Company Background

Health Management International Ltd (“HMI”) is a growing private healthcare provider in Malaysia. The Group’s key assets comprise of two tertiary hospitals in Malaysia, the 288-bed capacity Mahkota Medical Centre (“MMC”) in Malacca and the 218-bed capacity Regency Specialist Hospital (“RSH”) in Johor. These hospitals are supported by a network of 17 patient referral centres across the region. The Group also owns and operates the HMI Institute of Health Sciences (“HMI-IHS”) in Singapore.

Investment Merits

Initiate coverage with “Buy” rating with a DCF valuation of S$0.83. We believe that healthcare has a long-term investment potential. Asia’s favourable socio-economic landscape and supportive government policies underpins medical tourism in Malaysia. We expect earnings to grow 38.0% CAGR over the next five years, following the consolidation of NCI, expanding capacity, and realisation of operating efficiencies.

Investment Thesis

– Expansion to bring double digit growth in next five years

1) Organic growth machine, growth pipelines set to see PATMI to grow at 11.5% CAGR in the next five years.

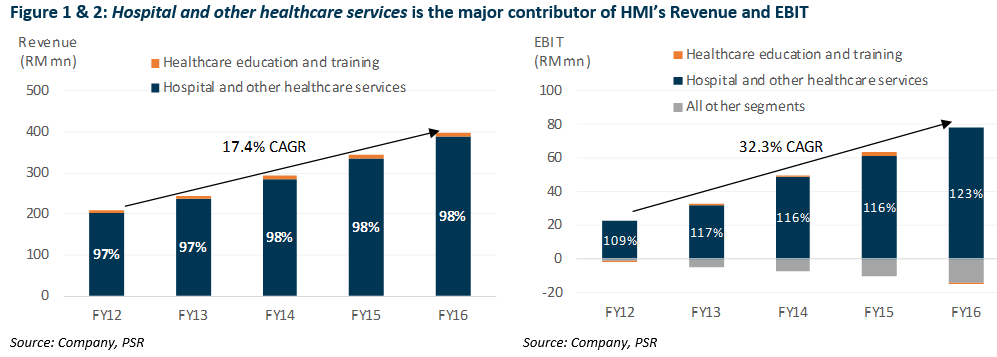

Hospital Services contributed 97.6% to FY2016 Revenue, with the remaining 2.4% are derived from Healthcare Education and Training.

Generally, a private hospital bills has two components, i.e. the doctors’ professional fees and the hospital charges. Doctor’s professional fees include consultation and procedure fees. While hospital charges include sale of drugs and medical supplies, use of facilities (such as operating theatre, diagnostics, beds, etc.), nursing charges and laboratory tests.

Malaysia’s healthcare fees are regulated under the Private Healthcare Facilities and Services Act 1998 and Regulations 2006. The professional fees of doctors are controlled with a maximum ceiling. However, the cost of hospital care, day surgeries, screening and diagnosis services, ambulance services, and clinical laboratories, are not covered under these Acts.

As all partner doctors are independent practitioners, HMI is partially cushioned from the risk of margin compression arising from increasing doctors’ fees. On the other hand, to achieve the higher end of average bill size per patient would critically depend on the number of complex cases treated in the hospitals and the utilisation of its services and facilities.

Revenue grew at a 4-year compounded annual growth rate (“CAGR”) of 17.4% from FY2012 to FY2016; while EBIT jumped at 32.3% CAGR in the same period. The stellar performance over the past five years was due to (i) increased patient load, (ii) more specialist consultants recruited, and (iii) higher average bill size per patient. The three factors interlink with each other.

Favourable social demographics (such as burgeoning middle income, ageing populations, and increasing health awareness, etc.) and continued growth of the private insurance market will continue to drive the demand for quality healthcare services in Malaysia.

