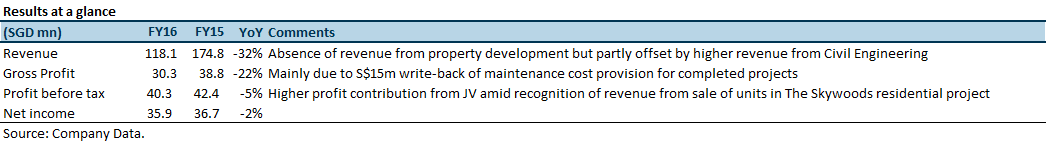

HLSH secured a new contract worth S$1.1 billion via a 60:40 joint venture project with Sembcorp Industries in FY16, where the contract is expected to begin contribute positively in FY17 as works are expected to intensify. Although we are expecting gross margin for the project to remain depressed (c.5%), however contributions from the new project is much welcomed considering that there will not be any revenue contribution from property development until FY18. We are estimating a 60% year-on-year decline in PBT amid no more contributions from The Skywoods, as well as excluding a one-off S$15 million write-back of provision for completed projects.

Management shared that sales volume for Shine@Tuas, 174-unit industrial property located in Tuas district, was muted since its launch in 3Q16 due to the softer market conditions. We are expecting sales volume to accelerate in FY17 as demand for industrial space improved in 4Q16 which we have identified in a sector report dated 20 February 2017. We have adjusted our forecast and view that the development can potentially fetch an average selling price of S$280 PSF and add S$0.06 in development profits when completely sold. Revenue from units sold in Shine@Tuas can only be recognised upon hand over in FY18.

Investment Action

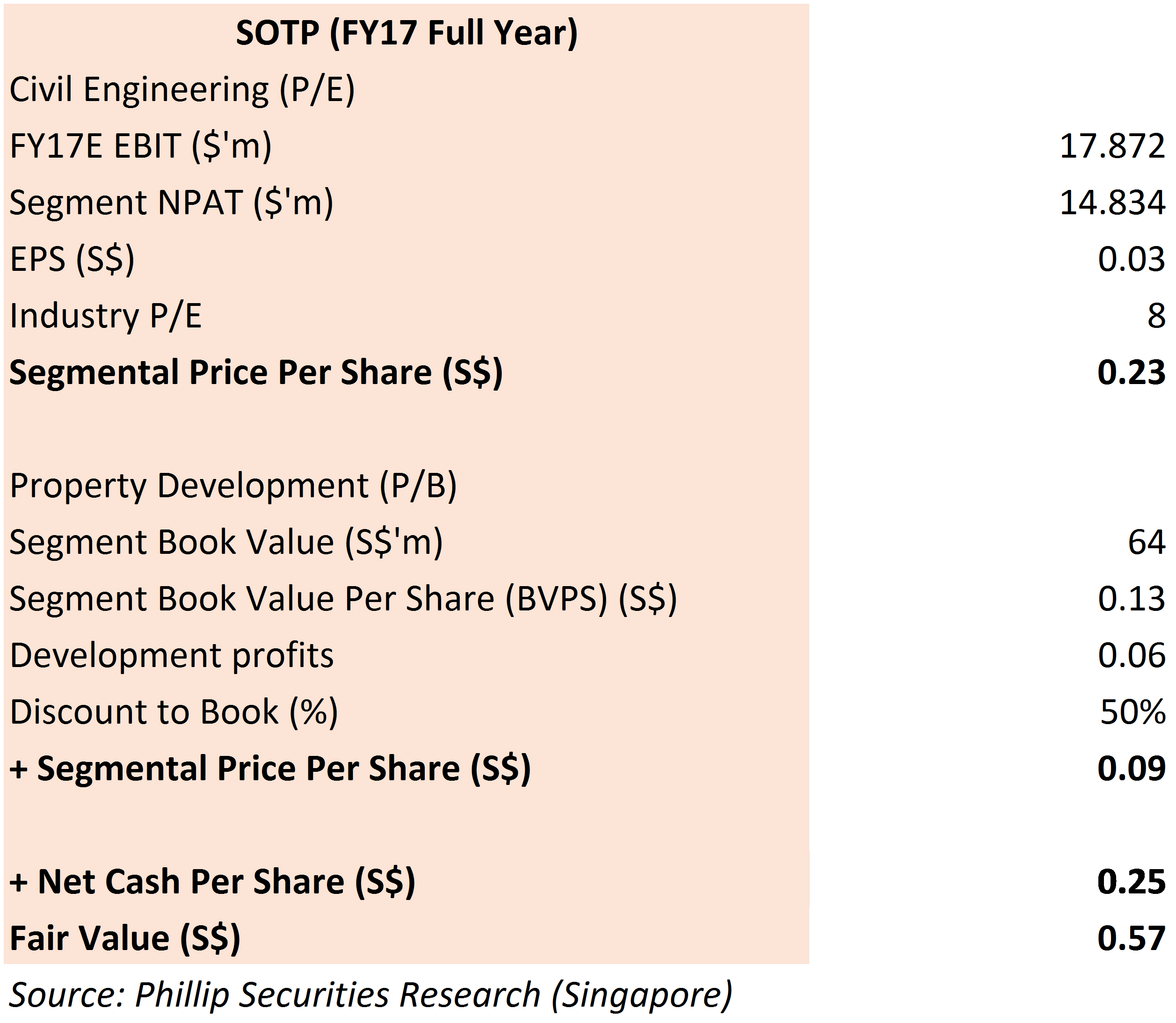

We have revised our valuations on HLSH to take into account of future contributions from the newly secured Changi Airport project, as well as a more optimistic view in the sales of Shine@Tuas industrial development property. The Group’s balance sheet remains rock solid (net cash – S$0.25) even after including the payment of the S$0.10 special dividend per share. We maintained our rating of “neutral” along with a higher TP of ‘S$0.57’ based on FY17’s full-year SOTP valuation. The new TP is post-payment of special dividends and final dividends declared in FY16.

Valuations