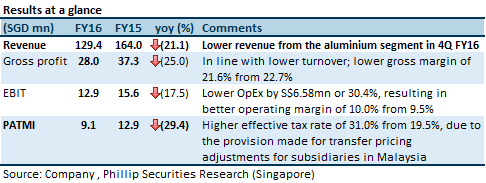

Yoy weaker 4Q FY16 did not come as a surprise, but the extent was worse than expected

In our initiation report (16 September 2016), we stated that we had erred on the side of conservatism to forecast a year-on-year (yoy) weaker 4Q FY16. Our 4Q forecast was for S$45.7mn revenue and S$4.45mn PATMI. However, actual 4Q was S$31.8mn revenue and S$1.17mn PATMI. While we forecasted a 4.1% lower yoy FY16 PATMI, the significantly weaker 4Q results dragged the full year PATMI 29.4% lower yoy. Gross margin in 4Q was defended at 18.9%, thus preserving full year gross margin at 21.6%, which is in line with our forecast of sustainable low-twenties.

Disappointed with lower dividends, in spite of the cash hoard that grew

Nam Lee has a dividend policy based on payout ratio, paying about a third of earnings. This is in contrast to a constant dividend policy which pays a constant payout regardless of volatility in earnings. FY16 dividends are lower due to the lower profit, but payout ratio is actually higher. We highlight that the lower FY16 dividend is purely due to the dividend policy based on payout ratio; and nothing has changed in terms of ability to pay a higher dividend. FY16’s 2.0 cents dividend is equivalent to S$4.8mn cash, which is manageable in the context of the net increase in cash of S$8.3mn in FY16 (and this is even after paying S$6.0mn cash for FY15’s dividends). Evidence of the cash hoard can be inferred from the cash ratio that now stands at 2.3x.

Clean balance sheet and net cash position (cash less total borrowings) of 17.4 cents

Nam Lee carries little debt on its balance sheet, with debt-to-equity ratio of 2.9%. Thus we view Nam Lee’s interest burden as being insensitive to changes in interest rates. The cash position is able to pay off total debt and ability to pay dividends should not be affected. In our initiation report, we opined that any price below the net current asset value (NCAV, total current assets less total liabilities) is irrational. We think a price floor at the new NCAV of 35.8 cents is not without merit.

Maintain “Buy” rating with lower target price of S$0.60 (previous: S$0.69)

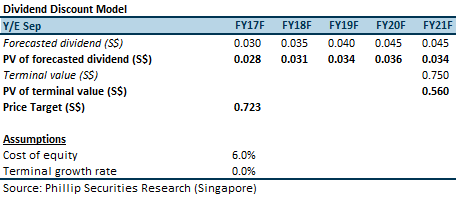

As described in our initiation report, a significant portion of revenue comes from projects and yoy net profit is expected to be volatile. We continue to view Nam Lee as a yield play with low debt, thus avoiding the vagaries of interest rate movements. FY16’s 2.0 cents dividend represents a yield of 5.1%, based on last close price of 39.0 cents. We forecast FY17F dividend of 3.0 cents (1.0/2.0 cents ordinary/special); the implied forward yield of 7.7% is attractive.

Company Valuation

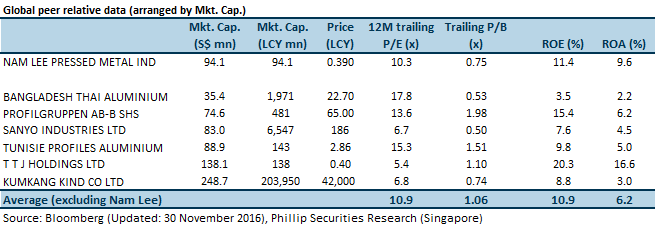

We continue using a blended method of P/E multiple and dividend discount model (DDM) to arrive at our valuation for Nam Lee. We apply a P/E multiple to the FY17F earnings. The use of P/E multiple valuation allows us to benchmark Nam Lee to the peer average. At the same time, we also use the DDM in view of the cash generating ability of the business and its history of paying dividends.

For peer relative valuation, we use the same set of peers found on Page 8 of our initiation report, and use the same 10% discount to peer average P/E. A slight change to our methodology is we will not be using the rolling next-twelve-months (NTM) earnings, but will be using the FY17F earnings for the rest of the year instead. This is in view of the lumpiness in revenue recognition that is due to project-based contributions as well as timing differences on progress billing.

Based on our FY17F expectation of 4.84 cents earnings per share (EPS), we peg that to 9.8x P/E (10% discount to peer average of 10.9x) and derive a valuation of 47.5 cents.

We believe that ability to pay dividends remain unaffected, with a net cash position being maintained going forward. We have assumed 0% terminal growth rate in our DDM and valuation is 72.3 cents.

Our blended valuation for Nam Lee implies 54% upside from the last closing price of 39.0 cents.

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.