Adobe Inc – Semrush acquisition strengthens Adobe marketing arm

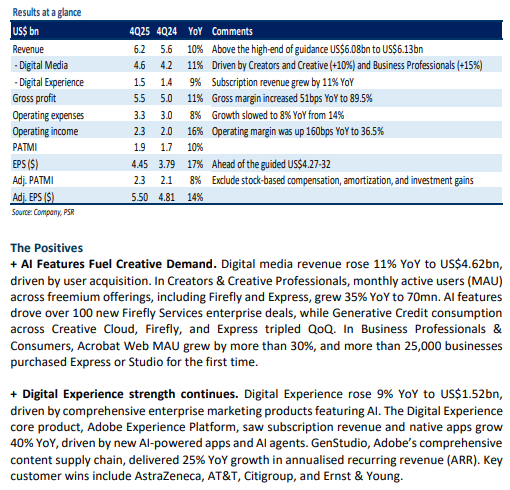

- FY25 results met our expectations with revenue/adj. PATMI at 101%/100% of our FY25e forecasts. 4Q25 adj. PATMI increased 8% YoY to US$2.3bn, driven by higher topline and operating leverage.

- For 1Q26e, Adobe expects adj. EPS of US$5.85–5.90 (+16% YoY) on revenue of US$6.25–6.30bn (+10% YoY), driven by 10% growth in Creative & Marketing Professionals Subscription revenue to US$4.3–4.33bn. The US$1.9bn Semrush acquisition is expected to close in 1HFY26e, with minimal impact on EPS in the first year and accretive thereafter.

- We maintain a BUY recommendation with a lower DCF target of US$487 (prev. US$560) as we roll forward our forecasts. For FY26e, we expect 10% revenue growth and 6% EPS growth, supported by rising AI adoption and higher subscription revenue. We retain a 7.3% WACC but lower terminal growth to 3.5% from 4%, due to increased competition from generative AI among smaller customers. Risks remain limited for enterprise clients using Adobe for complex workflows, where third-party models complement the platform.

Adobe Inc – Delivers another top-end guidance beat

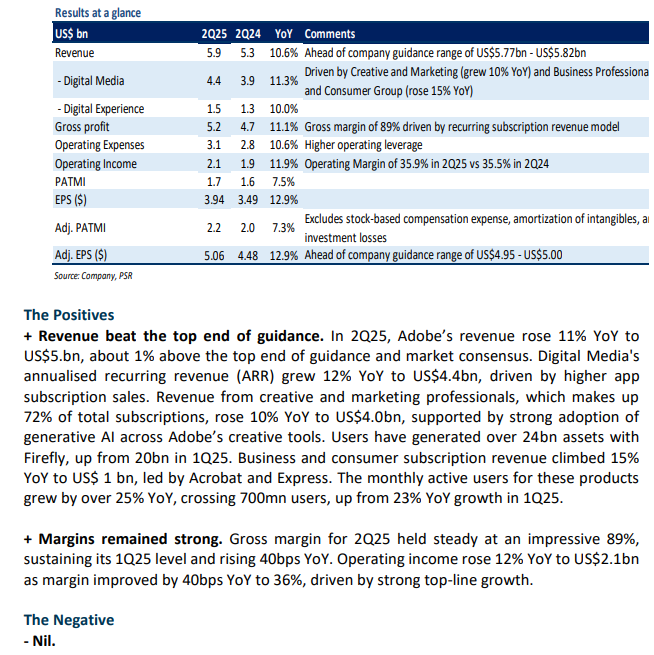

- 9M25 revenue/adj. PATMI met expectations at 74%/71% of our FY25e forecasts. 3Q25 adj. EPS rose by 9% to US$5.06bn on a higher operating leverage.

- For 4Q25e, Adobe expects Adj. EPS of US$5.38 (+12% YoY) on revenue of US$6.1bn (+9% YoY), driven by continued strength in its Digital Media segment, which is projected to grow 10% YoY on the back of rising subscription sales across Creative tools.

- We maintain a BUY recommendation with an unchanged DCF target price of US$560 (WACC 7.3%, g 4%). We raised our FY25e revenue estimate by 0.3% following Adobe’s strong 3Q results and updated guidance offset by higher expense estimates due to increased investment in AI and product development. Higher growth in Digital Media revenue supports an FY25e Adj. EPS upgrade to US$20.83. We believe the upward guidance reflects management’s confidence in steady performance, supported by growing AI traction and higher subscription revenue.

