Ceasing coverage due to reallocation of internal resources.

The Positives

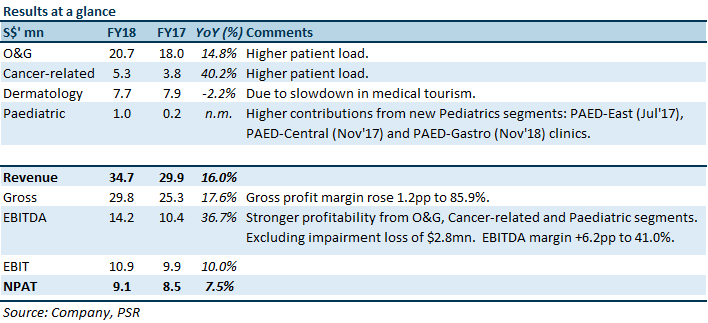

- Significant improvement in EBITDA, due to the pick-up in profitability of O&G, cancer related and paediatric segments. The O&G segment delivered 1,824 babies in FY18 as compared to 1,716 in FY17, growing 6% YoY (FY17: -1% YoY). As more specialists inch towards their breakeven point even though the total number of O&G specialists remained flat at 6. It typically takes 1-2 years for specialists to breakeven.

- Cancer-related segment revenue grew 40% YoY, more than offset the challenging dermatology segment and gestations costs incurred by the newly established paediatrics segment.

The Negatives

- Dermatology segment performance lacklustre due to a slowdown in medical tourism. FY18 EBIT declined 5% YoY, and EBIT margin fell 0.9pps to 29.7%. The number of patients treated by Dr Joyce Lim was reduced because of the slowing medical tourism and her active involvement in teaching and conferences to gain visibility. In a bid to expand the dermatology business, SOG recruited one new dermatologist in December 2018 who specialises in paediatric dermatology.

- The new Paediatrics segment incurred S$0.5mn ‘start-up’ losses to date. One new paediatrician joined in November 2018. We expect the two existing Paediatricians to breakeven by end-FY19. The two paediatricians joined in July and November 2017.

- S$2.8mn impairment of goodwill. The impairment relates to the excess of the carrying amount of the cash generating unit (CGU) over the recoverable amount of the CGU as at year end of the Dermatology segment, using a DCF valuation model and projected over 7 years plus terminal value. Current accounting standards require impairment instead of

Outlook

With a gradual recovery in birth rates in Singapore, coupled with the Group’s ability to consistently gain market share in live births in Singapore, we expect the O&G segment to continue registering better growth.

We also expect the cancer-related segment to support Group’s FY19e profitability amidst persistent headwinds – (a) sluggish birth rate and (b) structural slowdown in medical tourism.

Profitability from the O&G and Cancer-related segment should improve as more doctors breakeven and gain more patient load. The Group is actively seeking suitable doctors to join its team to further grow its four business pillars. New doctors typically take 1 – 2.5 years to break even.

The Group has a robust balance sheet with zero debt and a cash position of S$21.5mn (c.13% of its market cap).

Ceasing coverage

Our most recent rating from our 13 August 2018 report, was Buy with a target price of $0.420. We are ceasing coverage on this counter due to the reallocation of internal resources.

S$1.25mn non-recurring item booked in 2Q18

Refer to the announcement dated 6 Mar-18, SOG has received the settlement amount of S$1.25mn for a settlement related to a dispute with its former Lead Independent Director, Mr. Christopher Chong Meng Tak.