Amazon.com Inc.- AWS growth accelerating

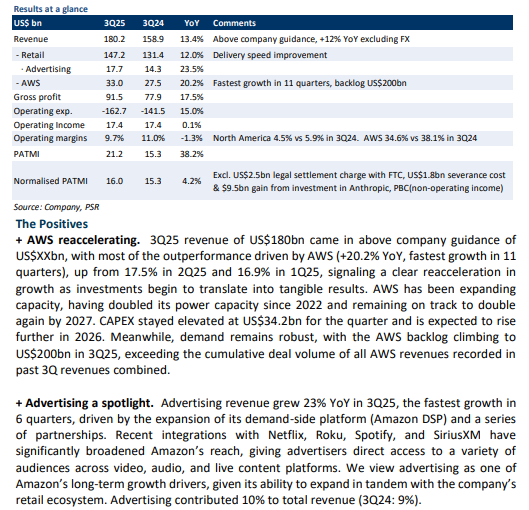

- 3Q25 revenue/Adjusted PATMI grew 13%/4% and were in line with expectations. 9M25 Revenue/Adjusted PATMI were at 70%/79% of our FY25e forecasts.

- The primary revenue driver was AWS (+20% YoY) and advertising (+24% YoY). AWS's operating margin compressed 3.5% YoY to 34.6%, due to heavy AI investment. Retail margin compressed 1.4% due to US$1.8bn severance cost and US$2.5bn legal settlement charge.

- We increase our FY25e revenue by 1% and PATMI by 6% to account for the growing demand in AWS as well as continued cost discipline efforts in the retail segment. We increase our DCF target price to US$290 (prev. US$260). We downgrade our recommendation from BUY to ACCUMULATE due to recent price rally. WACC of 6.4% and a terminal growth rate of 5% remaining unchanged. AMZN’s outlook remains strong with AWS reaccelerating.

Amazon.com Inc.-Growth prospects still intact

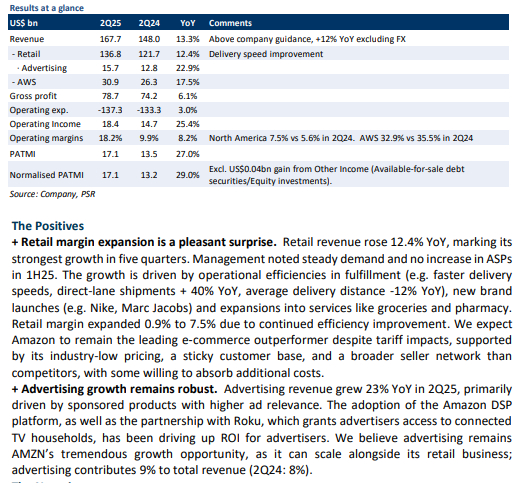

- 2Q25 revenue/PATMI was in line with expectations. 1H25 Revenue/PATMI was at 46%/55% of our FY25e forecasts.

- The primary revenue driver was AWS (+18% YoY) and advertising (+23% YoY). AWS's operating margin compressed 2.9% YoY to 32.9%, due to heavy AI investment. Retail margin increased 0.9% due to efficiency improvement.

- We keep our FY25e revenue and PATMI assumption unchanged. We maintain our recommendation of BUY, with the same DCF target price of US$260, WACC of 6.4% and a terminal growth rate of 5% remaining unchanged. We remain positive on AMZN as we continue to see strong momentum in both retail and AWS. AMZN’s scale, sourcing flexibility, and strategic focus leave it well positioned to manage macro risks while AWS demand remains robust.