Adobe Inc – Revenue beat top end of guidance

- 2Q25 revenue/adj. PATMI was in line with expectations at 49%/50% of our FY25e forecasts. 2Q25 adj. Adj. EPS rose by 13%, 2% above guidance and ahead of consensus.

- For 3Q25e, Adobe expects adj. EPS of US$5.18 (+11% YoY) on revenue of US$5.9bn (+9% YoY). Digital Media revenue is expected to grow by 10% YoY, driven by increased subscription sales across its Creative tools.

- We maintain a BUY recommendation with a higher DCF target price of US$560, up from US$543 (WACC 7.3%, g 4%). We nudge our FY25 revenue estimate higher by 0.3%, following Adobe’s strong first-half results and raised guidance. Higher growth in Digital Media revenue supports an EPS upgrade to US$16.39. We believe the upward guidance revision reflects management’s confidence in continued steady performance, driven by higher subscription revenue.

Adobe Inc – Stability amid market uncertainties

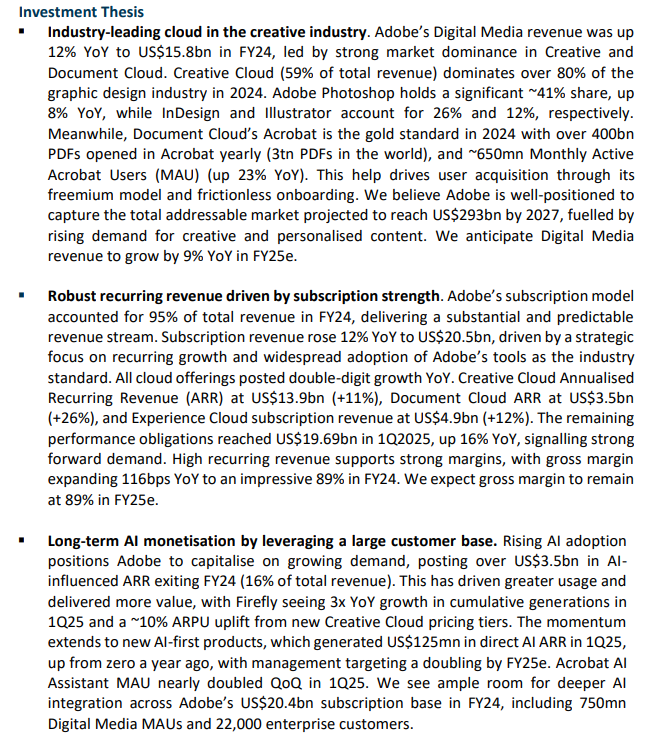

- Industry-leading cloud, with Creative Cloud leading over 80% of the graphic design market and Document Cloud’s Acrobat reaching ~650mn MAUs in FY24 (up 23% YoY).

- Robust recurring revenue (95% of FY24 total) driven by double-digit subscription growth across all cloud offerings, supporting a substantial 89% gross margin.

- We upgrade to BUY from REDUCE recommendation due to recent price performance and raise our DCF target price to US$543 from US$480 (WACC 7.3%, g 4%). We rolled over an additional year of valuations and nudge our FY25e revenue estimates lower by 2% due to moderating client spending. While momentum for GenAI solutions like Firefly and AI Assistant is building, they have yet to boost the top line.

