Market: STI was unchanged in April. We are NEUTRAL on the Singapore market. Our bottoms-up STI target is 3,200, implying a 16x PE FY17E. With limited upside, our preference is back to high dividend paying stocks. Why back to dividends? 1) Lingering doubts over the ability of the new US administration to cut corporate taxes or ignite infrastructure spending; 2) Rising concerns over geopolitics, in particular tensions in the Korean Peninsula; and 3) Weakening US economic data. US 10-year Treasury rates have peaked in the near-term and a reversal of expectations of higher interest rates lead us to Underweight Singapore banks. Our key picks for yield are Asian Pay Television Trust, Croesus Retail Trust and Keppel DC REIT.

Other recommendations are CDL and CapitaLand. The momentum in property sales is better than anticipated. Unsold inventories are starting to clear and demand-supply is turning more favourable especially for high-end residential property.

Over the past 6 months, the STI has rallied in two phases. The first kicked off with a rebound in commodity prices; the second came with “hopes” of a Trumponomics reflation. A 3rd potential phase, in our opinion, may be triggered by any larger than expected economic bounce in China. We await better data to affirm this.

Economics: 1Q17 flash GDP was 2.5% yoy (4Q16: +2.9%). We expect GDP forecast to be revised upward following strong industrial production and exports in March 17. MAS has kept its currency policy unchanged; it intends to maintain its neutral stance for an extended period. Unemployment rate at 7 year high.

Sector/Corporate: Reporting season kicked-off with REITs and healthcare. REITs results were generally in-line though rental reversions for retail and office are turning negative. Healthcare revenue has been weaker than expected, especially for hospital operators. Patients have been switching to lower cost public hospitals and while medical tourism has been sluggish, due to the strong Singapore dollar. Separately, telecommunications sector continued its weak share price performance following the aggressive bidding for spectrum by the upcoming 4th mobile operator, TPG.

Best performing sectors in Apr17 are: Healthcare, Industrials and Transportation. Leading the gains in Healthcare was IHH (+5%). Major gainers in industrial were AEM (whopping 83% spike) and Valuetronics (+9%). Performance in Transportation was led by Comfort Delgro (+ 7%).

Worst performing sectors in Apr17 are: Shipping, Telecommunications and Commodities. In Shipping, Ezion was down almost 16%, followed by SembCorp Marine (-15%). Telecommunication decline was led by SingTel (-4%). In Commodities, Golden Energy (-8%) and CNMC (-7%) were the major losers.

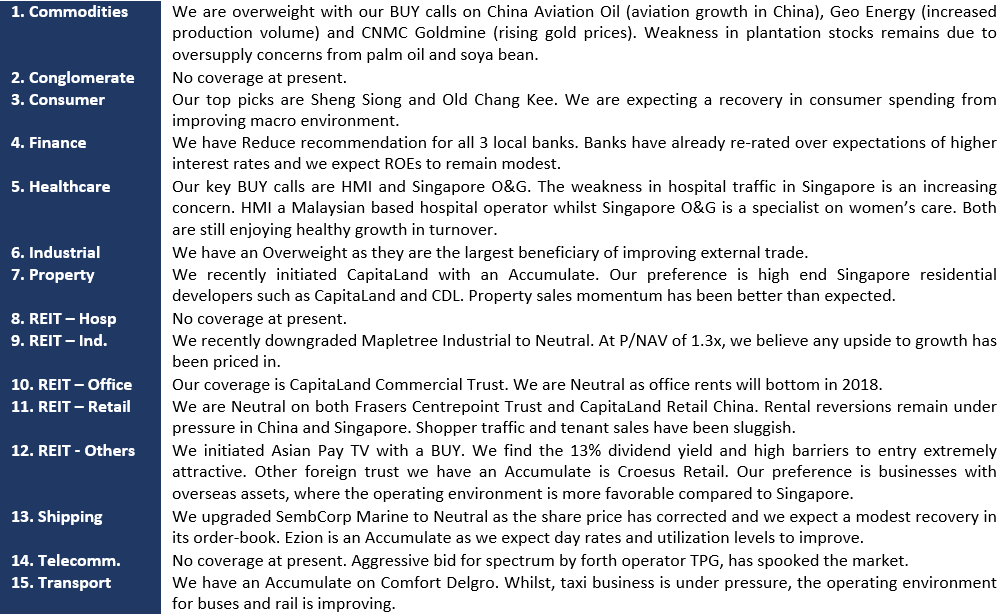

SUMMARY OF SECTOR AND COMPANY VIEWS

MAS maintain neutral policy stance: MAS will maintain the rate of appreciation of the S$NEER policy band at zero percent. The width of the policy band and the level at which it is centred will be unchanged. MAS added that its neutral policy stance is appropriate for an extended period. This policy stance is unchanged from the October 2016 monetary policy statement (MPS).