Amazon.com Inc. – Price fall gives an opportunity

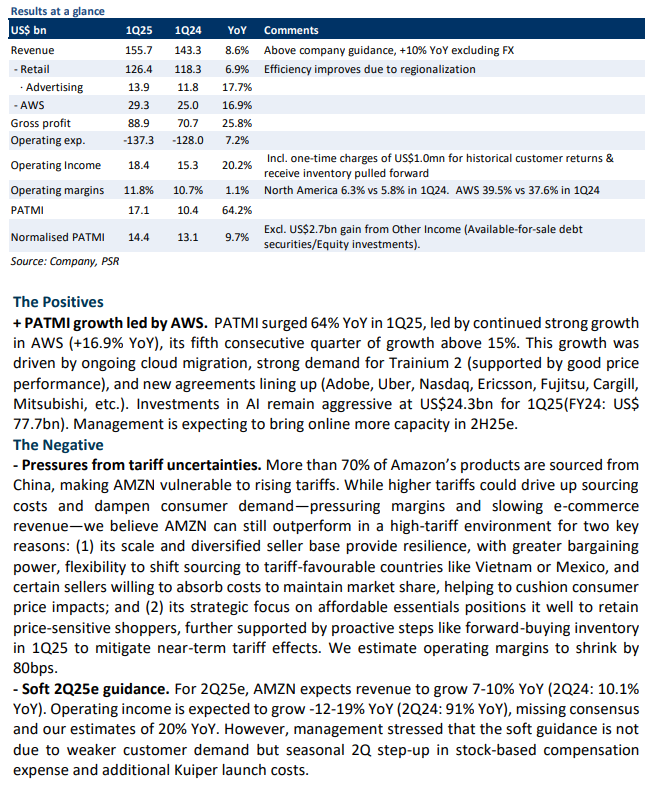

- 1Q25 revenue was in line with expectations. 1Q25 Revenue/PATMI was at 22%/26% of our FY25e forecasts.

- The primary revenue driver was AWS (+17% YoY). AWS operating margin rose 1.9% YoY to 39.5%, driven by server capacity optimisation, which helps lower infrastructure cost. AMZN is focusing on low-priced essentials to mitigate tariff uncertainty risks.

- We lower our FY25e revenue estimate by 1% and PATMI by 2% to reflect the dampening of customer demand and retail margin pressure due to higher tariffs. Due to recent share price weakness, we upgraded our recommendation from ACCUMULATE to BUY and lower our DCF target price to US$260 (prev. US$270). The company’s strong momentum in AWS continues to scale profit meaningfully, helping offset pressures in retail.

Amazon.com Inc. – Strong results yet soft guidance

- 4Q24 revenue was in line with expectations. PATMI outperformed due to increasing operating leverage and cost discipline (3.1% YoY higher operating margins). FY24 Revenue/PATMI was at 100%/112% of our FY24e forecasts.

- The primary revenue driver was AWS (+19% YoY). AWS operating margin rose 7.3% YoY to 36.9%, driven by cost control and an extended server lifespan (contributed to a 200bps expansion).

- We roll over another year of valuations. We decrease FY25e revenue and PATMI by 1% to reflect the leap-year effect, decrease in the useful life of services and increase in the useful life of heavy equipment. Due to recent share price strength, we downgrade our recommendation from BUY to ACCUMULATE and raise our DCF target price to US$270 (prev. US$240). We believe AMZN is well-positioned in generative AI and should benefit from cloud migration as it is still in early stage.