Adobe Inc – Weak sales outlook

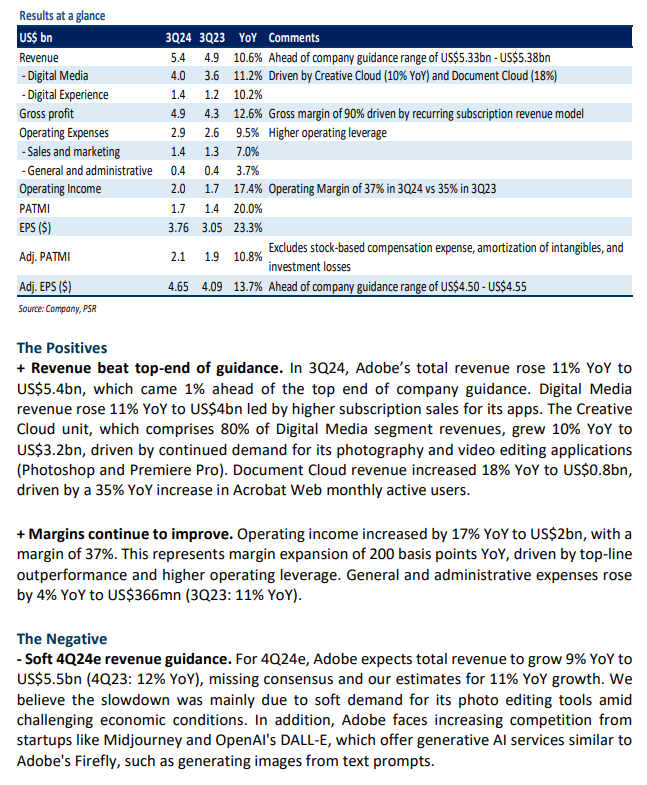

- 9M24 revenue/adj. PATMI was in line with expectations at 74%/75% of our FY24e forecasts. 3Q24 adj. PATMI rose 11% YoY to US$2.1bn on higher operating leverage.

- For 4Q24e, Adobe expects adj. EPS of US$4.66 (up 9% YoY) on revenue of US$5.5bn (up 9% YoY). Digital Media revenue is expected to grow by 10% YoY, driven by increased subscription sales for its Creative Cloud and Document Cloud apps.

- Maintain REDUCE recommendation with an unchanged DCF target price of US$480 (WACC 7.3%, g 4%). We nudge lower our FY24e revenue estimates by 1% due to moderating client spend, while increasing our adj. PATMI by 1% to account for higher interest income. While momentum for GenAI solutions like Firefly and AI Assistant is building, they have yet to boost the topline. Rising competition from startups like Midjourney and OpenAI's DALL-E could also provide headwinds to Adobe's growth and AI monetisation plans.

Adobe Inc – Outlook raised, revenue growth stagnant

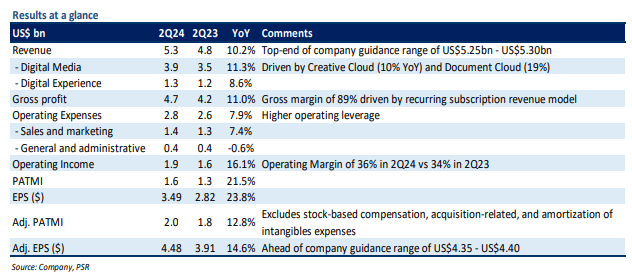

- 2Q24 revenue/adj. PATMI was in line with expectations at 49%/50% of our FY24e forecasts. In 2Q24, revenue grew 10% YoY to US$5.3bn led by higher subscription sales for its creative and document management solutions. Adj. PATMI rose 13% YoY to US$2bn on higher operating leverage.

- For FY24e, Adobe expects its total revenue to grow by 10% YoY to US$21.45bn (FY23: 10% YoY), taking the midpoint. The company increased its net new Digital Media ARR forecast to US$1.95bn from US$1.9bn driven by subscriber growth and early traction around new product innovations such as Firefly and Acrobat AI assistant. Adj. EPS guidance also raised to US$18.10 from US$17.80 (FY23: US$16.07).

- We maintain the REDUCE recommendation but raise our DCF target price to US$480.00 (prev. US$465.00), with an unchanged WACC of 7.3% and a terminal growth rate of 4%. Our FY24e revenue estimates remain unchanged while we nudge higher our adj. PATMI by 1% to account for lower expenses. While Adobe is witnessing strong demand trends for its new generative AI solutions, it needs to demonstrate accelerated revenue growth. In addition, the company faces tough competition across its markets by startups like Canva and OpenAI's DALL-E, which could provide headwinds to Adobe’s growth and monetization plans.