Comment: Despite economic conditions improving since the last MPS in October, MAS has maintained the slope, band width and midpoint within the band of the nominal effective exchange rate. MAS mentioned that the global economy has picked up, global capital expenditure has begun to turn up and China has stabilised. However, MAS views the domestic economy to remain lacklustre due to subdued labour markets, weak consumer sentiment and declining housing rents. MAS guidance was still dovish by stating its neutral stance is expected for an extended period. Expectations by MAS for the Singapore economy are as follows: 1. GDP of 1-3% in 2017. 2. MAS Core Inflation will rise from 0.9% in 2016 to average 1–2% in 2017 due to increases in global oil prices

Unemploment rate in Singapore, seasonally adjusted, for 1Q17 was 2.3% (4Q17: 2.2%). This is a 7 year high. At the peak of SARs and global financial crisis, the unemployment rate was 4.8% and 3.3% respectively.

FINANCE

Singapore may be set to get a third derivatives exchange, this time backed by China.

Comment: Dalian Commodity Exchange (“DCE”) is largest market for iron ore futures trading. We believe major trading houses would have been trading at DCE in China because of the ability for physical delivery of the iron ore commodity. But if DCE could offer attractive tax rates by setting up a derivatives exchange in Singapore, we could see physical trading houses consolidate their iron ore paper and physical trades with DCE in Singapore. The stronger clout commanded by DCE’s presence in Singapore may shift other non-physical traders such as Banks and brokerage Firms to DCE’s platform and intensify competition for SGX for Iron Ore Futures. However, DCE is primarily a commodities exchange and currently there are only 2 overlapping products between the two exchanges – Iron Ore and Coking Coal.

Profitability of several large banks today is below the cost of capital and is worrying, said Monetary Authority of Singapore managing director He added that unprofitable banks are a potential source of instability. Banks also need to be profitable to be able to support the real economy. They have to earn a decent return for intermediating credit, otherwise they will do less of it.

HEALTHCARE

Some 2,500 beds have been added to public hospitals over the past three years, raising the total capacity to 10,500 beds. More than 2,000 hospital beds will be added by 2020.

Comment: A 2,000 increase in public bed capacity implies a 19% increase over the next three years. However, we do not consider it as a major threat to the private healthcare providers.

(i) Hospital beds are still undersupplied in Singapore. Total hospital beds per 1,000 people is at about 2, compared to United States’ 3 and Euro Area’s 5; (ii) Ageing population in Singapore will underpin the demand for more hospital beds. According to Ministry of Health (2014), older people are four times more likely than younger people to be admitted into hospital; (iii) The main driver for demand for private healthcare remains as rising affluence. Although public bed capacity increased by 31% over the past 3 years to 10,500 beds, private hospital admissions continues to account for c.25% of total hospital admissions in Singapore in during this period.

Singapore Medical Association says ethical guidelines for the medical profession prohibit profit guarantees involving healthcare services.

Comment: Listed Singapore Medical Group said that it is reviewing the terms in its current (proposed acquisition of two local pediatric clinics) and future acquisitions strategies. For Q&M Dental, we do not think the Group has imposed any financial imperative terms that could risk the dentists’ ethical standards and requirements.

PROPERTY

URA’s overall private home price index eased 0.5 per cent q-o-q in Q1 2017. For the first time after 13 quarters of decline, the price index for non-landed private homes remained flat.

Comment: We are expecting the Core Central Region price index to rebound in 2Q17, as momentum from higher developer sales flows into the next quarter while maintaining a healthy level of ASP. Although the Rest of Core Region segment stayed flat at 136.4 points in 1Q17, the market segment is likely to regain interest in the next quarter as notable launches such as Seaside Residences (843 units) and Artra (400 units) are expected to be launched in end-April.

URA to tackle developers that misrepresent info.

Comment: According to our channel checks and reference from recent launches, most developers are already adhering to these development rules set out by URA. As such, we do not foresee much impact on the overall market from the reinforcement of these rules.

REIT – INDUSTRIALS

Viva Industrial Trust tenant, building manager Jackson International files for liquidation. This tenant provided rental support to Viva.

Comment: None of the four Industrial REITs under our coverage (Cache Logistics Trust, Soilbuild Business Space REIT, Keppel DC REIT and Mapletree Industrial Trust) have income support arrangements. However, Cache Logistics Trust and Soilbuild Business Space REIT have been negatively impacted by tenant dispute over rent renewal rate and rent default, respectively. Keppel DC REIT has a special arrangement in which it is receiving a coupon from the Vendor of the mainCubes data centre while it is under development.

REIT – RETAIL

Lazada, RedMart and others team up for e-membership scheme ahead of Amazon’s entry in Singapore this and likely to offer its Prime membership programme.