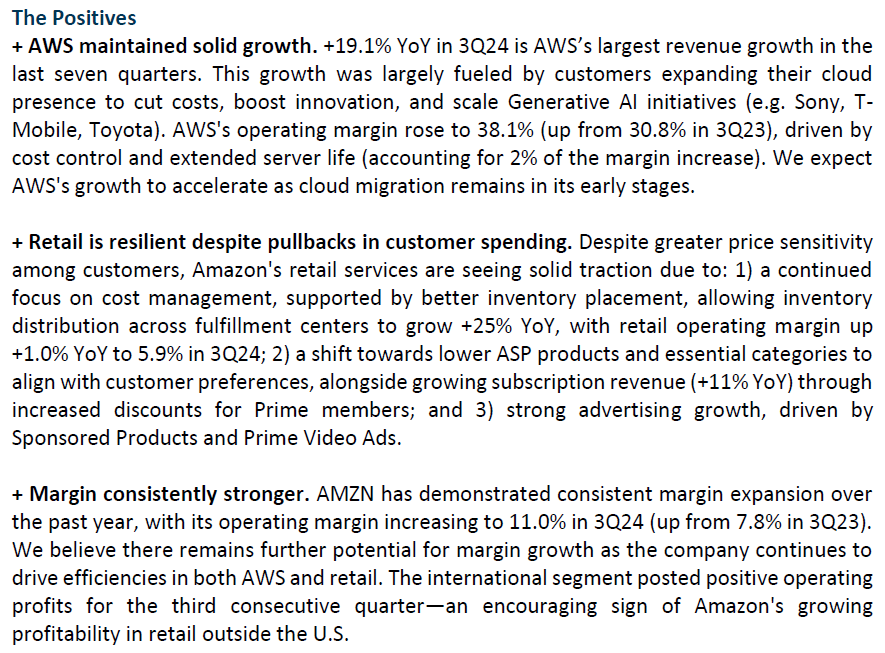

Amazon.com Inc. – Strong Third-Quarter Profitability

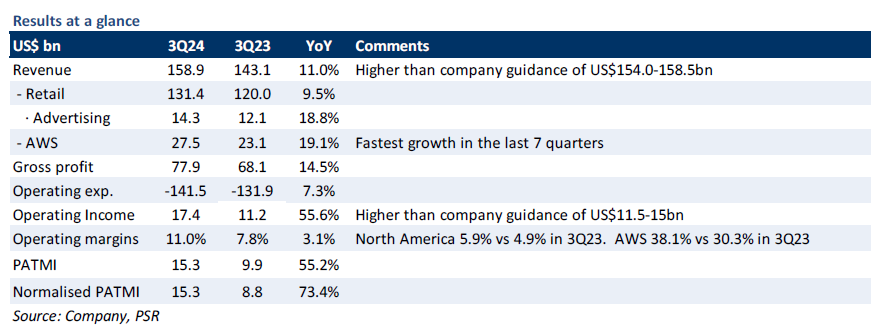

- 3Q24 revenue was in line with expectations. PATMI increased by 73% YoY due to continued cost-reduction efforts and increasing profitability and contribution from AWS. 9M24 Revenue/PATMI was at 70%/79% of our FY24e forecasts.

- +19% YoY AWS growth was the main driver of total revenue. AWS operating margin increased 6.8% YoY to 38.1% due to cost control and the extension of server useful life, contributing to AMZN’s overall 3.2% YoY operating margin expansion.

- We keep our FY24e revenue unchanged but increase PATMI by 6% to reflect the improving efficiencies, lowered costs, and higher operating margins from retail and AWS. We raise our DCF target price to US$240 (prev. US$220). We downgrade our recommendation from BUY to ACCUMULATE as we account for recent share price performance. We believe AMZN is well-positioned in generative AI and should benefit as cloud migration remains in its early stages.

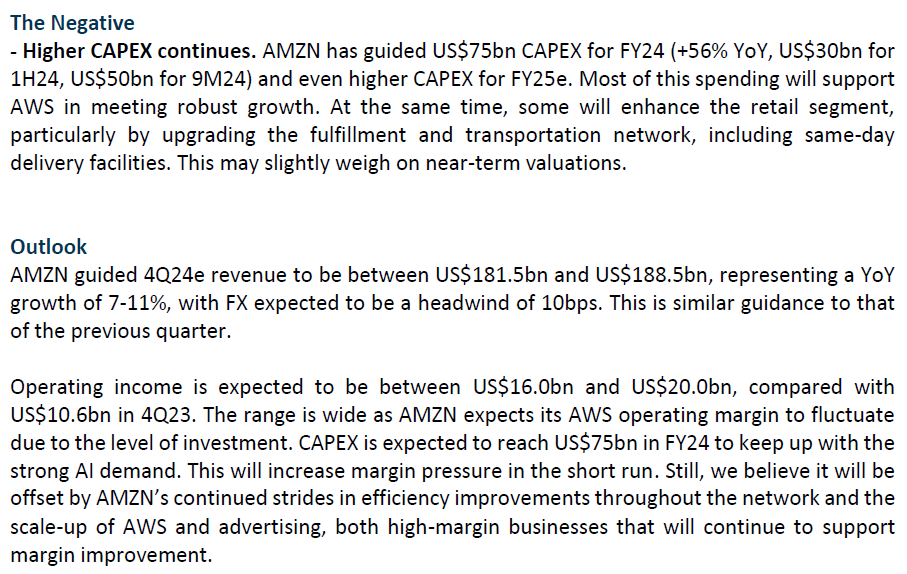

Amazon.com Inc. – AWS Continues to Accelerate

- 2Q24 revenue/PATMI was in line with our expectations. 1H24 revenue/PATMI was at 45%/55% of our FY24e forecasts.