The Positives

+ Net new Digital Media ARR beat guidance. Digital Media segment revenue increased by 11% YoY to US$3.9bn. Net new Digital Media annualized recurring revenue, or ARR, was US$487mn for the quarter, exceeding the US$440mn company guidance, driven by subscriber growth and new product innovations (Express for Business, Firefly services, and Acrobat AI). Within the Digital Media segment, Creative Cloud revenue rose 10% YoY to US$3.1bn, and Document Cloud revenue jumped 19% YoY to US$782mn. The growth was mainly led by continued demand for its photography and video editing applications (Photoshop and Illustrator) as well as PDF and e-signature solutions. Acrobat Web’s free monthly active users grew by 60% YoY driven by an explosion of PDF consumption through Chrome and Edge extensions.

+ Operating margins expanded on higher operating leverage. Operating income grew 16% YoY to US$1.9bn as margins expanded by 180 basis points YoY. The margin improvement was mainly due to top-line upside and continuous improvements in cost efficiencies, as expense growth slowed to 8% YoY (2Q23: 13% YoY). General and Administrative expenses were down 1% YoY. We raise our FY24e adj. PATMI by 2% on higher operating leverage.

The Negative

- Creative Cloud segment faced pricing headwinds. In 2Q24, the net new Creative Cloud annualized recurring revenue dropped by about 9% YoY to US$322mn. We believe the drop is mainly because of tough comparisons as price increases over the last two years has started to roll-off. In addition, Adobe faces increasing competition from startups like Midjourney and OpenAI's DALL-E, which offer generative AI services similar to Adobe's Firefly, such as generating images from text prompts.

Adobe Inc – Revenue growth to decelerate

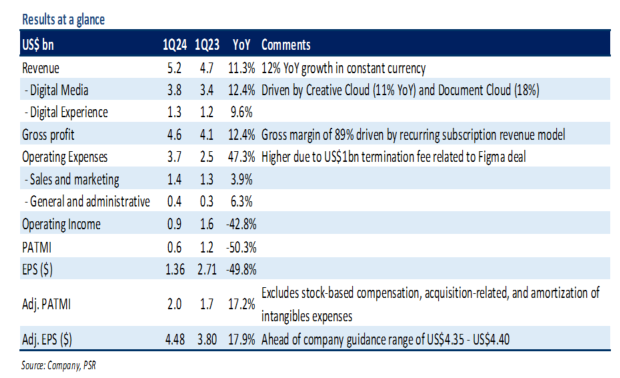

- 1Q24 revenue/adj. PATMI was in line with expectations at 24%/25% of our FY24e forecasts. Adj. PATMI increased 17% YoY to US$2bn due to higher operating leverage.

- For 2Q24e, Adobe expects adj. EPS of US$4.38 (up 12% YoY) on revenue of US$5.3bn (up 9% YoY). Digital Media segment revenue will grow 11% YoY led by higher subscription sales for its Creative Cloud and Document Cloud apps.

- Maintain REDUCE recommendation with an unchanged DCF target price of US$465 (WACC 7.3%, g 4%). No change to our forecasts, except for a one-off US$1bn termination fee related to the Figma deal. Adobe faces headwinds from increased competition and tough comparisons due to pricing actions. In addition, Firefly AI tools are unlikely to boost revenues until the end of this year as Adobe is currently focusing on enhancing customer engagement instead of immediately monetising generative tokens.

The Positives

+ Revenue beat top-end of guidance. In 1Q24, Adobe’s total revenue rose 11% YoY to US$5.2b, which came 1% ahead of the top end of company guidance. Revenue from the Digital Media segment grew 12% YoY to US$3.8bn, with Creative Cloud revenue growing to US$3.1bn (up 11% YoY) and Document Cloud growing to US$0.8bn (up 18% YoY). This growth was mainly fueled by continued demand for its photography and video editing applications (Photoshop and Illustrator) and Acrobat PDF and e-signature solutions. Management highlighted that Acrobat Web’s monthly active users, or MAUs, spiked 70% YoY and surpassed 100mn users in the quarter.

+ Margins continue to improve. Gross and adj. net profit margins expanded by 80bps and 200bps YoY, respectively. The margin improvement was mainly due to top-line upside and higher operating leverage, including careful sales and marketing spend. Adj. PATMI increased by 17% YoY to US$2bn.

