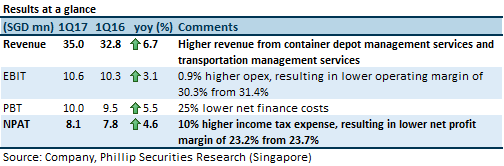

Increase in revenue flowed through to bottom line; margins remain largely intact

Revenue was $1.2 million higher than we expected, while operating cost was in line with our forecast. This resulted in net profit being higher than we expected by $1.5 million. The 23% higher than expected net profit was due to base-effect.

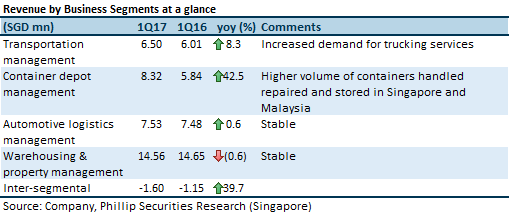

Revenue growth came mainly from two segments

The Group’s y-o-y increase in revenue was mainly attributable to the Container depot management segment (43.5% y-o-y higher), which handled higher volume of containers repaired and stored in Singapore and Malaysia. Recall that the Group recently announced in April the completion of Phase 2 of its facility in Port Klang Free Zone, Malaysia. Phase 2 is situated on an adjacent plot of land to Phase 1 of the warehouse and container depot facility. Both warehouses are fully let to the same master tenant. The Group has also announced in January that it had acquired two new sites for container depots in Singapore on Jurong Island (2.5 hectares) and Tuas South (5.9 hectares).

The Transportation management segment also saw 8.3% revenue growth due to increased demand for trucking services. This segment has been in decline since the middle of FY15 due to the slower oil & gas sector. This is the second consecutive quarter of y-oy revenue growth for the segment albeit at a slower clip than in 4Q FY16. We understand that revenue growth in this quarter was driven by a petrochemical customer and a few shipping companies.

Maintain “Buy” rating with higher target price of S$1.18 (previous $1.08)

In our recent AGM Note, we outlined the two ongoing projects on Jurong Island that is to drive the next phase of growth for the Group. Particularly for the Jurong Island Chemical Logistics Facility (JICLF), which we estimate will drive earnings growth of more than 40% in FY19F when it becomes operational.

Our target price gives an implied 18.6x FY17F P/E multiple, and a lower 11.1x FY19F P/E multiple.

Richard covers the Transport Sector and Industrial REITs. He graduated with a Master of Science in Applied Finance from the Singapore Management University. He holds the CFTe and FRM certifications and is a CFA charterholder.

He was ranked #2 Top Stock Picker (Asia) for Real Estate Investment Trusts in the 2018 Thomson Reuters Analyst Awards, and ranked #2 Top Stock Picker (Singapore) for Resources & Infrastructure in the 2016 Thomson Reuters Analyst Awards.