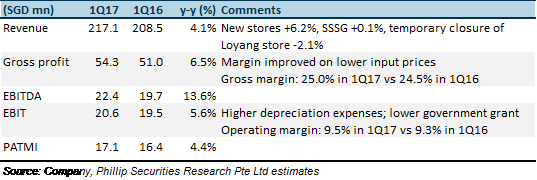

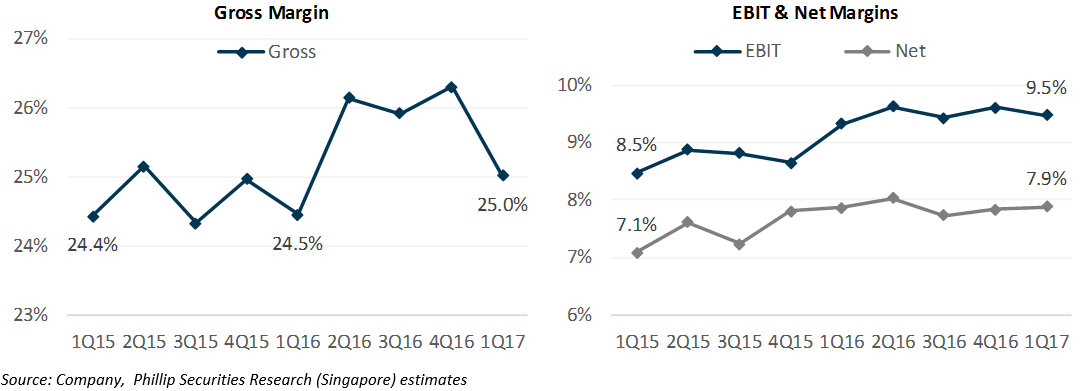

Expect 2Q17 gross margin to revert to its 25.5%-26.0% level. First and third quarters typically register lower gross margins as retailers push for volume amid the festive season. Margins have been improving over the past two years (refer overleaf for Figure 1 & 2), thanks to (i) lower input prices; (ii) effective cost management; (iii) improvement of product mix with sales of higher-margin fresh products; and (iv) increase bulk handling. We expect these margin expansion drivers to remain intact throughout FY2017.

Revenue growth slowed; drags mainly came from:

Putting hopes on 2H17 for new stores to drive growth in FY2018. We are becoming wary of the Group’s market share and the lack of future growth driver after nine unsuccessful HDB supermarket bids since 3Q16. Out of the nine bids, NTUC Fairprice had won two, Giant had won one (under Cold Storage’s name), and the remaining were won by smaller competitors. Nonetheless, we take some comfort that the irrational bidding seen in end-2016 have eased. The recent two winning supermarket bids were at S$14.3 psqf and S$14.8 psqf, which Sheng Siong Group lost out narrowly by only 2 cents and 8 cents respectively. There are six new supermarkets units pending completion by Oct 2017 according to data on HDB HBiz website.

Maintained ‘Accumulate’ rating and TP of S$1.06, based on unchanged 4.61 cents FY17F EPS and 23x PE multiple. We expect the five new stores opened in 2016, particularly the Yishun Junction 9 store, to provide support to FY17F topline growth. Management is cautiously optimistic that newly renovated and bigger store at Tampines Central store could lift 2H17 sales growth after the renovation work completes in Jun-17. Re-rating catalysts: (i) Successful bidding of new stores; and (ii) Improvement of product mix.

Figure 1 & 2: Expanding margins over the past two years

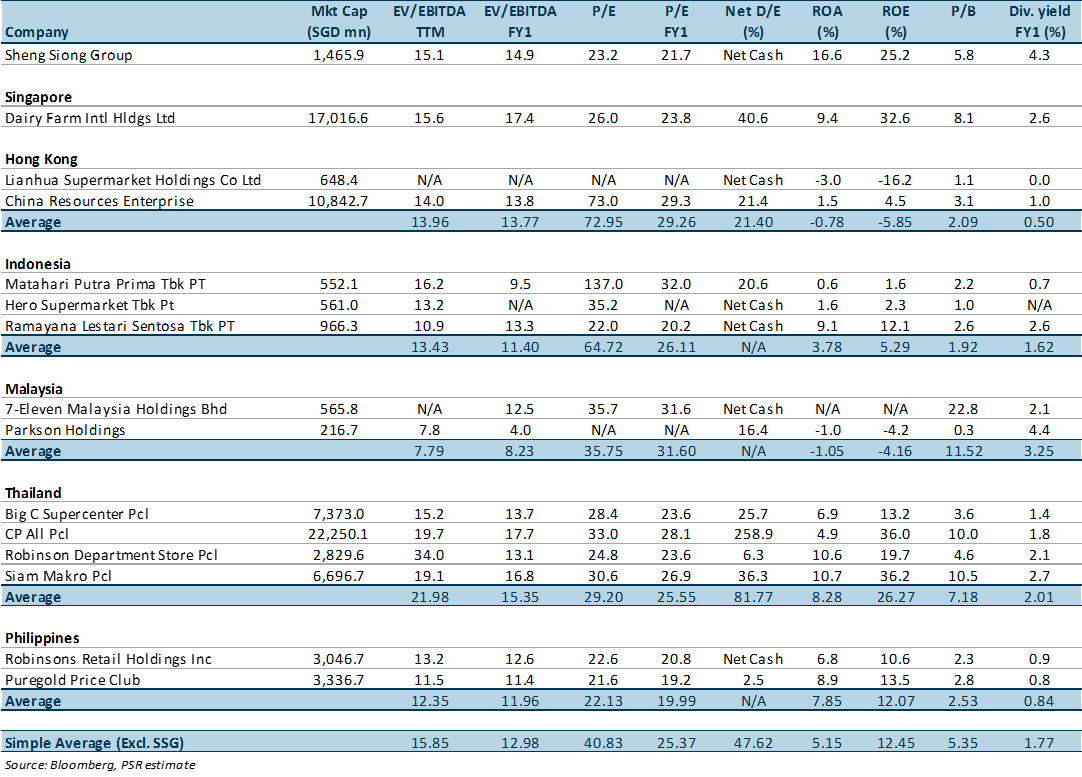

Figure 3: Peers comparison

SSG is currently trading below its regional peers’ average in terms of trailing P/E multiple.

It also provides an attractive FY17F dividend yield of 4.3%, as compared to its regional peers’ average of 1.8%.

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.