The Negative

- Soft 2Q24e revenue guidance. For 2Q24e, Adobe expects total revenue to grow 9% YoY to US$5.3bn. Management highlighted that the slowdown is mainly because of tough comparisons as price increases over the last two years has started to roll-off. Meanwhile, the new pricing for Creative Cloud apps with Firefly AI tools would become a tailwind towards the end of FY24e as it hits larger customer base at renewals. In addition, Adobe faces increasing competition from startups such as Midjourney and OpenAI's Dall-E, which offer gen-AI services similar to Adobe’s Firefly like generating images from text prompts.

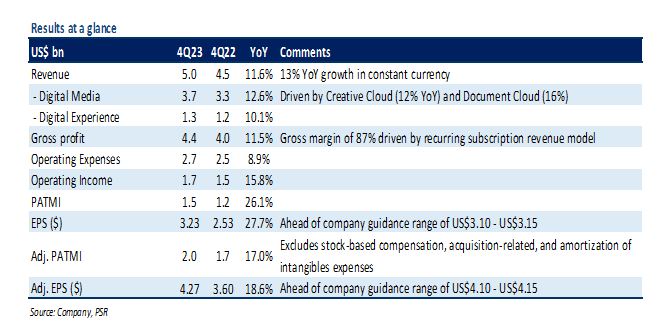

Adobe Inc – Valuations remain expensive

- 4Q23 results met our expectations. FY23 revenue/PATMI were at 100%/101% of our FY23e forecasts. 4Q23 PATMI increased 26% YoY to US$1.5bn driven by higher operating leverage, lower taxes, and higher interest income.

- For FY24e, Adobe expects adj. EPS to grow by 11% YoY to US$17.80 on total revenues of US$21.4bn, up 10% YoY. Management signaled that the AI-related boost and recent price hike for its Creative Cloud offerings would take longer to

- We maintain a REDUCE recommendation with a higher DCF target price of US$465 (WACC 7.3%, g 4%), up from US$441. We cut our FY24e revenue by 1% to account for lower-than-expected pricing impact, while increasing FY24e PATMI by 3% to reflect lower expenses. However, we believe ADBE valuations remain expensive as its market cap is up about 60% or US$100bn over the last six months on an annual incremental profit opportunity of US$4bn assuming Creative Cloud revenue doubles with its generative AI functionality Firefly.

The Positives

+ Revenue growth driven by Digital Media vertical. 4Q23 revenue grew 12% YoY to US$5.0bn, in line with the company guidance. Digital Media segment revenue rose 13% YoY to US$3.7bn led by higher subscription sales for its creative software applications. Adobe's Creative Cloud unit, which makes up 80% of Digital Media segment revenues, reported revenue growth of 12% YoY to US$3.0bn. The growth was mainly led by strong demand for its photography and video editing applications (Photoshop and Illustrator). Management highlighted that users have generated over 4.5bn images so far using its generative AI functionality Firefly compared with 3bn in October. Document Cloud revenue grew by 16% YoY to US$721mn (20% of Digital Media revenues) driven by continued demand for PDF and e-signature solutions. Management highlighted that Acrobat Web’s monthly active users, or MAUs, spiked 70% YoY while Acrobat Mobile surpassed 100mn MAUs in the quarter.

+ Improvements in margins. Adobe reported an impressive gross margin of 87% as the company reports the bulk of its sales from recurring revenue. Operating margins expanded 120bps YoY driven by continued focus on operational discipline, including careful investments in research and development as well as sales and marketing. Net margins expanded 340bps YoY driven by higher operating leverage, lower tax expense, and a 2.5x increase in interest income. PATMI rose 26% YoY to US$1.5bn.

The Negative

- Soft FY24e revenue guidance. For FY24e, Adobe expects total revenue to grow 10% YoY to US$21.4bn at the midpoint, which was below our estimate of US$21.8bn. The soft guidance was primarily due to a lower-than-expected impact from the pricing changes. Management highlighted that the price increase in November would impact less than half of the Creative Cloud base and expects a material impact in 2H24e and beyond.