- Better-than-expected AWS strength (19% YoY) continues to support growth driven by customers migrating workloads from on-premises to the cloud. Retail growth decelerated, in line with the company’s growth guidance, due to customers being cautious with spending.

- We maintain the BUY recommendation with an unchanged target price of US$220.00, WACC of 6.4%, and terminal growth rate of 5%. We increase our FY24e PATMI/CAPEX forecast by 8%/7% to account for margin improvement and higher CAPEX spending. Margin strength is from scaling up of AWS and advertising, as well as AMZN’s improvements throughout the network that helps lower costs and improve delivery speeds.

Amazon.com Inc.- More AWS growth ahead

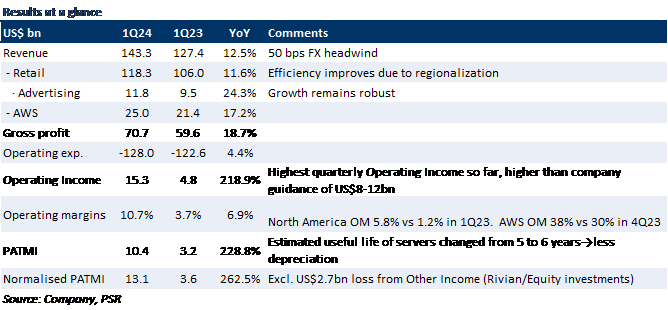

- 1Q24 revenue/PATMI meet our expectations at 22%/26% of our FY24e forecasts. 1Q24 revenue grew 12.5% YoY to US$143.3bn led by continued strength in AWS and advertising. Operating income benefited from lower depreciation due to a change in useful life of servers (~US$900mn in 1Q24)

- AWS revenue growth accelerated (17.2% YoY), driven by: 1) the end of the cost-optimizing trend as companies pivot towards newer initiatives to modernize their infrastructure; 2) accelerated demand for Gen AI; 3) strong emphasis on security and operational performance that appeals to customers. >85% global IT spend still remaining on-premises, highlighting significant growth headroom ahead.

- We maintain the BUY recommendation but raised our DCF target price to US$220.00 (prev. US$215.00), with an unchanged WACC of 6.4% and terminal growth rate of 5%. Our FY24e revenue estimates remain unchanged, while we increased our PATMI by 4% to account for lower expenses, a result of improved cost efficiencies.

The Positives

+ AWS showing more signs of reaccelerating. Revenue of US$143 bn is at the top-end of the company’s guidance, with most of the outperformance driven by AWS (13.2% YoY) and Advertising (26.8% YoY). The high growth of AWS is fueled by customers migrating workloads from on-premises to the cloud. Gen AI services are seeing a strong demand signal, evidenced by extended contracts and larger commitments (e.g., Perplexity AI/Workday). Management has disclosed a significant increase in Capex for 2024 to bolster AWS growth, indicating the company's confidence in AWS expansion prospects.

+ Improvement in margins. AMZN continues reaping the benefits of regionalizing its operations and has shown progress in bringing the cost structure down further (e.g. consolidation of units into fewer boxes). Its first-quarter operating income is at an all-time high of $15.3 bn, beating the company’s top-end guidance of US$12.0 bn. Consequently, the operating margin stood at 10.7% (reaching double-digits for the first time), a substantial increase from 3.7% in 1Q23. Notably, the international business achieved positive operating income for the first time in over two years. AWS’s operating margin reaches an all-time high of 37.6%.