Comment: The intensifying competition amongst the e-commerce players and incoming Amazon is likely to result in more benefits for consumers as these players offer discounts to entice consumers to subscribe. Benefits from this e-membership scheme can possibly include online shopping rebates and discounts, cross platform promotions e.g. Netflix-UberEats or free/faster delivery. The “ecosystem” such a subscription/membership model creates is likely to create a stickiness factor towards online shopping and further intensify the pressure on brick and mortar shopping malls.

TRANSPORT

Public Transport Council (PTC) has started a review of the formula that is used to adjust bus and train fares. PTC said it targets to complete the review by the first quarter of 2018, and apply the new formula starting from that year’s fare review exercise. The current formula – which takes into account changes in the inflation rate, wages and an energy index that charts oil and electricity costs – will continue to be used for this year’s fare adjustment exercise. It has been used since 2013.

SMRT in talks to sell its taxi business to Grab. It has the 3rd largest fleet of taxis in Singapore with 3,400 cabs. SMRT has been in the taxi business for 27 years. Prime taxi, Singapore’s smallest taxi operator, with a fleet of 704 also indicated its interest.

Comment: SMRT’s sale of its taxi business is likely to be a combination of two factors: margin compression due to competition from private-hire cars and re-alignment of focus on the Rail business to improve service reliability. It appears that Grab intends to meld its ride-hailing app (asset-light) with a traditional taxi business (asset-heavy), similar to what Uber is already doing with a car rental company (Lion City Rentals). Nothing much has changed for Comfort DelGro, as overall taxi fleet remains the same with the transfer of ownership from SMRT to Grab. At the last results briefing for FY2016, Comfort DelGro had outlined a strategy of slowing down taxi fleet renewal, and extending the lifespan of taxis to keep the rental low and retain hirers.

KPMG flags going concern issues with KS Energy: Auditors cited “material uncertainty related to going concern” in relation to its FY16 financial statements. As at Dec16, secured bank loans for KS Energy is S$354m.

Marco Polo Marine says no need to suspend trading. It has been engaging various banks and financial institutions to discuss the current debt situation with a view to presenting to them the proposed refinancing and debt restructuring as soon as practicable.

Nam Cheong announced it is holding discussions with its principal lenders to address significant debt maturities. Obligations include current loans of RM948m.

RH Petrogas‘s auditor has included an emphasis of matter over its audited financial statements for FY16. RH Petrogas’ liabilities exceeded total assets and pointed out that these factors indicate the existence of a material uncertainty which may cast significant doubt about the group’s ability to continue as going concern.

Hong-Kong Listed HNA Group has launched a general offer for CWT Ltd at S$2.33 per share, or roughly S$1.4 billion in total. CWT is the sponsor of Cache Logistics Trust.

Centurion Corp is proposing a dual primary listing on the Sock Exchange of Hong Kong.

A coal producer based in China’s Shanxi province and China Broadband Capital are among bidders for M1.

Singapore Press Holdings is entering the healthcare sector with the purchase of nursing home operator Orange Valley Healthcare for $164 million. Orange Valley runs five nursing homes with 900 beds in Singapore.

Croesus Retail Trust announced it has been approached by a potential buyer for the whole trust.

Rotary Engineering has won a S$140 million contract from Jurong Port Tank Terminals to build a new tank terminal in Singapore. The job scope involves the construction of a tank farm with 19 tanks

Sembcorp Industries’ renewable energy business in India has won a S$414m bid for a new wind power project with close to 250MW of capacity.

China Everbright Water (CEWL) has won the bid for a 3.1 billion yuan (S$628.6 million) project in Shandong province, China.

Comment: Project involves booster pump station, rural water supply facilities, and pipeline networks, to be completed in two years. We believe gross profit (GP) margin will drop as construction margins hover around 20% compared with group margins of 36%. CEWL has established a good network and relationship with local government in Shandong. Therefore, we expect the implementation of this large scale integrated project to be smooth. We maintain our Buy recommendation.

SBS Transit was awarded the third bus package with the lowest bid of $480.3m. Under the bus contracting model, the Government owns all fixed and operating assets while operators focus on meeting service standards.

Frasers Centrepoint Singapore’s latest condominium project, Seaside Residences, sold 392 units – 70% of the 560 units released – in its first weekend of sales.

Container ship operator Rickmers Maritime said it has found a buyer for its entire fleet of container ships for US$113 million. The announcement comes just a week after the trust said it would wind up after debt restructuring talks failed last December.

Frasers Centrepoint, together with TCC Assets, will jointly develop a fully integrated development called One Bangkok, with an estimated investment value of over US$3.5bn.

Source: Bloomberg, Business Times, Straits Times, SGX announcements

Please sign in to download our full report in PDF.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.