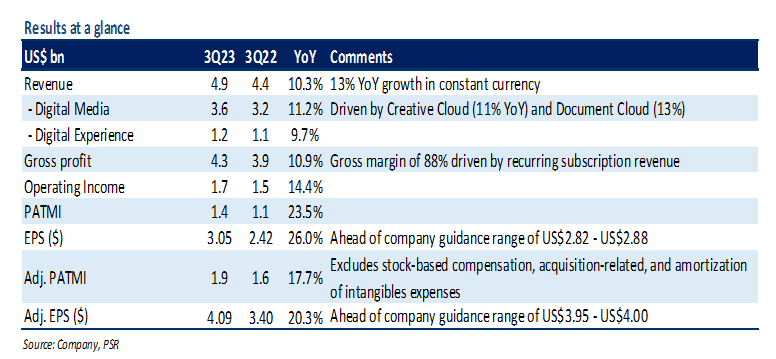

Adobe Inc – Priced at a premium

- 9M23 revenue/PATMI was in line with expectations at 74%/76% of our FY23e forecasts. In 3Q23, revenue grew 10% YoY to US$4.9bn led by higher subscription sales of its creative software applications. PATMI rose 24% YoY to US$1.4bn driven by higher operating leverage and lower tax rate.

- For 4Q23e, Adobe expects GAAP EPS of US$3.12 on revenue of US$5bn (up 10% YoY). Net new Digital Media annualized recurring revenue is expected to be US$520mn with a modest contribution from generative AI tools. Adobe plans to hike pricing for some Creative Cloud products (Photoshop and Premiere Pro) by about 10% starting Nov. 1.

- We maintain a REDUCE recommendation with a higher DCF target price of US$441 (WACC 7.3%, g 4%), up from US$435. Our FY24e revenue/PATMI has increased by 1%/2% to account for new pricing and AI-related tailwinds. However, we believe ADBE is priced at a premium as its market cap is up about 43% or US$74bn over the last four months on an annual incremental profit opportunity of US$4bn assuming Creative Cloud revenue doubles with Firefly.

The Positives

+ Creative Cloud momentum remained robust. Adobe’s Creative Cloud business comprises 81% of Digital Media segment revenues. Creative Cloud revenue grew 11% YoY to US$2.9bn (14% YoY in constant currency). Net New Creative Cloud annualized recurring revenue, or ARR, was US$332mn during the quarter, with a total Creative Cloud ARR of US$12bn. The growth was mainly led by strong demand for its photography and video editing applications due to a surge in both the creation and consumption of digital media. Management highlighted that the company has integrated its generative AI offering Firefly into flagship products Photoshop and Illustrator, with more than 3mn beta release downloads. Key customer wins for Creative Cloud in 3Q23 include Amazon, SAP, and Take-Two Interactive.

+ Continued strength in Document Cloud. Document Cloud sales grew 13% YoY to US$685mn, accounting for 19% of Digital Media revenues. Net new Document Cloud ARR was US$132mn, exiting the quarter with Document Cloud ARR of US$2.6bn. The growth was primarily driven by continued demand for Acrobat PDF solutions across computing devices and e-signature capabilities. Management highlighted that Acrobat Web monthly active users spiked by 70% YoY led by growth in documents opened through Chrome and Edge extensions. Key customer wins in 3Q23 include Citibank, GlaxoSmithKline, and Morgan Stanley.

The Negative

- FX impacted revenue growth. Adobe generates 40% of its total revenue from international markets. The company’s revenue was negatively impacted by the strengthening of the US dollar relative to most other currencies, including the Euro, British pound, and Japanese yen. In 3Q23, FX headwind to revenue was about US$125mn (~10% of PATMI).

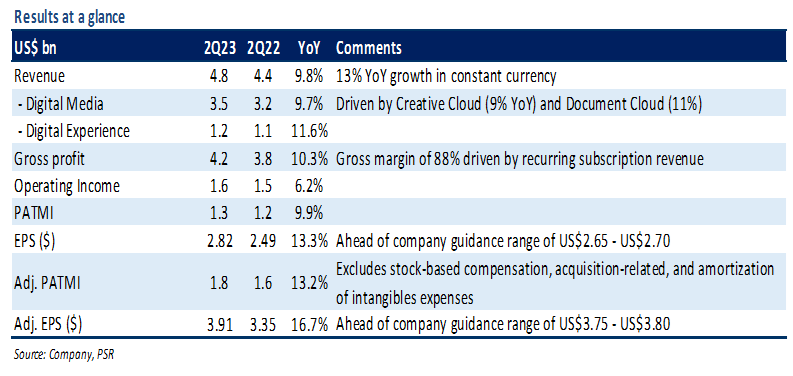

Adobe Inc – Pricing too much for AI

- 1H23 revenue/PATMI was in line with expectations at 49%/50% of our FY23e forecasts. In 2Q23, revenue grew 10% YoY to US$4.8bn led by higher subscription sales associated with its Digital Media and Digital Experience offerings. Adj. PATMI, which primarily excludes stock-based compensation expense, grew 13% YoY to US$1.8bn.