The Negative

- Potential pullback in consumer spending. AMZN's hinted at potential signs of a slowdown in consumer spending. Despite growth in retail revenue, management noticed that customers are cautious about their expenditures, seeking bargains and opting for lower-priced alternatives. This trend appears to persist into the second quarter, especially for the European market. AMZN has guided a revenue growth between 7% and 11% in 2Q24e, including an unfavourable foreign exchange impact of 60 bps.

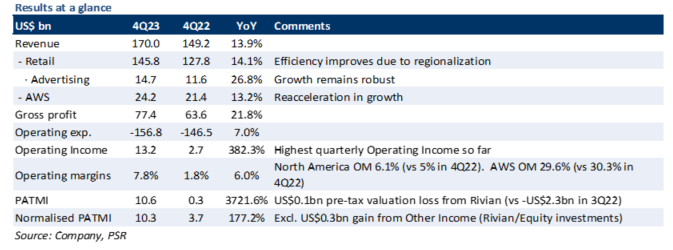

Amazon.com Inc. – Improving efficiency through regionalization

- 4Q23 revenue was in line with our expectation, while PATMI exceeded. The PATMI outperformance was due to cost efficiencies and higher operating leverage. 4Q23 Adj. PATMI grew ~3x YoY. FY23 revenue/PATMI was at 100%/111% of our FY23e forecasts.

- Operating income for 4Q23 grew ~5x YoY due to the benefits of network regionalisation in the US and strong advertising growth. Operating margin grew to 7.8%, an increase of 6.0% YoY.

- Due to higher operating leverage, we raise our FY24e PATMI by 58%. Our revenue forecast remains unchanged. We roll over an additional year of valuations and maintain our BUY recommendation with a raised DCF target price of US$215 (prev. US$190) to reflect our assumptions. Our WACC/growth rate of 6.4%/5% remains unchanged.

The Positives

+ Retail operating income was driven by regionalization and efficiency. AMZN’s retail operating income improved by 382% YoY. North American/International segment’s operation income increased from -US$0.2bn/-US$2.2bn in 4Q22 to US$6.5bn/-US$0.4bn in 4Q23, primarily driven by cost-cutting and lower transportation rates. North America benefit from regionalisation and expansion of last-mile delivery facilities, increasing same day deliveries by 65% YoY. Improved inventory placement drove faster deliveries and lowered transportation distances (cost to serve declined by >US$0.45 per unit). We foresee revenue growth to continue in the long term as lower costs lowers ASPs, improving affordability. This, together with faster delivery speed, should lead to greater purchase consideration & frequency.

+ Advertising growth remains robust. Advertising revenue grew 27% YoY in 4Q23, primarily driven by sponsored products with higher ads relevancy. AMZN benefits from being able to collect its own first-party data, and has been able to efficiently convert this data into more efficient and relevant ads for consumers, driving up ROI for advertisers. We believe advertising remains AMZN’s great growth opportunity as it has the ability to scale alongside its retail business, advertising only contributes 8% of the company’s total revenue presently.

+ AWS seeing stabilization in growth. AWS revenue was up by 13.2% YoY in 4Q23, compared to 12.3% and 12.2% YoY in 3Q23 and 2Q23. AWS revenue growth has dipped in previous quarters due to customers moderating their spending. The recent acceleration in growth rate suggests that this effect has bottomed out. Accelerated new deals and backlog conversion is expected to drive growth. Management has indicated that the acceleration in growth will continue into FY24, driven by accelerating demand in Gen AI. AWS’ order backlog grew ~40% YoY in 4Q23.

The Negative

- Nil.

