How do we view this?

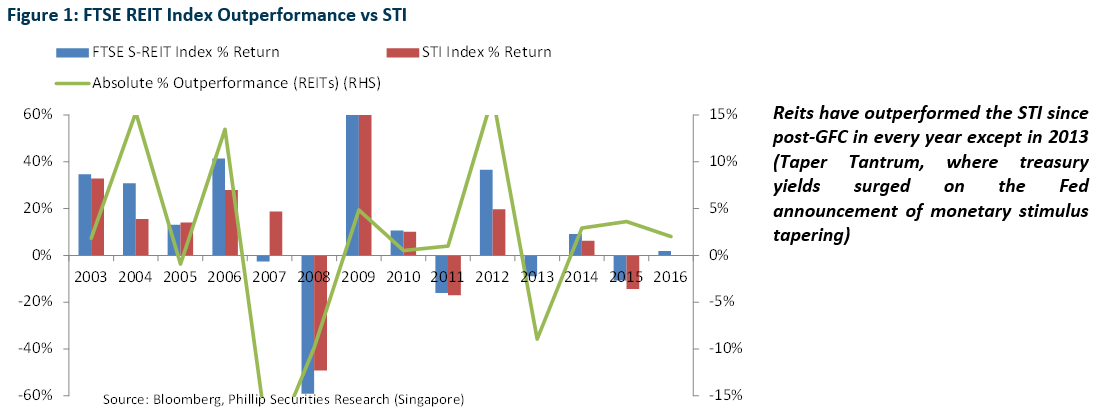

S-REITS have performed incredibly well since post Global Financial Crisis (GFC) until now, outperforming the STI every year except in 2013 where we had the “taper tantrum” and Treasury yields surged after the Fed announced the “tapering” of monetary stimulus.

One of the major contributing factors for the strong performance of S-REITs was the presence of low interest rates and loose monetary policies from major central banks including the Federal Reserve, European Central Bank (ECB) and Bank of Japan (BOJ). This drove funds towards yield investment instruments amidst the low interest rate, low growth environment. Together with a recovering property market across most sectors from 2009, better consumer sentiment driving strong retail sales, and banks and companies rehiring post GFC, these were the perfect fuel for a sustained run in REITs prices.

With the Federal Reserve gradually normalising interest rates, we think that this could mark the start of the reversal of the “yield carry-trade”. 2017/2018 will likely see steeper and more frequent Fed rate hikes versus the one rate hike/year in each of 2015 and 2016.

The last time Fed started a rate hike cycle from 2004-2006, the FTSE S-REIT Index returned a CAGR of 26.5% over the 2 years (vs STI’s 15.9%). This time though, property and economic fundamentals of Singapore are vastly different. This difference in strength of the underlying economy at a period of rising interest rates, is what we believe would lead to an underperformance of REITs vs the general index over 2017/2018 and potentially bring an end to the S-REIT bull market which started since 2009.

2004-2006 vs 2017

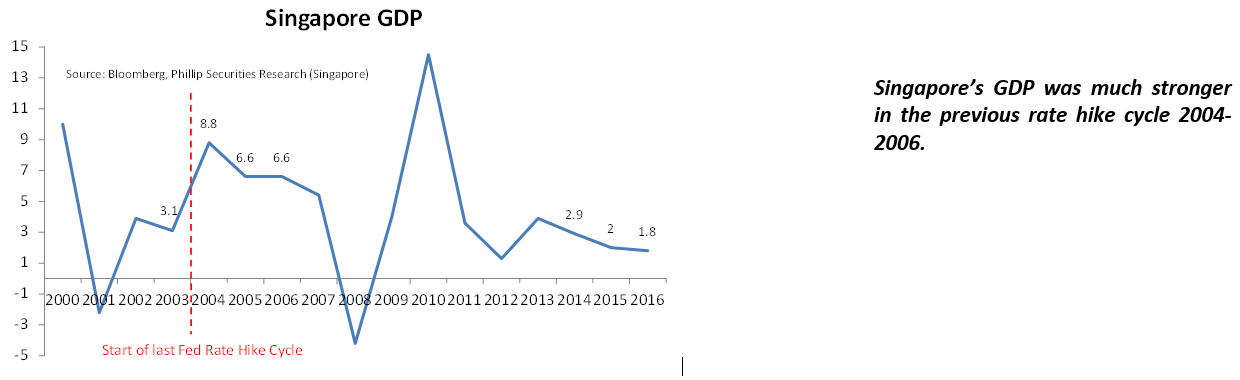

In the previous Fed rate hike cycle from 2004-2006, the FTSE S-REIT index chalked up an 85% return in the 3 years, versus the STI’s 58%. However, Singapore was going through much stronger growth then as the first rate hike of that cycle occurred in 2004, with also more favourable demand/supply dynamics across all REIT property sectors. From 2004-2006, Singapore’s GDP growth grew 8.8% in 2004, 6.6% in 2005, and 6.6% in 2006. More recently, Singapore’s latest preliminary GDP figures for 2016 showed an increase of 1.8%. The Ministry of Trade and Industry (MTI) expects a 1-3% growth in 2017. Net property demand tends to be closely correlated to GDP figures.