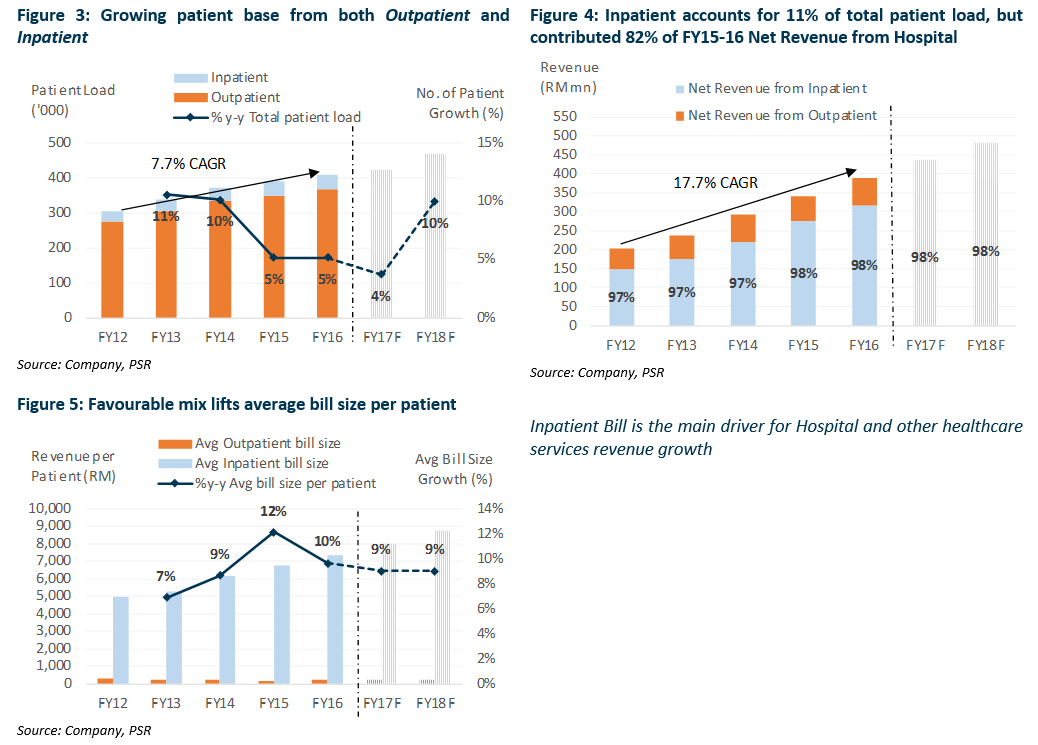

Net revenue from hospital grew at 17.7% CAGR during FY2012 to FY2016, driven by growth in: patient load in both hospitals (at 7.7% CAGR); and average bill size per patient (at 9.3% CAGR).

In FY2012, an average Inpatient Bill size is c.16x more than an average Outpatient Bill size. As its range of specialty and sub-specialty consultants expanded over the years, revenue intensity and the number of complex cases increased. Growth in average Inpatient Bill size outpaced that of Outpatient’s, with CAGRs of 20.8% and 8.0% respectively during FY2012 to FY2016. As in FY2016, an average Inpatient Bill size is c.38x more than an average Outpatient Bill size.

We expect the CAGR for patient load at average bill size to increase at 7.7% and 9.0%, respectively over the next five years, driven by expanding inpatient bed, medical consultants, facilities and services.