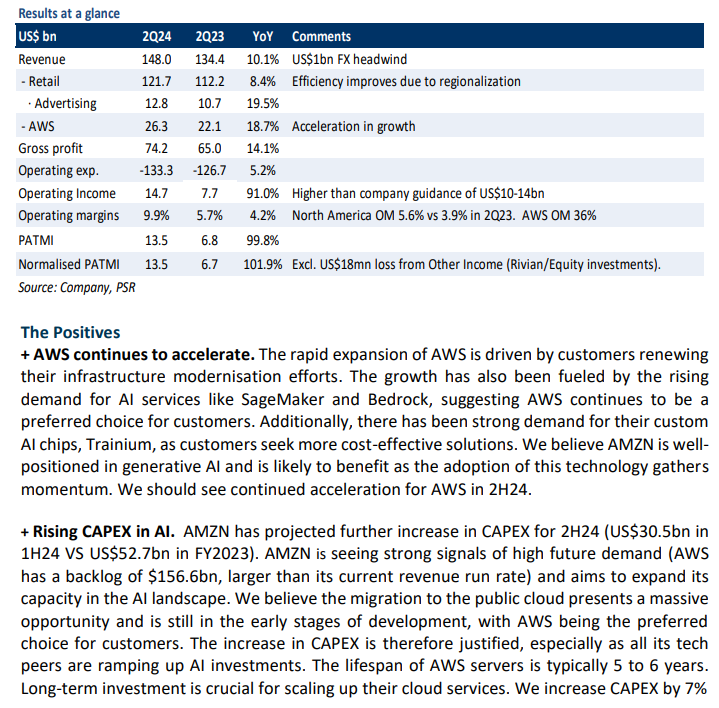

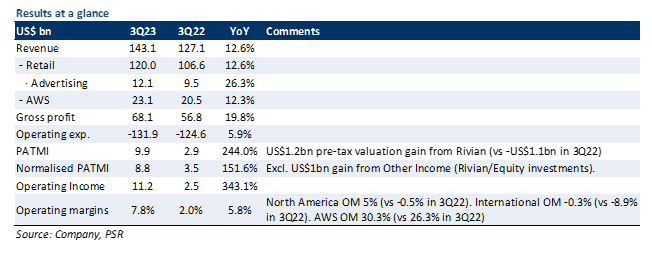

Amazon.com Inc. – Margins expansion still the main story

- 3Q23 revenue was in line with our expectation, while earnings exceeded. 9M23 revenue/PATMI was at 73%/98% of our FY23e forecasts. Earnings outperformance was due to higher-than-expected gross margins and lower-than-expected operating expenses.

- Operating income more than tripled YoY due to the benefits of network regionalisation in the US, easing inflation, strong advertising growth, and lower headcount. AWS growth has stabilised as the rate of customer cost-optimisation continues to attenuate.

- We maintain a BUY rating with an increased DCF target price of US$190.00 (prev. US$175.00), with a WACC of 6.4% and terminal growth rate of 5%. We increase our FY23e revenue/PATMI forecasts by 2%/31% to account for the higher-than-expected operating leverage.

The Positives

+ Margins continue to improve. Gross and operating margins expanded by ~300bps and ~600bps YoY, respectively. Operating income more than tripled YoY to a record level of US$11.2bn, beating the top-end of US$8.5bn company guidance. The retail business benefitted from the lower cost to serve because of its fulfillment network regionalisation initiative in the US, easing inflationary pressure in line-haul, ocean, and rail shipping rates, as well as the strong 26% YoY growth of its advertising business (7% of revenue). AWS operating margin also expanded by 600bps QoQ and 400bps YoY, back to the level last seen in 2Q22, primarily driven by headcount reductions in the business and lower energy costs.

+ AWS growth stabilised. Segment revenue was up by 12% YoY, in line with management’s guidance of stabilising growth. Despite customer cost-optimisation efforts being relatively elevated compared to 2022, it is starting to meaningfully attenuate as more companies shift their focus towards deploying new workloads. Management expects the rate of such optimisations will continue to ease in the next several quarters. Furthermore, AMZN indicated that it signed several deals with customers that will take effect in 4Q23, including those where existing customers expand their AWS deployments and move away from short-term contracts to commitments ranging between 1-3 years. Hence, we expect growth will start to re-accelerate in the near term.

+ Strong free-cash-flow. Trailing-twelve-months (TTM) FCF was US$21.4bn, tripling QoQ and a US$41bn improvement YoY. This was driven by the increased operating income in both retail and AWS segments, improved leverage on fixed costs and working capital efficiency.

The Negative

- Nil.