Figure 2: Singapore GDP Growth (2004-2006 vs current)

Previous rate hike cycle from 2004-2006 coincided with a Singapore economy on much stronger footing and more favourable demand/supply dynamics across all REIT property sectors.

Retail Sector: Comparison with 2004 conditions, Recent Updates and Outlook:

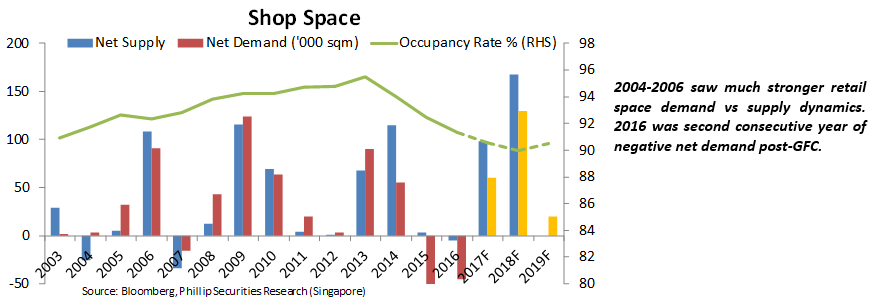

Figure 3: Retail Space Demand and Supply (2004-2006 vs Current)

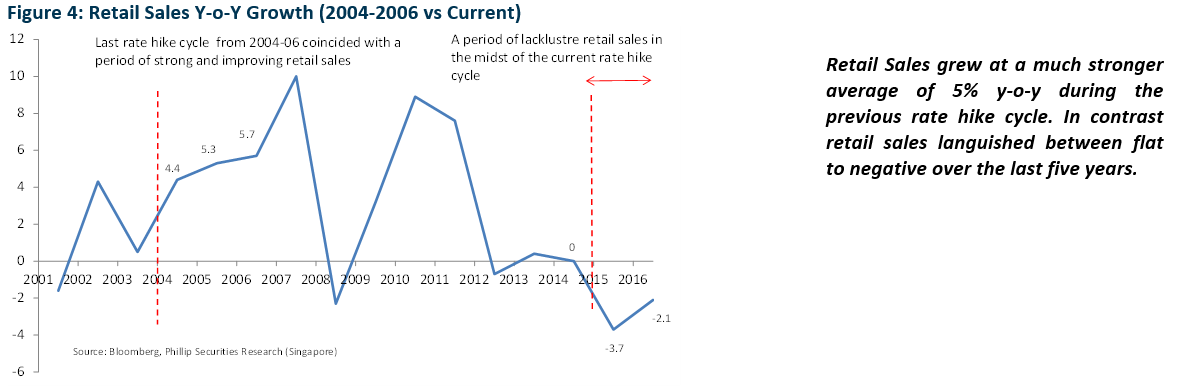

Net absorption of shop space in 2016 hit -45,000 sqm., the second consecutive year where we witnessed a negative net absorption of shop space. This is a phenomenon not seen even during the GFC years. Occupancy has been trending down since hitting 96% in 2013 to 91% in 2016. 2004-2006 though saw periods of increasing net absorption and occupancy. This is hardly surprisingly as Singapore was experiencing strong and improving retail sales growth in the period from 2004-2006 versus the flat to negative growth in the past 5 years. YoY Retail sales growth averaged 5.1% in those 3 years. In contrast, retail sales growth has been flat to negative in the last 3 years.

Looking forward, much of the new upcoming supply is concentrated in the city fringe and suburban areas, with limited new supply in the city areas. These include Paya Lebar Quarter (2018), Jewel in Changi (2018) and Northpoint City (2018). We do not foresee a strong recovery for retail sales on the back of expectations for modest wage growth, already low unemployment rate, cautious sentiments amidst rising interest rates, and the growing challenges posed by e-commerce.

