What is in the news?

SGX has announced that it will mandate all Mainboard IPO companies to allocate at least 5%, or SGD50mn, whichever is lower, of their offer size to retail investors. This mandate is aimed to facilitate greater retail participation in the Singapore’s equities market. The new rules on the minimum allocation will be effective 2 May 2017.

How do we view this?

*Singapore household units include Singapore citizens, permanent residents, foreigners and unincorporated enterprises (e.g., sole proprietorships).

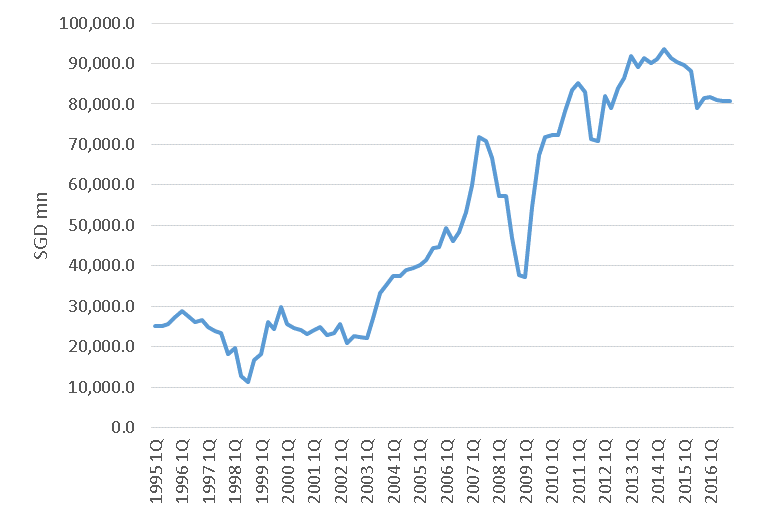

Figure 1: Singapore Household’s Listed Shares by Value

Source: Singstat.gov.sg

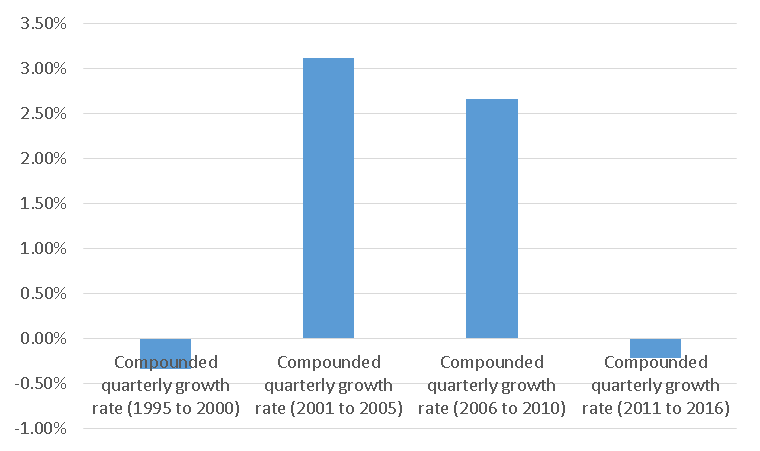

Figure 2: Singapore Household’s Compounded Quarterly Growth Rates between Selected Periods

Source: Singstat.gov.sg

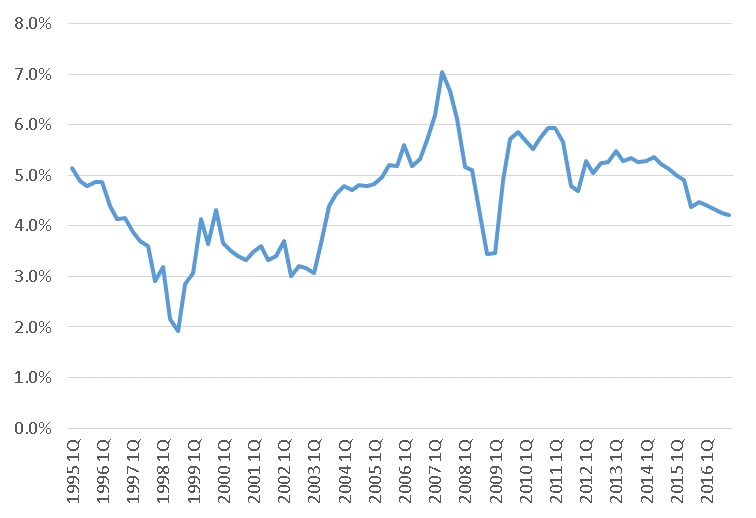

Figure 3: Percentage Component of Singapore Household’s Listed Shares to Total Assets

Source: Singstat.gov.sg

YTD February 2017 market statistics update. SGX’s securities daily average value (SDAV) for Jan and February 2017 was SGD1.228bn, up 1.07% year-on-year (y-o-y) following an overall risk-on momentum which also saw S&P500 Index up 5.79% year-to-date and Dow Jones Industrial Average Index up 6.43% year-to-date. The SDAV growth is higher than our 3Q17F SDAV forecast of SGD1.13bn. Total Derivatives volume was 12.47 million, up 7% month-on-month (m-o-m) but down 10% y-o-y. SGX’s Total Derivatives volume was supported by strong m-o-m growth from Equity Index Futures contracts and Commodities Derivatives contracts. Iron Ore Derivatives volume was 1.31 million, up 28% m-o-m and we attribute the increase to the surge in Chinese imports of key commodities including iron ore during the month of February.

Investment Actions

We view that the mandate for minimum allocation of new Mainboard IPOs for retail investors could facilitate more retail participation in equity investing but the main driver would still lie with increased confidence to invest. Maintain “Accumulate” with TP of S$7.75.

Jeremy covers primarily the Banking and Finance sector. He has 6 years’ experience in equities related dealing and research roles.

He graduated with Bachelors of Mechanical Engineering from Nanyang Technological University.