We visited the SIF to discuss the changes to Finance Company Regulations announced by MAS on the 14th February 2017. We believe, finance companies are finally unshackled to finance and service better the SMEs in Singapore.

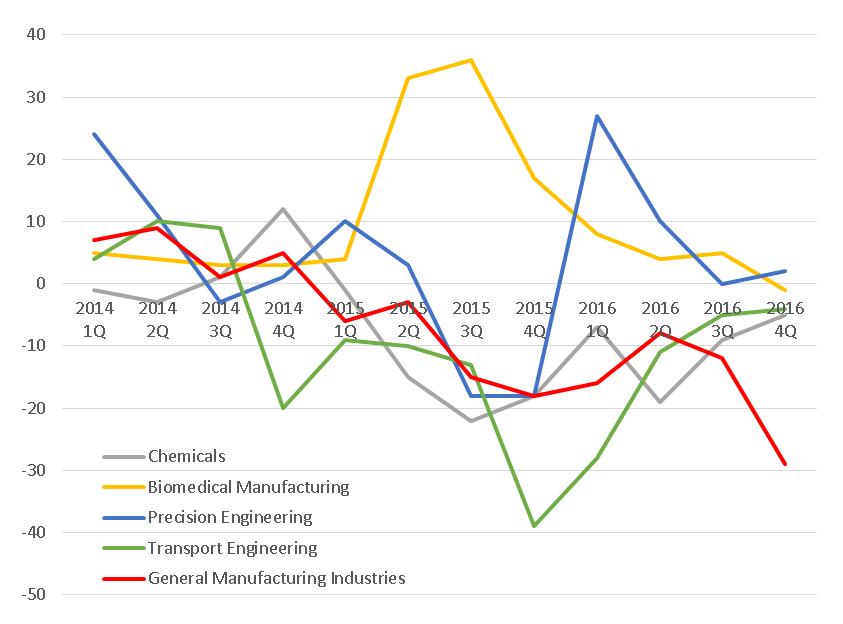

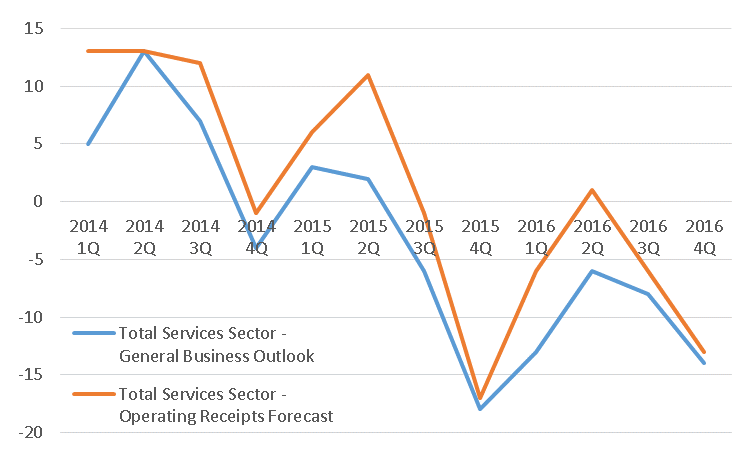

General Business Expectations released by Singapore Economic Development Board showed a generally muted outlook for the period January – June 2017. For the Manufacturing Sector, 96% manufacturing establishments responded to the survey. The result was a net weighted balance of 2% of the respondents anticipate a favourable business situation. And for the Services Sector, c.1,500 enterprises were surveyed. The result was a net weighted balance of 14% of the enterprises anticipate a deteriorating business situation for the period January – June 2017.

Household ability to service mortgages remain at record low levels. The ratio of Private Property Mortgage Loans to Total Annual Income from Work by Households in Private Properties over a 16-year period from 2000 to 2016 has reached beyond +1 standard deviation since 2012. Not only had the growth rate of Average Monthly Income from Work by Households in Private Properties been declining since 2010 but the growth rate had also fallen below the private property mortgage loans growth rate; even though private property mortgage loans growth had declined sharply after the implementation of TDSR in June 2013.

We estimate that the three local banks’ market share of Singapore housing loans at c.47% by end of 2016 compared to c.43% by end of 2014. In 2016, the Singapore housing loans growth for each of the local banks have outpaced the system loans growth of 4%. We estimate Singapore housing loans grew c.10% for OCBC, c.8% for UOB and c.12% for DBS. In the report, we explain why this trend is expected to continue in 2017.