- For FY23e, Adobe raised its revenue guidance to US$19.3bn (vs US$19.2bn prior) and GAAP EPS guidance to US$11.20 (vs US$11.00 prior) taking the midpoint. The management raised its outlook on optimism that generative AI tools (Firefly) will increase demand for its creative software.

- Market cap is up about 30% or US$52bn over the last month on an annual incremental profit opportunity of US$3bn assuming Creative Cloud revenue doubles with Firefly. We downgrade to REDUCE from ACCUMULATE recommendation after the recent jump in its stock price. We increase our DCF target price to US$435.00 (prev. US$402.00) with a WACC of 7.3% and terminal growth of 4%. Our FY23e revenue/PATMI is increased by 1%/2% due to rising digital content creation and a shift to electronic document processes.

The Positives

+ Firefly beta adoption was robust. Creative Cloud sales grew 9% YoY to US$2.9bn (14% YoY in constant currency) led by booming content demand. Net new Creative Cloud annualized recurring revenue (ARR) was US$354mn, exiting the quarter with Creative Cloud ARR of US$11.6bn. In 2Q23, Adobe released a beta version of Firefly, its generative AI offering for creating content using text prompts. Management noted that Firefly-powered capabilities integrated into Photoshop and Illustrator have generated 500mn digital assets so far. While the focus remains on driving broad-based adoption, Adobe plans to publish additional information regarding AI monetization later this year. Key customer wins for Creative Cloud in 2Q23 include NVIDIA and Ernst & Young.

+ Strong momentum in Document Cloud. Document Cloud revenue was US$659mn, up 11% YoY (14% YoY in constant currency). Document Cloud ARR grew by 17% YoY to US$2.5bn, adding US$116mn during the quarter. The growth was mainly due to strong demand for Acrobat with integrated Sign capabilities across the web, desktop and mobile. Management noted that Acrobat web monthly active users grew by 50% YoY driven by an explosion of PDF consumption through Chrome and Edge extensions. Key customer wins in 2Q23 include Boston Consulting Group, Novartis, and T-Mobile.

The Negative

- Negative impact of FX. Adobe’s revenue was negatively impacted due to the strengthening of the dollar against several key foreign currencies, including the Euro, British pound, and Japanese yen. In 2Q23, FX headwind to revenue was about US$150mn (~12% of PATMI).

Outlook

For FY23e, Adobe now expects GAAP EPS of US$11.20 on total revenue of US$19.3bn (prev. GAAP EPS of US$11.00 on revenue of US$19.2bn) taking the midpoint (Figure 1). The company also bumped its net new Digital Media ARR forecast to US$1.75bn from US$1.70bn driven by product-led growth initiatives, including Adobe Express and generative AI tools. Notably, we expect AI-driven revenues to be modest in 2H23e given they are still in the early stages. Meanwhile, the company lowered its Digital Experience segment revenue forecast to US$4.88bn (prev. US$4.98bn) due to cautious enterprise buying behaviour resulting in an elongated sales cycle, additional deal approval layers and deal size compression.

For 3Q23e, Adobe is guiding for revenue of US$4.85bn, up 10% YoY, and GAAP EPS of US$2.85, both at the midpoint of its guidance. Management also guided Digital Media and Digital Experience segment revenues to be US$3.56bn and US$1.22bn, respectively.

Adobe reiterated its belief that its pending US$20bn acquisition deal of design startup Figma should close by the end of FY23e. Cash flow generation continues to be strong, with the company generating about US$2bn in Free Cash Flow in 2Q23, ending the quarter with US$5.5bn in cash and cash equivalents.

Get access to all the latest market news, reports, technical analysis

by signing up for a free account today!

Login

The full article is only available for premium content subscribers. To continue reading this article, please log in:

Not a Premium Content Subscriber yet? Sign up here!

- Home >

- Phillip Research Report