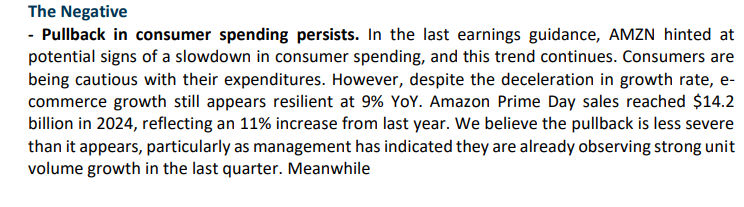

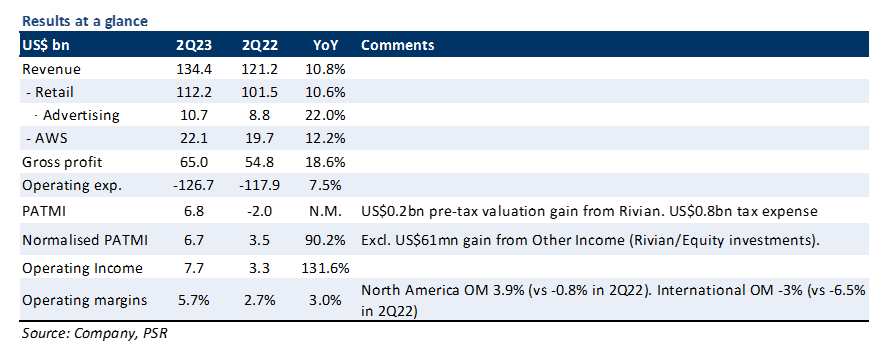

Amazon.com Inc. – Efficiency enhancements bearing fruit

- 2Q23 revenue was in line with our expectation, while earnings exceeded. 1H23 revenue/PATMI at 47%/68% of our FY23e forecasts. Earnings outperformance was due to higher-than-expected gross margins.

- Revenue grew 10.8% YoY, beating top-end of company guidance. AWS was up 12% and growth seems to have bottomed out.

- We upgrade to a BUY rating with an increased DCF target price of US$175.00 (prev. US$120.00), with a WACC of 6.4% and terminal growth rate of 5%. We increase our FY23e PATMI forecast by 39% to account for the higher margins as well as the lower CAPEX spending plans.

The Positives

+ Revenue beats guidance. 2Q23 revenue grew 10.8% YoY to US$134.4bn, above the top end of US$133bn company guidance. International segment revenue growth re-accelerated QoQ as it was up by 9.7% YoY, from a growth of 1% YoY in 1Q23, as macro conditions continue to improve. Advertising growth also improved, increasing by 22% YoY (vs 21% in 1Q23) to US$10.7bn (7.9% of total revenue), with Amazon’s performance-based advertising offerings being the largest contributor. AWS was up 12% YoY, slightly above company guidance of 11%.

+ AWS growth stabilising. Despite customers continuing to optimise costs in 2Q23, management said it has started seeing some customers shift their focus towards innovation and new workload deployments. Amazon sees the trend continuing into 3Q23 and it expects the optimisation efforts to ease further, suggesting that growth has bottomed out. Hence, we believe there is a possibility of re-acceleration in 2H23, particularly in 4Q23, as Amazon rolls out its new AI services while customers gradually increase their spending on AWS.

+ Efficiency enhancements drive operating leverage. Gross and operating margins each expanded by ~300bps YoY, with operating income more than doubling to US$7.7bn from US$3.3bn in 2Q22. This was driven by the reduction in the cost to serve (shipping and fulfillment costs) as Amazon is seeing easing inflation headwinds, particularly in fuel prices, linehaul rates, ocean and rail rates. In addition to that, it is also benefitting from the headcount reductions (which fell by 4% YoY or 62,000 employees) and a lower CAPEX. The company’s regionalisation initiative is paying off as it reduced the number of touches for packages by 20% and miles traveled to deliver packages to customers by 19%, resulting in less transportation costs and faster delivery speed.

+ Strong free-cash-flow. Trailing-twelve-months (TTM) FCF was US$7.9bn, the first positive FCF since 3Q21. The improvement was driven by increased operating income as a result of higher operating leverage and the moderating inflationary pressure, as well as lower CAPEX.

The Negative

- Nil.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report