQ, leaving c.S$1.8bn of debt headroom for CLAS to reach its medium-term asset allocation of 25-30% for longer-stay accommodation (currently at c.19%). We expect cost of debt to increase marginally as CLAS refinances 13% of its total debt (c.S$372mn) due at the end of 2023 denominated in JPY, AUD and EURO. A 10bps increase in benchmark rates will impact full-year DPU by 0.02 Singapore cents.

The Negatives

Outlook

Forward bookings remain healthy, supported by the strong demand from both international and domestic travel. We expect international travel to pick up pace as airline capacity increases – it has not fully recovered to 2019 levels. As corporates seek to optimize their expenses, many are downgrading from luxury to more cost-effective mid-tier mass market accommodation options. CLAS stands to benefit as the bulk of its portfolio comprises properties within the mid-tier segment, making it an attractive choice for cost-conscious corporate clients.

We forecast growth in ADRs to moderate as it has already surpassed pre-pandemic levels in some markets, and the driver for RevPAU growth going forward will be from higher occupancy. Portfolio occupancy at 75% is roughly 90% of pre-COVID occupancy.

Downgrade from BUY to ACCUMULATE, DDM-based TP lowered from S$1.26 to S$1.20.

FY23e/FY24e DPU is lowered by 4%/6% on higher interest cost assumptions. CLAS remains our top pick in the sector with its geographically diversified portfolio, wide range of lodging asset classes, stable income base which has proven its resilience through COVID-19, and a strong sponsor. We also like CLAS for its balanced mix of stable and growth income sources, which stands at 58% and 42% of gross profit in 1H23 respectively. The current share price implies a FY23e dividend yield of 5.7%.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report