The advent of e-commerce and the threat presented by it to brick-and-mortar stores is ever growing. Retailers are forced to re-invent themselves to enhance the shopping experience to consumers who are otherwise flooded with cheaper, more available options online. The imminent entrance of Amazon into Singapore is likely to exacerbate the situation. With quicker, cheaper deliveries made possible by the new local Amazon warehouse at Mapletree Logistics Hub – Toh Guan, shoppers will have added incentives to shop online for cheaper alternatives. The increasing number of startups trying to disrupt the logistics and e-commerce space also serve to improve the shopping experience online for consumers. The increasing popularity of online shopping sites such as Amazon, Lazada (bought by Alibaba in 2016), Qoo10, and the numerous independent online fashion stores such as “Love, Bonito”, Dressabelle, and Zalora will continue to drain retail money into the non brick-and-mortar space. Proliferation of groceries/food delivery services start-ups such as RedMart (bought by Alibaba in Nov 2016), UberEats (launched in 2016) and Deliveroo (launched in 2015) also mean that the perceived more “stable” supermarket anchor tenants and F&B tenants are not immune to the threat of e-commerce.

The main draws of online shopping are lower price points and convenience. What used to be pet peeves for online shoppers were the logistical issues (including long delivery time and shipping difficulties in ordering from certain overseas who may not ship to local shores), which are also increasingly mitigated by the emergence of logistics start-ups such as NinjaVan and Ta-Q-Bin. The setting up of self-collection lockers and better utilisation of delivery fleet also serve to improve the last mile delivery bottleneck problem and shorten delivery waiting time for a better customer online shopping experience.

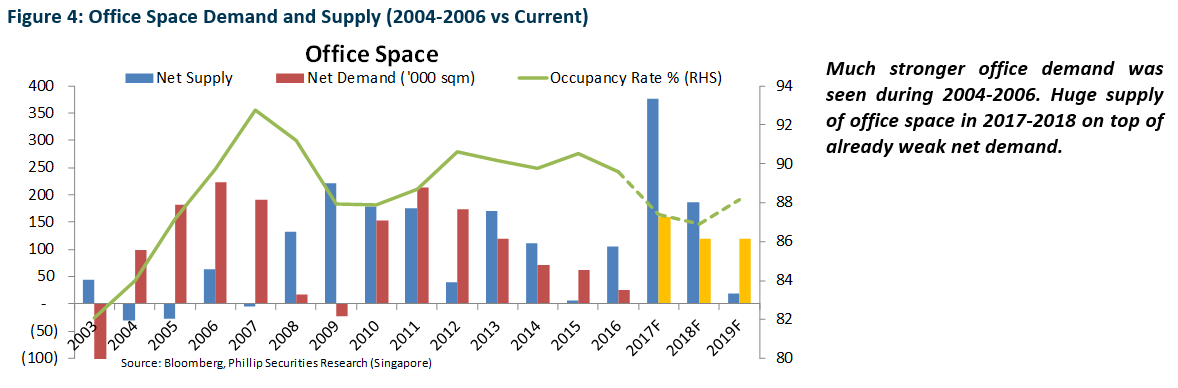

Office Sector: Comparison with 2004 conditions, Recent Updates and Outlook:

Net office demand saw its fifth consecutive year of contraction in 2016, culminating in net office demand of 26,000 sqm. in 2016. Nonetheless, the limited supply over these few years meant that occupancy stayed relative flat at 90%. Downsizing and relocation of operations overseas by banks, the traditional major occupiers of CBD space, contributed to the declining net demand, notwithstanding increased demand by sectors such as Technology.

In contrast, from 2004-2006, average annual net supply was negligible, versus a strong net demand of 168,000 sqm., causing a 49.4% spike in office rental index. Broad structural developments in recent years could also affect the potential demand of office space in Singapore. Singapore’s shift away from a liberal immigration policy which will inevitably lead to slower workforce population growth, increasing trends of decentralization away from city centre to ease the city congestion through setting up of suburban commercial hubs, technological advancements allowing people to work from home, and broader government calls encouraging employers to allow flexible work arrangement schemes, such as allowing employees to work from home initiative to encourage increased participation for labour force all serve to slow down the demand growth for city centre office space.

Industrial Sector: Comparison with 2004 conditions, Recent Updates and Outlook:

Industrial space likewise saw an oversupply in the midst of falling demand in recent years, especially for factory space and warehouse space. As a result of the slowing economy, supply has outstripped demand in most years since 2012. Rental index as a result as fallen 10.7% since its peak in 2013. Business parks was the sole bright spot and the asset class continues to benefit from the relocation of IT companies and back-end operations of financial institutions out of city centre. The low upcoming supply of business parks mean rents should sustain and occupancy should slowly creep up.

The last rate hike cycle though saw totally different dynamics with demand outstripping supply, driving up occupancy and industrial space rents.

Please sign in and download the PDF file to read further.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

Dehong covers primarily the REITs and property developer sector. He has close to 7 years experience in equities related dealing and research roles.

He graduated with a Masters of Science in Applied Finance from SMU and Bachelors of Accountancy from NTU.