INVESTMENT ACTIONS

UNDERWEIGHT on Singapore Banking Sector – We are cautious on the Singapore Banking Sector. The weak Singapore economic outlook offsets some positive progress the Singapore banks are making in supporting network clients such as large conglomerates in Singapore expand overseas. Though the Singapore banks may continue to grow Singapore mortgage loans in 2017, we believe the volume growth will be offset by weaker margins. Owing to the operating headwinds we presented in this report, we are Underweight the Singapore Banking Sector. We maintain our Reduce rating on UOB, DBS and OCBC. We do not have a market weight on the Singapore Finance Companies because currently we do not have coverage on Singapore Finance Companies.

HOW DO WE VIEW THIS?

Regulatory changes to enhance finance companies’ ability to finance SMEs.

The regulatory changes are still preliminary but from our visit to SIF, we saw a couple of straightforward opportunities for finance companies to enhance SME lending:

To estimate the potential net interest income contribution to SIF from uncollateralised business lending, we assume spread on SIF’s uncollateralised loans to be an average of 3% per annum for an aggregate uncollateralised business loan size of c.S$60mn. This will yield S$1.8mn in net interest income (“NII”) which will potentially add 4.7% to SIF’s FY16 NII and hiring charges of S$38.6mn. In addition, we believe there will be positive knock-on effects from increased activity in uncollateralised business lending. Finance companies can start building relationships with fledgling SMEs through uncollaterised lending and when these SMEs expand, there will be better opportunities to extend collateralised business loans by way of a stronger relationship. We opine that the new regulation presents a sweet spot for finance companies to engage and nurture fledgling SMEs that would otherwise be paid less attention by larger banking entities.

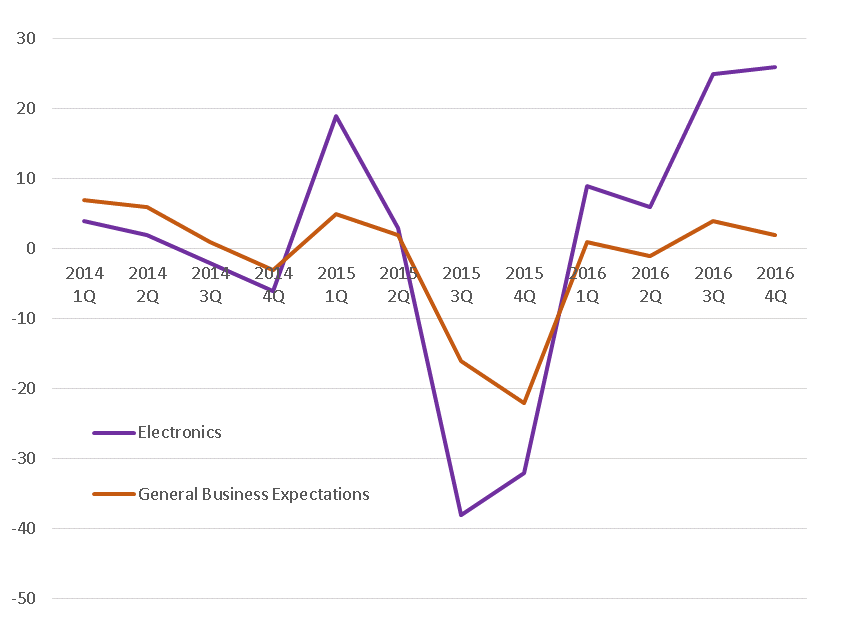

Marginally positive General Business Expectations from January 2017 to June 2017 was supported only by the electronics sector.

Fig 1. All indicators show either a negative or a marginally positive net weighted balance.

Source:Singstat, PSR estimates

Fig 2. Except for the Electronics Sector but expectations in this sector are very volatile.

Source: Singstat, PSR estimates

Fig 3. Services Sector Expectations are also weaker.

Source: Singstat, PSR estimates

Please sign in to download the full report in PDF.

Jeremy covers primarily the Banking and Finance sector. He has 6 years’ experience in equities related dealing and research roles.

He graduated with Bachelors of Mechanical Engineering from Nanyang Technological University.