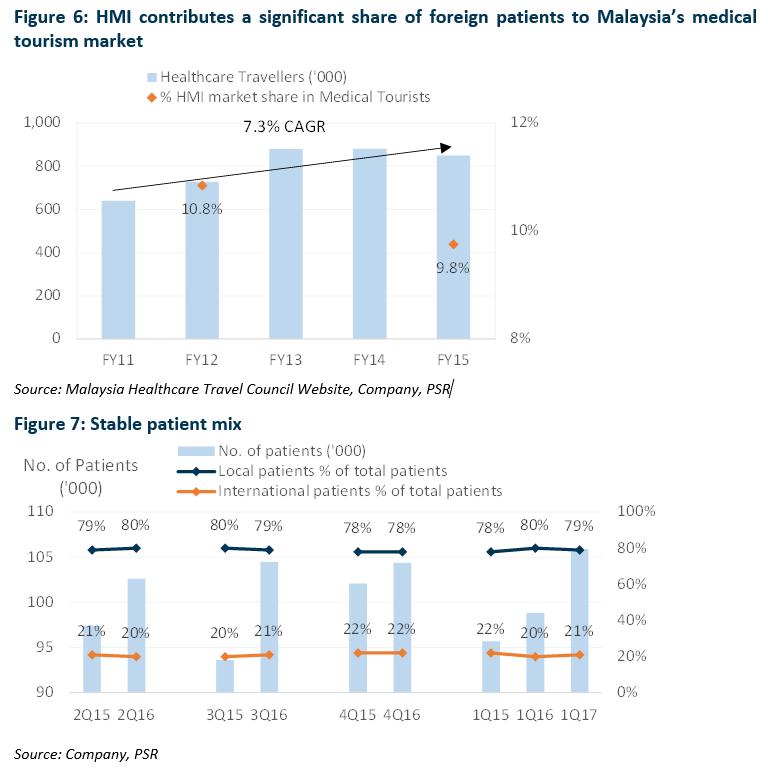

According to Malaysia Healthcare Travel Council* (MHTC), the number of healthcare travellers in Malaysia registered a 7.3% CAGR over 2011 to 2015. In 2015, it attracted over 850,000 medical tourists in 2015 and HMI had about 10% market share of it.

In addition, medical tourism is lucrative business for HMI as foreign patients tend to seek more intensive and costly treatment compared to local patients. MHTC estimated about RM1 billion revenue from medical tourism in Malaysia in 2016 (0.08% of 2016 Malaysia GDP) and expects to grow 30% in 2017.

Strategic location and favourable macro backdrop has put HMI in a sweet spot to capture demand from foreign patients. By providing same-day surgeries, HMI helps to save time and limit travel costs for foreign patients.

Foreign patient mix in HMI was consistent across past nine quarters at 21% of total patients. HMI is one of the hospital partners with Malaysia Healthcare Travel Council as a Partner Healthcare Provider; while its network of 17 regional patient representative offices would help to promote and cater for foreign patient demand.

Various government marketing efforts as well as improving flight and land connectivity could spur medical tourism in Malaysia. Prospects for medical tourism have heighten by recent developments in Malacca, namely (i) the construction of a new off-shore trading port in Malacca (dubbed “the Melaka Gateway”); and (ii) the expansion of Malacca International Airport. The Melaka Gateway is expected to complete by 2025. Upon completion, it is expected to bring in an additional 2.5 million international tourist arrivals per year to Malaysia. (Source: Melaka Gateway official website)

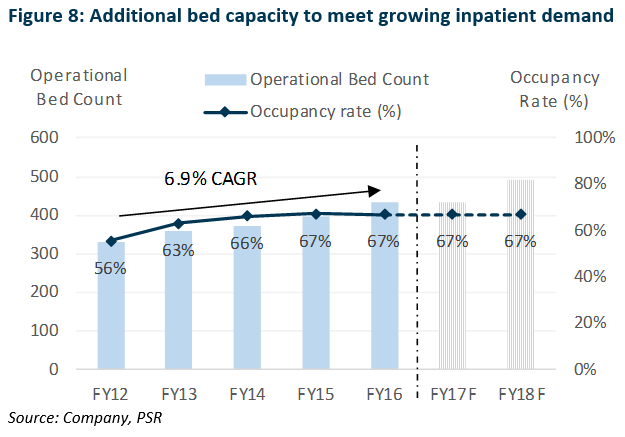

HMI’s operational beds grew at 5-year CAGR of 6.9%. Its ability to maintain occupancy rate at above 60% within the same period is a testament to its ability to draw patient demand. Within the same period, its Net Revenue from Hospital grew at 18% CAGR.

Due to strong patient demand, it intends to add a new ward to each of MMC and RSH by 1H FY2018 (end-CY2017), which will add c.30 new beds to each of the hospitals. We expect HMI to be able to maintain its occupancy rate at c.70%. We also took a conservative assumption where its c.14% increase in total inpatient beds in 1H FY2018 would support a c.10% growth in Net Revenue from Hospital.

In medium term, RSH will add a Hospital Extension Block by FY2020 to cope with the overstretched bed capacity. The new Hospital Extension Block was initially planned for Medical Block construction (which consists mainly of clinic suites). It was then re-designed to fit in more inpatient beds, clinical service areas, operating theatre capacity, as well as clinic suites. We expect a full impact kick-in by FY2021.

We expect its combined effort to grow its key disciplines, recruit new consultants, opening more Centres of Excellence (“COEs”), launching new services, and expand its marketing network both locally and overseas, to translate to 11.5% of top line growth per year over the next five years.

Please sign in to download the full report in PDF.

Lin Sin has been an investment analyst in Phillip Securities Research since June 2014, where she started as an economist, focusing on China and ASEAN macroeconomics. Currently, she covers primarily the Consumers and Healthcare sectors in Singapore equities market.

She graduated with a Bachelor of Science in Mathematics and Economics from NTU.