Company Description:

JD.com, Inc. is also known as Jingdong, is a Chinese e-commerce company. It is one of the two massive B2C online retailers in China by transaction volume and revenue, and a major competitor to Alibaba-run Tmall. JD.com, Inc. was listed on Nasdaq in the U.S. on May 2014. JD.com also is the world’s leading company in high tech and AI delivery through drones. It has recently started testing robotic delivery services and building drone delivery airports, as well as operating driverless delivery by unveiling its first autonomous truck.

Why we like JD:

Robust growth in revenue. Revenue grew 22% YoY to RMB150.3bn, and the key revenue drivers were advertising revenue growth (+24.04%) and logistics revenue (+98.05%) due to larger orders from lower-tier cities. JD is the top listed retailer in China in terms of revenue, almost double than second place. Based on the latest 1H19 statistics from China Home Electric Appliance Research Institute, JD further enhanced its leadership in the China online home appliance market with a market share of 39.6% now vs 38.9% in 2018.

Consistent expansion of operating margin. Operating margin went up 2ppt QoQ in 2Q19, to 2.1%, compared to operating margin of 0.1% in 2Q2018. The increase was primarily due to the growth of the company’s online direct sales business and the reduced losses of third-party logistics service.

Active customer rose further. Annual active customer accounts increased to 321.3mn in 2Q19 compared to 310.5mn in 1Q19. Based on JD’s data, the new users’ growth of lower-tier cities is much higher than tier-one and tier-two cities. The new users (over 50% located in lower-tier cities based on delivery address) from lower-tier cites account for 60% of total new users. JD guided that it will continue to achieve stable new users growth from lower-tier cities.

Recommendation

Overall, we are positive on JD, because of three reasons: 1) revenue growth recovery 2) margin improvement 3) user growth.

Technicals:

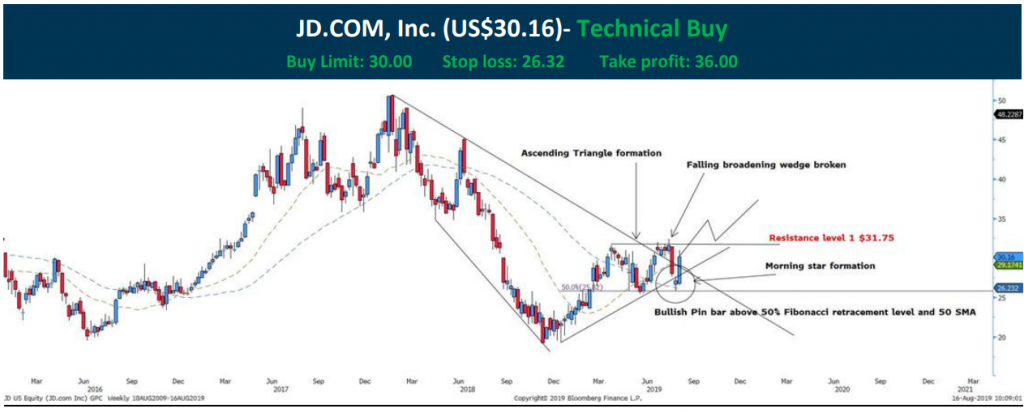

Blue line = 50 periods moving average

Green line = 22 periods moving average

Relative Strength Index

Support 1: 25.82 Resistance 1: 31.75

Resistance 2: 45.00

JD.com current price action indicates that the stock is heading for a strong bullish upside as there are two classical technical patterns that reveal the stock underlying bullish sentiment. First, the falling broadening wedge has been broken in June 2019. Secondly, the ascending triangle formed gave us a clue that the stock may be heading for a breakout of the top at $31.75.

Although the ascending triangle has been broken out of the bottom of the descending triangle, the breakout seems to be a false breakout as the bullish pin bar close above the 50 SMA and 50% Fibonacci retracement gave a clue that the stock is heading for a strong bullish movement. To add on, this week’s bullish candle has confirmed a morning star formation, which is the strongest reversal signal.

Zheng Jieyuan is a research analyst in Phillip Securities Research, focusing on the China and Hong Kong markets as well as China stocks listed in the US.

He holds a Master Degree in Finance from Nanyang Technological University (NTU), and Bachelor Degree in Information and Computing Science from Minzu University of China.